by Dan Lefkovitz, CFA Institute.

ESG's growing prominence requires that investors expand their toolkits.

In the first installment of a series from the Index Industry Association (IIA), Dan Lefkovitz, Strategist for Morningstar Indexes, explores the surprising resilience of environmental, social, and governance (ESG) investing in 2020, citing passive investment trends and a growing performance correlation between ESG scores and sound traditional financials.

Crises tend to accelerate trends. The upheavals of 2020 — from the global pandemic to the movement for racial justice and the ongoing threat of climate change — have undoubtedly helped propel environmental, social, and governance (ESG) investing into the mainstream. ESG-related topics have never been so central to the investment conversation. Assets are growing and the connection between ESG and risk is strengthening.

But ESG also requires that investors expand their toolkits. And it poses a range of challenges to investment managers and index providers alike.

Not Letting a Crisis Go to Waste

Source: CIRANO

Amid the market turmoil of 2020’s first quarter, some predicted that ESG would be exposed as a bull market luxury: “Sustainability” is easy to champion during boom times, but when markets plunge, priorities like securing retirement savings dominate investors’ hierarchy of needs.

ESG has defied the naysayers by continuing to attract capital in 2020. Regulators, mostly in Europe, are an important impetus. Yet the asset growth in retail funds incorporating ESG factors reflects genuine bottom-up interest.

According to Morningstar research, mutual funds and exchange-traded funds (ETFs) designated as sustainable attracted $46 billion of inflows in the first quarter, in contrast to the several billion in net redemptions suffered by the overall fund universe. More than 80% of sustainable assets are in Europe. But ESG-oriented funds in the United States attracted record inflows in the first quarter, surpassing their previous record set in the fourth quarter of 2019.

Global Sustainable Fund Assets Are Growing Fast (In US Billions)

Source: Morningstar Direct, Manager Research. Data as of 31 March 2020.

Source: Morningstar Direct, Manager Research. Data as of 31 March 2020.

Investor preference for passive, index-tracking strategies has carried over to ESG. This trend has been most pronounced in the United States, where index funds and and ETFs captured 80% of sustainable flows in the first quarter of 2020, up from 60% in 2019.

In Europe, passive ESG strategies are also increasing their market share. Of course, sustainable mutual funds and ETFs represent only a fraction of the more than $30 trillion in sustainable mandates, as measured by the Global Sustainable Investment Alliance in 2018. That figure includes the likes of pension and sovereign wealth fund assets.

Not Just About Values

This year has reminded us that investing is affected by a wide range of forces, including those falling into the ESG rubric. The pandemic has highlighted the importance of biodiversity, supply chain management, human capital, and health and safety. The movement for racial equality has spotlighted corporate practices around diversity and inclusion. “Stakeholder capitalism” is a trending term, embraced even by mainstream organizations like the Business Roundtable.

It’s clear that sustainable investing has evolved beyond its roots among values-based investors. While ethical considerations still figure in, a growing number of investors see ESG issues affecting financial results. Climate change poses risks and opportunities; workforce relations affect a company’s competitive positioning; and checks and balances on corporate management lead to better decision making. No wonder CFA Institute “now encourages all investment professionals to consider ESG factors,” viewing their integration as “consistent with a manager’s fiduciary duty to consider all relevant information and material risks in investment analysis and decision making.”

Indexes that incorporate ESG into their selection criteria can be useful analytical tools. They may not be explicitly constructed to boost returns or lower risk, but comparing them to their broad market equivalents can be revelatory.

