by Andy Kochar, AGF Management Ltd.

Sustainable investing has shown remarkable resilience during the COVID-19 pandemic, but it’s not just equity strategies with environmental, social and governance (ESG) parameters that have held their own. The ESG theme has been equally embraced by fixed income investors who continue to expand their lens on responsible investing and are now turning to bond markets as an important new source of financing in the fight against the coronavirus.

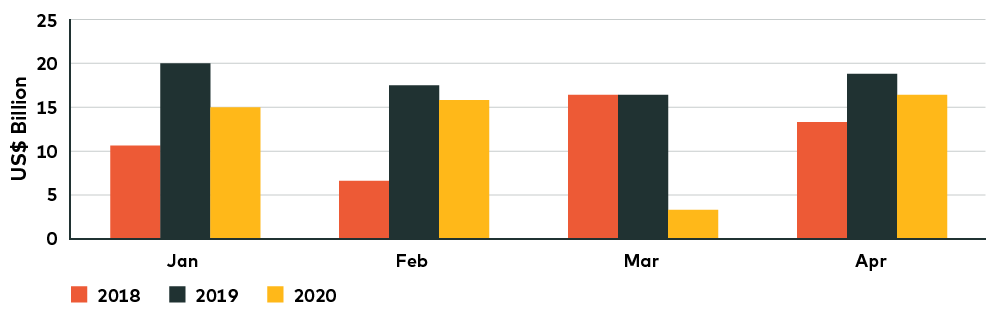

In fact, the global issuance of sustainable bonds is expected to surpass all previous years despite a slight setback at the height of the market crisis in March. Green bond issuance, for instance, totaled US$16.6 billion in April after falling to US$3.4 billion in March, and is targeted to reach US$350 billion by the end of 2020, up from US$257 billion last year, according to Climate Bonds Initiative, an investor-focused not-for-profit research firm. Last month’s issuance was the highest one-month total this year and can be attributed to several countries issuing US$1 billion or more in new green bonds. This includes China, France, the Netherlands and Germany, as well as Canada which hadn’t reached this monthly threshold in green bond issuance since July 2019.

Green Bond Issuance Bounces Back

Source: Climate Bonds Initiative (www.climatebonds.net)

Social bonds also gained some momentum in April, albeit for different reasons than in the past. Unlike green bonds, whose proceeds are primarily designated to climate initiatives such as renewable energy, clean transportation and/or sustainable water and wastewater treatment, social bonds are generally earmarked for wide-ranging societal issues like gender diversity, affordable housing and Indigenous Peoples’ business and community lending. In recent weeks, however, a new variation on the theme has emerged, one that is directly linked to the COVID-19 outbreak. Pandemic bonds, as some are calling them, have been issued in several countries to date and by several international institutions. China, for one, has issued multiple bonds over the course of the past few weeks, and so too have Indonesia and Sweden, where US$100 million in commercial paper was recently sold to help finance the production increase of ventilators and other life-saving equipment. The African Development Bank, meanwhile, launched a US$3 billion “Fight COVID-19” bond at the end of March that was reportedly the largest U.S. dollar-denominated social bond ever issued.

For their part, organizations like Sustainalytics and the International Capital Markets Association (ICMA) are supporting these issues by updating their internal taxonomies to include guidance on how proceeds from these bonds can be used. To that end, the ICMA says social bonds related to COVID-19 should mitigate specific issues, especially for target populations, which in this case may also include the general population affected by the crisis.

If anything, this growing wave of pandemic-related issuance shows the critical role that sustainable bonds can have in fighting against the virus, but also more broadly as a powerful source of financing that can aid the pursuit of a cleaner environment and healthier, more equitable society.

That’s not to say that the market for ESG bonds is equally established across all fronts. Issuance of social bonds was US$13 billion in 2019, according to Sustainalytics, and remains small relative to green bonds, which have been the greater focus of investors to date and typically provide a more defined issuing structure. Still, there’s no denying that demand for sustainable fixed income exposure continues to gain strength. This is evident not only when it comes to new issuance of both green and social bonds, but in recent fund flows that showed global ESG bond strategies held their own during the worst part of the crisis and performed largely in line—when adjusting for duration and sector mix—with fixed income strategies that don’t take these factors into consideration, according to Morgan Stanley research.

Moreover, it is exactly that resilience which is likely to drive even more interest in sustainable bonds going forward. After all, who appreciates this trait in an investment more than a fixed income investor whose primary goal is to preserve capital over the long term?

Andy Kochar is a Portfolio Manager and Head of Global Credit at AGF Investments Inc. He is a regular contributor to AGF Perspectives.

To learn more about our fundamental capabilities, please click here.

The commentaries contained herein are provided as a general source of information based on information available as of May 13, 2020 and should not be considered as investment advice or an offer or solicitations to buy and/or sell securities. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Investors are expected to obtain professional investment advice.

The views expressed in this blog are those of the author and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds or investment strategies.

AGF Investments is a group of wholly owned subsidiaries of AGF and includes AGF Investments Inc., AGF Investments America Inc., AGF Investments LLC, AGF Asset Management (Asia) Limited and AGF International Advisors Company Limited. The term AGF Investments m ay refer to one or more of the direct or indirect subsidiaries of AGF or to all of them jointly. This term is used for convenience and does not precisely describe any of the separate companies, each of which manages its own affairs.

™ The ‘AGF’ logo is a trademark of AGF Management Limited and used under licence.

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. AGF brings a disciplined approach to delivering excellence in investment management through its fundamental, quantitative, alternative and high-net-worth businesses focused on providing an exceptional client experience. AGF’s suite of investment solutions extends globally to a wide range of clients, from financial advisors and individual investors to institutional investors including pension plans, corporate plans, sovereign wealth funds and endowments and foundations.

For further information, please visit AGF.com.

© 2020 AGF Management Limited. All rights reserved.

This post was first published at the AGF Perspectives Blog.