by Don Vialoux, EquityClock.com

Technical Notes for Monday September 14th

Canadian Pacific (CP), a TSX 60 stock moved above $398.00 to an all-time high extending an intermediate uptrend.

Canadian National Railway (CNR), a TSX 60 stock moved above $140.27 to an all-time high extending an intermediate uptrend.

Agnico Eagle (AEM), a TSX 60 stock moved above US$84.45 and $112.09 Cdn. to an all-time high extending an intermediate uptrend.

Nutrien (NTR), a TSX 60 stock moved above $52.64 extending an intermediate uptrend.

Global Metals iShares (PICK) moved above $28.60 extending an intermediate uptrend.

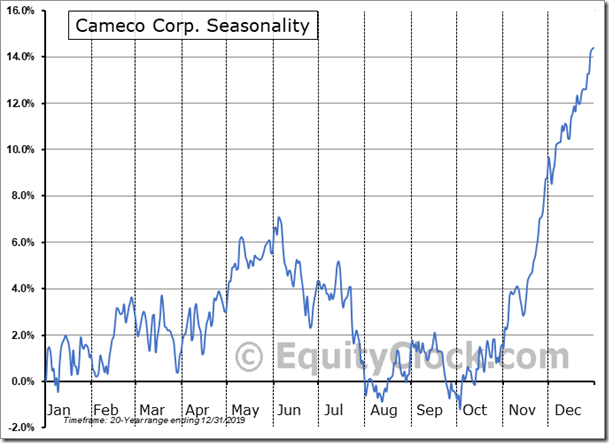

Cameco and other uranium stock moved higher on news that Russia and the U.S extended an agreement that limits Russian uranium sales into the U.S. until 2040. The agreement sets the stage for higher uranium prices in North America. Former agreement expires at the end of 2020.

Seasonal influences turn positive for Cameco and uranium stocks at the end of September

Trader’s Corner

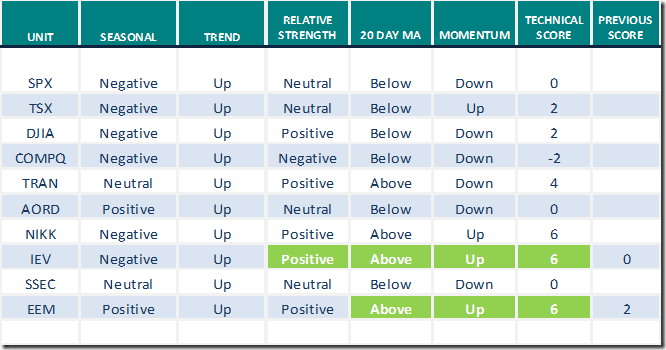

Equity Indices and related ETFs

Daily Seasonal/Technical Equity Trends for September 14th 2020

Green: Increase from previous day

Red: Decrease from previous day

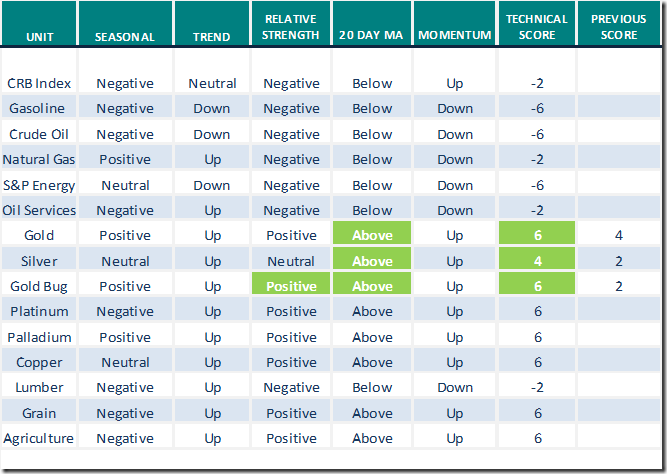

Commodities

Seasonal/Technical Commodities Trends for September 14th 2020

Green: Increase from previous day

Red: Decrease from previous day

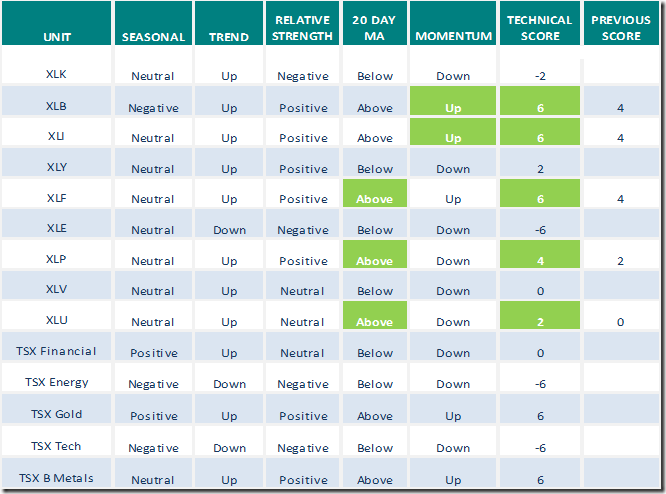

Sectors

Daily Seasonal/Technical Sector Trends for September 14th 2020

Green: Increase from previous day

Red: Decrease from previous day

Technical Scoop

Thank you to David Chapman and www.EnrichedInvesting.com for a link to their weekly comment. Headline reads,” Reserve currencies, shelf life, money supply, velocity diverges, stock drop, gold hold, cruel low, second wave”. Following is the link:

Editor’s Note: The report includes an excellent history on the evolution of money.

S&P 500 Momentum Barometer

The Barometer gained 8.22 to $62.12 yesterday. It changed from intermediate neutral to intermediate overbought on a move back above 60.00.

TSX Momentum Barometer

The Barometer gained 9.29 to 58.10 yesterday. It remains intermediate neutral.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.