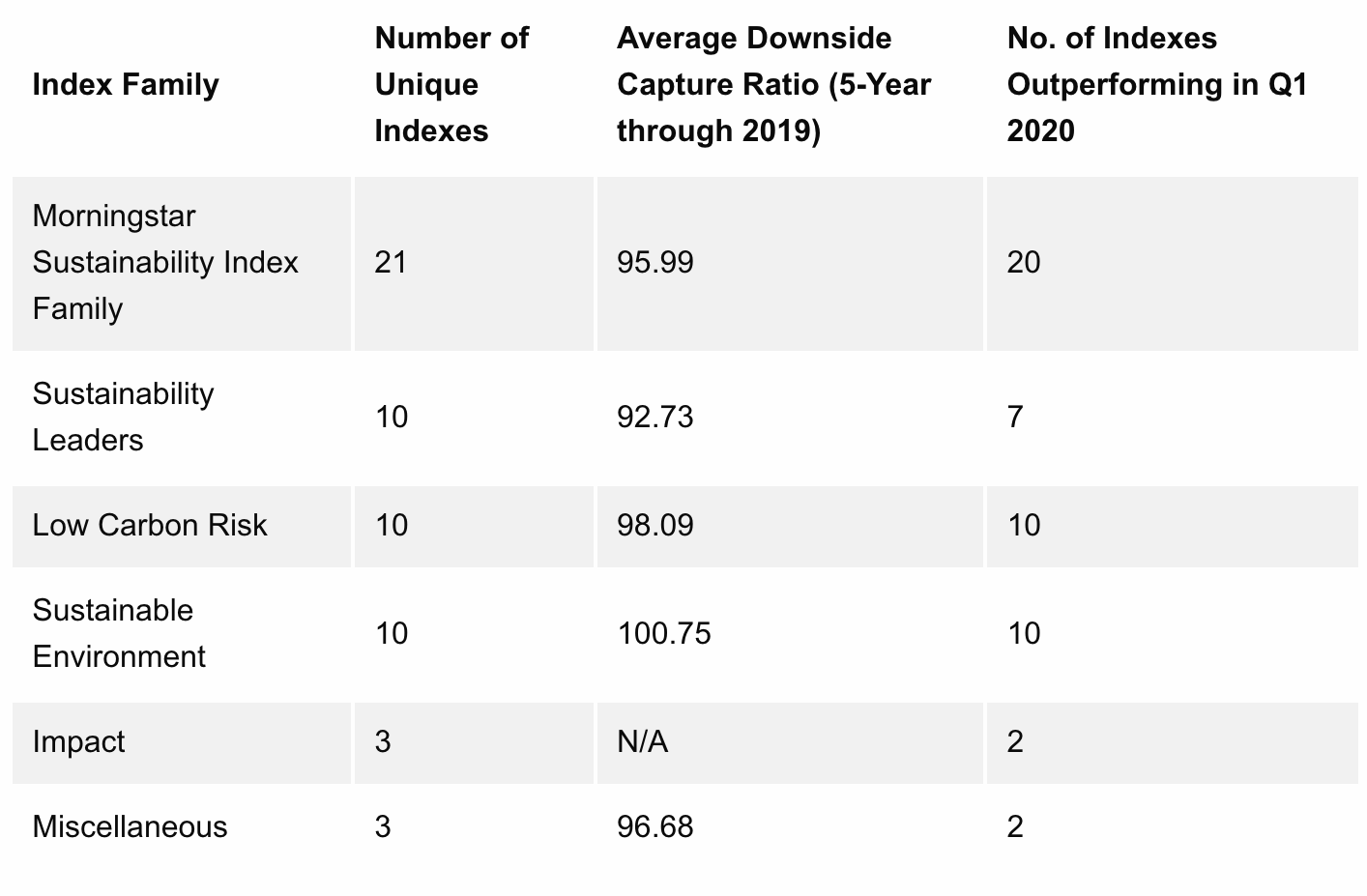

In February, Morningstar Indexes published research examining the risk profiles of its ESG-screened equity benchmarks. The study looked at the downside capture ratios for Morningstar’s ESG-focused equity indexes. Did they lose more or less than their parent indexes during down markets between 2015 and 2019? For example, the Morningstar Global Markets Sustainability Index, a market-capitalization-weighted equity benchmark that selects the best-scoring companies on ESG criteria from the Morningstar Global Large–Mid Cap Index, was compared to that broad bogey spanning nearly 50 developed and emerging markets. Company-level scoring is provided by Sustainalytics, a leading ESG researcher recently acquired by Morningstar.

We found that 72% of the ESG indexes held up better than their broad market parents for the five-year period through year-end 2019. The fourth quarter of 2018 was the biggest stress test during that time frame — easily surpassed by the first quarter of 2020. Morningstar’s ESG indexes acquitted themselves extremely well as equities entered a bear market. Their performance was consistent with that of the ESG-screened benchmarks offered by other index providers as well as with sustainable funds.

ESG Has Mitigated Risk in 2020 and Beyond

Source: Morningstar Indexes. Data as of 31 March 2020.

There’s a temptation to dismiss these results as a consequence of fortunate sector bets. There’s no question that above-market exposure to high-flying technology stocks and less exposure to the lagging energy sector have generally boosted sustainable investments. But there’s more to the story, as revealed by performance attribution. For the first quarter of 2020, stock selection within sectors contributed more than sector allocation to the outperformance of the Morningstar Global Markets Sustainability Index and the U.S. Sustainability Index.

The key seems to be the relationship between ESG and risk attributes like quality and financial health. Research by Morningstar and others, across indexes and funds, has found that companies that score well on ESG also tend to exhibit higher profitability and stronger balance sheets, which make them more durable during times of market stress. While relative returns fluctuate, risk attributes tend to persist.

An Evolving Field

Even as assets grow and performance impresses, ESG investing poses challenges. Just as value investing comes in different shapes and sizes, ESG is a broad tent. Due diligence is necessary to understand whether an index or strategy uses exclusionary screens, positive ESG selection, or focuses on a particular issue — and most combine these elements. Company-level ESG researchers may come to divergent conclusions because their methodologies vary. Sustainalytics’ Carbon Risk Rating, for example, can differ markedly from carbon footprint analysis, because it includes a qualitative assessment of a company’s efforts to manage climate risk.

For index providers and investment managers, ESG is an evolving field. Keeping up with regulation, such as the European Union’s Climate Transition and Paris-aligned benchmarks, is a constant challenge. So, too, is reflecting changing investor preferences on ESG matters, such as exclusions related to controversial weapons. Efforts to bolster reporting and standardize ESG corporate disclosures will improve the company-level data that is the fundamental building block of portfolio construction. Charges of “greenwashing” will need to be countered by demonstrating rigorous ESG research and thoughtful investment approaches.

As the new normal of the post-pandemic world takes shape, there’s little doubt that ESG investing will grow in importance. Not only are sustainable assets likely to increase, but the materiality of ESG issues will be more widely accepted.

[/signinlocker]

Morningstar is a member of the Index Industry Association and supports the Association’s goals of independence, transparency, and competition of index providers. For more on the IIA’s work on ESG, please see the results of the group’s leading index industry survey and this recent article on ESG benchmarks featuring further comments from IIA CEO Rick Redding and IIA member firms.

If you liked this post, don’t forget to subscribe to the Enterprising Investor.

All posts are the opinion of the author. As such, they should not be construed as investment advice, nor do the opinions expressed necessarily reflect the views of CFA Institute or the author’s employer.

Image credit: ©Getty Images / aydinmutlu

This post was first published at the CFA Institute's Enterprising Investor blog.