by Chris Nikolich, Head, Glide Path Strategies, Multi-Asset Solutions, AllianceBernstein

The turmoil in the first quarter of 2020 reinforced the importance of rebalancing in target-date design. As we see it, a finely tuned, systematic approach can help keep emotions in check and risk under control—benefits that translate to many types of multi-asset solutions.

So far, 2020 has seemed like the definition of market volatility. The S&P 500 Index swung by more than 2.5% in 18 of March’s 22 trading days. The VIX (or CBOE Volatility Index), a gauge of expected volatility that’s based on S&P 500 option pricing, soared. The so-called “fear index,” which had been in the teens for some time, peaked above 80 in mid-March.

When markets are struggling to find solid footing, portfolio allocations can swing wildly, too, and asset allocations left unattended can drift far out of balance. Portfolios that rebalance based only on the calendar can be left behind in fast-changing markets, and not every rebalancing approach gets the formula right.

For plan sponsors, the first-quarter dislocations were a reminder that rebalancing can be a make-or-break element in target-date design. A long bull market may have masked rebalancing shortcomings, so we think this is a good time to take a fresh look at how target-date funds keep their allocations in line.

Reinforcing Timeless Investing Principles

Rebalancing is an emotional challenge. Humans are hardwired to put more money into investments that are doing well and take money from those that aren’t. It can be hard to make—and justify—reallocation decisions that run counter to emotional current when considering the right time to rebalance.

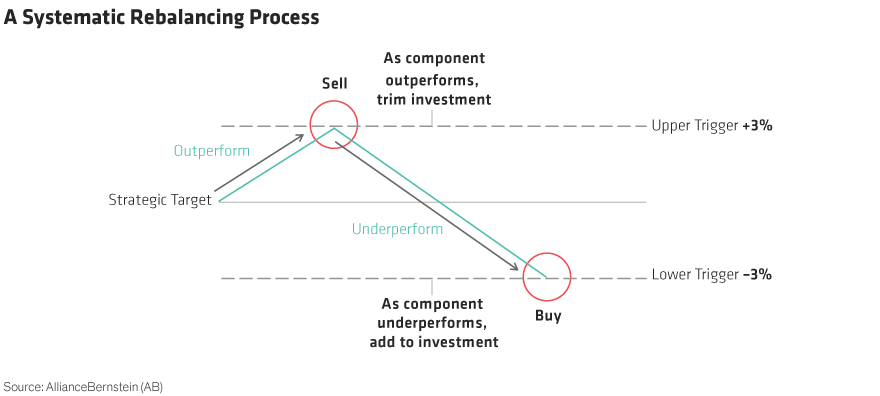

Systematic rebalancing can change the narrative—a strong framework using trigger points to signal the need to realign exposures. When an outperforming asset’s exposure reaches an upper trigger point, it drives a sell decision. When an underperforming asset’s exposure reaches a lower trigger point, it drives a buy decision (Display). In this way, systematic rebalancing enforces the timeless principle of buying low and selling high.

Road Test: 2020 Turmoil with—and Without—Rebalancing

The wild ride of markets in 2020 provided a good road test for systematic rebalancing. Let’s look at a hypothetical portfolio of 60% stocks and 40% bonds, funded with $1,000 in December 2018.

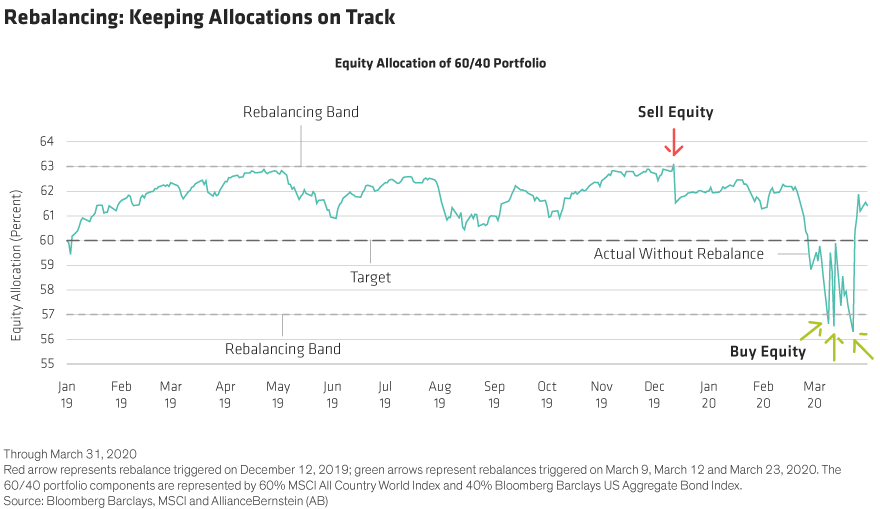

If the portfolio wasn’t rebalanced, the 2019 global equity rally would have driven its equity allocation up to almost 64% by the end of the year—but not for long. The painful bear market in February–March would have slashed that equity exposure to 54%. So, the un-rebalanced portfolio would have been overexposed to equity at the top of the market and underexposed at the bottom.

