Waiting on the sidelines can cost you – maybe more than you realize

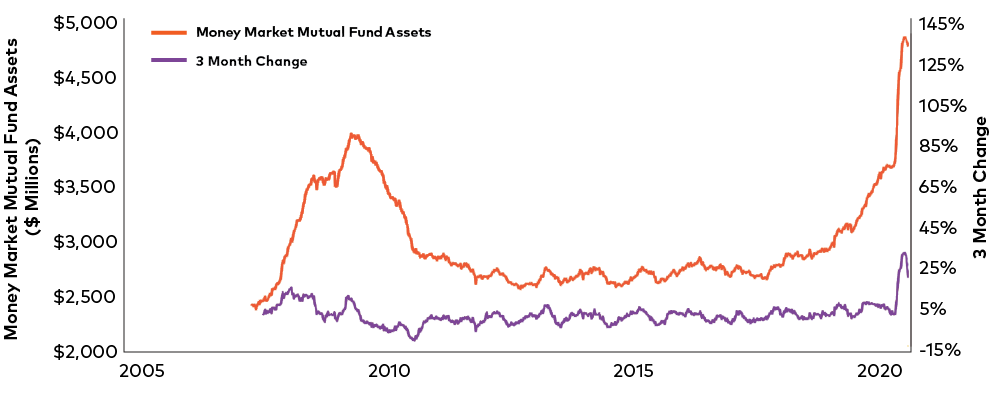

The “flight to safety” has resulted in an estimated US$5 trillion is sitting in cash or money market accounts1 – and that’s just the U.S. numbers.

The chart below helps to put that into perspective:

- The previous three months set a record for the largest three-month change ever1

- The amount sitting on the sidelines exceeds that of the Great Financial Crisis of 2008-91

Source: LPL Research, ICI June 17, 2020.

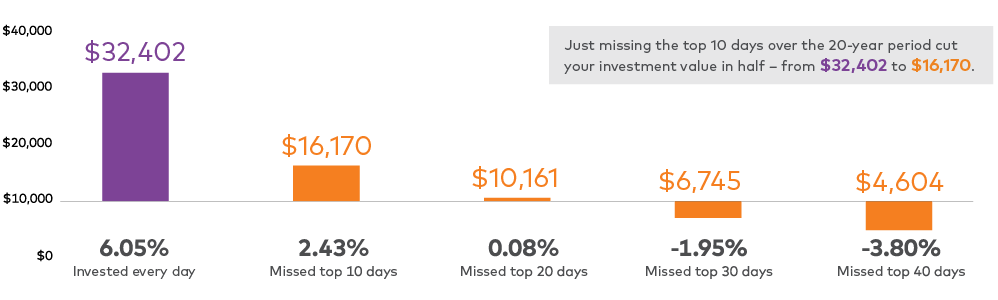

It’s time in the markets – not market timing – that matters.

We understand that when market volatility occurs, it may be tempting to pull your money out of the market.

But consider that just missing the top 10 days over the 20-year period cut your investment value in half – from US$32,402to US$16,170.

Source: AGF Investment Operations as at December 31, 2019. For illustrative purposes only. You cannot invest directly in an index. Past returns are not indicative of future results. All amounts are in U.S. dollars.

Watching markets go up and down can be trying. Staying focused on the long term rewards investors. If you’re concerned about market volatility, contact your financial advisor.

1Source: 3 Charts That Have Our Attention. LPL Financial Research, June 18, 2020.

The commentaries contained herein are provided as a general source of information and should not be considered personal investment or tax advice. Every effort has been made to ensure accuracy in these commentaries at the time of publication; however, accuracy cannot be guaranteed. Market conditions may change investment decisions arising from the use or reliance on the information contained here.

The contents of this Web site are provided for informational and educational purposes, and are not intended to provide specific individual advice including, without limitation, investment, financial, legal, accounting or tax. Please consult with your own professional advisor on your particular circumstances.

AGF Management Limited (“AGF”), a Canadian reporting issuer, is an independent firm composed of wholly owned globally diverse asset management firms. AGF’s investment management subsidiaries include AGF Investments Inc. (“AGFI”), AGF Investments America Inc. (“AGFA”), Highstreet Asset Management Inc. (“Highstreet”), AGF Investments LLC (formerly FFCM LLC) (“AGFUS”), AGF International Advisors Company Limited (“AGFIA”), AGF Asset Management (Asia) Limited (“AGF AM Asia”), Doherty & Associates Ltd. (“Doherty”) and Cypress Capital Management Ltd. (“CCM”). AGFI, Highstreet, Doherty and Cypress are registered as portfolio managers across various Canadian securities commissions, in addition to other Canadian registrations. AGFA and AGFUS are U.S. registered investment advisers. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. AGF AM Asia is registered as a portfolio manager in Singapore. AGF investment management subsidiaries manage a variety of mandates composed of equity, fixed income and balanced assets.

TM The ‘AGF’ logo and ® ‘Sound Choices’ are registered trademarks of AGF Management Limited and used under licence.

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. AGF brings a disciplined approach to delivering excellence in investment management through its fundamental, quantitative, alternative and high-net-worth businesses focused on providing an exceptional client experience. AGF’s suite of investment solutions extends globally to a wide range of clients, from financial advisors and individual investors to institutional investors including pension plans, corporate plans, sovereign wealth funds and endowments and foundations.

For further information, please visit AGF.com.

© 2020 AGF Management Limited. All rights reserved.

This post was first published at the AGF Perspectives Blog.