by Don Vialoux, EquityClock.com

Pre-opening Comments for Wednesday July 1st

CANADA DAY

U.S. equity index futures were lower this morning. S&P 500 futures were down 8 points in pre-opening trade.

Index futures recovered following release of the June ADP Private Employment report released at 8:15 AM EDT. Consensus was an increase of 3.000 million versus an upwardly revised gain of 3.065 million in May. Previous May report indicated a drop of 2.760 million. Actual in June was an increase of 2.369 million.

FedEx gained $15.56 to $155.78 after reporting higher than consensus fiscal fourth quarter earnings. Cowen raised its target price from $156 to $167.

UnitedHealth Group slipped $2.54 to $292.41 despite initial coverage by Leerink with an Outperform rating and a target of $360.

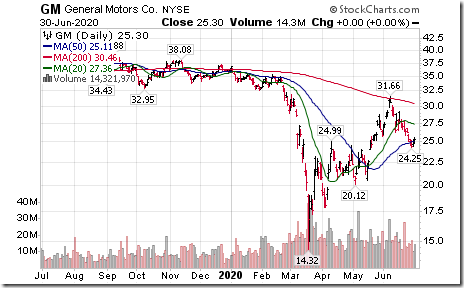

General Motors slipped $0.21 to $25.09 despite a target price increase by Benchmark from $29.00 to $41.00.

General Mills eased $1.45 to $60.20 despite reporting higher than consensus fiscal fourth quarter revenues and earnings.

Tech Talk for (CANADA DAY) Wednesday July 1st 2020

Technical Notes

eBay, (EBAY) a NASDAQ 100 stock moved above $51.88 extending an intermediate uptrend.

Xilinx (XLNX), a NASDAQ 100 stock moved above $98.17 extending an intermediate uptrend.

Base Metals ETF (DBB) consisting one third weight each in copper, zinc and aluminum moved above $13.73 extending an intermediate uptrend.

Morgan Stanley A Shares (CAF), a closed end fund with a portfolio of Chinese A shares moved above $19.50 extending an intermediate uptrend.

Trader’s Corner

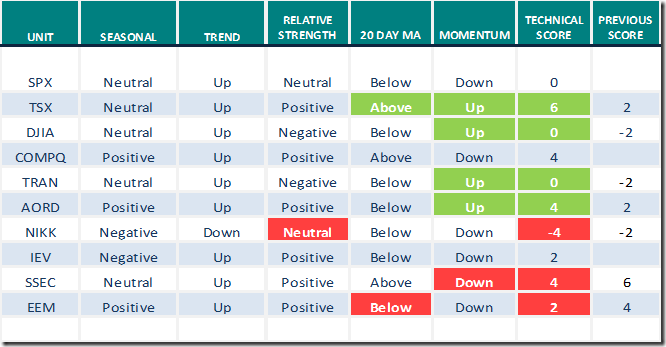

Equity Indices and related ETFs

Daily Seasonal/Technical Equity Trends for June 30th 2020

Green: Increase from previous day

Red: Decrease from previous day

Commodities

Seasonal/Technical Commodities Trends for June 30th 2020

Green: Increase from previous day

Red: Decrease from previous day

Sectors

Daily Seasonal/Technical Sector Trends for June 29th 2020

Green: Increase from previous day

Red: Decrease from previous day

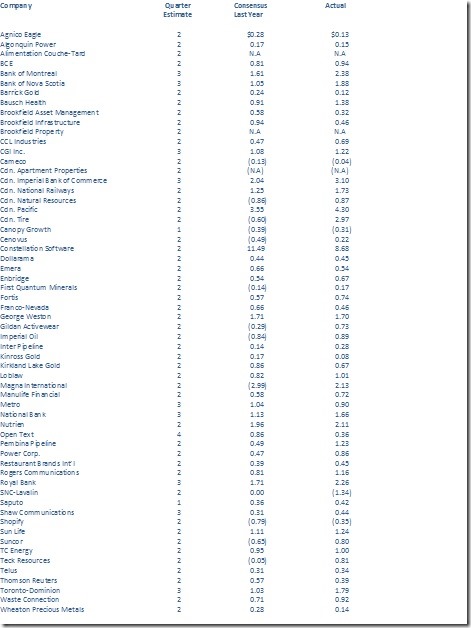

Consensus Second Quarter Earnings Estimates for TSX 60 Companies

Earnings estimates for Canada’s top listed companies generally are expected to move lower in the second quarter primarily due to impact of COVID 19: According to Zack’s, 16 companies are expected to report higher year-over-year earnings, 42 companies are expected to report lower earnings. Data was not available on two companies. Top gainers were gold stocks. Top decliners were energy companies. Average (median) decline is 20.5%. Following is the data provided by www.Globeinvestors.com

S&P 500 Momentum Barometer

The Barometer added another 8.22 to 71.74 yesterday. It remains intermediate overbought.

TSX Momentum Barometer

The Barometer added another 4.59 to 73.71 yesterday. It remains intermediate overbought.

Disclaimer: Seasonality and technical ratings offered in this report and at

www.equityclock.com are for information only. They should not be considered as advice to purchase or to sell mentioned securities. Data offered in this report is believed to be accurate, but is not guaranteed

This post was originally publised at Vialoux's Tech Talk.

![clip_image001[1] clip_image001[1]](https://advisoranalyst.com/wp-content/uploads/2020/07/clip_image0011_thumb.png)

![clip_image002[1] clip_image002[1]](https://advisoranalyst.com/wp-content/uploads/2020/07/clip_image0021_thumb.png)

![clip_image002[4] clip_image002[4]](https://advisoranalyst.com/wp-content/uploads/2020/07/clip_image0024_thumb.png)

![clip_image002[6] clip_image002[6]](https://advisoranalyst.com/wp-content/uploads/2020/07/clip_image0026_thumb.png)

![clip_image002[8] clip_image002[8]](https://advisoranalyst.com/wp-content/uploads/2020/07/clip_image0028_thumb.png)