by Mark Stacey, Senior Vice-President, Co-CIO AGFiQ Quantitative Investing, Head of Portfolio Management, AGF Investments

Listed infrastructure is not an easy investment to categorize. To some, it’s part of the alternative universe of asset classes and strategies that can help fortify traditional 60/40 portfolios; for others, it falls more squarely into the bucket marked “equities” and is a unique way to differentiate the vast pool of stocks traded daily around the world.

However you want to categorize it, it’s not hard to agree on the valuable role listed infrastructure can play in asset allocation decisions. Whether the goal is to add growth, income or downside protection, it is increasingly evident that portfolios with liquid exposure to the structures, facilities and systems that help support and keep the global economy on track may end up better off than those that don’t.

In fact, infrastructure stocks offer not only many of the same benefits that are often associated with private infrastructure funds, but also greater versatility to gain broad global exposure across multiple sectors and to move in and out of positions more easily. As such, they are routinely used as both a substitute for and a complement to less liquid approaches. For instance, while they often act as strategic long-term holdings, many institutions hold them as tactical placeholders for longer-term commitments they’ve made to private investments that have yet to issue capital calls (or required drawdowns) needed to fund new infrastructure deals.

Still, the advantages of listed infrastructure might not be fully appreciated by every investor. One of those advantages is the sheer magnitude of the opportunity. According to a 2016 study by the consulting firm McKinsey & Co., for example, US$3.3 trillion needs to be invested globally in infrastructure every year to 2030 – just to support current economic growth rates. It might seem that the infrastructure gap between what currently exists and what is required never seems to budge, given the inaction of politicians to spend what they promise. But the global rash of power outages, contaminated water supplies and bridge collapses that have happened in recent years confirms the desperate need to repair, replace and upgrade the infrastructure the world relies upon.

If anything, the COVID-19 pandemic only adds to this growing sense of urgency, as governments around the world reassess their investment requirements in social infrastructure such as hospitals and enact fiscal stimulus measures to kick-start economies that have been waylaid by the outbreak. U.S. President Donald Trump, for one, recently proposed a US$1-trillion infrastructure package focused on roads, bridges, tunnels, fifth generataion (5G) wireless infrastructure and rural broadband as part of the government’s response to the coronavirus. He also signed an executive order that gives federal agencies emergency powers to fast-track public works and highway projects, as well as energy projects like pipelines and terminals.

Of course, not all this pent-up infrastructure investment will flow to public markets; much will remain in government hands and/or be owned privately via public-private partnerships (PPPs). Yet opportunities to participate through listed stocks are far from negligible, and they should continue to grow as governments look to manage their debt loads and more money is put to work along the infrastructure supply chain. That would come to the benefit of various companies and industries, including power producers, electrical equipment manufacturers, toll roads and airports, as well as engineering and construction firms and steel, cement and stone makers.

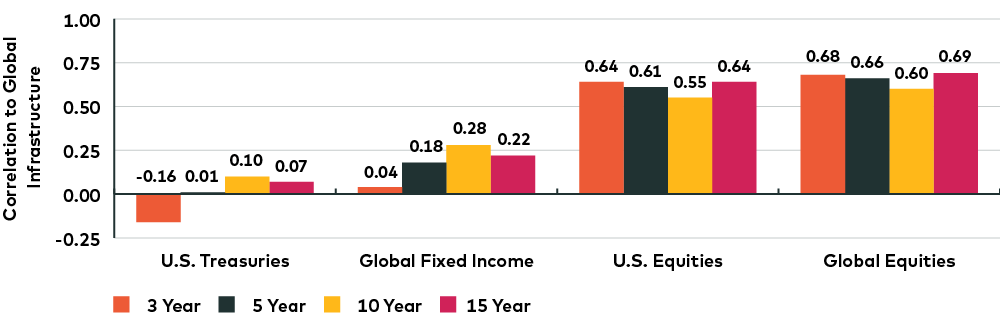

Even if listed infrastructure’s growth potential takes time to realize (or worse, falls short of the mark), it can still have an immediate and positive portfolio impact as a risk-mitigator and income-generating investment. Infrastructure stocks have a solid track record of returns, with low and even negative correlations to stocks and bonds, over the past 15 years. Our research also shows that listed infrastructure tends to offer a slightly smoother return profile than equity markets do. More specifically, the Dow Jones Brookfield Global Infrastructure Total Return Index experienced a standard deviation of 12.35% during the 10-year period ending March 31, 2019, compared with the S&P 500 Total Return Index’s standard deviation of 13.86% over the same stretch.

Source: Morningstar Direct as of March 31, 2020 in U.S. dollars (US$). Global Infrastructure is represented by the Dow Jones Brookfield Global Infrastructure Total Return Index, US Treasuries are represented by the Bloomberg Barclays US Aggregate Bond Total Return Index, Global Fixed income is represented by the Bloomberg Barclays Global Aggregate Total Return Index, US Equities are represented by the S&P 500 Total Return Index and Global Equities are represented by the MSCI World Index. One cannot invest directly in an index.

