by Talley Léger, Sr. Investment Strategist, Invesco Canada

Since the dark days of March and April, I have remained steadfast in looking across the valley to better times ahead, and this time is no exception. Regardless of near-term turbulence, I continue to favour portfolio positioning for optimistic, long-term outcomes by emphasizing the “recovery” trade and embracing cyclicality. Fortunately, key barometers of global growth have validated this positive outlook.

Each month, the JPMorgan Global Manufacturing Purchasing Managers Index (PMI) takes the first pulse of business conditions and executive sentiment across the worldwide manufacturing sector. Not only has the PMI enjoyed a literal V-shaped recovery, but it has achieved levels of optimism higher than those immediately preceding the Great Lockdown (Figure 1).

Similarly, South Korea is the first major exporting nation to release monthly trade data, providing an early gauge of international commerce. Improving planetary demand for chips, computers and cars are supporting shipments from this high-tech, industrialized and global growth-sensitive economy. Indeed, South Korean exports are growing faster now than they were before the pandemic (Figure 1).

Figure 1. Key barometers of global growth have validated the ‘recovery’ trade

In North America, U.S. retail sales have rebounded to a high single-digit pace unseen since the aftermath of the Great Recession and Global Financial Crisis of 2008-2009. Clearly, fading government support, delays over further stimulus payments, and still over 700,000 people filing for initial jobless claims each week haven’t stopped American consumers from spending.

Downside risks

Have my views changed given the recent risk-off tone in markets? No. But responsible stewards of capital must contemplate the downside risks. In order to derail the cyclical advance, I believe something devastating would have to happen.

True, the rise of new COVID-19 cases has been weighing on risk assets, including the overall stock market. In response to increasing infection rates, Germany, France and Canada have renewed lockdowns and social restrictions to curb the spread of the coronavirus.

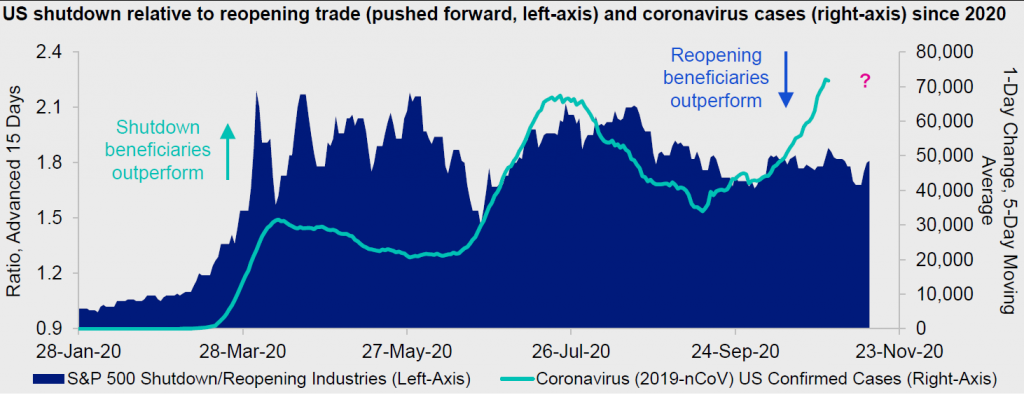

Despite virus-related concerns, however, S&P 500 industries that previously profited from the shutdown (i.e., Biotechnology, Hypermarket & Super Center, Interactive Home Entertainment, Internet & Direct Marketing Retail, and Internet Service & Infrastructure stocks) have been underperforming those that stand to gain from reopening (i.e., Airline, Casino & Gaming, Hotel, Resort & Cruiseline, and Restaurant stocks) since early July. In other words, when the dark blue area declines, it means the “reopening” beneficiaries outperformed the “shutdown” beneficiaries (Figure 2).

Perhaps these leading indicators of potential economic activity are sensing another peak in the case count, as they did back in June/July and February/March? If so, I would prefer to take a cue from such intra-stock market trends and stick to the broader “recovery” trade.

Figure 2. Despite virus-related concerns, the U.S. ‘reopening’ trade has been outperforming the ‘shutdown’ trade since early July

Upside risks

Is it possible that investors spend too much time worrying about the downside risks and not enough time considering the upside risks? For this exercise, let’s explore some “what if” scenarios:

- What if potential treatments and/or vaccines for the virus materialize, and meaningfully alter trends in the case count? According to CNBC, the U.S. Food and Drug Administration (FDA) has already approved Gilead Science’s remdesivir as the first COVID-19 treatment.1

- Granted, there’s a stalemate in Washington over the next round of fiscal stimulus, but I see this as an ebbing tailwind for now rather than a gathering headwind. What if a “blue wave” materializes on Election Day, but delivers another round of significant fiscal stimulus as opposed to higher taxes? Recall that Obama extended the Bush-era tax cuts a few times in the recovery stage of that business cycle.

