by Mark Phelps, AllianceBernstein

In a world of increased uncertainty, many investors’ natural instinct is to “hedge their bets” by diversifying, rather than investing in a concentrated strategy. But this year, a portfolio consisting of just the five largest US stocks would have significantly outperformed. So, is there a way to reduce risk and to capture long-term growth in a concentrated portfolio?

Investors often choose to diversify extensively by investing in an ETF that replicates the benchmark. While this approach will provide market or ”beta” returns, it offers no opportunity for outperformance or “alpha”. But in a world where many companies are no longer offering guidance regarding their businesses because of COVID-19, we believe investors can seek better returns through active management based on rigorous fundamental analysis, particularly by focusing on companies that should be able to prosper even in these difficult conditions. Meanwhile, a portfolio consisting of just Microsoft, Amazon, Facebook, Alphabet and Apple would have significantly outperformed the MSCI World this year.

The Diversification Dilemma

So, is a five-stock portfolio the right approach? Well, in the unprecedented conditions created by global economic lockdowns, this combination performed extremely well. But on any longer-term timescale, academic research suggests somewhere between 20 and 35 stocks is optimal. In a global equity portfolio, most diversification benefits are achieved with 20 stocks (Display). Once the portfolio holds more than 35 stocks, further diversification benefits are modest. Of course, there may be other reasons to own more stocks, such as liquidity constraints or country and currency diversification, but additional individual stock diversification is not very beneficial, in our view.

Concentrated Portfolios Benefit from Persistent Growth Stocks

In our opinion, for long-term investing, stability of earnings growth is the key to success. We believe companies that can grow their earnings per share by more than 10% a year over three to five years are excellent candidates. According to our research*, from 1989 to 2019, global companies that delivered such consistent earnings growth over three years outperformed the market by 2.2% a year on average; those that did it for five years delivered excess returns of 3.5% a year.

These companies are also hard to find. Over the last 30 years, only 64 global companies on average managed to deliver 10% growth per annum over three years, while only 13 did so over five years. Holding a small number of companies like these in a concentrated portfolio can produce powerful results, in our view.

Pandemic Quashes Near-Term Growth

Today, finding long-term growth is especially challenging. Given the uncertainty about the pandemic and the global recession, perhaps it’s unrealistic to target 10% earnings growth. And if you can’t find that, is the rationale behind a concentrated portfolio of persistent growth stocks still valid?

We think it is, for three reasons. First, this year’s earnings collapse doesn’t necessarily mean the long-term outlook is severely compromised. Second, consensus forecasts suggest many companies are still expected to grow earnings by more than 10% per year. Third, a select group of high-quality companies have even stronger potential.

Long-Term Forecasts Point to Recovery

Nobody can deny the challenges facing companies this year. As countries locked down economies to contain the spread of COVID-19, the 2020 earnings per share forecast for MSCI World companies plunged by 24% to about US$0.96 at the end of June (Display below, left).

But the longer-term picture is not as dire. While three- to five-year compound annual growth rates have declined from pre-pandemic levels, most sectors are still expected to deliver average earnings growth of at least 6% over the long term. And for select sectors, such as healthcare and technology, the average earnings growth expectation exceeds 10% per year.

