by Liz Ann Sonders, Jeffrey Kleintop, Kathy Jones, Charles Schwab and Company

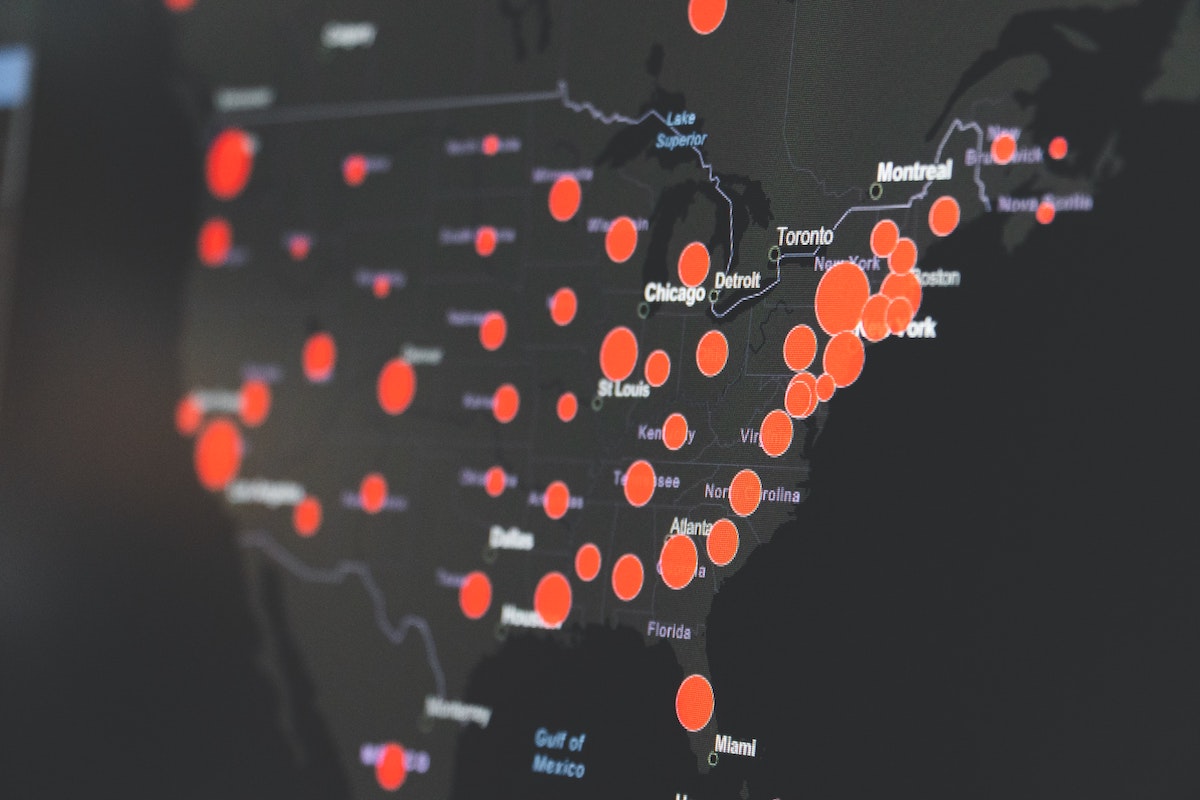

The COVID-19 pandemic has severely affected the U.S. economy, with containment efforts leading to widespread business closings and surging unemployment—and stock market volatility. The key questions now are when can the economy reopen, and what happens when it does?

Shutdowns have rocked U.S. stocks and economy

Large sections of the U.S. economy remain shut down in an effort to slow the spread of COVID-19, and the ripple effects are increasingly being felt. Nearly 22 million Americans filed for unemployment benefits during the three weeks ending April 11th. Because of reporting lag times, the monthly U.S. employment report hasn’t yet fully reflected the severity of the situation.

Initial unemployment claims have shattered records

Source: Charles Schwab, Bloomberg, as of 4/16/2020.

Meanwhile, corporate earnings estimates are more of a guess than anything. Analysts were relatively optimistic at the start of the year, but have since sharply dialed back expectations, with more estimate reductions likely. Many companies have withdrawn guidance, making valuation analysis exceptionally difficult.

Earnings optimism has faded considerably

Source: Charles Schwab, I/B/E/S data from Refinitiv, as of 4/16/2020.

While many economists agree that we are in a recession, there is disagreement about how deep and long the contraction will be—forecasts for second-quarter real gross domestic product (GDP) growth range from -9% to -50% (on a quarter-over-quarter annualized basis). Economic growth in the second quarter is expected to fall sharply, resulting in the largest contraction in real GDP in the post-WWII era.

