by Richard Bullas, Franklin Templeton Investments

The United Kingdom is in a phase of reopening businesses and economies, trying to get life back to some form of normality as lockdown restrictions continue to ease. The next few months will be crucial as businesses and consumers adapt to a new way of life, and we expect to get a better picture of employment and the path of recovery when many fiscal and monetary schemes potentially come to an end. Companies are already talking about restructuring, and many individuals could face the reality of permanent job losses.

There are two potential scenarios we could see regarding the recovery from here. There is a heightened risk of additional waves of infections as we head into autumn and winter, which could cause a setback in the recovery we’ve seen so far. Or, the outbreak could weaken and the recovery continues to gather pace as consumers feel more comfortable going out and getting back to work—and thus spending more. The initial post-lockdown economic data so far seems to be showing a faster-than-expected recovery, but whether it’s based on short term pent-up demand or more sustainable demand that pulls businesses out of the downturn remains to be seen. That said, there are signs that governments are ready to keep the taps turned on in terms of fiscal support, which we think should be supportive to the market.

Data Points Don’t Tell the Whole Story

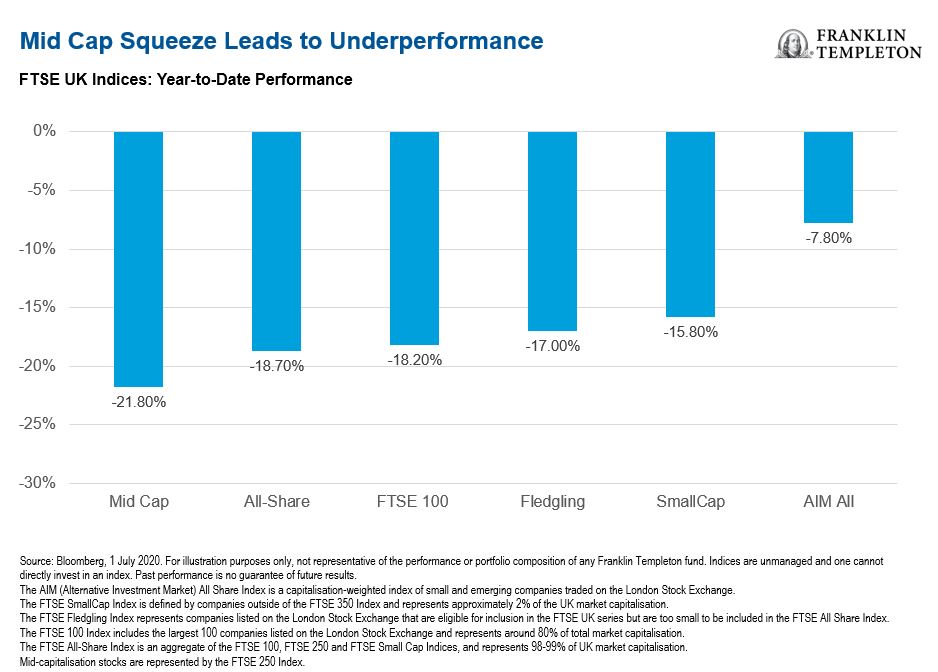

The mid-market area of the UK market (represented by the FTSE 250 Index) has underperformed relative to the wider market during the first half of 2020, bearing the brunt of the pandemic-driven volatility and uncertainty.1 The chart below illustrates that UK mid caps were the worst-performing area of the UK equity market, declining more than large caps (the “blue-chip stocks”) and even small caps.

Why was that the case? The heightened risk-off period during February and March encouraged a flight to liquidity, namely perceived safe havens and defensive stocks. There’s a greater domestic bias to mid caps, greater cyclicality in the sub-sector constituents and there are fewer defensive stocks such as the health care, food and utility stocks which you find in the FTSE 100 Index. As such, there was a liquidity squeeze in mid caps amidst the scramble for more liquid assets.

However, the underperformance of the headline index we’ve seen year to date doesn’t tell the whole story of the mid-cap space. We’ve seen some interesting underlying market dynamics within the market moves. There’s been a large variation in style; not all stocks have been treated the same. Stock dispersion has been quite high even within the mid-cap universe.

