The recovery remains vulnerable to recent surges in COVID-19 cases.

by Carl R. Tannenbaum, Ryan James Boyle, Vaibhav Tandon, Northern Trust

The first wave of the economic recovery from the pandemic has generally exceeded expectations. Policy interventions in the form of large fiscal packages, asset purchases and government loan schemes have prevented household and business failures. Economies appeared well-positioned to recover as health-related restrictions were lifted.

But the recovery remains vulnerable to recent surges in COVID-19 infections and the expiration of government support programs in major world economies. It is increasingly likely that the pace of recovery could flatten in the second half of 2020 and beyond.

Following are our views on how major world economies will fare this year and next.

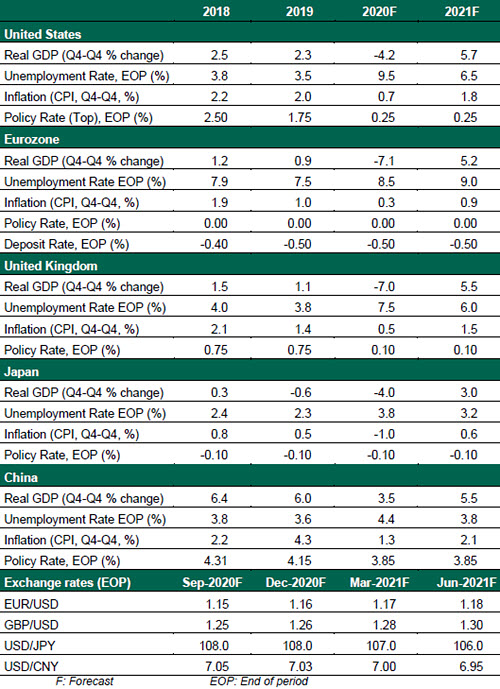

United States

- With several U.S. states either closing down portions of their economies or pausing their reopening plans, the U.S. economy faces the risk of losing momentum. Tradeoffs that prioritize safety today will pay dividends in economic activity in the future. We expect real gross domestic product (GDP) to return to growth in the third quarter, but the economy won’t recover all of its lost output until well into 2021.

- The June employment report revealed a continued rebound, as payrolls increased by 4.8 million. The unemployment rate has already dropped by more than three percentage points from its April peak. However, the labor market has still lost more than 14 million jobs, the labor force is three million workers smaller than it was in February, and the most recent report didn’t capture the economic effects of the fresh surge in COVID cases.

Eurozone

- The incoming data show that activity in the region started to recover in May. Both the consumer and industrial sectors have rebounded as the eurozone economy emerged from lockdowns. But progress will be gradual; a return to last year’s output will likely take six to eight quarters.

- The eurozone unemployment rate has increased in the past couple of months, but only slightly. Labor market support schemes, including furlough and short-term paid leave aimed at preventing layoffs, have eased the hit to labor market metrics. That said, those measures come with expiration dates. As those dates arrive, we expect the unemployment rate to gradually move up.

- Member states have failed to agree on the €750 billion recovery fund proposed earlier this year. Even if progress is made, the fund is unlikely to offer meaningful assistance as disbursements will be part of the European Union’s seven-year budget.

United Kingdom

- Economic recovery in the United Kingdom has lagged behind other countries, as the U.K. lockdown lasted longer than its peers. Retail sales rebounded in May but are still far below pre-COVID levels. Recent easing of restrictions should further underpin the recovery, but growing precautionary savings present a challenge for consumption. While the United Kingdom’s initial fiscal response was strong, the most recent phase has raised some concerns. With the government opting to halt its furlough scheme in October, the economy faces the risk of mass unemployment.

- Brexit and a second wave of infections are the key risks for the U.K. economy. Differences over a post-Brexit trade deal remain, but some form of a free trade deal with the EU is still our central case.

Japan

- Japan’s consumer sectors are showing signs of recovery, with retail sales contracting at a slower rate in May and consumer confidence rising for the second straight month. However, the outlook for Japanese industries remains challenging. Manufacturers’ assessments of business conditions collapsed in June; industrial production and exports have not yet bottomed out. With renewed infections in recent weeks, those looking for a V-shaped recovery will be disappointed.

- The Bank of Japan (BoJ) at this week’s meeting left its monetary policy unchanged, maintaining the current level of short- and long-term rates and the broad direction of its asset purchases. Unsurprisingly, the central bank revised down its growth outlook for FY2020. Unless the outlook deteriorates notably, the BoJ is likely to maintain status quo over the forecast horizon.

China

- Momentum in household consumption has improved notably in recent months, and exports have remained resilient thus far. The quicker-than-expected recovery in domestic demand and resilience of exports have prompted us to revise China’s fourth quarter 2020 GDP forecast to 3.5% year-over-year compared to 1.0% in the previous outlook. That said, the recent spread of COVID-19 in Beijing is leading to concerns of a second viral wave that could hinder the recovery.

- COVID-19 is not the only concern for China. Sino-American tensions are rising rapidly, and relations between China and other countries have become challenged. The “phase one” U.S.-China trade deal is in jeopardy, and hope for progress on phase two now appears misplaced. With global markets for Chinese products narrowing, Chinese policymakers are facing a hard choice between stimulating economic growth and fueling a debt bubble amid surging bond defaults and bad loans.

Global Economic Forecast – July 2020

Copyright © Northern Trust