by Chad Balcom, Russell Investments

Many financial advisors deserve a pep talk, and in some cases a standing ovation!

In observance of stay-at-home orders, I have been meeting and speaking with clients, friends and family online. The current times are truly extraordinary. But there is one silver lining—we’ve all been afforded an opportunity to have more meaningful conversations, given the time and desire to connect with folks in general while being hunkered down at home.

One recent conversation elicited a strong desire for me to offer a sincere and well-deserved pep-talk to financial advisors given the current environment and it came from an unexpected source—my parents.

My family is and always has been very close. We speak frequently and honestly on a wide range of topics including financial discussions. But the one question I have never really asked is when and why they first began working with a financial advisor. My father was a truck driver and my mother was a receptionist at a pediatrics clinic. Although they were savers, they didn’t leverage the assistance of a financial advisor until my mother retired, which ironically was in 2008. Keep in mind, my folks did all the right things when it came to saving—they saved often, they saved consistently and they saved as much as they could. They never took on too much or too little risk, they communicated with each other and carefully budgeted. They were very astute investors considering they did it well before the internet and did it without a financial advisor to help guide them along the way.

They are typical investors by many accounts, in fact:

“A whopping 85% of the general population of the U.S. isn’t working with a financial advisor. But working with one can help them prepare much better for financial decisions as they approach retirement.”1

You look like you need a pep talk

In our 2020 Value of an Advisor study, we believe behavior coaching is one of the most vital parts of the advisor job description. This year in particular, when it comes to delivering value, we believe avoiding behavioral mistakes may be the most significant contributor to total value.

Despite this incredible value, many financial advisors still do not have a framework to describe their service model to clients, even though they spend a tremendous amount of time researching investments, preparing portfolios and conversing with clients.

I want to offer a borrowed framework from a past colleague built on three descriptive words: Guru, Guide and Gladiator.

Guru /ˈɡo͝oro͞o/

An influential teacher or popular expert

You are a guru. You are someone who regularly researches and categorizes products, asset classes and investment strategies being introduced to the market at a stunning pace every year. An advisory guru prognosticates with experience and solves to the client’s outcomes.

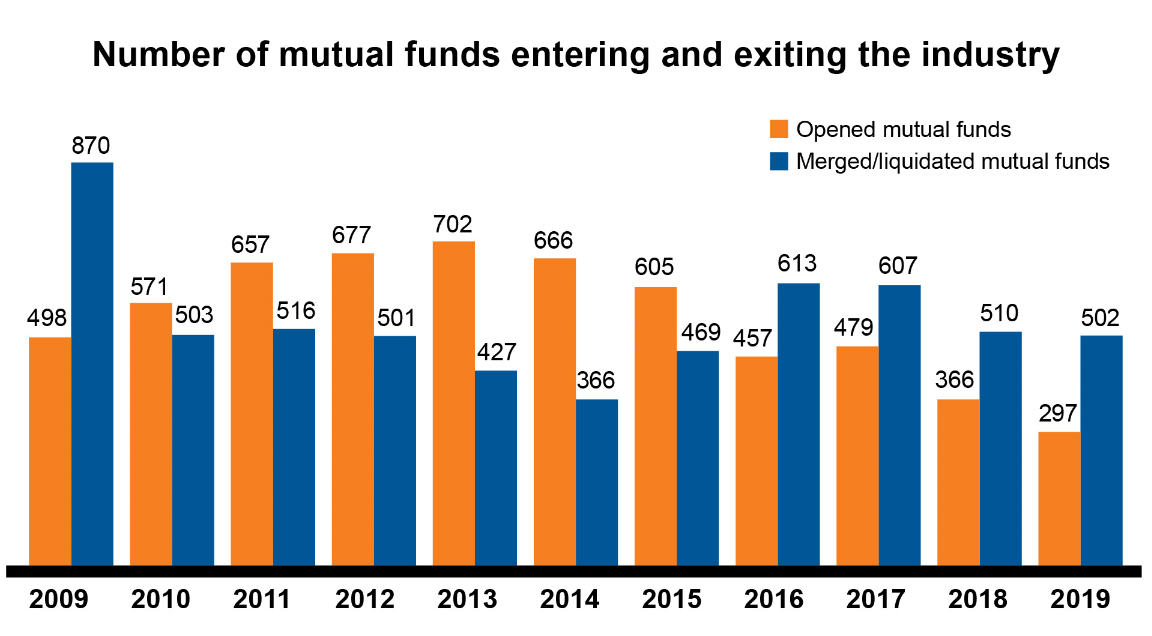

Every year of the 25 years I’ve been in the industry, a new slew of investment products has been released while a healthy number are discontinued. The graphic below highlights just how pervasive new product releases and closures are going back to 2009.

