by Dan Roarty, CIO, Thematic and Sustainable Equities, AllianceBernstein

The global response to the coronavirus crisis has reinforced the importance of sustainable investing. With the private sector playing a key role in efforts to stop the virus and accommodate evolving consumer trends, investors should look for companies with strong environmental, social and governance (ESG) credentials for the dramatic changes unfolding around the world.

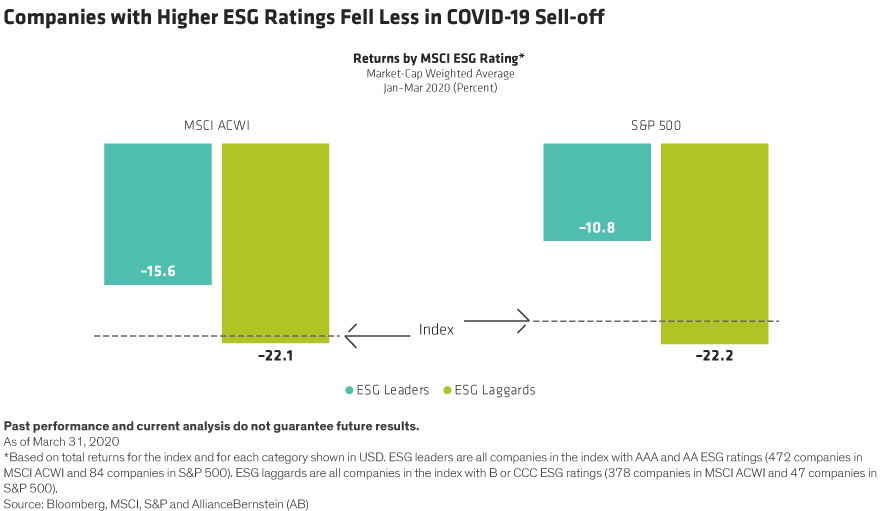

Sustainable stocks fell much less than the broader market during the historic market crash in the first quarter. But a sustainable investing agenda provides much more than downside protection. We believe that ESG-focused portfolios can deliver results in a wide range of market conditions and can provide several benefits to investors through the COVID-19 crisis and an eventual recovery.

ESG Focus Added Resilience in Sell-off

Companies with the strongest ESG practices relative to their peers are, by definition, higher quality companies. They are more profitable, have less volatile earnings and, according to research from MSCI, are better at mitigating serious business risk that can lead to large financial losses and bankruptcies. As a result, they tend to provide enhanced downside protection in times of market stress.

These attributes were in high demand during the recent sell-off. During the first quarter, companies with the highest ESG ratings (AAA and AA) in the MSCI ACWI Index fell by 15.6% on average, about 650 basis points less than those with the lowest ESG ratings (B and CCC) (Display). The spread was even wider for US equities, where ESG leaders declined by 10.8% in a market that tumbled by 19.6%. As a result, funds that focus on such ESG leaders fared well during the quarter. Morningstar reports that 70% of sustainable equity funds ranked in the top halves of their respective categories and 44% ranked in their category’s best quartile in the first quarter.

COVID-19 Tests Stakeholder Capitalism

ESG leadership is being redefined by the coronavirus crisis. As the social and economic impact of the pandemic escalates, we’re now witnessing the first major test of the era of stakeholder capitalism.

Last summer, 181 American CEOs cosigned a declaration stating that their businesses would include consideration for all stakeholders, not just shareholders. In a statement released by Business Roundtable, corporate leaders from Amazon to Xerox affirmed their commitment to support the environmental and social health of the communities in which they operate and to embrace sustainable practices across their businesses. Today, actions that might have been dismissed as merely philanthropy or public relations in the past are being viewed through a very different lens.

Home Depot, for example, recently froze prices on goods deemed to be in high demand during the current health crisis. The company also extended extra paid leave to employees over 65, who are most at risk of getting sick from a coronavirus infection. Alibaba Group has temporarily waived charging commissions from its merchant sellers. PayPal established an emergency relief fund for employees with short-term cash needs. Microsoft is giving its collaboration software to nonprofit organizations for six months for free.

Investors are embracing these types of corporate actions. Even though these moves may not directly benefit short-term earnings, investors increasingly understand that companies that follow an ESG compass will strengthen their competitive positioning by lowering regulatory risk, deepening customer loyalty and bolstering employee engagement.

Wake-Up Call for Global Sustainability

Challenges created by the coronavirus crisis are a wake-up call for global sustainability. Just like governments cannot conquer the virus without the private sector, the world’s largest environmental and social challenges cannot be solved by public policy alone. Governments can create accommodative policy and legal backdrops, but ultimately require the innovative and financial capacity of the private sector to drive meaningful change. And companies with the best solutions can tap into substantial long-term growth opportunities.

But it’s not always easy for investors to identify companies that can benefit from these sustainable trends. In our view, the UN Sustainable Development Goals (SDGs) are a good investment guide to sustainable companies because they point the way to long-term structural changes that will drive growth. Accomplishing the UN’s ambitious agenda will require more than $90 trillion in capital over a 15-year period, with the bulk of that being supplied by the private sector.

Identifying Long-Term Growth Themes

Investment themes derived from the SDGs offered a wide range of investing opportunities even before the world was hit by the coronavirus. Now, the crisis is both changing behaviors and creating new opportunities, as well as accelerating some trends that were already in place.

Information and communication technologies were already vital to the SDG agenda as a means of sharing knowledge, connecting communities and providing economic empowerment. In today’s world of social distancing, digital communication technologies that support the “virtualization of everything” are gaining massive momentum. Companies that provide the hardware and software enabling us to work, shop, learn, exercise and receive healthcare digitally are clearly enjoying a boost in short-term demand. For example, Zoom’s daily users ballooned to more than 200 million in March from just 10 million in December. We think it’s likely this momentum is sustainable beyond the current period.

Financial technology and payments companies help enable growth for small- and medium-sized enterprises (SMEs), another key objective of the SDGs. Although these businesses account for a substantial share of employment and economic growth, they are often underserved by traditional financial institutions. Fintech solutions expand the reach of smaller firms, increase their profitability and give them better access to capital on favorable terms. The current crisis highlights the vital importance of SMEs and the companies that support them.

Health in the Spotlight

Coping with a pandemic has obviously pushed health-related themes into the spotlight. Promoting health and well-being is a fundamental objective of the SDGs, and global needs are vast, especially in less developed countries and poorer communities. But the recent crisis has exposed the frailty of global health systems, even in wealthier countries.

The ultimate solution to this crisis will be the development of a vaccine, which will most likely be provided by an innovative private sector company. But other solutions will be important as well. Telemedicine, drug discovery and diagnostic testing stimulate innovation, lower the cost of healthcare service delivery and extend its reach, helping strengthen the resilience of global societies.

Sticking with Sustainable Stocks

Sustainable companies have long-term staying power, in our view. They have clearly proven their resilience in weaker markets. And even if a recovery might at least temporarily favor deeper-value stocks that underperformed the most in the sell-off, we believe the longer-term prospects for sustainable stocks are very promising. The crisis is adding new catalysts for companies that can provide innovative solutions to our largest environmental and social challenges, in our view. With a renewed focus on the SDGs as the world emerges from the coronavirus shock, investors can identify companies that help improve the resilience and long-term health of society and equity portfolios.

Dan Roarty is Chief Investment Officer—Thematic and Sustainable Equities at AB.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein.

This post was first published at the official blog of AllianceBernstein..