Systematic rebalancing would have moderated those exposures (Display). Using a 3% rebalancing trigger point would have reduced equity exposure once it reached 63%, providing some cushion against the sell-off. At the market’s depths, the portfolio would have bought cheaper stocks as the allocation fell below 57%—on March 9, March 12 and March 23. These adjustments would have enabled more participation in the rebound. By March 31, rebalancing would have added nearly half a percent (42 basis points), net of transaction cost, to that original $1,000 investment.

Dimensioning the Rebalancing Framework

Systematic rebalancing has shown the ability to remove human emotion—and the calendar—from the rebalancing formula, but what determines the numbers in the equation: When to rebalance a target-date portfolio and by how much?

The most notable inputs are risk tolerance, volatility, asset-class correlations and transaction costs—and those elements aren’t static. Transaction costs, for example, have been a topic of much discussion in the recent sell-off, given the illiquidity that gripped markets and drove up trading costs. If nothing else changed, higher transaction costs would lead to wider rebalancing triggers—because rebalancing would be costlier.

Of course, the idea of one input changing at a time is unrealistic. Volatility, for example, also changed, driving greater allocation swings. Even though volatility has fallen from its peaks, it’s still more than twice its normal levels. Higher volatility on its own would argue for narrower trigger points than in a normal environment, but changing inputs tend to offset each other, and the rebalancing trigger-point framework still holds.

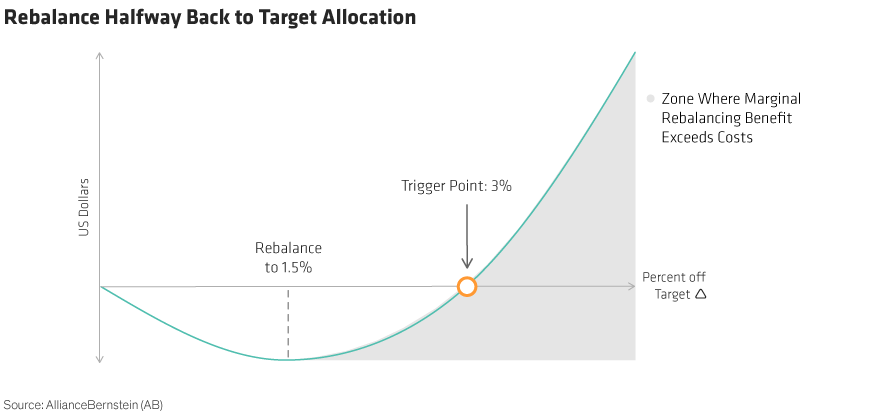

Transaction costs also factor into the decision of how far target-date allocations should be returned toward their strategic targets when rebalancing. Based on our research, the answer isn’t “all the way back.” The optimal approach is actually to rebalance halfway back to target (Display).

The benefit of rebalancing—in terms of reducing a portfolio’s tracking error—rises geometrically. On the other hand, the transaction costs rise in a straight line—it costs twice as much to rebalance back to target from a 2% deviation than it costs to rebalance back from a 1% deviation. The net result: the benefits of rebalancing allocations all the way back to strategic targets aren’t justified by the cost. Halfway is best.

Systematic Rebalancing: Not Just for Target-Date Solutions

Rebalancing is a critical component of target-date design, keeping glide paths in close proximity to their strategic allocations over time. Given the long time horizon of target-date investors, systematic rebalancing can help keep target-date allocations on track over time, reinforcing time-tested investing principles.

But systematic rebalancing doesn’t have to be limited to target-date solutions. We think it makes sense for all types of multi-asset strategies used by defined contribution plans, defined-benefit plans, endowments, foundations, insurance accounts and individuals.

There are many ways to manage risk, including tactical asset allocation and adjusting strategic allocations. But for long-term investors who don’t use these tools, systematic rebalancing offers an appealing way to manage multi-asset risk—maintaining the strategic asset allocation, preventing timing risks, systematically taking advantage of market dislocations to add value and removing emotion from the equation.

Chris Nikolich is Head of Glide Path Strategies (US) for Multi-Asset Solutions at AB.

Elena Wang is Research Analyst—Multi-Asset Solutions at AB.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

"Target date" in a fund's name refers to the approximate year when a plan participant expects to retire and begin withdrawing from his or her account. Target-date funds gradually adjust their asset allocation, lowering risk as a participant nears retirement. Investments in target-date funds are not guaranteed against loss of principal at any time, and account values can be more or less than the original amount invested—including at the time of the fund's target date. Also, investing in target-date funds does not guarantee sufficient income in retirement.

This post was first published at the official blog of AllianceBernstein..