by Hussein Rashid, Vice President, ETF Strategist, Invesco Canada

The unprecedented global response to the coronavirus pandemic has caused a sudden and severe economic slowdown. But not all companies – even within a sector – should be affected to the same degree. And part of that differentiation may be attributable to corporate policies that are recognized in environmental, social and governance (ESG) traits.

I spoke with Mona Naqvi, Senior Director, Head of Environmental, Social, and Governance (ESG) Product Strategy for North America at S&P Dow Jones Indices (S&P DJI), about the impact that the pandemic may have on ESG investing – and how ESG scores may reveal the companies that may recover most quickly.

Hussein Rashid: With the recent market events and the coronavirus crisis, will ESG investing become more important?

Mona Naqvi: Momentum toward ESG investing has been steadily building over the past few years for a variety of reasons.1 Much of this relates to the better availability of corporate sustainability performance data, giving rise to new ESG integration approaches and tools like the S&P 500® ESG Index that need not imply a trade-off with returns. Moreover, research continues to suggest that sustainable companies are associated with strong stock market performance.2

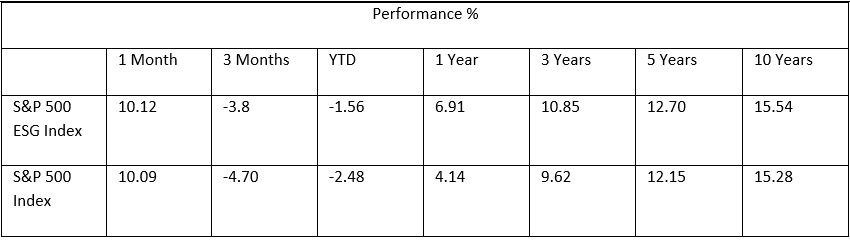

However, the myth of an “ESG versus performance trade-off” has still plagued the widespread adoption of ESG among mainstream investors in certain markets. Those misconceptions around performance, however, are being challenged by current market conditions where the S&P 500 ESG Index has outperformed its benchmark, the S&P 500 Index.

Another possibility is that the recent market volatility could be making prior investment allocations less profitable, thereby potentially freeing up assets for investors to reallocate elsewhere.

This “de-anchoring” of assets might well amount to additional flows into ESG investment approaches for those investors that were previously intrigued by ESG but were unable to fund such allocations due to consistent returns elsewhere. However, the returns of ESG investing are what will likely make it more compelling for investors – with its potential for resilient and sustainable long-term value creation – notwithstanding short-term market fluctuations.

HR: Are we seeing any ESG-related changes due to the crisis that may remain in place for the long-term?

MN: ESG is often regarded as a wide lens through which we can assess the behaviour of companies in ways that traditional financial analysis might fail to see. By incorporating financially material ESG signals into the investment process, the theory is that more holistic (and thereby accurate) valuations of investment securities are possible – though this of course depends on the time horizon.

Much of this is driven by financial materiality, where ESG issues matter to varying degrees depending on a company’s business model or industry. However, ESG also offers a pathway for investors to align their values with their investments. Fortunately, it just so happens that many of the issues that people care about, such as climate action, gender diversity, or resource efficiency, are also some of the material drivers of success in many industries. Indeed, any positive changes that shape either our values, company business models, or broader macroeconomic trends in the global economy will typically be captured by ESG.3

The current crisis appears to be reshaping all of these. For instance, there is public support for companies that protect both the job security and health and safety of their employees. Stay-at-home orders are also challenging the business-as-usual operations of many companies and forcing them, where possible, to adapt to remote working alternatives.

While low revenues and disruptions in supply chains may have revealed which companies are more resilient and equipped to withstand these current market disruptions, perhaps due to better contingency planning and supply chain risk management – precisely the types of issues assessed through ESG.

Throughout this crisis, it has been humbling to see how many companies have in fact increased their commitment to sustainability, with record levels of interest in this year’s SAM Corporate Sustainability Assessment (CSA) – the proprietary research process that underpins our S&P DJI ESG Scores*. The CSA, which offers unparalleled insight into sustainability issues of growing importance to companies, often long before they publicly disclose them, will no doubt shed additional light on the unique and unprecedented challenges they are facing this year (and beyond) in light of COVID-19.

Needless to say, this crisis might engender some perennial changes. But it remains to be seen which of these changes will remain when things go back to “normal,” whatever that might be. However, ESG – when defined simply as a tool for more expansive investment decision-making – has proven itself to be a useful framework for navigating these types of unprecedented changes. If anything, I would think a likely outcome could be that ESG investing itself becomes more of the “norm,” as investors look to additional data points to make sense of an ever-shifting macroeconomic landscape with more uncertainty than ever before.

HR: As travel has been curtailed, society has coincidently become more sustainable. Are there any immediate opportunities in the ESG space as we are faced with the new normal coming out of this crisis? Such as innovation?

MN: Indeed, the restrictions on movement have produced better air quality and a sizeable reduction in global greenhouse emissions. For instance, earlier this year, Chinese emissions dropped by about 25% over a four-week period.4 This is a quarter of the required annual decrease in global emissions to achieve net-zero emissions by 2050 – key to maintaining a livable planet, according to the IPCC.5 However, we must not let temporary improvements like this breed complacency, for the task before us is enormous if we are to successfully transition to a low-carbon economy.