Economic growth is expected to contract sharply this year

Source: Charles Schwab, Bianco Research LLC, Bloomberg, as of 4/14/2020.

The prospective shape of the post-virus recovery—whether it looks like a V, U, W or any other letter—has been a topic of debate among economists and investors. We think the most apt letter may be a Y, given that parts of the economy were already weak before the crisis, including manufacturing and business investment. As businesses start to reopen, the initial resumption in activity may cause a short-term surge in growth, but it might be difficult to sustain over the long term (hence the Y shape).

Regardless of the shape of any potential recovery, the shape of the virus curve is the most important. A flattening in the number of new cases and deaths is the key to determining when the economy can reopen. Longer term, developing an effective vaccine and/or treatment is paramount.

Europe has launched massive stimulus

Including loan guarantees, Germany’s stimulus totals more than 20% of its GDP, while the totals in Spain, France and the U.K. exceed 15% of their respective GDPs. This is roughly five times the support provided in the wake of the global financial crisis of 2008-09, and compares favorably to the cumulative stimulus announced to date in Japan and the United States. Additionally, the European Stability Mechanism for the first time will issue “coronabonds” and distribute the proceeds proportionally to economies based on their size.

Europe’s fiscal spending relative to GDP is high

Source: Charles Schwab, as of 4/10/2020. Amounts include loan guarantees outside of the United States. Additional 4% of GDP eurozone fiscal spending not added to eurozone country totals.

When comparing the numbers, it is important to remember that Europe already spends more on its social safety net than the United States and many other countries, which may buffer the impact during recessions. For example, in 2008-09’s global recession, eurozone unemployment rose by about 3%, compared with nearly 6% in the United States. Currently, just over 13% of the U.S. labor force has filed for unemployment benefits during the final two weeks of March and first two weeks of April (as per the Bureau of Labor Statistics). Unemployment filings in Spain and Ireland—the countries for which we have data so far—totaled just 1% of the labor force for the entire month of March. The differences in support for workers means the amount of one-time stimulus is not the best measure of the economic support in place.

The Federal Reserve has come to the rescue

It would be hard to overstate the magnitude of what the Federal Reserve has done to address the impact of the coronavirus on the fixed income markets. In a span of about six weeks, it has lowered the federal funds rate to a range of 0.0-0.25%, increased its bond holdings by more than $1.6 trillion, eased bank regulations to encourage more lending, opened up lending of U.S. dollars to foreign central banks, and set up facilities to increase the flow of credit to households and businesses.

In response, fixed income markets have staged a major turnaround in the past few weeks. Treasury yields have risen from the lows set during March, when panic buying by investors seeking a safe haven sent yields to all-time lows, while yields for riskier bonds have fallen from their peak levels. While risks still remain, we are becoming more optimistic that the worst of the fixed income market decline may be behind us.

The Fed has increased its bond holdings, injecting liquidity into financial markets

Source: All Federal Reserve Banks: Total Assets, Trillions of Dollars, seasonally adjusted. Weekly data as of 4/8/2020.

The most notable moves by the Fed have been those that support areas of the fixed income markets it has not moved into historically, such as high-yield and municipal bonds. These moves have significantly reduced the yield spread between those bonds and Treasuries.

High-yield credit spreads are down from the March peak

Source: Bloomberg, using daily data as of 4/9/2020. Option-adjusted spreads (OAS) are quoted as a fixed spread, or differential, over U.S. Treasury issues. OAS is a method used in calculating the relative value of a fixed income security containing an embedded option, such as a borrower's option to prepay a loan.

However, the Fed’s various programs are not an all-clear signal for investors to flood into the riskier segments of the fixed income market. There are limits as to how far the Fed is willing and able to go, especially in the corporate bond market. It has the ability to buy bonds of companies that were downgraded from investment-grade to high-yield, but that is a limited universe. Not all boats will be lifted by the Fed’s injection of liquidity.

What to do now

Market volatility underscores the importance of having a portfolio that contains a variety of asset classes, including stocks and bonds, balanced in a way that reflects your risk tolerance and investment timeline. It’s also a good idea to rebalance your portfolio periodically to bring it back to your original asset allocation targets (Schwab clients can log in to their accounts and use the Schwab Portfolio Checkup tool to help with this).

Fixed income investors who are focused on yield may find opportunities in higher-rated corporate bonds (those rated A or better) and municipal bonds (those rated AA or better). Yields for those investments relative to Treasuries of comparable maturity are more attractive now than prior to the crisis. However, investors should be prepared for a potentially bumpy ride—with the economic outlook so uncertain, volatility is likely to bounce up from time to time.

Copyright © Charles Schwab and Company