by Hubert Marleau, Chief Investment Strategist, Palos Management

In self-isolation I wrote this piece in the middle of nowhere, pondering what is needed to make the current investment environment a generational buying opportunity. As I said last week, I have no idea whether things are going to get better biologically and economically---but I know that the markets will know before any of us. What we know is that the proposed fiscal and monetary stimulus is large enough to take a $2.0 trillion hit—-that is 10% of the N-GDP. It’s an all out war. During the Second World War, the U.S. ran budget deficits that accounted for 25% of N-GDP and there were no massive purchases of government debt by the Fed. We are lucky that we live in an era of abundance. Therefore, the measures taken are not going to cause a stagflation scenario.

The wisdom of the crowd is a potent force capable of predicting what’s coming with relatively good precision. It's imperative to monitor the level of confidence to get confirmation. Consumer sentiment fell in early March, not surprising given the disruption caused by COVID-19. Nevertheless, the preliminary reading for March from the University of Michigan showed that the consumer sentiment index remained strong at 95.9, down from 101.0 in February but higher than it was last July. Keep a watch on sentiment.

The bond and the forex markets will get a head start on timing. Shortly after, these two markets will transmit their assessment of conditions to the stock markets. And that is when stock prices will head north fast with a vengeance because 1) valuations are compelling, 2) Risk Parity funds and Value at Risk sensitive investors have certainly less assets to shed, 3) portfolio managers need to rebalance their weightings by selling bonds and buying equities to be in harmony with their investment mandates. JPMorgan has calculated that rebalancing flows into equities would come to close to $1.0 trillion. Keep a watch on money flows

While the potential for such an outcome is a strong possibility, one must be pretty sure that stabilization is evident before a real recovery will be seen. In this respect, the market needs to believe that we have already had a capitulation. It looks as if we have.

The Dash for Cash Caused a Capitulation

Interestingly, the sudden and huge drop in stock prices was not attributable to retail investors. According to Charles Schwab & Co. individuals were acting as market stabilizers trying to benefit from dips, while momentum traders, debt-ridden speculators and market participants in need of cash flow were taking advantage of brief rallies, selling indiscriminately anything including toilet paper and safe haven assets for cash. Cash became king again. The volatility index spiked to record levels touching 82.7 on Monday and the CNN Fear & Greed Index fell to 2 last Thursday.

Fear is often amplified by recency and confirmation biases that can anchor investors in the wrong direction. In his book, Your Money and Your Brain, Jason Zweig discusses how the fight or flight instinct is triggered when people lose or gain money too fast. Investors can easily be persuaded to speculate by piling into wild bull markets or to indiscriminately panic by exiting bear ones. The point is that generally people respond quickly to potential dangerous risks of losing and to possible opportunity of winning.

On Friday, the S&P 500 (2305) was down 31.9% from the peak (3386) registered on February 19, 2020. I get it that we are in a health crisis and that we have limited tools at this time to truly shield ourselves from the virus other than locking ourselves down. However, I have faith that we have sufficient scientific knowledge, and allocatable resources to find solutions which will in due time contain this life threatening pandemic. The stock market is not buying my optimistic thesis at this time and that is why stock prices have fallen like chickens with their head cut-off.

The Coronavirus Curve Needs To Flattened

Since investors' main focus remains on slowing the spread of the coronavirus, I closely watch on a daily basis the logarithmic curve of people infected with COVID-19. I’m looking for a break. Johns Hopkins University (CSSE) has an excellent site that regularly updates how many people get infected with the virus. The website plots the number of cases in logarithmic form which can detect inflection points---if the spread of the virus is coming in decline. With the help of this website, one will be able to see if a deviation in the current upward trajectory is occurring and, in turn, know if containment measures are having a positive impact. So far, whilst the numbers in China and South Korea seem to be moving in the right direction, it is not the case in NorthAmerica and the rest of the world. In other words, the CSSE curve has not yet flattened.

Market Curves Also Need To Flatten Out:

The spreads between long and short bond duration needs to narrow. It is perhaps counterintuitive because positively riding yielding curves is usually associated with a positive economic outlook. However, in this current environment the bond market has little to do with conventional

economic logic. It is evident that the level of economic activity for March and April will be down by several percentage points. Lower bond prices were triggered by risk management systems flashing red across all markets creating forced selling by debt loaded people in need of money. The latter sold anything regardless of value.

A movement toward a flatter yield curve would reflect that the fire sale of safe havens assets for the purpose of hoarding cash has stopped. On February 19, when the stock market peaked, the differential between ten ten-year treasury yields and 3-months treasury bills was -5bps compared to +120bps just two days ago. Normally a spread of this magnitude would send a positive message. The yield curve flattened on Thursday and Friday as a result of fall in both nominal and real bond yields. It offered some relief and a ray of hope. At the close of markets on Friday, the yield on ten-year treasuries was 0.85%, down from 1.20% on Wednesday. I’m not bold enough to say that two days of favourable bond trading suggests a final turn; but it's encouraging nevertheless. The reason why I do not have the courage to say that the dash for cash is over is that the DXY kept on rising even though the Federal Reserve expanded and augmented its dollar swap lines with virtually all central banks. Consequently, the jury is still out on whether the Fed will be able to meet the global demand for U.S. dollars. On Friday, the DXY closed at 102.70, up a whopping 6.4% since the start of 2020. However, it did stabilize on Friday. A narrower yield curve and a weaker dollar is key because the combination would send a message that the panic selling is over. By the same token, it would create a perception that there are enough dollars around to meet household and business obligations.