Click image to enlarge

Source: 2019 Investment Company Fact Book, page 57, https://www.icifactbook.org/

The number of mutual funds available in the U.S. (excluding the 2,096 ETFs) has steadily increased over the last two decades.

- In 1997:6,6752

- By 2019: 7,9453

An increase of over 19% within two decades!

In the late 70s and early 80s, George F. Russell, Jr., suggested pension managers would be well served by incorporating international equity exposure to lower a plan’s risk and increase the long-term return potential. It was not well received. Yet now this is an expected sleeve within an investor’s typical asset allocation.

This is why we need a guru—they think outside the box, plan and have the courage to recommend change to seek to help the client achieve their goals. It might be worth noting that George Russell’s willingness to courageously offer his perspective as a guru started Russell Investments on its path to now advising on $2.5 trillion globally.4

Guide /ɡīd/

A person who advises or shows the way to others

You are a guide. You are someone who creates financial plans that represent the client’s goals, fears needs and aspirations. An advisory guide keeps an investor focused on the path all the way to their destination.

Everyone needs a guide at some point in their life. George Russell needed a guide to scale Mount Rainier and I also leveraged one on an ambitious climb. What’s interesting is how much we DO use a guide for one simple task alone–directions.

There are 154,000,000 unique users for Google Maps each month!5

This means that over the course of a year, there are almost 2,000,000 unique instances where true guidance is needed to help folks navigate a single (and highly important) element of their life. Clearly we are seeking a guide in one form or another on a daily basis. Think of how much more important your role as a financial advisor is when it comes to helping your clients navigate market volatility!

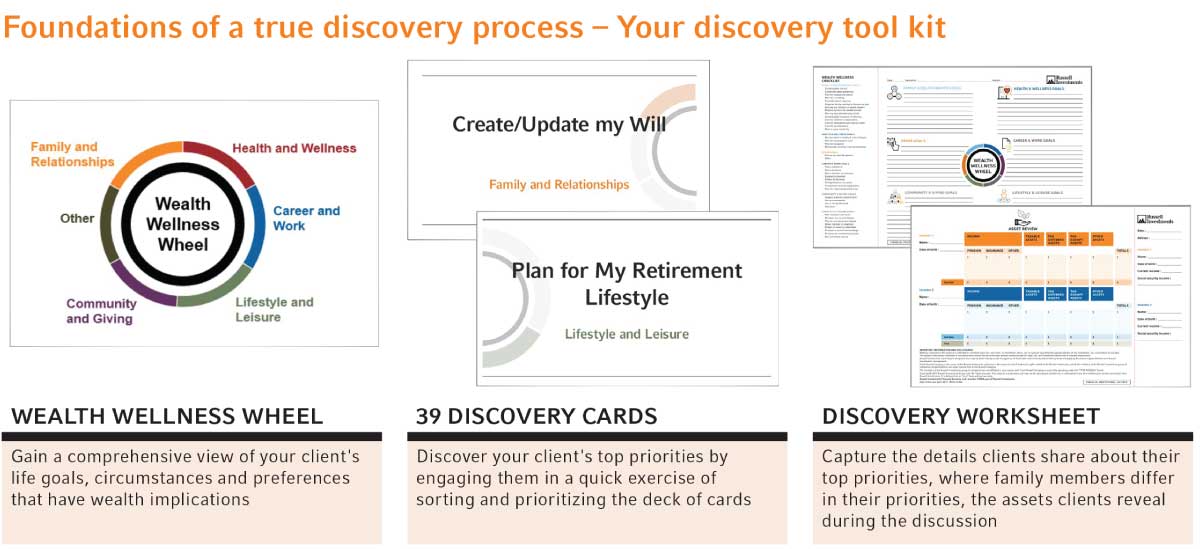

However, with over 300,000 financial advisors in the U.S. helping guide investors every day, it is imperative to make sure you understand those needs more specifically—in order to offer guidance that is truly helpful, and to ensure a long standing, mutually productive relationship.6 One way in which you can approach this topic is by utilizing our online Client Discovery Cards. Ask your Russell Investments representative for access to this easy-to-use tool.

