by Alessio De Longis, Senior Portfolio Manager, Invesco Investment Solutions, Invesco Canada

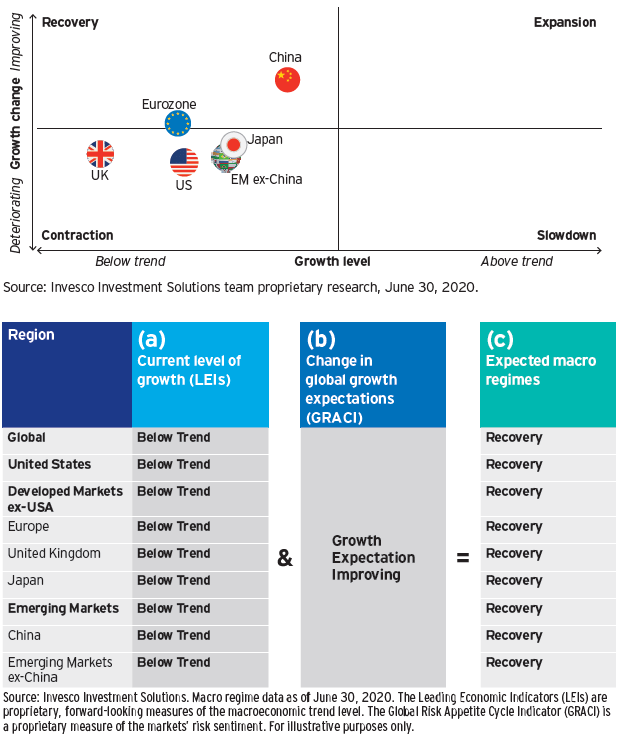

Our macro regime framework continues to indicate the global economy is likely moving into a recovery regime, confirming our expectation of an inflection in the business cycle. By and large, recent global economic data releases have shown signs of stabilization as most economies have begun the reopening process. Over the past two months, indicators from consumer confidence to retail sales, business surveys and industrial orders suggest modest improvements off the bottom readings registered in April when the most stringent lockdown measures were in effect. The improvement in economic data is most apparent in Asia, particularly in China, where evidence of an economic recovery is emerging across several parts of the economy, such as housing, industrial orders and production, money and credit growth. Emerging markets outside of Asia are still lagging, reflecting the most recent contagion waves in Latin America and Russia (Figure 1).

