by Don Vialoux, EquityClock.com

Morning Technical Notes for July 14th

Analog Devices (ADI), a NASDAQ 100 stock moved below $115.07 completing a double top pattern.

Automatic Data Processing (ADP), a NASDAQ 100 stock moved below 142.44 setting an intermediate downtrend.

Pre-opening Comments for Tuesday July 14th

U.S. equity index futures were higher this morning. S&P 500 futures were up 3 points in pre-opening trade.

Index futures moved slightly lower following release of the June Consumer Price Index at 8:30 AM EDT. Consensus was an increase of 0.5% versus a decline of 0.1% in May. Actual was an increase of 0.6%. Excluding food and energy, consensus for the June Consumer Price Index was an increase of 0.1% versus a decline of 0.1% in May. Actual was an increase of 0.2%

JP Morgan Chase added $1.90 to $99.50 after reporting higher than consensus second quarter revenues and earnings.

Wells Fargo dropped $1.18 to $24.23 after reporting lower than consensus second quarter revenues and earnings. The company also cut its dividend. to $0.10 per share

Citigroup added $0.80 to $53.00 after reporting higher than consensus second quarter revenues and earnings.

Delta Airlines slipped $0.19 to $26.65 after reporting a larger than consensus second quarter loss. The company also issued a cautious outlook.

EquityClock’s Daily Market Comment

Following is a link:

http://www.equityclock.com/2020/07/13/stock-market-outlook-for-july-14-2020/

Note seasonality chart on the S&P 500 Index during its traditional summer rally.

Technical Notes

The S&P 500 Index traded as high as 3235.32, slightly higher than its intermediate high on June 8th at 3323.13, but failed to trigger additional buying. The Index abruptly dropped 80.10 points to close at 3,155.22, triggered by weakness in FAANG +MSFT stocks.

The VIX Index soared during the last two hours of trading.

S&P 500 SPDRs (SPY) briefly moved above $321.99 extending an intermediate uptrend , but closed lower.

Hedged S&P 500 iShares trading on the TSX (XSP) briefly moved above $34.96Cdn.extending an intermediate uptrend, but closed lower.

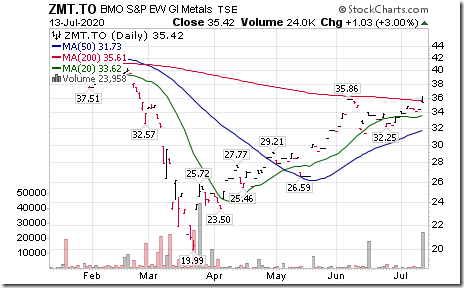

Equal Weight Global Metals ETF (ZMT) moved above $35.86 Cdn. extending an intermediate uptrend.

Auto ETF (CARZ) moved above $34.23 extending an intermediate uptrend.

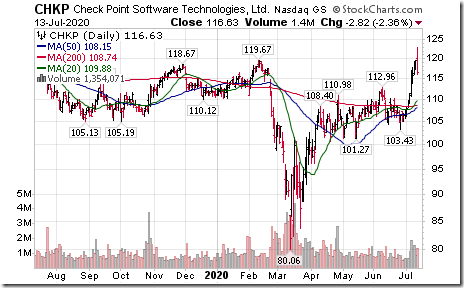

Check Point (CHKP), a NASDAQ 100 stock moved above $119.67 extending an intermediate uptrend

Procter & Gamble (PG), a Dow Jones Industrial stock moved above $124.16 extending an intermediate uptrend.

Walmart (WMT), a Dow Jones Industrial stock moved above $132.80 to an all-time high extending an intermediate uptrend.

Triggered by strength in Walmart, Consumer Staples iShares (XLP) moved above $60.63 extending an intermediate uptrend.

Couche-Tard (ATD.B), a TSX 60 stock moved above $45.93 Cdn. to an all-time high extending an intermediate uptrend.

Pepsico (PEP), a NASDAQ 100 stock moved $137.56 setting an intermediate uptrend.

Spot price for Silver moved above $19.75 to a four year high extending an intermediate uptrend.

Silver equities and related ETFs (SIL) continue moving higher. First Majestic Silver (FR) moved above $14.72 Cdn. extending an intermediate uptrend.

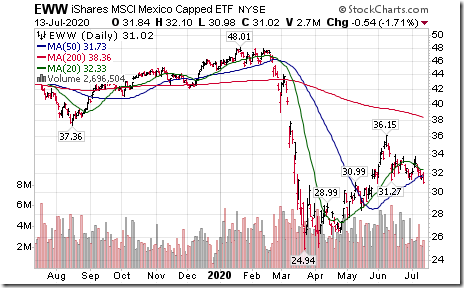

Mexico iShares (EWW) moved below $31.27 setting an intermediate downtrend.

