Supported by monetary and fiscal policies and boosted by renewed investor enthusiasm, global financial markets have rebounded.

by Jim McDonald, Chief Investment Strategist, Northern Trust

OUTLOOK

Just months after one of the sharpest drops ever, stock markets globally are nearing cycle highs as most economic data continues to show repair. Fiscal stimulus and income support programs have supported consumer spending over the last several months, as have lending programs to businesses intended to underpin employment. However, we remain concerned that continuing COVID-19 cases will blunt the pace of the current rebound. While most broad measures of growth are still rebounding firmly, there are signs of softening in areas like restaurant and airline bookings as well as retail sales. Even regions where the virus is well-controlled, like Hong Kong, are seeing the effects, as a small rise in virus cases led to the re-closing of Hong Kong Disneyland. In the U.S., California has responded to rising cases by cancelling in-person public schooling in Los Angeles and San Diego starting in August.

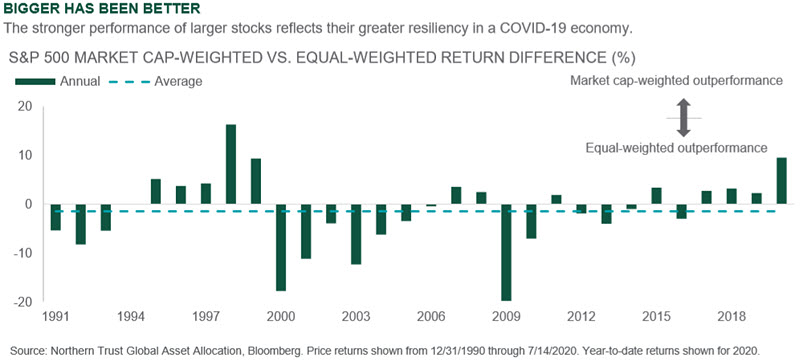

So, is the market being irrational in continuing to advance in the face of these resurgent risks? Certainly, the stock market is not directly representative of the real economy. Many of the most affected industries, including retail, travel, and hospitality, are small parts of the market; while some of the greatest beneficiaries, such as the technology industry, are the largest. This can be illustrated by comparing the market cap-weighted S&P 500 performance to that of the equal-weighted index. As shown below, the market cap-weighted index has materially outperformed the average stock this year. While the better economic (and market) performance of the bigger technology companies makes the earnings outlook less uncertain than may be believed at first glance, we see only around 5% upside to our 2021 earnings outlook.

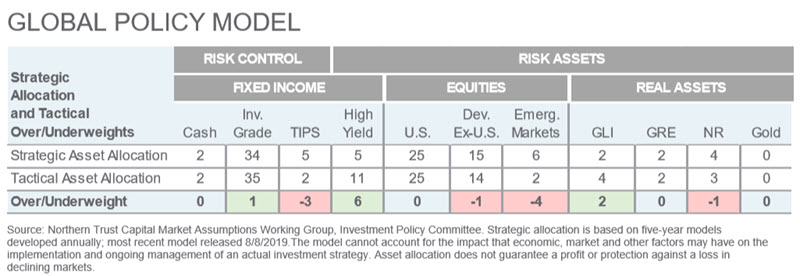

Even though interest rates have returned to near-record lows, the stock market looks somewhat pricey. Valuations aren’t a timing device, and markets can stay expensive for extended periods of time. After reducing our recommended tactical risk position in our global policy model the last two months, we stood pat with our moderate underweight to risk this month. Our Structural Monetary Accommodation theme posits that central banks will continue to provide extraordinary monetary support for the foreseeable future, which provides support to risk taking. We do expect COVID-19 to create recurring public health problems over the next year, but we will also see continued advances in treatment and vaccine development that may lead the market to look past the shorter-term challenges. Heightened volatility will likely be the resulting environment as investors assess the outlook for global growth in 2021 and beyond.

INTEREST RATES

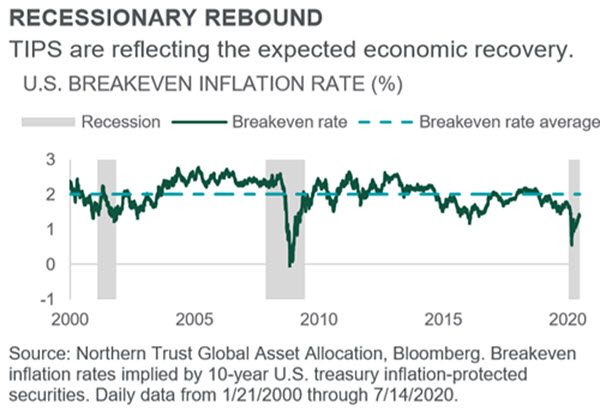

- TIPS performed typically during the early stages of the recession.

