by Don Vialoux, EquityClock.com

Technical Notes for Tuesday October 13th

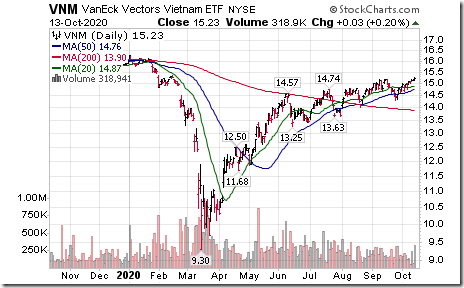

Vietnam ETF (VNM) moved above $15.20 extending an intermediate uptrend.

Wills Tower Watson (WLTW), a NASDAQ 100 stock moved above $218.58 to an all-time high extending an intermediate uptrend.

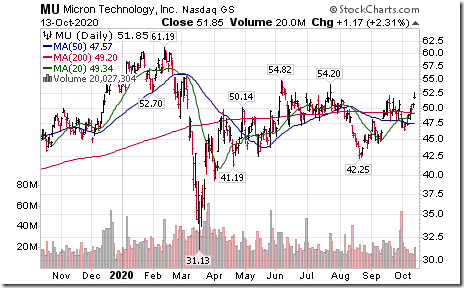

Micron (MU), a NASDAQ 100 stock moved above $52.17 resuming an intermediate uptrend following an upgrade to Buy by Deutsche Bank

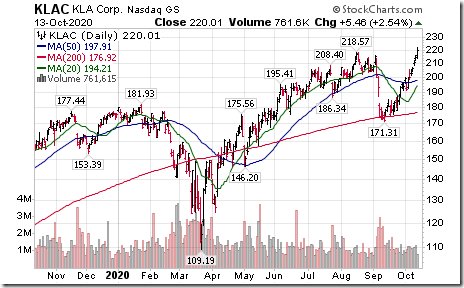

KLA Tencor (KLAC), a NASDAQ 100 stock moved above $218.57 to an all-time high extending an intermediate uptrend.

ASML Holdings (ASML), a NASDAQ 100 stock moved above $402.86 to an all-time high extending an intermediate uptrend.

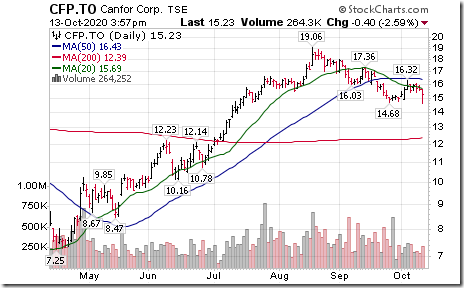

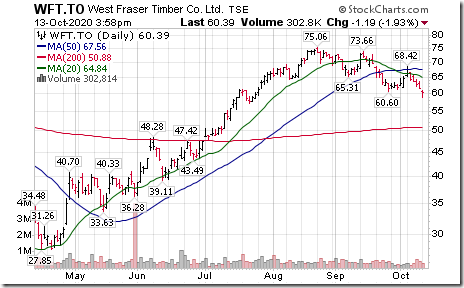

Canadian forest product stocks moved below short term support levels including Canfor (CFP), West Fraser (WFT) and Interfor (IFP).

Trader’s Corner

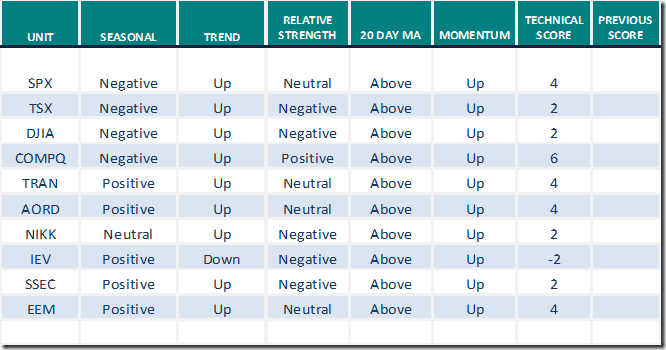

Daily Seasonal/Technical Equity Trends for October 13th 2020

Green: Increase from previous day

Red: Decrease from previous day

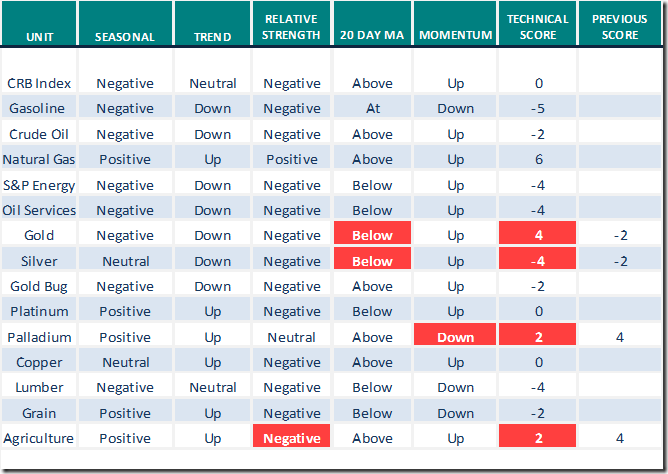

Commodities

Daily Seasonal/Technical Commodities Trends for October 13th 2020

Green: Increase from previous day

Red: Decrease from previous day

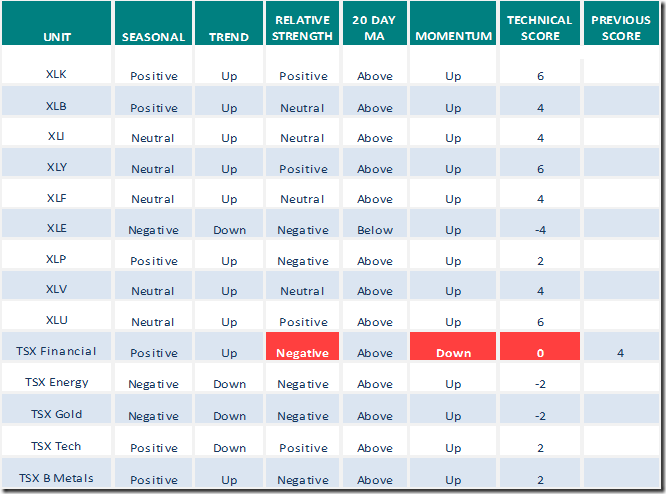

Sectors

Daily Seasonal/Technical Sector Trends for October 13th 2020

Green: Increase from previous day

Red: Decrease from previous day

S&P 500 Momentum Barometer

TSX Momentum Barometer

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.