Trader’s Corner

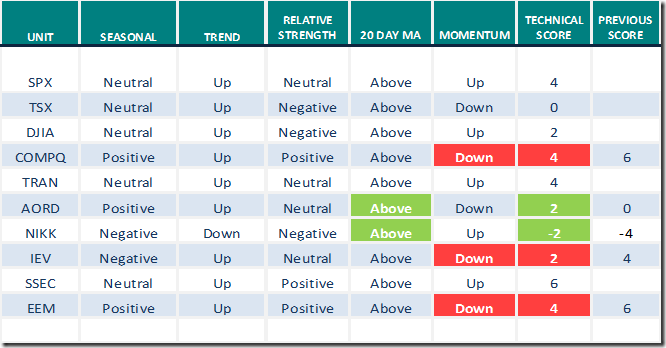

Equity Indices and related ETFs

Daily Seasonal/Technical Equity Trends for July 13th 2020

Green: Increase from previous day

Red: Decrease from previous day

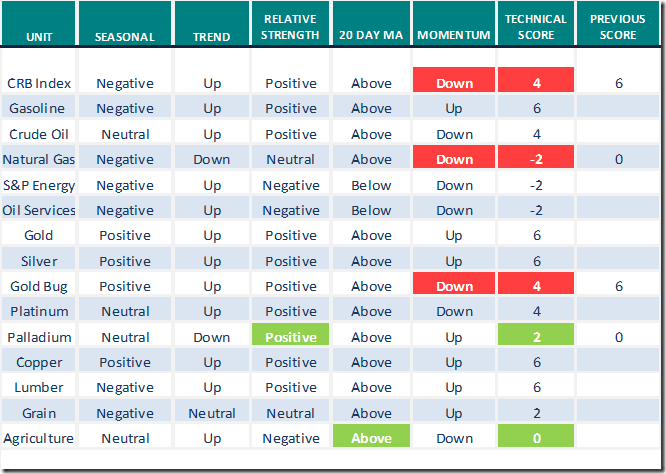

Commodities

Seasonal/Technical Commodities Trends for July 13th 2020

Green: Increase from previous day

Red: Decrease from previous day

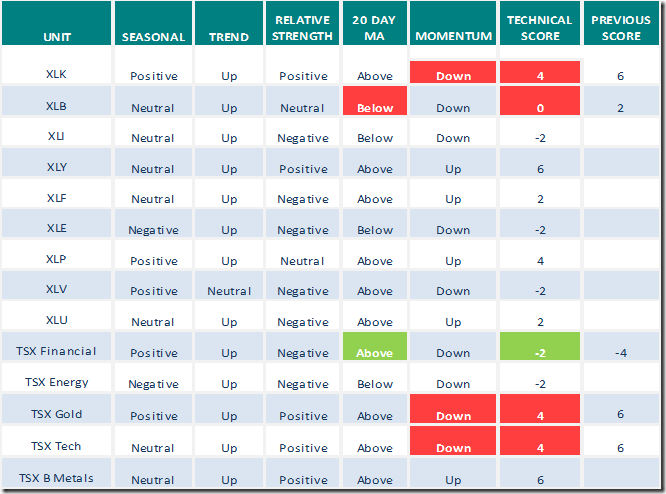

Sectors

Daily Seasonal/Technical Sector Trends for July 13th 2020

Green: Increase from previous day

Red: Decrease from previous day

Technical Scoop

Thank you to David Chapman and www.EnrichedInvesting,com for a link to their weekly comment. Headline reads,” Virus records, earnings fall, markets rise, QE3 lifts, technicals diverge, gold bull, narrow outperformance”. Following is the link:

S&P 500 Momentum Barometer

The Barometer slipped 1.60 to 61.92 yesterday. It remains intermediate overbought and trending down.

TSX Momentum Barometer

The Barometer added 1.60 to 68.42 yesterday. It remains intermediate overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.

![clip_image001[7] clip_image001[7]](https://advisoranalyst.com/wp-content/uploads/2020/07/clip_image0017_thumb-1.png)

![clip_image002[7] clip_image002[7]](https://advisoranalyst.com/wp-content/uploads/2020/07/clip_image0027_thumb-1.png)

![clip_image001[5] clip_image001[5]](https://advisoranalyst.com/wp-content/uploads/2020/07/clip_image0015_thumb-2.png)

![clip_image002[5] clip_image002[5]](https://advisoranalyst.com/wp-content/uploads/2020/07/clip_image0025_thumb-2.png)

![clip_image003[5] clip_image003[5]](https://advisoranalyst.com/wp-content/uploads/2020/07/clip_image0035_thumb-1.png)

![clip_image004[5] clip_image004[5]](https://advisoranalyst.com/wp-content/uploads/2020/07/clip_image0045_thumb-1.png)