by Carl R. Tannenbaum, Ryan James Boyle, Vaibhav Tandon, Northern Trust

Over the past month, all states have gradually started to relax lockdown policies, aiming to return to normal economic activity while keeping people safe. Against this backdrop, incoming economic data has shown mild improvement relative to the massive declines seen in March and April. The May employment report was a welcome surprise but should be read with caution.

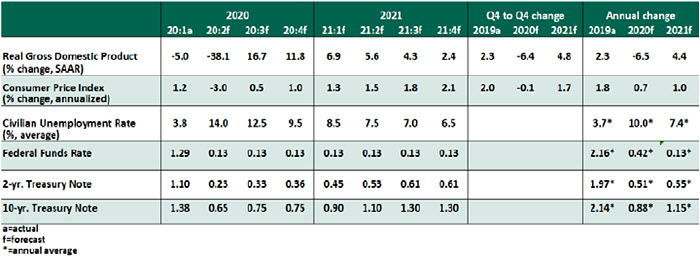

The near-term outlook remains dismal. A slew of economic readings for April have revealed significant damage to the economy from COVID-19-related lockdowns. Real gross domestic product (GDP) is likely to contract at a rate not seen in the post-war era. Recovery should begin in the third quarter, but we do not expect the economy to recover all of the output lost until well into 2022. A renewed wave of infections (amid the recent discontent) that brings the economy to a standstill again remains a key downside risk.

Key Economic Indicators

Influences on the Forecast

- The unemployment rate unexpectedly dropped to 13.3% and total nonfarm payrolls rose by 2.5 million in May. While the lower unemployment rate was a welcome surprise, the employment situation remains difficult. Initial jobless claims are declining but remain elevated; nearly 43 million people have filed for regular unemployment insurance since the crisis took hold, and more than 6 million have filed for Pandemic Unemployment Assistance (for jobs not normally eligible for unemployment benefits). We expect the unemployment rate to continue to recover, but to hover in double digits for the most of the year and stay well above pre-crisis levels even in 2021.

- Real GDP for the first quarter was revised by two-tenths, to -5.0% on an annualized basis, as inventories proved to be a bigger drag than initially reported. Incomes have surged, thanks to government support payments, but much of it has been saved rather than spent. The U.S. saving rate rose to a record level in April. We expect real GDP to drop at an annualized pace of about 40% in the second quarter, and then follow a recovery that will be graded by curves.

- As expected, the Federal Open Market Committee, at its June 9-10 meeting, made no major policy announcements and decided to keep its foot on the gas as inflation and employment objectives remain far from desired levels. The Federal Reserve didn’t expand any of its current programs, but Chair Jerome Powell faced some questions about the Fed’s range of facilities to support financial markets. Recently, the Fed expanded its $500 billion Municipal Liquidity Facility to a wider range of local governments, cash-strapped airports and public transit agencies.

- While massive fiscal and monetary stimulus measures have helped ease financial conditions and offset some economic shocks, more will be needed to underpin the recovery. We are likely to see further fiscal measures before the August recess, but at a smaller scale than the measures seen in the initial phase of the outbreak. On the monetary policy front, the Fed is likely to scale up its current programs but will refrain from pushing rates into negative territory.

- COVID-19-related shocks to demand for energy and other goods and services has led to a strong disinflationary effect on prices. The headline consumer price index dropped to a five-year low of 0.1% year-over-year while the core measure fell to 1.2%, the lowest since March 2011. Disinflationary forces are likely to start fading in the third quarter as the economy reemerges from the lockdown measures, but the recovery in demand will be gradual.

- The labor market isn’t the only metric showing signs of bottoming out. Both the Institute for Supply Management’s manufacturing and non-manufacturing indices rose slightly to a still-contractionary reading of 43.1 and 45.4 in May, respectively. That said, just like in the case of the labor market, a closer look beyond the headline readings reveals that conditions are far from normal. Non-manufacturing conditions remain depressed owing to weak new orders, and business activity is still contracting.

- The housing market has seen some swings. Pending home sales and housing starts fell last month; however, mortgage purchase applications continue to increase, supported by low interest rates. Weak labor markets, the expiration of government support payments, and tightening lending standards could weigh on housing demand.

- Amid tumbling sales and earnings, some businesses have closed permanently, and others face increased risk of default. While it is not our base case, a second wave of the viral outbreak could trigger another series of defaults and renewed financial market turbulence.

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

© 2019 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For legal and regulatory information about individual market offices, visit northerntrust.com/disclosures.

Copyright © Northern Trust