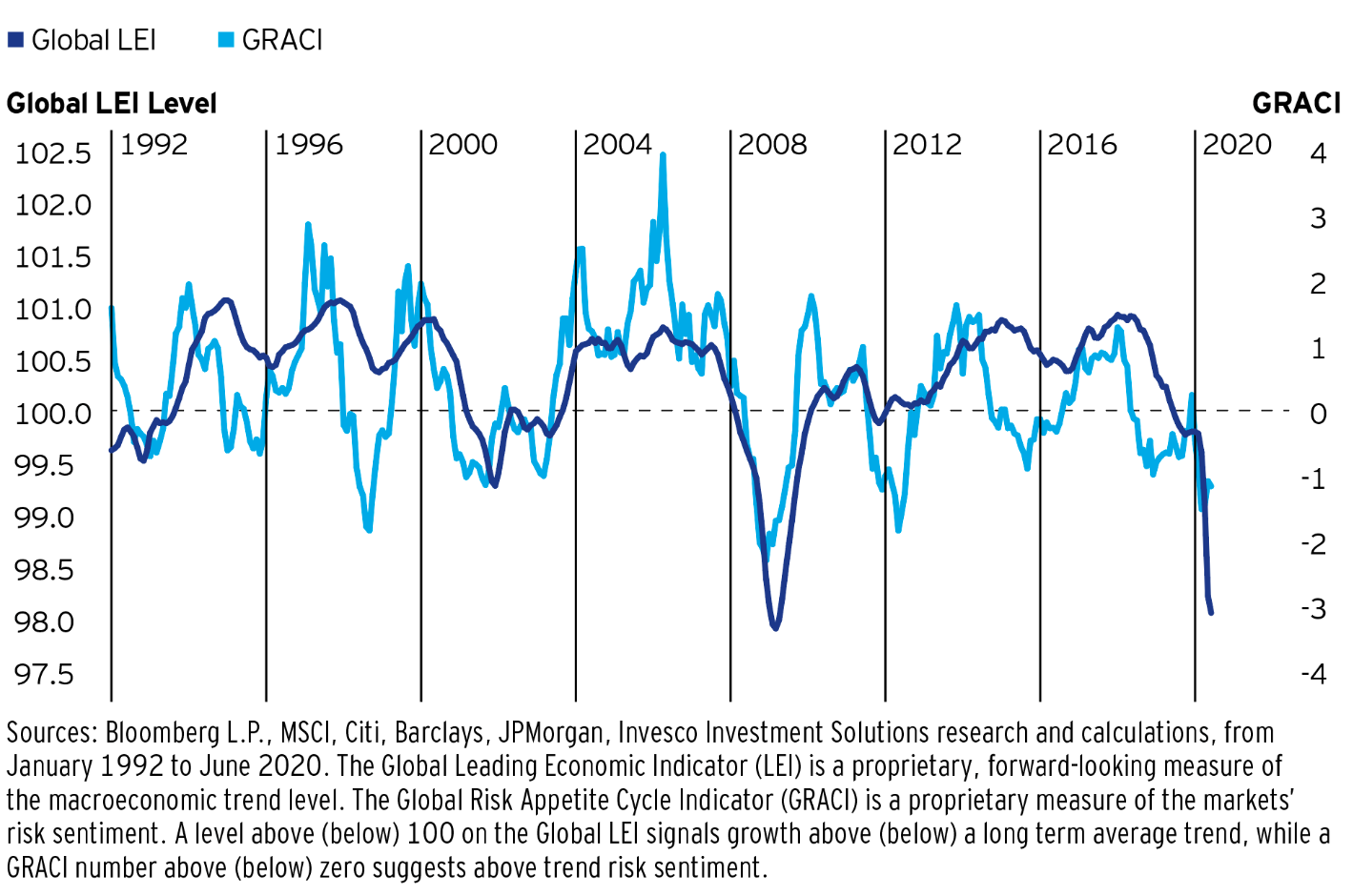

While the developed world is still contracting, the rate of deterioration is slowly improving, particularly in Europe where economic data may soon confirm the transition to a recovery phase likely ahead of the United States. Furthermore, sentiment in global capital markets continue to improve with additional broad-based outperformance in risky assets, indicative of improving global growth expectations despite recent concerns of rising COVID-19 cases in several parts of the United States (Figure 2). Overall, a combination of below-trend growth (as indicated by our leading economic indicators) and improving growth expectations leads us to believe all regions are in a recovery (as Asia today) or may move into a recovery phase soon (i.e. the developed world).

Figure 1: Leading economic indicators suggesting Emerging Asia is already in recovery. Improving growth expectations, implied by rising risk appetite, suggest the rest of the world is entering a recovery regime soon.

Figure 2: Market sentiment signaling improving growth expectations and the potential for a bottom in the global economic contraction

Investment Positioning

- We maintain a higher risk posture than our benchmark1, sourced through an overweight exposure to credit, emerging market equities and cyclical equity factors. In particular:

- We maintain a neutral total equity exposure tilted towards cyclical markets and sectors with an overweight to emerging market equities, and cyclical factors such as size and value. In addition, we have increased our exposure to developed markets outside the US, at the expense of US equities, given favorable currency valuations and relative growth momentum.

- In fixed income, we maintain an overweight exposure to US high yield credit, emerging markets sovereign dollar debt, and event-linked bonds at the expense of government bonds, particularly in developed markets outside the US. Our total duration stance is neutral.

- In currency markets, we maintain an overweight exposure to foreign currencies, positioning for US dollar depreciation. We remain underweight perceived safe havens2 such as the Japanese yen and the Swiss franc in favor of cheaply valued, growth sensitive currencies like the Euro, Canadian dollar and Scandinavian currencies.

1 Global 60/40 benchmark (60% MSCI ACWI / 40% Bloomberg Barclays Global Agg USD Hedged).

2 Safe havens are investments that are expected to hold or increase their value in volatile markets.

The Barclays Global Aggregate Index is an unmanaged index considered representative of the global investment grade, fixed income markets

The MSCI All Country World Index is an unmanaged index considered representative of large- and mid-cap stocks across developed and emerging markets.

Important information

The Invesco Investment Solutions team employs the science of investment factors to blend active and passive strategies to suit various investment goals. You can learn more about how we do this here: https://www.invesco.ca/mp/en/index.html

An investment cannot be made into an index.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Mutual funds are not guaranteed, their values change frequently and past performances may not be repeated.

The opinions expressed are those of Alessio de Longis as of July 5, 2020, are based on current market conditions and are subject to change without notice. These opinions may differ from those of other Invesco investment professionals.

Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions, there can be no assurance that actual results will not differ materially from expectations.

Diversification does not guarantee a profit or eliminate the risk of loss.

In general, stock values fluctuate, sometimes widely, in response to activities specific to the company as well as general market, economic and political conditions.

The risks of investing in securities of foreign issuers, including emerging market issuers, can include fluctuations in foreign currencies, political and economic instability, and foreign taxation issues.

The dollar value of foreign investments will be affected by changes in the exchange rates between the dollar and the currencies in which those investments are traded.

Fixed-income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

This does not constitute a recommendation of any investment strategy or product for a particular investor.

This post was first published at the official blog of Invesco Canada.