Infrastructure stocks in several sectors, including transportation, energy and utilities, have also shown a tendency to outperform their broader universe counterparts, both over the long term and during the recent market selloff, our research shows. For example, during the period between February 24 and March 23, 2020, when the global benchmark MSCI ACWI Index fell 33%, exposure to transportation infrastructure stocks netted a loss of 21% versus the ACWI Transportation Index that fell 25%. Similarly, exposure to energy and utilities infrastructure lost 7% and almost 6% less, respectively, than the comparable ACWI sector indices.

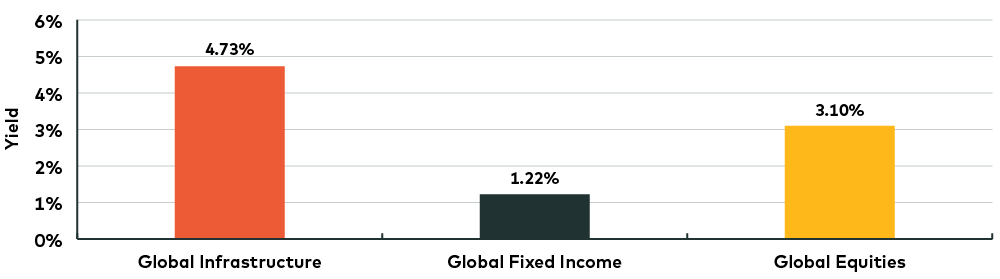

Listed infrastructure’s appeal as a reliable, high-yield dividend payer, meanwhile, is also well established. At the end of March, the index was yielding 4.73% versus comparable aggregates for global bonds and equities that were yielding 1.22% and 3.1%, respectively. While not always so wide, this favourable differential has been consistent over the years, in part because many infrastructure companies are monopolies offering predictable cash flows through regulated or concession-based revenues. The low interest rate environment of the past decade has also been a factor in the relative attractiveness of infrastructure yields, and that should continue given recent indications from the U.S. Federal Reserve that its overnight lending rate will remain near zero for at least the next few years, if not longer.

Source: Morningstar Direct as of March 31, 2020 in U.S. dollars (US$). Global Infrastructure is represented by the Dow Jones Brookfield Global Infrastructure Total Return Index, Global Fixed income is represented by the Bloomberg Barclays Global Aggregate Total Return Index and Global Equities are represented by the MSCI World Index. One cannot invest directly in an index.

In short, listed infrastructure can be advantageous on several different fronts and stands to benefit those who own it through ebbs and flows in both equity and bond market cycles. Granted, that doesn’t mean it’s foolproof. The economic downturn that has resulted from the pandemic has been particularly hard on short-term cash flows for toll-based infrastructure, including highways and airports, while energy-related infrastructure has been additionally burdened by the recent rout in oil prices. But these types of risks are often temporary and will give way to newer opportunities, not negate them. Areas of promise moving forward include the cell tower and data centre industries, which both stand to benefit from the necessary expansion of our telecommunications infrastructure to support 5G network technology.

Call it what you will—an alternative or just an equity—but there’s no denying the importance that listed infrastructure can have in a well-diversified portfolio.

Mark Stacey is Co-CIO AGFiQ Quantitative Investing and Head of AGFiQ Portfolio Management, AGF Investments Inc. He is a regular contributor to AGF Perspectives.

Bill DeRoche is Chief Investment Officer, AGF Investments LLC, and Head of AGFiQ Alternative Strategies. He is a regular contributor to AGF Perspectives.

*****

To learn more about our quantitative capabilities, please click here.

The commentaries contained herein are provided as a general source of information based on information available as of June 26, 2020 and should not be considered as investment advice or an offer or solicitations to buy and/or sell securities. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Investors are expected to obtain professional investment advice.

The views expressed in this blog are those of the author and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds or investment strategies.

AGF Investments is a group of wholly owned subsidiaries of AGF and includes AGF Investments Inc., AGF Investments America Inc., AGF Investments LLC, AGF Asset Management (Asia) Limited and AGF International Advisors Company Limited. The term AGF Investments m ay refer to one or more of the direct or indirect subsidiaries of AGF or to all of them jointly. This term is used for convenience and does not precisely describe any of the separate companies, each of which manages its own affairs.

™ The ‘AGF’ logo is a trademark of AGF Management Limited and used under licence.

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. AGF brings a disciplined approach to delivering excellence in investment management through its fundamental, quantitative, alternative and high-net-worth businesses focused on providing an exceptional client experience. AGF’s suite of investment solutions extends globally to a wide range of clients, from financial advisors and individual investors to institutional investors including pension plans, corporate plans, sovereign wealth funds and endowments and foundations.

For further information, please visit AGF.com.

© 2020 AGF Management Limited. All rights reserved.

This post was first published at the AGF Perspectives Blog.