Nevertheless, it is clear this crisis, like any other, will create both winners and losers. For instance, technology, which was already an important feature in our lives, is more essential now than ever before. Meanwhile, brick and mortar businesses are inevitably suffering.

But ESG integration – again, when defined as a tool for expansive investment decision-making – is not necessarily about picking the “right sectors,” especially when it comes to passive investing with broad, diversified exposure. It is about using the data and tools at our disposal to dig deeper into the companies we are investing in, than is possible with traditional regulatory disclosures.

As we live more of our lives online, for instance, ESG can help uncover whether technology companies are stepping up in terms of security, data privacy, and responsible stewardship to fulfil the expanded role they are occupying in society. The opportunity, then, is for companies like this to distinguish themselves as sustainability champions with respect to how they facilitate communication and responsibly handle our interpersonal interactions. More broadly, the opportunities for all types of businesses will ultimately stem from their ability to adapt to this new normal – while continuing to satisfy and demonstrate leadership on long-term, sustainable value creation in a manner consistent with our values.

HR: How is the S&P 500 ESG Index performing against other indexes? Are ESG approaches outperforming regular strategies? Why do you think this is the case?

MN: The S&P 500 ESG Index has outperformed the benchmark S&P 500® over the past year, as well as over the course of the past few months when we have witnessed high volatility. While this is certainly an interesting and welcome result, it is important to note that the objective of this particular index is not to outperform the benchmark. Instead, the S&P 500 ESG Index is designed to offer a sustainable alternative to the iconic S&P 500 Index with similar levels of risk and return, while at the same time achieving a meaningful boost in ESG score performance with measurable, positive impacts.

Notwithstanding the recent market turmoil, the S&P 500 ESG Index has indeed delivered on this objective, and then some. Over the past year, the S&P 500 ESG Index has provided low tracking error relative to the S&P 500 and similar risk, but also a better return.6

To recap our ESG index methodology: it is designed to retain as many companies from the benchmark index as possible, after removing the worst ESG performers and re-weighting those that remain by market capitalization. Companies are excluded if they have a low ESG score relative to their global industry peers, are involved in controversial weapons or tobacco7, do not adhere to global social norms as per the U.N. Global Compact, or are involved in severe controversies in ways that are material to their overall ESG performance.

Once these exclusions have been applied, the methodology targets 75% of the market cap within each industry group in the S&P 500 index, selecting the best ESG performing companies ranked by S&P DJI ESG Scores. Because the index is market-cap weighted, the methodology essentially sifts through the largest companies for the ESG index to perform in line with its objective.

Some companies that were significant drivers of the S&P 500’s performance over the past 12 months, such as Apple and Microsoft, passed through the screens and remained in the S&P 500 ESG Index. Other major companies with less than stellar performance, such as Boeing, did not. Without further research, one cannot necessarily attribute this outperformance to the ESG characteristics of these companies per se, as there are of course many other contributing factors. However, it is interesting to note that a rules-based approach, driven by ESG principles, increased the index exposure to several successful names that have driven the outperformance.

HR: Alternatively, has the pandemic response made ESG considerations irrelevant, with the economic shutdown affecting everyone pretty much the same, regardless of ESG score?

MN: As with any type of major economic shock – be it a natural disaster, financial downturn, or global health pandemic forcing nationwide lockdowns – the risks might be the same for all businesses, but the impacts almost certainly are not. This is essentially the difference between exposure and sensitivity.

Consider the example of two food and beverage manufacturers, both considered essential businesses, but still facing challenges throughout their supply chains due to restrictions on movement, a sick work force, and less demand from consumers. On the face of it, these two companies would seem to face similarly dire situations, especially through the lens of simple cash flow analysis often used to value companies in traditional investment decision-making.

However, let’s say one of these companies was operating at extremely wide margins (and thus looked more profitable according to its balance sheet), but had minimal health and safety policies, inadequate risk management in place, and poor medical benefits for its staff. Meanwhile, the other company had invested heavily in employee wellness and risk management efforts, including scenario modelling and contingency planning for event risks, for example, like those associated with the impacts of climate change. Standard financial analysis might well produce a higher valuation for the first company, but ESG analysis would help shed light on these “extra-financial” albeit financially material considerations in light of current market conditions.

In this hypothetical example, my guess would be that the second, better ESG-performing company would probably fare better by the time this crisis plays out – by retaining most of its workforce, adapting its business to deal with any problems in its supply chain, and effectively managing limited cash flow with smaller operating margins until business returns to normal. Undoubtedly, the first firm would try to do the same, but without having invested in the research and planning to do so effectively, it might not be as successful. As this example demonstrates, the ESG approach is probably more relevant now than ever before.

Source: S&P Global as of April 30, 2020. For illustrative purposes only. The S&P 500 ESG Index (USD) launched on January 28, 2019. All information for an index prior to its launch date is hypothetical back-tested, not actual performance. The back-test calculations are based on the methodology in effect on the index launch date. Back-tested performance is subject to inherent limitations because it reflects application of an index methodology and selection of index constituents in hindsight. No theoretical approach can take into account all of the factors in the markets in general and the impact of decisions that might have been made during the actual operation of an index. Actual returns may differ from, and be lower than, back-tested returns. Past performance is no guarantee of future results. You cannot directly invest in an index.

This post was first published at the official blog of Invesco Canada.