We’ve observed stronger performance for stocks that are more growth-orientated or that could be classified as structural growth stocks or growth compounders. There has been greater demand for these types of stocks because their earnings were perceived to be under less pressure during this crisis period and it’s also these types of stocks that trade on the highest valuation multiples. Thus, the valuation dispersion within the market is at elevated levels, and has produced an environment that could be characterised as a period of “growth at any price”.

At the other end, we’ve seen the underperformance of the more cyclical and value names. These types of stocks bore the brunt of the volatility we saw in the first half of the year. While we think earnings of cyclical and value stocks are likely to see a greater earnings hit than many growth stocks, on the flip side, their profits have greater upside into a recovery.

One of the biggest challenges for investors has been the huge uncertainty of the pandemic’s impact on companies’ profits and cash flow. Quite early on, the severity of the economic hit in the short term was clear, but to what extent earnings would be impacted has been somewhat of a guessing game. At the moment, it seems many investors are almost writing off 2020 given the brutal trading environment and are instead looking towards 2021 and beyond. There is still risk that forecasts our too high for outer years, especially if the recovery loses momentum; however, the relative pace of earnings downgrades appears to be slowing. We’re hopefully getting closer to an earnings floor for 2020 which can then be built upon and potentially rebound even stronger in future years.

Mind the Gap

The crisis period has accentuated a trend we’ve seen for a while—it has widened the valuation gap between highly rated growth stocks and the more cyclical names. Yet, this creates very attractive investment opportunities and, in our view, amplifies why active stock picking is crucial to navigate this period.

We look for value across the market, taking a style-agnostic approach to find attractively valued opportunities. We like structural growth opportunities in companies. For example, a telecoms-testing company that is geared towards fifth-generation (5G) infrastructure looks attractive to us. While domestic consumer stocks may be facing operational challenges in the current environment, companies with underlying momentum, well-financed balance sheets and strong track records of growth and innovation look generally attractive to us.

Uncovering Opportunities

The COVID-19 selloff this spring felt like uncharted territory, but since we last wrote about the initial implications of the coronavirus pandemic on the UK market, many stocks have rallied off their lows—including mid caps. It would seem recent economic and company data points to a bottoming in April time, so we are starting to see early evidence of a recovery. The economic data is improving, and while the current fundamentals look challenging, the economy and many businesses are in early stage recovery mode.

We have also been using the volatility and the weakness in the market to add to our portfolio, but we have remained very selective. Not only are we looking for companies that have strong balance sheets and adequate financing to support them through this difficult period, but also where profits have strong recovery potential. Importantly, we’re also looking for management teams that we believe can strengthen their market position, so that coming out of this crisis they can operate more efficiently and grow market share. We seek out businesses that came into the downturn in good shape and can re-establish that momentum over the next few years. This is a period for business where the strong can get stronger and unfortunately the weak will struggle.

Against this backdrop, we believe the remainder of the year offers some good potential investment opportunities in the mid-cap space. We are optimistic that we will be able to navigate the crisis—no matter what comes next.

To get insights from Franklin Templeton delivered to your inbox, subscribe to the Beyond Bulls & Bears blog.

For timely investing tidbits, follow us on Twitter @FTI_Global and on LinkedIn.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as of publication date (or specific date in some cases) and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own professional adviser or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Templeton Distributors, Inc., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com—Franklin Templeton Distributors, Inc. is the principal distributor of Franklin Templeton Investments’ U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

What Are the Risks?

All investments involve risk, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments. Smaller and newer companies can be particularly sensitive to changing economic conditions. Their growth prospects are less certain than those of larger, more established companies, and they can be volatile. Actively managed strategies could experience losses if the investment manager’s judgment about markets, interest rates or the attractiveness, relative values, liquidity or potential appreciation of particular investments made for a portfolio, proves to be incorrect. There can be no guarantee that an investment manager’s investment techniques or decisions will produce the desired results.

________________________________________________________

1. Mid-capitalisation stocks are represented by the FTSE 250 Index; large-capitalisation stocks by the FTSE 100 Index. Indices are unmanaged and one cannot directly invest in an index. Past performance is no guarantee of future results.

This post was first published at the official blog of Franklin Templeton Investments.