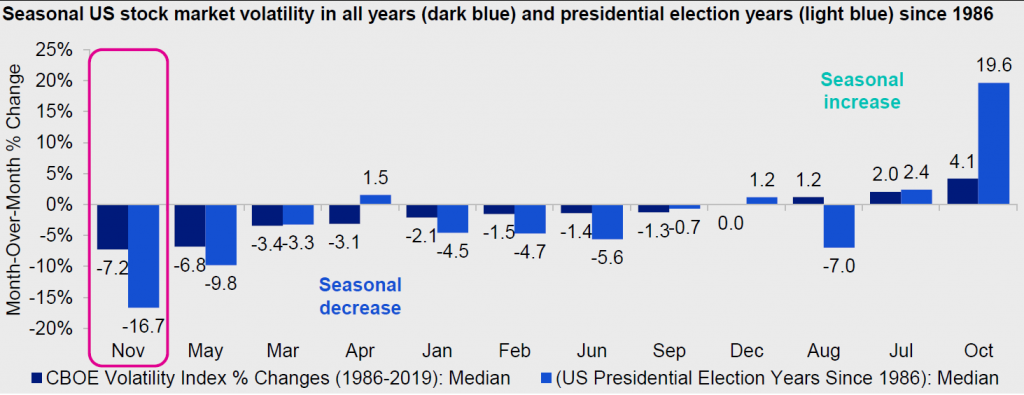

- What if volatility were to decrease and stocks were to increase following the election, helped by typical year-end seasonal patterns (read: the “January” effect) and election-year tailwinds? In spite of all the fears about persistent volatility around the election, history shows that the Chicago Board Options Exchange (CBOE) Volatility Index (VIX) has fallen the most in November (during all calendar years since 1986) and even more in U.S. presidential election years (Figure 3).

Figure 3. Historically, volatility has fallen the most in November during U.S. presidential election years

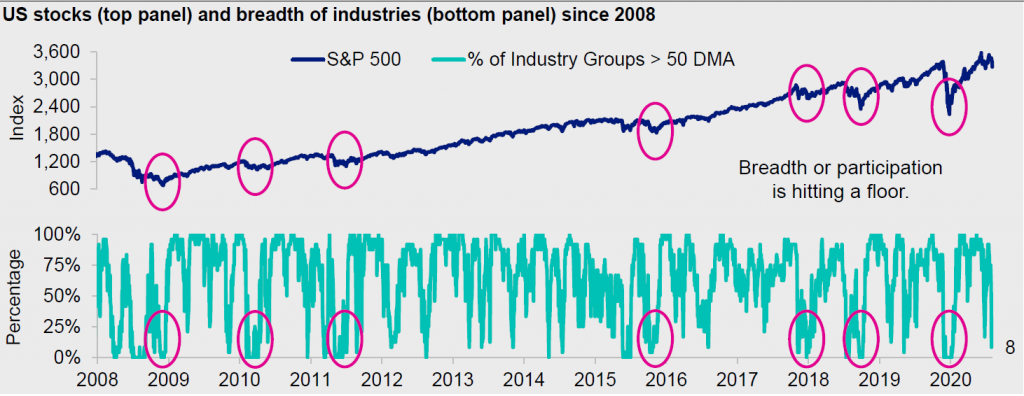

As a result, I’m inclined to interpret the recent shakeout as a temporary risk-shedding event, as opposed to a sinister change of trend, and I continue to treat such short-term pullbacks as buying opportunities for stocks. In fact, this technical indicator suggests S&P 500 industry breadth or participation has essentially fallen to washout levels (Figure 4), and a playable rally may ensue.

Figure 4. U.S. stock market breadth has fallen to washout levels, and a playable rally may ensue

Stick to cyclical growth

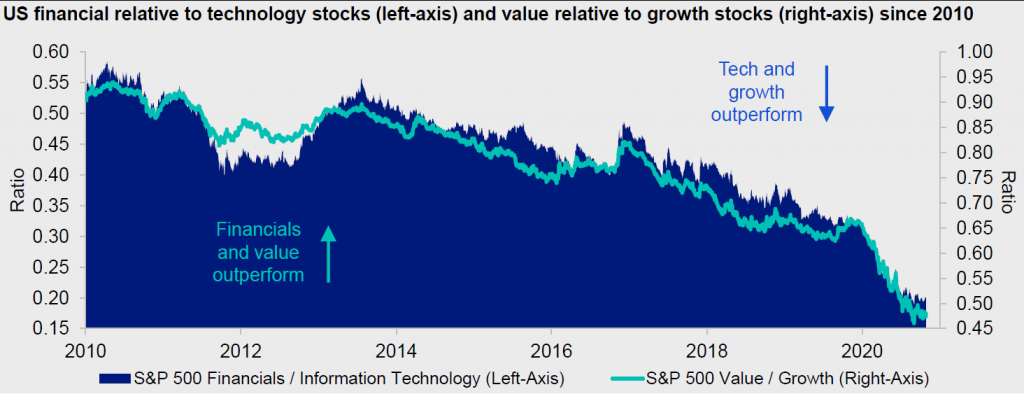

Within the economy-sensitive sectors of the stock market, the real debate still centers on “growth” cyclicals (e.g., Information Technology, Consumer Discretionary) versus “deep value” cyclicals (e.g., Financials, Energy).

I’m watching the yield curve or spread between 10- and 2-year government bond yields for signs of a persistent rotation into deep value cyclicals. True, the yield curve has steepened a bit recently, but has failed to break out above 0.7% so far in the economic recovery.2

From my lens, Financial and Technology stocks seem unconvinced the economy’s about to rapidly shift into sustainably higher gears. Until it does, I’m staying committed to cyclical growth. (No, the bottom of the chart doesn’t equal technical support.)

Figure 5. Technology was ground zero for the recent sell-off, but I’m unconvinced the economy’s about to rapidly shift into sustainably higher gears

For price-conscious investors, it might be more palatable — and maybe just as effective — to consider participating in this prolonged, low-altitude recovery and cyclical advance through the Industrial and Material sectors.

This post was first published at the official blog of Invesco Canada.