by Jeffrey Kleintop, Senior Vice President and Chief Global Investment Strategist, Charles Schwab & Co., Inc.

Key Points

- This recession is the result of a shock, not the natural end result of a slow build-up of excesses. This may mean the recession and bear market could be deeper, but also that the duration may be shorter.

- Early signs in Asia of a V-shaped rebound are encouraging, but may instead look more like a square root, flattening out as weaker global growth saps Asian economic momentum in the second quarter.

- Emerging markets, led by China and South Korea, are leading the recovery in the economy and markets as they did during the global recessions of 2000-02 and 2008-09.

In a typical recession, the global economy tends to have large imbalances that take a long time to unwind, such as a housing bubble or overinvestment by businesses. This time the global economy is experiencing a shock, rather than the natural end result of a slow build-up of excesses. While this implies that the recession and bear market could be deeper, but the duration may be shorter. We have yet to see how deep this recession is going to go, and although it is unlikely to end until people feel comfortable leaving their homes again, it isn’t too early to consider what the eventual recovery may look like and what areas may lead it.

Already recovering

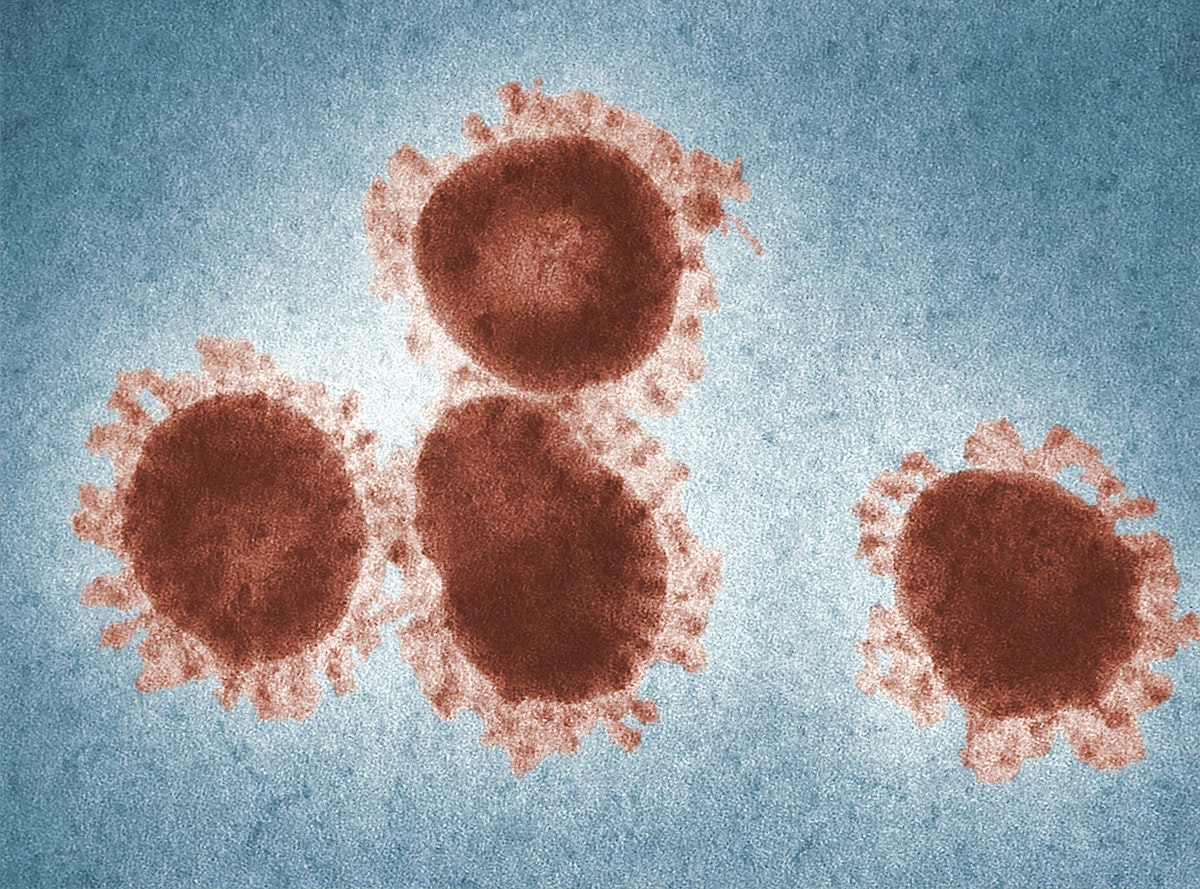

Parts of the world are already in recovery. China and South Korea are recovering from their peak in COVID-19 cases and related business shutdowns, as you can see in the chart below. Even the Chinese city of Wuhan, the epicenter of the epidemic, will reopen in about a week (April 8). Together, these two countries account for about 20% of the world’s population and economy.

