by Don Vialoux, EquityClock.com

Technical Notes for Thursday

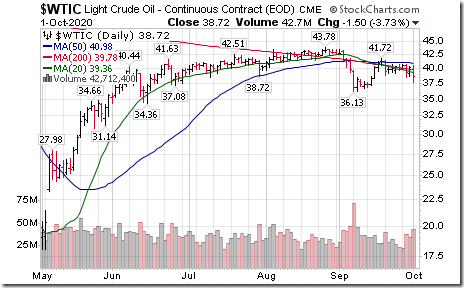

Occidental Petroleum (OXY), an S&P 100 stock moved below $9.82 extending an intermediate downtrend. The stock responded to a 2.9% in the price of WTI Crude Oil.

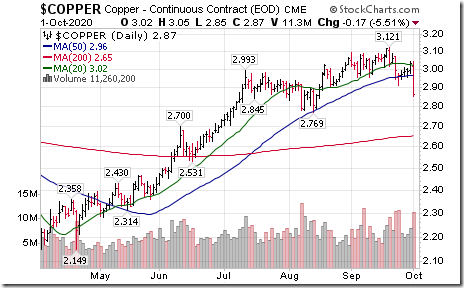

Base metal equities and related ETFs responded to a 5.51% drop in the price of copper.

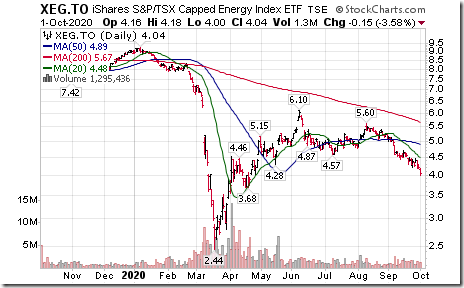

Energy equities and related ETFs moved lower following a 3.73% drop in the price of WTI crude oil on both sides of the border. Crude oil prices are responding partially to declining demand related to global expansion of COVID 19.

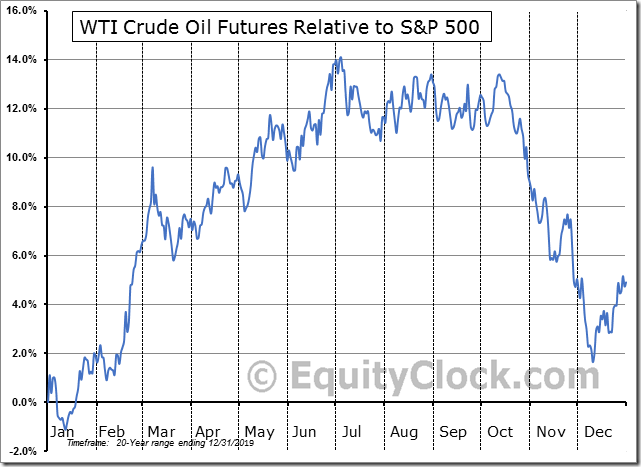

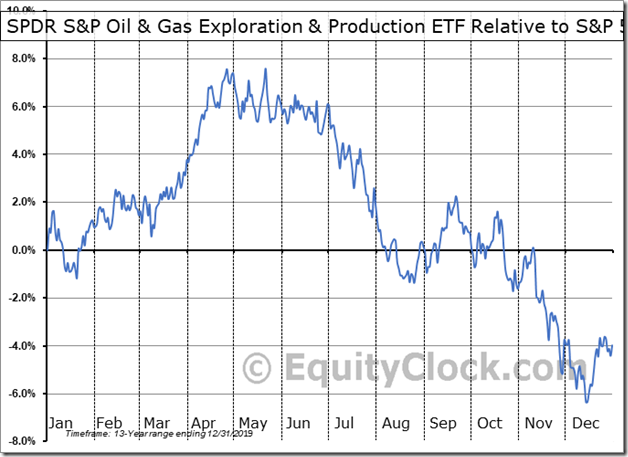

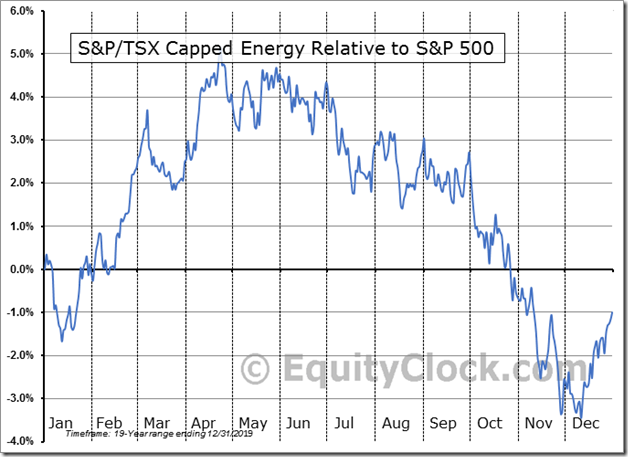

‘Tis the season for WTI crude oil prices to move lower!