- The rebound in expected inflation has been muted, which we think is correct.

- We remain underweight TIPS in our global policy model.

Treasury inflation-protected securities (TIPS) have historically fallen during recessions as inflation expectations decrease. This recession has been no different. After bottoming in March, TIPS have rebounded due to monetary and fiscal stimulus. Inflation expectations (as measured by 10-year breakeven rates) showed an initial sharp bounce from March’s virus-depressed level and have continued to slowly inch up over the past three months. TIPS funds have seen $4.7 billion of inflows since mid-July.

During the financial crisis, 10-year breakevens contracted over 260 basis points (bps), from 2.6% to about 0%, before rallying back to prior levels over the next year. During the beginning of the COVID-19 crisis, we also saw a significant contraction with peak-to-trough breakevens falling by over 120 bps. Breakeven rates have since recovered by more than 80 bps as the economy slowly re-opened and consumer demand strengthened. We reduced our TIPS underweight in May to capture this dynamic. However, the acceleration of COVID-19 cases across parts of the world remains a significant headwind. As a result, we maintain a (smaller) underweight to TIPS, expecting traditional investment grade bonds to outperform over the next year.

CREDIT MARKETS

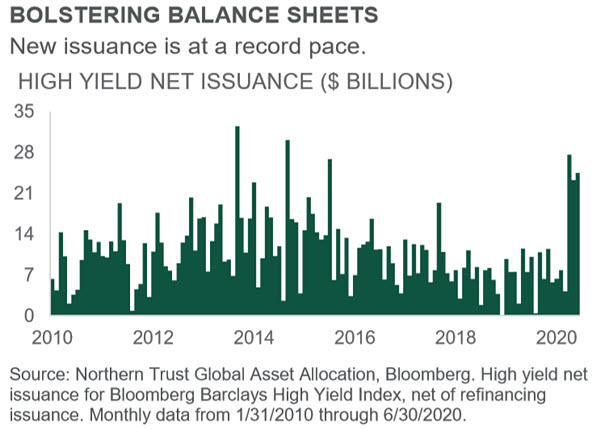

- High-yield companies have been furiously raising capital to protect their financial positions.

- Easy monetary policy and resulting low interest rates have supported issuance.

- We continue to remain overweight high yield in our global policy model.

The high-yield market has experienced record supply in 2020 as companies have looked to raise cash to protect balance sheets. Halfway through 2020, the market is on record pace for gross issuance, nearly doubling 2019’s figure. Issuance is expected to normalize in the coming months as management teams assess further liquidity needs. Companies must optimize capital structures in order to comply with financial covenants, while being prepared for future business disruption.

Similar to the investment-grade market, which has also experienced record issuance, investors have been eager to buy high yield at attractive valuations. Cumulative inflows through June are roughly $30bn, which is a tailwind for the asset class through quieter summer months when new issuance decreases. Cash inflows support valuations as managers must invest capital in order to maintain neutral cash balances. Many uncertainties remain as economies attempt to “re-start,” but based on investor appetite for record new issuance over the past six months, supportive fiscal and monetary policy going forward, and a continued search for yield from global investors, the high-yield asset class appears able to continue to attract capital, ultimately supporting valuations.

EQUITIES

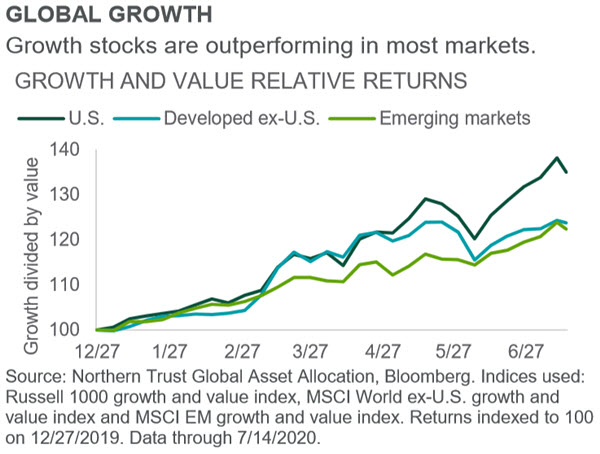

- Stock markets are benefitting from growth stock leadership.