Click image to enlarge

For illustrative purposes only.

Gladiator /ˈɡladēˌādər/

A person who engages in a fight or controversy.

You are a gladiator. You are someone who has the courage to fight the client’s greatest nemesis—themselves. An advisory gladiator cuts through the noise and protects the client from making behavioral mistakes they are classically prone to do—like selling low and buying high, selling all their stocks to buy bitcoin, or getting into tech stocks in the late 90s.

I love this aspect of the advisory relationship because clients often operate in a fight-or-flight mentality to their own detriment. Providing blunt, unvarnished perspective out of care and responsibility for clients when it matters most can often be the most caring and valuable act you can offer.

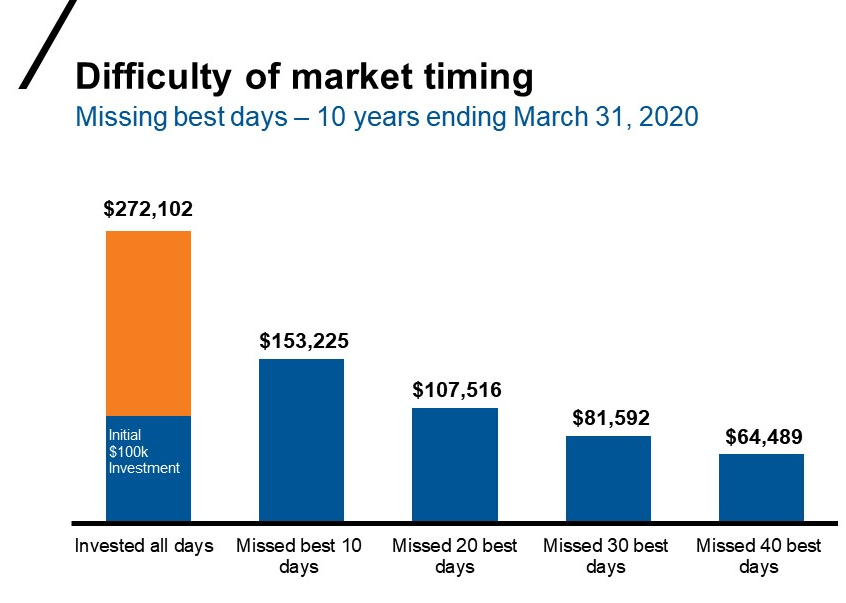

In order to highlight the importance of having this kind of advisory courage, the graphic below demonstrates how much opportunity can be lost (both for the client and for the advisor) when no one is holding a client accountable to their original financial plan:

Click image to enlarge

Source: Russell Investments, Confluence. In USD. Returns based on S&P 500 Index, for 10-year period ending March 31, 2020. For illustrative purposes only. Index returns represent past performance, are not a guarantee of future performance, and are not indicative of any specific investment. Indexes are unmanaged and cannot be invested in directly.

The bottom line

When you’re feeling tired and drained from the markets, client conversations or just the general state of the world, remember that you are guru, guide and gladiator all in one. I know from personal experience how much of an impact financial advisors can have on the overall health and wealth their clients realize throughout the course of their advisory relationship. Although my parents have done a truly fantastic job preparing for their retirement, think of how much more they might have been able to accomplish with the help of an advisor. As a wholesaler, I’m truly amazed and encouraged by the work you are capable of doing day-in and day-out, and I hope you are likewise encouraged by this post!

1 https://financialadvisoriq.com/c/2142463/253003/americans_have_should

2 https://www.statista.com/statistics/255590/number-of-mutual-fund-companies-in-the-united-states/

3 https://www.statista.com/statistics/255590/number-of-mutual-fund-companies-in-the-united-states/

4 Russell Investments, as of December 31, 2019.

5 https://www.statista.com/statistics/865413/most-popular-us-mapping-apps-ranked-by-audience/

6 Cerulli Associates, as of January 14, 2019.

Copyright © Russell Investments