‘Tis the season for relative weakness in the energy equity sector!

Trader’s Corner

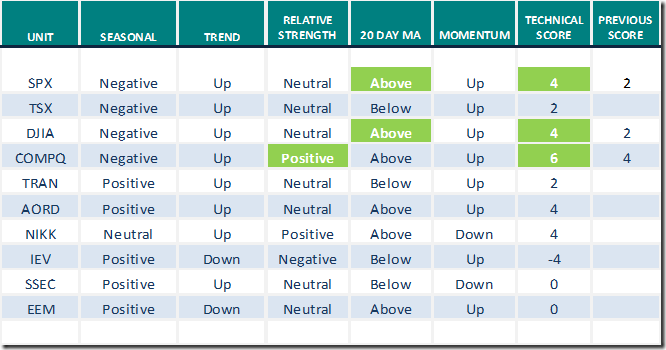

Daily Seasonal/Technical Equity Trends for October 1st 2020

Green: Increase from previous day

Red: Decrease from previous day

Commodities

Seasonal/Technical Commodities Trends for October 1st 2020

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for October 1st 2020

Green: Increase from previous day

Red: Decrease from previous day

Latest comments on the energy from Josef Schachter

Conclusion:

As we write this, WTI for November (the next contract) is at US$39.44/b with the day’s low at US$38.68/b. Further downside pressure is expected in the coming weeks as the pandemic caseload rises and the President’s indifference weights on the economy and individual behavior. The next breach level is US$36.13/b and we see this occurring during October. The next key level for WTI thereafter is US$34.36/b. If this is breached then the sector will face enormous selling pressure. We continue to see a risk of WTI falling below US$30/b if OPEC excess production is not reigned in.

Most energy stocks have significant downside risk. The most vulnerable companies are energy and energy service companies with high debt loads, high operating costs, declining production, current balance sheet debt maturities of some materiality within the next 12 months and those that produce heavier crude barrels. Results for Q3/20 should start shortly and continue through November and many reports will not be investor friendly. Another US producer fell by the wayside today – Bakken producer Oasis Petroleum filed for Chapter 11 with debts of US1.8B.

Hold cash and remain patient for the next low risk BUY window expected during Q4/20.

The S&P/TSX Energy Index has fallen from the June high at 96 (when we recommended profit taking) to the current level today of 65.76. Overall the index is now down by 32% in under four months. We see much more downside over the coming months as lousy Q3/20 results shaft the stocks even more. We will be watching to see how companies discuss their debt loads and lender support. Companies with pessimistic views about their reserve base lending, cutbacks in lines of credit and potential additional impairment write-downs will face significant stock price pressure. The next support for the S&P/TSX Energy Index is at 65.07 and then 58.05. Further lows are likely in Q4/20 as tax loss selling could be very nasty this year. We see the likelihood that the final low for the index will occur in the 32-36 area during tax loss selling season. We expect to see a very attractive BUY signal generated during Q4/20 and will recommend new ideas as well as highlight our favourite Table Pounding BUYS which should trade at much lower levels than now.

Subscribe to the Schachter Energy Report and receive access to all archived Webinars (our next one will be held at 7PM on Thursday November 26th), Action Alerts, TOP PICK recommendations when the next BUY signal occurs, as well as our Quality Scoring System review of the 27 companies that we cover. We go over the markets in much more detail and highlight individual companies in our two monthly reports. If you are interested in the energy industry this should be of interest to you.

To get access to our research go to http://bit.ly/2OvRCbP to subscribe.

S&P 500 Momentum Barometer

The Barometer added 5.21 to 51.10 yesterday. It remains intermediate neutral.

TSX Momentum Barometer

The Barometer added 5.58 to 47.44 yesterday. It remains intermediate neutral.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.

![clip_image002[9] clip_image002[9]](https://advisoranalyst.com/wp-content/uploads/2020/10/clip_image0029_thumb.png)

![clip_image002[7] clip_image002[7]](https://advisoranalyst.com/wp-content/uploads/2020/10/clip_image0027_thumb.png)

![clip_image001[5] clip_image001[5]](https://advisoranalyst.com/wp-content/uploads/2020/10/clip_image0015_thumb-1.png)

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/2020/10/clip_image0025_thumb.png)