by Alessio De Longis, Senior Portfolio Manager, Invesco Investment Solutions, Invesco Canada

The COVID-19 global outbreak that started in early January represents an exogenous shock to the global growth cycle, at a time when the world economy was on the cusp of a new synchronized cyclical recovery. Driven by this shock, our macro framework moved into a global contraction regime in February (i.e., global growth expected to be below trend and decelerate).

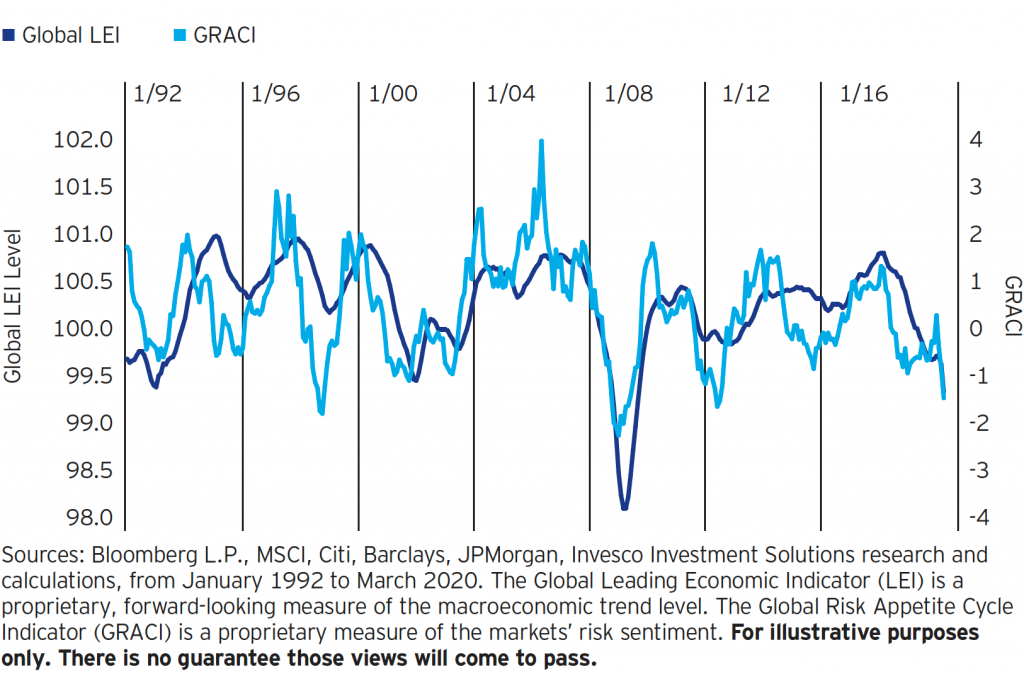

This regime remains in place today and is broad-based across regions (Exhibit 1). Furthermore, given the increased severity of the lockdown and quarantine measures undertaken by governments around the world, it is highly likely that most, if not all, countries and regions will experience a significant recession in the first half of 2020. Therefore, we expect the economic data to deteriorate meaningfully over the next few months.

At this stage it is difficult to determine how long this macro environment will persist. Historically, contraction regimes in our framework have lasted on average six months with wide dispersions, ranging between two and 15 months across all episodes since the 1970s. We will continue to follow the data and the framework as it runs its course, but it is nonetheless valuable to compare the current downturn to recent episodes of financial turmoil, despite meaningful differences in the source of the shock and market imbalances.

Figure 1: All regions are in a contraction regime, and are likely to deteriorate further

One thing, in particular, stands out in today’s downturn. Policymakers have learned valuable lessons from the global financial crisis of 2008 (GFC) and the European debt crisis (EDC), and they have reacted promptly to the challenge in just a couple of weeks, compared to the multi-month process during the GFC and EDC.

This time the fiscal and monetary policy response around the world has been meaningful in size and scope, and in some instances extraordinary. In many cases the fiscal response is even larger than in the GFC, with the U.S. fiscal package equaling about 9.2% of GDP (nearly double the size of the GFC response), and Europe’s response equaling 2.6% of GDP (compared to 2.3% of GDP in the GFC) with additional transient and contingent debt guarantee schemes that could amount to between 10%-25% of GDP across individual European countries, if utilized.1 Finally, given the typical gradual approach to stimulus removal, the fiscal impulse will likely be substantial for years to come.

Similarly, major central banks have promptly enacted measures to ease financial conditions and ensure liquidity in the financial system, resulting in interest rate cuts and open-ended quantitative easting. U.S. The Federal Reserve (Fed) has gone even further, becoming the effective lender of last resort and providing financial support to corporates both in the primary and the secondary markets. 2 Despite the enormous uncertainty and challenge of the current situation, it is reasonable to assume these steps should help stabilize markets, partially mitigate the economic damage of the enforced quarantines, and support the speed of the subsequent recovery.

While it is difficult to anticipate the timing of the cyclical trough, we expect such a turnaround to first occur in market-implied growth expectations, as asset prices should discount the positive impulse from fiscal and monetary policy ahead of the economic data (Figure 2). As in most recessions, we expect credit markets to lead the way, signaling a stabilization in the cost of capital and an inflection point for risky assets, ahead of earnings or earnings expectations.

Figure 2: Market-implied growth expectations not signaling a bottom in the cycle yet

Portfolio positioning

From a strategic asset allocation standpoint, for investors with a multi-year time horizon (longer than 5 years), we believe the current global sell-off represents a unique opportunity to rebalance exposures from risk assets (i.e. equities, credit) to strategic targets at much cheaper valuations.

From a tactical asset allocation standpoint (with a somewhat less than 2-year horizon), we believe it is appropriate to take a more selective approach to risk assets and remain somewhat defensive. Our global 60/40 portfolio total risk is marginally below the benchmark’s risk.3 Relative to the benchmark, we remain moderately underweight equities, primarily in emerging markets, and overweight government fixed income, with a bias towards a steeper yield curve. Within equities, we favor defensive factor exposures with tilts towards low volatility, quality and momentum, while we reduced exposure to (small) size and value. However, over the past two weeks we have moved to an overweight exposure in credit via U.S. investment grade and emerging markets sovereign debt, as a first step towards harvesting attractive risk premia.

This post was first published at the official blog of Invesco Canada.