by Christopher Hogbin, Head—Equities, AllianceBernstein

Global equities rebounded sharply in the second quarter, driven by massive stimulus efforts and progress in the fight against the coronavirus. But investors face new risks in the third quarter as companies and countries count the costs of the pandemic and cope with the threat of a second wave of contagion.

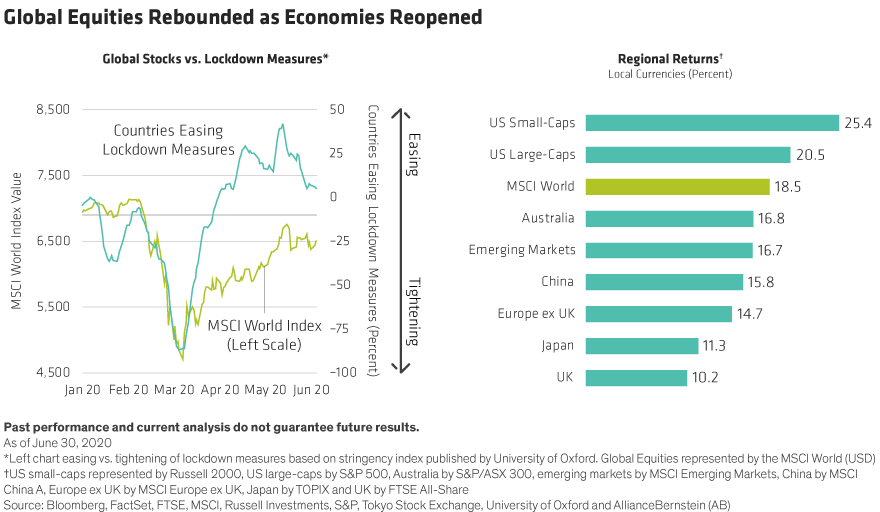

After a first-quarter crash, stocks bounced back in April, May and early June as many countries gradually reopened their economies for business (Display, left). Toward quarter-end, returns moderated slightly amid concern that infection rates were increasing. While elevated volatility persisted, the MSCI World jumped 18.5% in the second quarter, leaving it down 5.3% since the beginning of the year. US stocks led in developed markets; Japanese and UK stocks underperformed (Display, right).

Between Relief and Confusion

This rebound elicited mixed emotions. Investors were reassured that the 20% drop in global equities during the first quarter proved temporary. It also reinforced a timeless investing lesson on staying calm during a market panic. By selling during a crash, investors risk locking in losses and sacrificing recovery potential because it’s almost impossible to time market inflection points with precision.

But risks abound. Market performance late in the quarter indicated that rising COVID-19 case numbers can quickly trigger a correction. Even though macroeconomic data is improving, the global economy is undergoing its biggest recession in modern history. Nasty surprises in company results and stock returns can be expected.

Why Did Stocks Rebound in the Second Quarter?

So why did stocks do so well in this environment? We think the rebound reflected the fact that investors’ worst fears had been averted. While the road to recovery will be bumpy, a total global meltdown or prolonged depression now looks unlikely, given the fiscal and monetary stimulus commitments by governments and central banks.

Indeed, interest rates are expected to stay at historic lows for several years, further reducing the appeal of safer government bonds that offer almost no yield. This also compresses the discount rates investors use to value future cash flows of companies, which makes those cash flows more valuable today.

Market gains were also driven by a sharp jump in retail trading volumes. And with record amounts of cash parked in money-market funds, there’s plenty of pent-up buying power to be deployed when confidence improves.

Wide Dispersion in Returns

For now, confidence differs by sector. In the second quarter, many technology stocks continued to surge as investors rewarded companies that enable remote working, shopping and other stay-at-home activities. Cyclical sectors outperformed defensive sectors (Display, left). But financials continued to struggle because of low interest rates and heightened default risk. Value stocks, which include a large contingent of banks, continued to underperform growth stocks by a wide margin (Display, right).

