by Don Vialoux, EquityClock.com

Technical Notes for August 18th

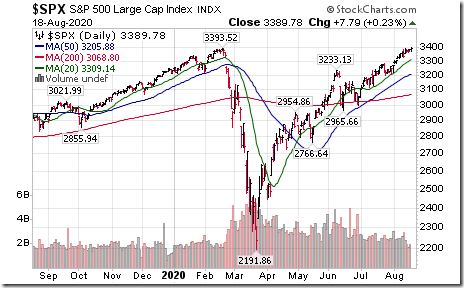

S&P 500 Index moved above 3393.52 to an all-time inter-day high extending an intermediate uptrend. It also closed at an all-time closing high.

U.S. equity indices and related ETFs are responding to weakness in the U.S. Dollar and corresponding gains by U.S. companies with international operations. Revenues and earnings from international subsidiaries are adjusted higher when their currencies are translated into U.S. Dollars. The U.S. Dollar Index and its related ETN dropped to a 28 month low yesterday. From their peak from the third week in March, the U.S. Dollar Index has plunged 11.0% and its ETN has dropped 13%.

Conversely, the Canadian Dollar has advanced 11% since the third week in March.

The CRB Index and its related ETN have jumped 49% since the third week in April

Frontier iShares (FM) moved above $24.69 extending an intermediate uptrend.

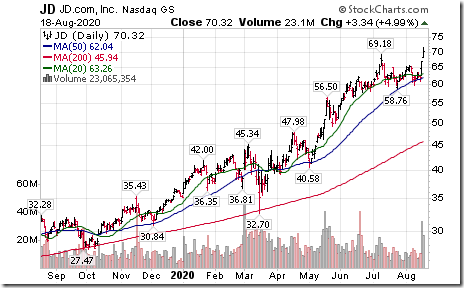

JD Inc. (JD), a NASDAQ 100 stock moved above $69.18 to an all-time high extending an intermediate uptrend.

Moderna (MRNA), a NASDAQ 100 stock moved below $66.54 setting an intermediate downtrend.

Trader’s Corner

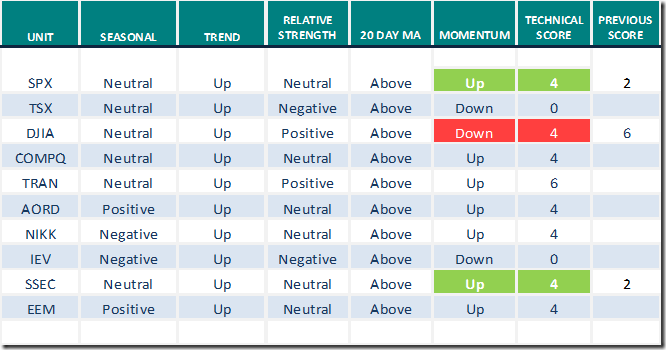

Equity Indices and related ETFs

Daily Seasonal/Technical Equity Trends for August 18th 2020

Green: Increase from previous day

Red: Decrease from previous day

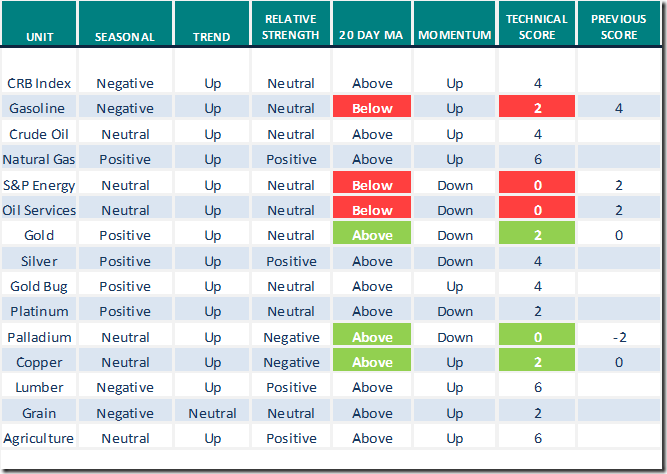

Commodities

Seasonal/Technical Commodities Trends for August 18th 2020

Green: Increase from previous day

Red: Decrease from previous day

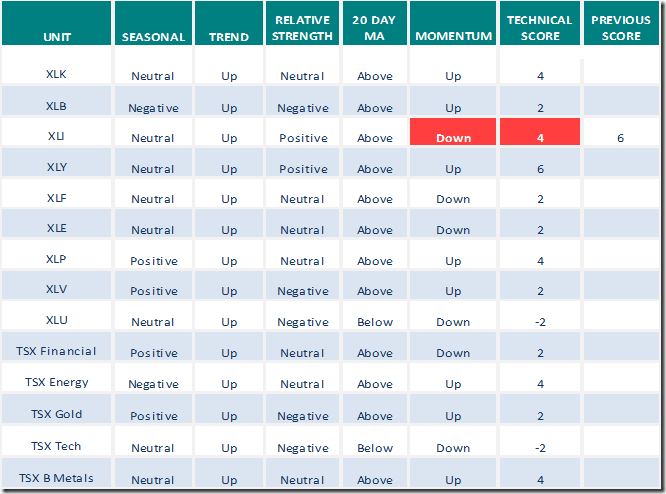

Sectors

Daily Seasonal/Technical Sector Trends for August 18th 2020

Green: Increase from previous day

Red: Decrease from previous day

S&P 500 Momentum Barometer

The Barometer slipped 1.60 to 76.15 yesterday. It remains intermediate overbought.

TSX Momentum Barometer

The Barometer added 2.00 to 81.43 yesterday. It changed from intermediate overbought to extremely intermediate overbought on a move above 80.00.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.

![clip_image001[5] clip_image001[5]](https://advisoranalyst.com/wp-content/uploads/2020/08/clip_image0015_thumb-8.png)

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/2020/08/clip_image0025_thumb-6.png)