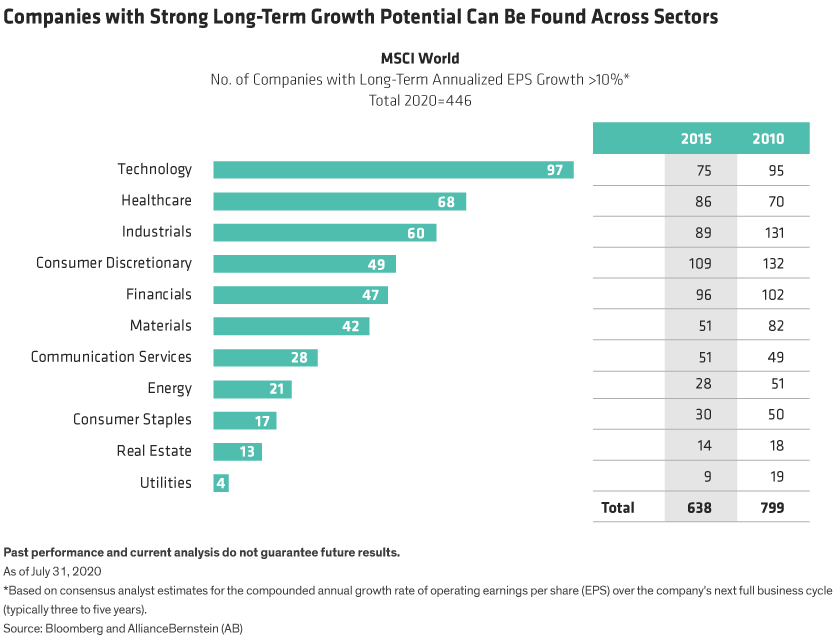

Sector averages obscure the strongest performers. In fact, at the end of June, 446 companies in the MSCI World were expected to deliver long-term growth of at least 10% per year, including 165 in the relatively resilient technology and healthcare sectors (Display, left). Of course, there are fewer such companies than five and ten years ago (Display, right). But investors with a discerning stock-selection process should be able to identify the top prospects.

The narrower number of opportunites argues for a concentrated portfolio. We believe that in an uncertain world, stocks that offer this level of consistency are likely to be significantly more highly valued.

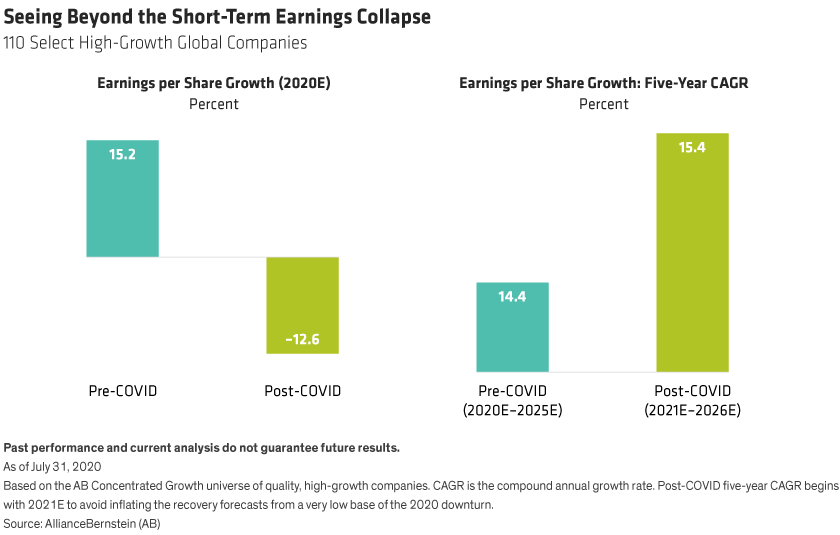

Even before the pandemic, only a small number of the top prospects actually delivered on their growth expectations. So we applied a more selective lens to single out 110 of the highest-quality companies, which revealed even stronger pent-up potential. These companies have proven business models, competitive advantages, healthy balance sheets and top-notch management. While some are facing a short-term earnings shortfall, our research suggests that for this cohort, long-term earnings growth rates may improve to 15.4% per annum after the worst of the recession is behind us (Display).

There are still many risks to these forecasts. Countries, sectors, industries and companies are facing vast uncertainty from the coronavirus. The range of potential outcomes is much wider than usual. At the same time, certain industries are holding up better than others. And some companies have more control over their destinies than peers.

To find the highest-quality companies today, investors need a deep understanding of how businesses will perform and adapt in a changing world—and to consider a much broader range of potential outcomes for each stock. Concentrated investors, who always rely on high-conviction positions, are well placed to single out the most promising prospects in a narrowing field of high-growth candidates. By doing so, we believe portfolios with a small number of companies can be positioned to withstand COVID-19 volatility and to deliver consistent long-term outperformance through a recovery.

*Sources: Center for Research in Security Prices, Compustat, FactSet, MSCI and AB

Mark Phelps is Chief Investment Officer—Concentrated Global Growth at AllianceBernstein

Dev Chakrabarti is Portfolio Manager/Senior Research Analyst—Concentrated Global Growth at AB

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time. AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.

Past performance is not a guarantee of future results. The value of an investment can go up or down and past performance is neither indicative of, nor a guarantee of, future results.

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.

This post was first published at the official blog of AllianceBernstein..