Recovering: China and South Korea

Source: Charles Schwab, World Health Organization data as of 3/29/2020.

With the threat of the virus receding, economic activity is reviving in Asia. Economic indicators we can measure daily—or even hourly—like road traffic, air pollution, and port activity all point to a pick up. Early official monthly data reports for March seem to support these signs of recovery. For example, last week’s data on South Korean exports measuring the first 20 days of March showed a monthly rebound of over 50% in goods sent to China.

As the shutdowns migrated from Asia to Europe then the U.S., we can see the impact in the economic data. As time progresses, and more data is reported economic activity in Europe and the U.S. is expected to deteriorate while Asia begins to rebound. The pattern is already unfolding in the March purchasing managers’ index (PMI) reports. March’s preliminary readings for the PMIs in Europe and the U.S. plunged to recession levels, following the pattern in China’s PMI for the month of February. Economists’ are expecting China’s PMI to recoup much of that February decline when the PMI is reported on March 31 and April 1, there is no preliminary reading for China’s PMI.

Top 3 economies going in different directions in March

Top 3 economies going in different directions in March

Source: Charles Schwab, Bloomberg data as of 3/27/20.

“Square-root” recovery

The COVID-19 outbreak peaked in China in early February, accompanied by a big hit to GDP for the first quarter of 2020. With the outbreaks in Europe and the U.S. accelerating as we move into the second quarter, the change in GDP for the second quarter is likely to be deeply negative in both Europe and the U.S., even as Asia sees some improvement from the first quarter. However, any second quarter recovery in Asia will be limited by the spread of recession to the rest of the world.

The shape of the recovery in the global economy may depend upon how long it takes until people feel comfortable leaving their homes again, which is not expected until we see a drop in new COVID-19 cases in the western hemisphere. The longer it takes, and the more jobs and businesses are lost, the more difficult the recovery. Early signs in Asia are of a V-shaped rebound—but that could instead end up looking like a square root, with the “V” shape flattening out as weaker growth elsewhere saps Asian economic momentum in the second quarter. That may delay the potential for a broader recovery into the second half of the year.

Emerging market leadership

With China and South Korea leading the economic recovery, it’s not too surprising that emerging market stocks, are outperforming developed stock markets since early February, when the peak in new COVID-19 cases in China occurred. It is not uncommon for emerging market stocks to lead the rebounds from bear markets. They did during both the global recessions of 2000–02 and 2008–09.

During the global recession of 2000-02, emerging market stocks bottomed in September 2001, well before U.S. and other developed markets, which bottomed over a year later, as you can see in the chart below of the period surrounding the 2000-02 recession and bear market.

Source: Charles Schwab, Bloomberg data as of 3/27/20. Past performance is no guarantee of future results.

Similarly, during the 2008-09 global recession, emerging market stocks bottomed in October 2008, well before U.S. and other developed markets, which bottomed in March 2009, as you can see in the chart below of the period surrounding the 2008-09 recession and bear market.

Source: Charles Schwab, Bloomberg data as of 3/27/20. Past performance is no guarantee of future results.

Will EM stocks, led by China, again lead the world equity rebound from the current bear market and recession? It’s possible, but there are some headwinds for EM stocks to overcome. They will have to find a way to get past the drag from commodity prices, affected by weak demand, the increase in the supply of oil from OPEC, and a strengthening U.S. dollar.

Commodity-driven companies make up only about 10% of the emerging market equity market cap. The effect on the currencies of commodity producers like Mexico, Brazil and Russia has been dramatic, with currencies falling about 25% this year, peak to trough, although they’ve started to rebound as the Fed’s actions took some pressure off the dollar late last week. Even if the outlook for demand improves when travel begins to revive, the oversupply issues for oil may linger and act as a headwind.