by Jennifer DeLong, AllianceBernstein

Demand for ESG investing is growing among DC plan participants, but with plan sponsors facing many choices and proposed new DOL rules, what’s the best approach? As we see it, fully integrating ESG considerations is fundamental to better financial outcomes—which is always in participants’ best interests.

Demand Grows, but the Pathway to ESG Adoption Isn’t So Obvious

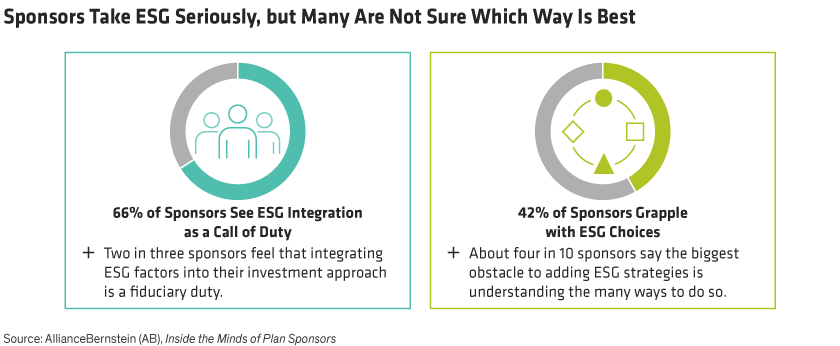

It’s clear that DC plan participants want environmental, social and governance (ESG) investment options in some form. About 67% of plan sponsors said they’re being asked for more investment choices with a responsible investing tilt, based on our ongoing survey, Inside the Minds of Plan Sponsors. And plan sponsors are taking ESG considerations seriously, with two in three (66%) saying they felt ESG integration—applying ESG factors in fundamental investment analysis—is a fiduciary duty.

Sponsors are taking ESG seriously, but many are not sure which way is best. That is, two in threes sponsors feel that integrating ESG factors into their investment approach is a fiduciary duty. But about four in 10 say their biggest obstacle is understanding the many ways to offer ESG.

But many plan sponsors still grapple with how to deliver ESG choices. And there’s lingering uncertainty about ESG investing’s definition and scope—even among rulemakers. There’s “no consensus about what constitutes a genuine ESG investment, and ESG rating system,” the Department of Labor (DOL) said recently. Another speed bump is sorting through the many ways to implement ESG investing: individual stand-alone purpose-driven funds, integration, industry screens, sleeves in asset-allocation models and target-date funds, or self-directed brokerage windows. For 42% of sponsors, the biggest obstacle is understanding the differences.

New DOL Rule Proposal: More Demands, But Not Much Change

Based on our interpretation, the DOL’s latest effort isn’t a big change from the current rules, but it may pose new challenges. “Plans are not vehicles for furthering social goals or policy objectives that are not in the financial interest of the plan,” the DOL postulated, while underscoring that pecuniary considerations (a.k.a. financial factors) should take sole priority.

The new rules wouldn’t prohibit ESG options, but they could encumber the selection and monitoring process. For example, plan sponsors would need to do a lot more documenting to validate any ESG considerations on top of the current “all else being equal” test. The rules would also all but preclude an ESG purpose-driven fund from serving as a qualified default investment alternative (QDIA). We think these measures are overly restrictive, which could lead sponsors to turn away from funds with any hint of ESG.

ESG Considerations Are Financial Considerations

Shunning all ESG would be unfortunate for participants, because, as we see it, ESG considerations must be a critical component of in-depth fundamental research in any investment solution—whether it has an ESG label or not.

For example, a company that emits a lot of carbon is exposed to carbon taxes—and those taxes are likely to increase over time. It can also be subject to higher operating costs from legally mandated equipment upgrades. Longer term, the business also risks losing market position to competitors who develop low-carbon alternatives—a changing of the guard that also highlights potential positive financial impacts from ESG. In short, ESG considerations are financial considerations.

In fact, the DOL acknowledges that ESG factors can be economic considerations if they present “material economic risks and rewards.” We agree: integrating ESG can uncover issues with material financial impact, therefore making it a key contributor to plan performance by improving returns and managing risk. In our view, ignoring ESG factors leaves the puzzle unfinished and could lead to suboptimal results.

Participants Want ESG—If It Drives Performance

Participant sentiment and trends shouldn’t drive a fiduciary’s investment-option decisions.

Still, 90% of participants want options to square with their ethical values, according to Inside the Minds of Plan Participants, the companion to our plan sponsor survey. And 71% of participants are likely to invest in socially responsible funds if performance and fees are comparable to other plan investments.

While proposed DOL guidelines sit in the pipeline, ESG opportunities for plan sponsors are already here. Yes, there are many different ways to access ESG investing. But a good first step is to look carefully at plan options—from the default fund or its underlying investments to core and stand-alone offerings—and question whether all factors are being considered in the investment process.

When the bottom line is better financial outcomes, plans can and should take an ESG integration lens across the investment line-up. For plan sponsors, we think doing financially right by participants can be achieved through ESG considerations and well within the scope of plan rules, fiduciary responsibilities—and perhaps do some good, too.

Jennifer DeLong is Head of Defined Contribution at AllianceBernstein (AB).

Michelle Dunstan is Global Head—Responsible Investing at AllianceBernstein (AB).

“Target date” in a fund’s name refers to the approximate year when a plan participant expects to retire and begin withdrawing from his or her account. Target-date funds gradually adjust their asset allocation, lowering risk as a participant nears retirement. Investments in target-date funds are not guaranteed against loss of principal at any time, and account values can be more or less than the original amount invested—including at the time of the fund’s target date. Also, investing in target-date funds does not guarantee sufficient income in retirement.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

This post was first published at the official blog of AllianceBernstein..