by Hubert Marleau, Market Economist, Palos Management

A confluence of better than expected economic prints continued to embolden the bulls. The Small Business Optimism Index increased 6.2 points in June to 100.6 with 8 out of 10 components improving. Industrial production surged 3.4% in July. Retail sales grew 1.2% in July surpassing its pre-pandemic level by 1.7%. Productivity soared at an annualized rate of 7.3% in Q/2.

While productivity usually rises during recessions as less efficient workers are the first to be let go, it very rarely spikes like that. Jobless claims snapped a worrisome streak of higher prints in the middle of July, dropping below one million (963,000) for the first time since the onset of the pandemic when a consensus of economists was expecting as much as 1,255,000.

After moving sideways from mid-June to late July, the JEF Economic Activity Index and the NY Fed Weekly Economic Index which follow high frequency daily and weekly data, have started showing signs of life. The Atlanta Fed’s GDPNow Model estimate for real GDP growth for Q/3 rose to 26.2%. It was 19.6% two weeks ago.

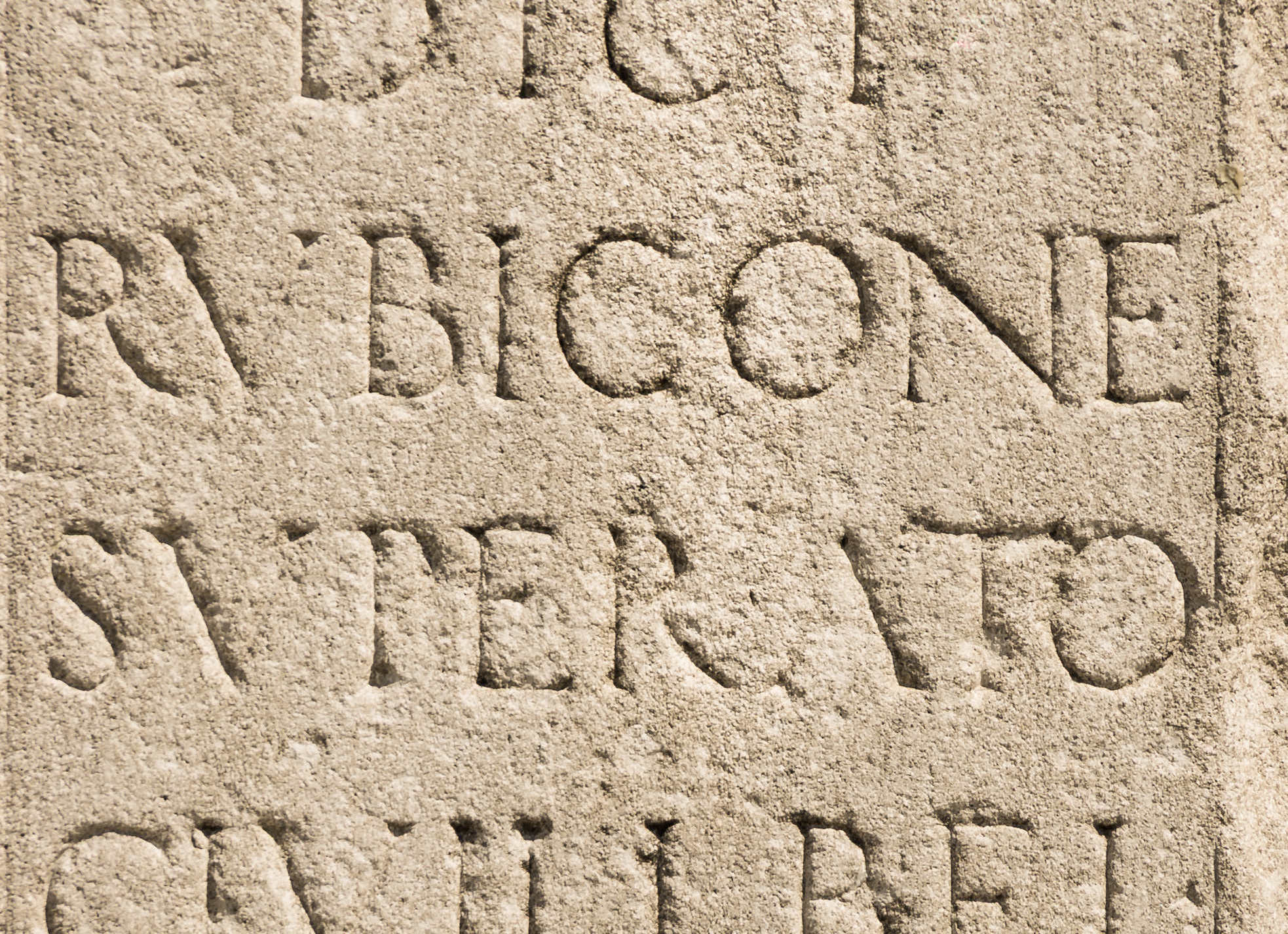

The S&P 500 increased 0.7% to end at 3351, near an all-time high of 3386. If it were not for the standoff between the Democrats and the Republicans with no signs of abating over the coronavirus bill, the S&P 500 would have crossed the Rubicon. While I recognize that market sentiment will be affected by how investors think the pandemic will end and on the timeline of potential vaccines, it will be determined much more by whether the rebound in inflation is sustainable. It’s what one would see if a clear and true recovery in cyclical forces is resuming.

The big news of the week was that all price measures jumped in July, and considerably more than expected. Firstly, producer prices, which measure the change in the price of goods sold by manufacturers and are leading indicator of other prices, increased 0.6% versus a consensus estimate of 0.3%. Secondly, U.S. import prices rose 0.7% in july, the third straight monthly gain and the largest in ten years. Thirdly, consumer prices rose 0.6% in July, double what a consensus of economists expected. Meanwhile the core consumer prices which excluded energy and food also rose 0.6%--triple the consensus.

The above data on inflation has not only ended the perception that the economy has fallen into a deflationary spiral. It’s much more. Prices have almost returned to pre-pandemic levels and the outlook is up. The University of Michigan sentiment survey showed that consumers expect a rising rate of inflation over the next 12 months. It does not mean that we are returning to the hyper-inflationary state experienced in the 1970s.

Yet, it does bring back some of the pre-pandemic arguments that catalysts – like on-shoring, protectionism, supply chain shakeups, tariffs, climate changes and lack of business investments – should at least return inflationary expectations to the 2.0% level. These impulses are reflected in the bond market. For example, the five-year inflationary expectations are currently 1.6% compared to a low of 0.15% on March 18. The indicators supporting the credibility of higher prices are:

- the rise in the price of several key commodities like copper, gold, crude and lumber,

- the steepening of the yield curve,

- the drop in the U.S. Dollar Index,

- the tenacity of the Fed to keep the monetary stance easy for an indefinite period, allowing an overshoot in its longstanding 2% inflation target, and,

- the increasing likelihood that Washington will pass another trillion dollar plus fiscal relief.

Past fiscal spending and monetary largess have brought about a speedy and huge increase in the money supply. The money supply is up 22% year over year. It should be noted that inflation has always been a monetary outcome when the money supply is put back to work. Over the past few weeks, bank deposits have fallen while bank reserves have risen, suggesting that corporations and individuals are paying back their bank loans and bank lines. Thus, the focus might be changing from risk aversion savings to risk tolerance expenditures. Velocity rises when money is spent, normally resulting in higher inflation and higher growth.

Nomura’s Charlie McElligot and the Heisenberg Report made the astute deductions in a note to clients that “going forward, investors should watch the trend in M2. The money supply may be the indicator to monitor when it comes to gauging whether corporates and households really believe in the recovery narrative, and thereby whether any pro-cyclical rotation in equities (Banks, Industrials, Materials and Energy) is sustainable.”

An absolute decline in the money supply from hereon would be particularly bullish for cyclicals, given that the Treasury General Account (TGA) will obviously decline further to pay for Trump’s executive stimulus orders. Assuming the TGA were to fall to USD 400bn from 1.635tn, the 1,235tn injection into the economy would boost money supply by 6.7%--according to Macro Strategy Partnership.

It makes sense that responses to BofA’s Global fund Manager survey shows unequivocally that all the things that concern money managers have large inflationary bias – reshoring supply chains, rise in protectionism, modern monetary theory, green energy, stagflation and universal basic income. The bank’s Michael Hartnett says there are “secular reasons to raise inflation hedges big-time heading into 2021”. He’s not without support.

Goldman’s David Kostin raised his year-end target for the S&P 500 to 3600, reflecting a 7% return despite all the known uncertainties including the election. Kostin based his forecast on an economy that will rebound 6.4% and S&P EPS rise to $170 respectively in 2021. He calculated that the equity risk premium should fall to 5.2% from 5.7% because bond yields should increase in 2021 reflecting a higher rate of inflation and suggesting that performance will be skewed to the cyclicals.

Copyright © Palos Management