by Evan McCulloch, Franklin Templeton Investments

In the past few months alone, the COVID-19 pandemic has already made a profound impact on every sector within our economy, and like every other sector, the biotechnology industry will continue to navigate the effects from COVID-19 for months and possibly years to come. However, despite the many challenges that have emerged as a result of the pandemic, the key growth drivers for biotechnology have remained intact, and importantly, we believe the industry will continue to generate innovative new drugs in both the near term and the long term.

Innovation has always been a key driver for the biotechnology industry, and even as COVID-19 presents new headwinds to the drug development process, we believe that any disruption to health care innovation will be temporary. For this reason, our long-term investment outlook remains positive.

In particular, we are excited about three therapeutic classes that have been especially innovative and disruptive in recent years: adoptive T-cell therapy for cancer, precision oncology drugs and gene therapy. We expect these three categories to transform the standard of care for many difficult-to-treat diseases.

Adoptive T-Cell Therapy

The concept of cancer immunotherapy involves harnessing the power of a patient’s own immune system to identify and destroy cancer cells. Immunotherapy has been shown to be highly effective in certain tumor types, driving long-lasting remissions in some patients. There are several different kinds of immunotherapies available, but one that we are particularly excited about is adoptive T-cell therapy. This involves the use of immune cells or T-cells—which are either collected from the patient or in some cases from healthy donors—that are modified and then expanded before being infused back into the patient.

We are excited about these cell therapies because some have been able to generate long-lasting remissions in difficult-to-treat patients who have failed multiple lines of therapies and would otherwise have no other treatment options left. Most of the products in development have been focused on hematological cancers and melanoma, but we are optimistic that cell therapy can be used to address other solid tumors such as lung cancer as well.

Precision Oncology

Precision oncology drugs are designed to target specific mutations or gene alterations that are known to cause certain cancers. This is a form of personalised medicine—a cancer patient’s tumor tissue is tested for the presence of any known driver mutations so that treatment can be tailored specifically for that patient, as long as there are drugs available to target those specific mutations. Precision oncology is not a new concept—several precision oncology drugs have been available for select tumor types in the past two decades. However, recently we have seen a surge in the number of new drugs that are even more effective and better tolerated than existing options.

Furthermore, several companies have developed innovative drug discovery platforms to design novel drugs to target new mutations that were difficult to target with older technologies. These novel platforms aren’t just focused on complex biologics like monoclonal antibodies and antibody-drug conjugates—we are also seeing a lot of innovation happening in the discovery of small molecule drugs for oncology. In particular, we are excited about the many new precision oncology drugs emerging for certain tumor types like lung cancer, breast cancer and gastrointestinal stromal cancer.

Gene Therapy

Some genetic diseases are known to be caused by a defect or mutation in a single gene, and for these rare and devastating monogenic diseases, gene therapy could be an incredibly useful treatment option. Gene therapy involves replacing a patient’s defective gene with a normal copy of that gene. Gene therapy is meant to be a one-time treatment that would ideally cure a patient for life. Like precision oncology, gene therapy is a decades-old concept that has made leaps and bounds in recent years.

We now have several FDA-approved gene therapy products available, including one for a rare neuromuscular disease called spinal muscular atrophy (SMA). Most children with severe SMA do not survive through early childhood, but gene therapy has truly transformed the management of SMA by improving the muscle function, movement and survival of these patients. We continue to see a lot of innovation in this area across many devastating diseases, and expect to see more gene therapy treatment options to become available shortly.

Innovation in the Context of COVID-19

Unfortunately, drug developers are facing some new operational challenges due to the COVID-19 pandemic, and as a result we anticipate some impact on clinical development timelines as well as the number of new drug approvals in the near term. Companies that are actively running clinical trials for investigational drugs are facing a slowdown in patient enrollment and in some cases have been forced to temporarily shut down trial sites entirely, especially as hospitals and treatment centers are prioritising treatment of COVID-19 patients. Patients who are already enrolled in trials and are actively receiving treatment are at a higher risk to being lost to follow-up, especially if shelter-in-place orders prevent them from visiting trial sites in person.

New drug applications that are under review by regulatory agencies could face delays as those agencies shift their resources to the expedited review of drugs for COVID-19. For drugs that are already approved, sales will be negatively impacted in the near term. The volume of new drug prescriptions has fallen temporarily, and the continued rise in unemployment rates will lead to more patients losing their health insurance coverage and therefore access to prescription drugs.

