by Talley Leger Sr. Investment Strategist, Invesco Canada

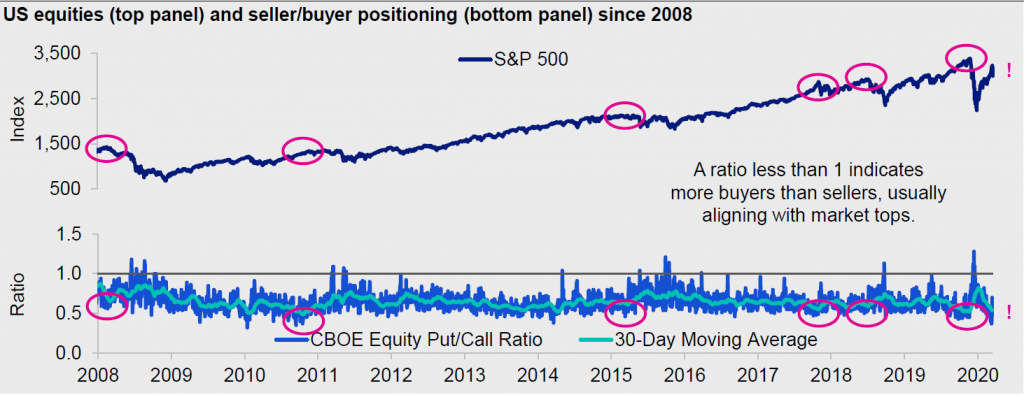

On March 13, 2020, we began talking1 and writing2 about a series of tactical market bottom indicators3 that showed signs of extreme risk-off positioning, which were positive from a contrarian perspective. One of those indicators was the Chicago Board Options Exchange (CBOE) equity put/call ratio. Little did we know it at the time, but ten days later, the S&P 500 Index would put in what now appears to be a major low for the cycle.

What is the CBOE equity put/call ratio and why does it matter?

The put/call ratio is a measure of seller (put) relative to buyer (call) positioning derived from the options market, where a ratio greater than 1 signals more sellers than buyers (or extremely negative investor sentiment) and usually aligns with big market bottoms. On March 12, 2020, the put/call ratio hit 1.28, its highest level since 20084 – in the depths of the Great Recession and Global Financial Crisis – meaning risk-off positioning was lopsided and investor pessimism was overwhelming.

The put/call ratio served us well three months ago, but what is it telling us now?

Unfortunately, there may be at least a temporary wrinkle in the bull case for stocks. The recent trough-to-peak surge of 44% on the S&P 500 Index compressed the put/call ratio to 0.37 on June 8, 2020, its lowest level since 2010 – just before the peak of the European sovereign debt crisis. In other words, risk-on positioning has gotten stretched, and the bulls are running rampant, raising the likelihood of a near-term pullback in stocks akin to what we saw in 2018, 2015 and 2011.

Figure 1. Too many buyers, not enough sellers

Source: Bloomberg L.P., Invesco, 06/11/20. Notes: CBOE = Chicago Board Options Exchange. The CBOE Equity Put/Call Ratio is a measure of seller (put) relative to buyer (call) positioning derived from the options market, where a ratio less than 1 signals extremely positive investor sentiment. An investment cannot be made in an index. Past performance does not guarantee future results.

Beyond investor positioning, is there a broader bearish case to be made for stocks?

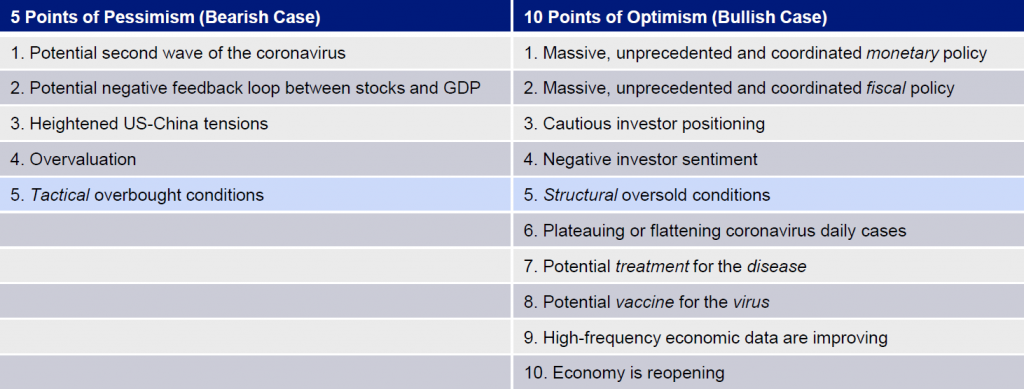

In our view, the bearish case includes 5 points of pessimism, namely:

1) Fears of a potentially deadly second wave of the coronavirus as the economy reopens and we approach cooler fall weather; 2) the risk of a negative feedback loop between stocks and 2Q20 gross domestic production (GDP) and earnings per share (EPS); 3) heightened U.S.-China tensions; 4) overvaluation; and 5) tactical overbought conditions, as discussed. All valid points, any one of which could prove to be the catalyst for a near-term pullback in stocks.