Concentration Risks Are Growing

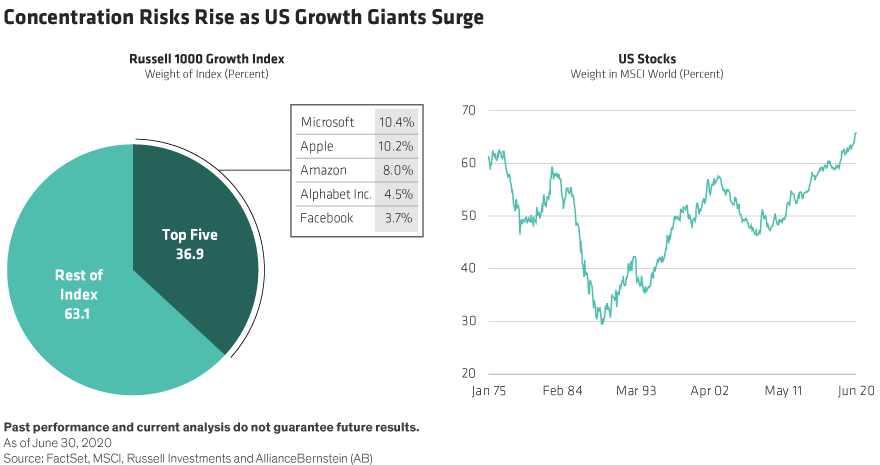

The wide dispersion of returns in different parts of the market is creating new distortions. The extreme case is the Russell 1000 Growth Index, where five stocks now account for a record 36.9% of the entire benchmark (Display, left). In broad global benchmarks these same names have a larger combined weight than any entire country’s market, other than the US. Partly as a result, US stocks now account for 66% of the MSCI World, versus just 30% three decades ago (Display, right).

Why is this a problem? In the past, extreme levels of concentration in a small group of stocks has typically reversed. If some of today’s mega-caps underperform, investors who own a benchmark or a heavy concentration in these names could be exposed.

Valuations are another concern. US stocks are much more expensive than usual relative to the rest of the developed world (Display).

Many US stocks offer good return potential, especially relative to bonds, in our view. However, current high valuations inevitably reduce the long-term returns investors can expect from the US market as a whole.

What Happens Next?

Investors should brace for more surprises as coronavirus risk persists. Many companies suspended earnings guidance in first-quarter reports, leading to an extremely wide dispersion in earnings forecasts. Investors should gain more clarity on which companies are coping better with the effects of the pandemic and which are not as second-quarter earnings season begins this month.

In this environment, we believe investors with a research process rooted in deep industry and company knowledge will have advantages. Projecting the path of the virus is not our job as investors. But investors can identify companies that are more vulnerable to government actions, such as lockdowns, if infection levels rise again.

Investing amid the COVID-19 crisis also requires an ability to look beyond 2020 and develop long-term cash-flow forecasts that reflect a highly uncertain environment. Sectors and industries will be redefined as weaker companies fail and stronger companies flourish. That requires scrutinizing balance sheets and engaging with management to determine which companies are making sound strategic decisions that will distinguish winners from losers in the aftermath of this crisis.

Three Guidelines for Investors

How should investors approach their equity exposures in the second half? First, accept volatility as a defining feature of today’s markets without allowing sharp swings in either direction to derail strategic goals. Second, define your risk tolerance for a volatile world and diversify exposures accordingly; today, there are many ways to capture long-term equity potential with varying levels of downside protection. Third, check regional and style exposures to ensure that an allocation isn’t overly vulnerable to elevated valuations or country concentrations that could reverse sharply.

The second quarter demonstrated that equity markets can rise above a severe exogenous shock when provided with enough external support. But performance patterns have been anything but even. As the crisis continues to unfold, avoiding the most vulnerable businesses and identifying companies with staying power will be necessary to generate long-term returns in a market that may continue to reflect a wide dispersion in results through the recession and recovery.

Christopher Hogbin is Head of Equities at AllianceBernstein (AB).

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein

This post was first published at the official blog of AllianceBernstein..