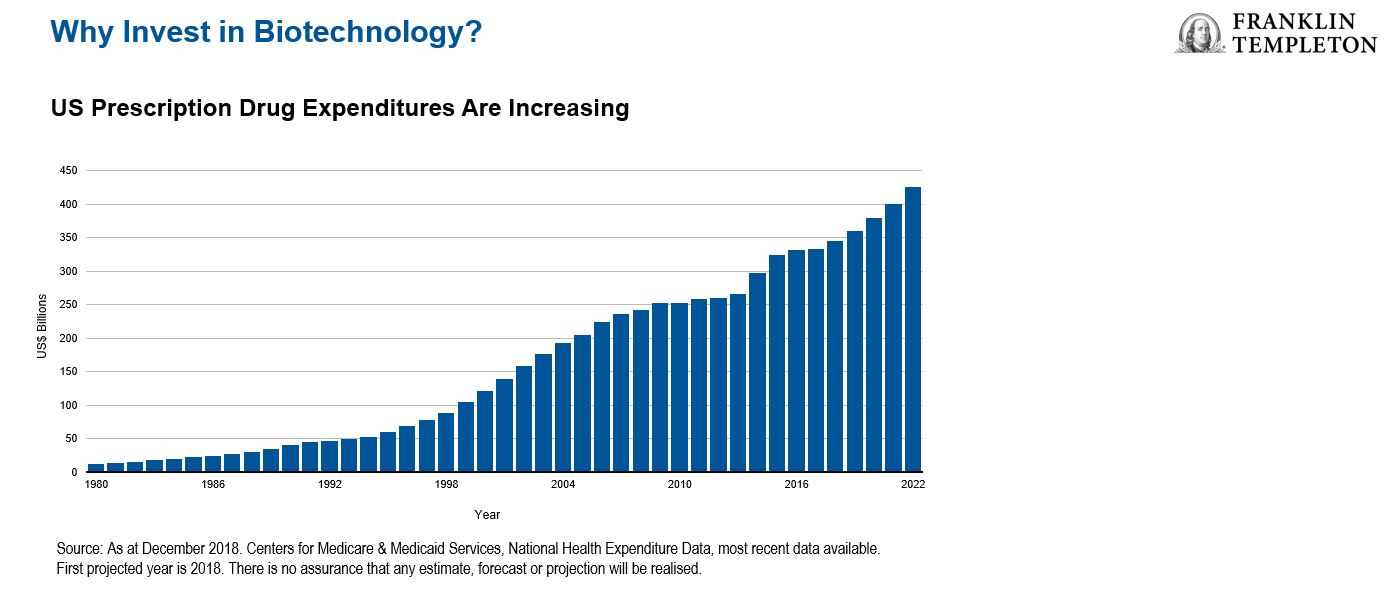

However, we believe that this disruption to the industry will be temporary, as the demand for prescription drugs has always been relatively inelastic and for this reason, biotechnology and pharmaceutical companies have been generally well insulated from fluctuations in the business cycle. Prescription drug expenditures have been on an upward trend, one that we anticipate should continue as we move past the current crisis.

No matter what environment we are in, we believe there are always attractive opportunities to be found in this industry. Even in the midst of this pandemic, we are still able to find companies that are undervalued and that we believe will continue to create value in the long term once we are past this pandemic. We have even been able to identify companies that are now applying their innovative drug discovery platforms to help manage this pandemic. The pipeline of drugs and vaccines in development for COVID-19 has been growing at an unprecedented pace, and we are optimistic that some of these will be effective in treating and preventing infections.

Long-Term Growth Drivers in Biotech Remain Intact

We expect to see continued growth in the biotech industry based on a number of global megatrends.

For one, the ageing global population will continue to drive health care demand; as the world’s population ages, the elderly as a group will continue to spend more on drugs and medical services than younger generations. Not surprisingly, we have seen a continued increase in annual prescription drug expenditures over the past four decades, and we expect this upward trend to likely continue.

In addition, we believe we as a society are finally beginning to reap the benefits of the many scientific and medical advancements made in the past 10-15 years, all of which have led to the recent surge in novel drugs and treatment modalities. Recent advances in genomics and proteomics, as well as in DNA sequencing technologies, have enabled a more informed and targeted approach to designing drugs.

Scientists and researchers are also now better equipped than ever before to identify new mutations that drive diseases, to design new drugs with better efficacy and fewer side effects, and to improve diagnoses of patients so that the best treatment options can be found for them to improve clinical outcomes.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as of publication date (or specific date in some cases) and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own professional adviser or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Templeton Distributors, Inc., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com—Franklin Templeton Distributors, Inc. is the principal distributor of Franklin Templeton Investments’ U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. The technology industry can be significantly affected by obsolescence of existing technology, short product cycles, falling prices and profits, competition from new market entrants as well as general economic conditions. Investments in fast-growing industries, including the technology and health care sectors (which have historically been volatile) could result in increased price fluctuation, especially over the short term, due to the rapid pace of product change and development and changes in government regulation of companies emphasizing scientific or technological advancement or regulatory approval for new drugs and medical instruments.

There is no assurance that any estimate, forecast or projection will be realised.

This post was first published at the official blog of Franklin Templeton Investments.