by Jeffrey Buchbinder, CFA, Equity Strategist, and Ryan Detrick, CMT, Chief Market Strategist, LPL Financial

This earnings season, corporate America will get closer to the return of earnings growth—which is likely in the first quarter of 2021. We probably will have another decline in profits for third quarter 2020, though potentially only about half as big as last quarter’s. And we will undoubtedly hear more about uncertainty—both COVID-19 and election-related. We also highlight three things investors can watch this earnings season.

MOVING IN THE RIGHT DIRECTION

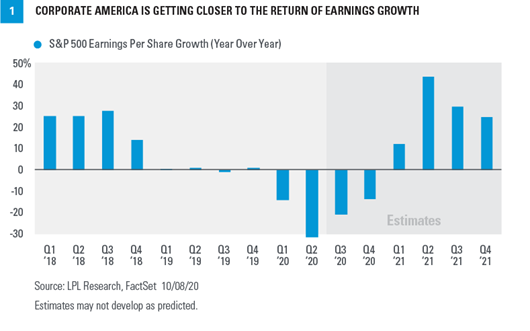

How investors evaluate this earnings season will depend on their perspectives. We are likely to get a much smaller year-over-year decline in S&P 500 Index profits in the third quarter compared to the second quarter, which is good news. Consensus is calling for a roughly 20% year-over-year decline in earnings per share (EPS) according to FactSet’s estimate, but we expect quite a bit better [FIGURE 1].

The consensus estimate for the third quarter has risen by about 4% over the past three months (best such increase in more than two years according to FactSet), a good sign that companies may be able to deliver more than the typical upside. And although fewer companies have offered guidance because of the amount of uncertainty, 67% of the guidance has been positive, significantly higher than the five-year average of 32%. Accordingly, we expect company management teams to instill confidence that the earnings rebound baked into analysts’ forecasts—or at least something close to it—may materialize.

The economic growth picture in the United States is also supportive. Mostly better-than-expected economic data during the quarter is a positive indication of earnings surprises. The possibility of a more than 30% annualized spike in US gross domestic product (GDP) during the third quarter is supportive of revenue growth for corporate America.

Bottom line, we think companies may deliver a solid upside surprise this earnings season, potentially comfortably above the long-term historical average of 3–4 percentage points, though probably well short of the double-digit positive surprise in the second quarter. The simple fact that getting past this quarter may get us closer to the end of the current earnings recession should help buoy investor sentiment.

WHAT TO WATCH

We are watching for three things this earnings season:

Impact of COVID-19. The increase in analysts’ earnings estimates reflects increased confidence in the outlook, even with the challenges COVID-19 still presents in terms of social distancing, various safety protocols, and shifting consumer behavior. We have been encouraged by recent data pointing to a continued steady reopening of the economy, and we believe the likelihood that additional lockdowns may meaningfully impair business activity remains very low.

Election front and center. As Election Day approaches, we expect to hear more about how potential policy changes may affect companies, particularly those most sensitive to regulations such as energy, financial services, and healthcare. Questions about regulatory risk for technology companies, as well as digital media and e-commerce, will surely come up on conference calls, so look for updates there. We think fears of large technology company breakups are overdone, while healthcare’s solid earnings outlook is being underappreciated by the market, in our view. We expect earnings growth only in the healthcare, technology, and utilities sectors this quarter, likely in the low single digits across the board.

Winners will keep carrying us. According to Credit Suisse, 54% of the market capitalization of the S&P 500 is on track to grow earnings in 2020. We believe the chances are good that the technology sector and the digital media and e-commerce internet industry groups will produce earnings growth in the third quarter. As long as those winners keep winning, and we think they will, they provide a solid earnings foundation for the broad market.

EARNINGS OUTLOOK INTACT

Following the strong second quarter earnings season, we raised our 2020 S&P 500 EPS forecast from $120–125 to $125–$130. That higher forecast still represents a drop of more than 20% from 2019 levels, similar to the historical average during recessions. We also believe it reflects both the snapback in economic activity this summer and early fall and the ongoing economic challenges presented by COVID-19.

But stocks are trading on expected earnings for 2021 and beyond, so we would put our focus there. That’s when economic conditions may return to some semblance of normal. Our estimate of normalized earnings, or the amount of earnings S&P 500 companies can generate after the pandemic ends, is $165 per share. The combination of efficiencies gained during the recession (which we think ended a few months ago), the strong performance of the winners, and the tremendous progress in COVID-19 treatment and vaccine development, all suggest we may be only a year away from reaching normalized earnings, though we fully recognize the risk that timeline may end up being too aggressive.

REITERATING OUR POSITIVE STOCK MARKET OUTLOOK

Our year-end S&P 500 fair value target range is 3,450–3,500, based on a PE ratio of near 21x and our normalized EPS estimate for the S&P 500 of $165, which we believe is achievable beginning in mid-2021. We anticipate further gains for this young bull market as the new economic expansion continues. We acknowledge the election is a wildcard, but history tells us election-driven volatility in the S&P 500 tends to be temporary and often followed by solid gains.

We believe these above-average stock valuations are justified based on the stronger-than-expected economic recovery to date, monetary and fiscal policy stimulus (and we think more is on the way), depressed interest rates and low inflation, and the likelihood that a safe and effective vaccine will be identified by the end of the year. We expect the developing earnings rebound may help stocks grow into their valuations over the rest of this year and in early 2021, as we hopefully see the end to the pandemic.

IMPORTANT DISCLOSURES

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.

References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly. Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. LPL Financial doesn’t provide research on individual equities.

All information is believed to be from reliable sources; however, LPL Financial makes no representation as to its completeness or accuracy.

US Treasuries may be considered “safe haven” investments but do carry some degree of risk including interest rate, credit, and market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Standard & Poor’s 500 Index (S&P500) is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

All index data from FactSet.

Copyright © LPL Research