Perhaps of lesser importance, is the difference between the spot price for oil and its 12-month future price. Commodity values are essentially a function of current demand and supply and have nothing to do with future cash flow discount models. Presently, the oil market is in a contango mode---meaning, in practice the futures have a tendency to fall in price over time to where the spot price is. Unless something big like an accord between Russia and Saudi Arabia or an Opec+Russia output cut and a reduction by U.S. producers, a backwardation curve is not in the cards. Here we can only hope for a decrease in the spread between future and spot price.

Conclusion

In a few months, the saying will be “I knew that exciting opportunities existed. It was in front of me, but I opted to wait a little longer because I wanted full-proof that I was not about to make a costly mistake.” The problem with confirmation bias is that it is an afterthought and associated with the want of being certain about something when everyone also else is. That is why timing right decisions is difficult. Yet, if one’s goal is to obtain superior market returns, one must be a contrarian. In this respect, I nibble at every drawdown—-slowly adding to my portfolio undervalued securities that offer either safe dividend rates or superior capital gain potential.

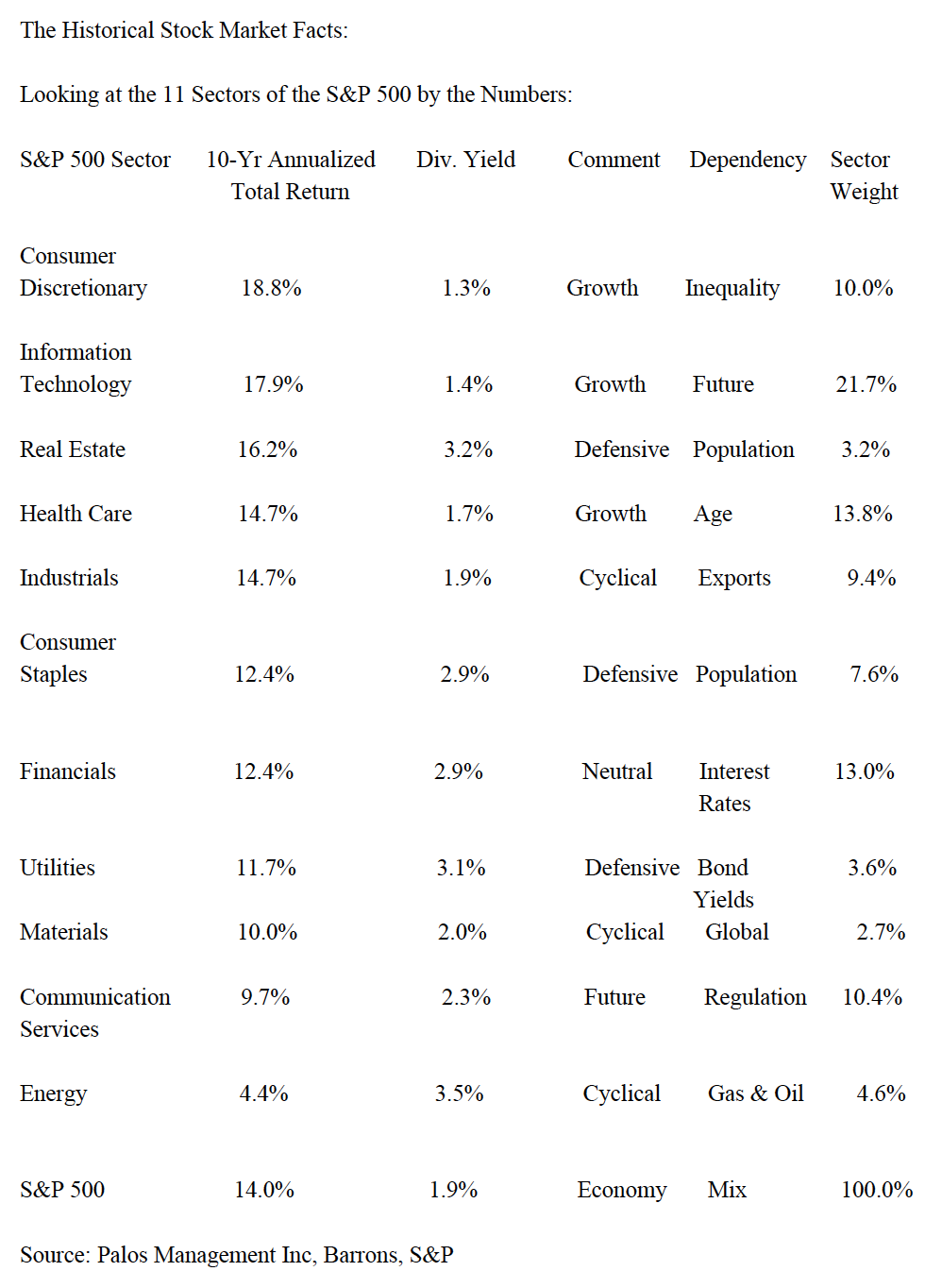

The Historical Stock Market Facts

Copyright © Palos Management