- Valuations appear full as we don’t see meaningful earnings upside potential.

- The risk/reward of equities is reduced by full valuations and growing public health uncertainty.

After pulling back to test the 3,000 level on the S&P 500 twice in June, equities are again moving higher. Second-quarter (2Q) earnings season is underway and is expected to represent this cycle’s earnings trough. Globally, 2Q earnings are expected to decline more than 40% from a year ago, led lower by energy, consumer discretionary, industrials and financials. More modest declines are expected in traditionally defensive sectors. Earnings are expected to sharply rebound in 2021, with full-year 2021 estimates for U.S. just below 2019 actual levels; developed ex-U.S. 7% below; and emerging market equities 10% above.

Market leadership continues to favor large-cap technology-related stocks where earnings are stable or even benefiting from the current environment. The >$1 trillion market cap tech stocks are exaggerating the outperformance of growth in the U.S., but growth outperformance is not a U.S.-only phenomenon. As the economy improves, value could see a comeback, but with P/E multiples on the broader market appearing full, even on 2021 expectations, we find the risk/reward of equities less attractive considering the potential for disappointing growth as the health threat overhang remains.

REAL ASSETS

- The acute nature of this recession hit GLI harder than in past market sell-offs.

- We remain overweight GLI in our global policy model for its income generation in a low-interest-rate world.

- We are slightly underweight natural resources, as we wait for a better commodity supply-demand balance.

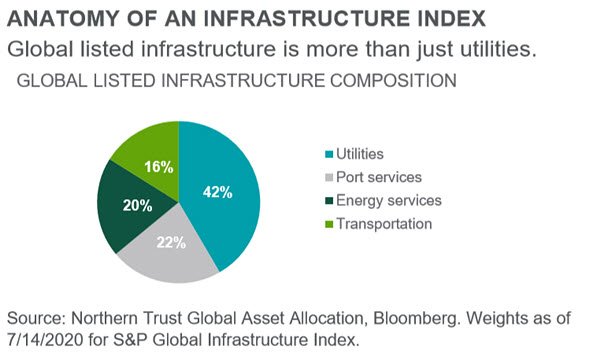

Global listed infrastructure (GLI) is supposed to be a “less risky” risk asset, providing income and downside protection to the risk portfolio. And yet it trailed global equities in the downturn by 9% and is still down 30% for the year while the broader equity market has materially recovered. What is going on here? The asset class’ exposure to interest rates – which normally fall during stock market sell-offs – usually stabilizes returns in times of equity market weakness. But the acute nature of this recession led to unusual asset class performance. Specifically, the notable reduction in air and seaport activity hurt port service stocks (22% of the index); the material fall in energy prices affected energy service stocks (20%); and reduced mobility hurt transportation (highway and railway) stocks (16%). Together, these sectors offset utility sector performance.

We remain overweight GLI, as we don’t expect permanent impairment to the worst-hit sectors. But we expect higher yields to be attractive in an extended low-interest-rate environment. We also note that more diversified infrastructure indexes have fared better this year. We remain tactically equal-weight global real estate weighing attractive income generation against property value write-downs (e.g. retail) and tactically underweight natural resources, given over-supply and low demand.

-Jim McDonald, Chief Investment Strategist

IN EMEA AND APAC, THIS PUBLICATION IS NOT INTENDED FOR RETAIL CLIENTS

© 2020 Northern Trust Corporation.

The information contained herein is intended for use with current or prospective clients of Northern Trust Investments, Inc. The information is not intended for distribution or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. This information is obtained from sources believed to be reliable, and its accuracy and completeness are not guaranteed. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor. Forward-looking statements and assumptions are Northern Trust's current estimates or expectations of future events or future results based upon proprietary research and should not be construed as an estimate or promise of results that a portfolio may achieve. Actual results could differ materially from the results indicated by this information. Investments can go down as well as up.

Northern Trust Asset Management is composed of Northern Trust Investments, Inc. Northern Trust Global Investments Limited, Northern Trust Global Investments Japan, K.K, NT Global Advisors Inc., 50 South Capital Advisors, LLC and investment personnel of The Northern Trust Company of Hong Kong Limited and The Northern Trust Company.

Issued in the United Kingdom by Northern Trust Global Investments Limited.

Copyright © Northern Trust