Figure 2. The optimists always win in the end

Source: Invesco, 06/11/20. Notes: GDP = Gross domestic production. EPS = Earnings per share.

How does the bullish case stack up?

That said, we remain compelled by the breadth and scope of the bullish case, which includes the following 10 points of optimism:

1) Massive, unprecedented and coordinated monetary policy support; 2) similarly impressive fiscal policy support; 3) cautious investor positioning in the form of high cash balances and net short positions in stocks; 4) negative investor sentiment as expressed by persistent outflows from stocks and more bears than bulls in the individual investor survey; 5) a structural oversold condition as seen in the rolling 20-year total returns on stocks; 6) plateauing or flattening coronavirus daily cases overall; 7) a potential treatment for the disease that is being researched and developed by a host of companies around the world, and that has already moved to human trials; 8) a potential vaccine for the virus that is evolving similarly; 9) the high-frequency economic data like weekly initial claims for unemployment insurance are improving; and 10) the economy is reopening and activity is moving in the right direction, as evidenced by the daily mobility data.

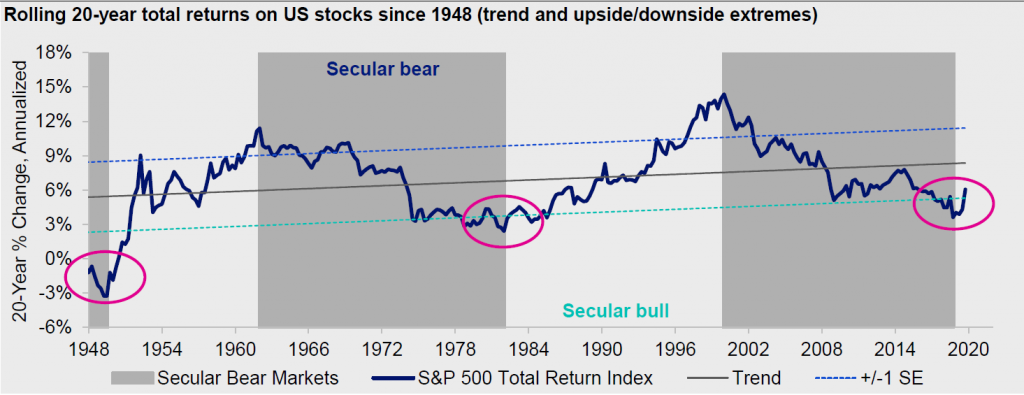

Is this a cyclical bear market in a secular bull market, or is this a cyclical bull market in a secular bear market?

While it may seem like a daunting task, we believe it is possible to differentiate between secular bull and bear markets. It is said that the trend is your friend except at the end where it bends. Historically, secular bull markets have not ended until stocks have produced 20-year annualized total returns of 11% to 15%. In the current environment, however, 20-year returns remain muted, so much so in fact that they seem more consistent with a secular bull market in its earlier stages than one in its later stages.

Figure 3. The trend is your friend except at the end where it bends

Source: Bloomberg L.P., Invesco, 03/31/20. Notes: Rolling 20-year annualized returns on the S&P 500 Total Return Index, calculated using quarterly data. SE = Standard error. Dark gray areas denote secular bear markets in U.S. stocks. Light gray areas denote secular bull markets in U.S. stocks. An investment cannot be made directly in an index. Past performance does not guarantee future results.

Amidst the biggest economic event in modern history, we must admit to being surprised by the v-shaped stock market recovery and the fact that equities haven’t yet re-tested the March low. Based on some of the tactical breadth and positioning indicators that we monitor, however, there is a case to be made for a near-term pullback in stocks. Short-term volatility aside, we believe the long-term bull case (10 points of optimism) outweighs the bear case (5 points of pessimism). As such, we think investors may benefit from maintaining structural exposure to stocks in the years ahead.

This post was first published at the official blog of Invesco Canada.