by Schwab Center for Financial Research

When a stock index falls by more than 10%, it is often said to have entered “correction” territory. That’s a fairly neutral term for what feels like a nerve-wracking drop to many investors. What does a correction mean? What’s likely to happen after a correction, and what can you do to help your portfolio weather the downturn? Here are answers to some commonly asked questions:

What is a correction?

There’s no universally accepted definition of a correction, but most people consider a correction to have occurred when a major stock index, such as the S&P 500® index or Dow Jones Industrial Average, declines by more than 10% (but less than 20%) from its most recent peak. It’s called a correction because historically the drop often “corrects” and returns prices to their longer-term trend.

Is it the start of a bear market?

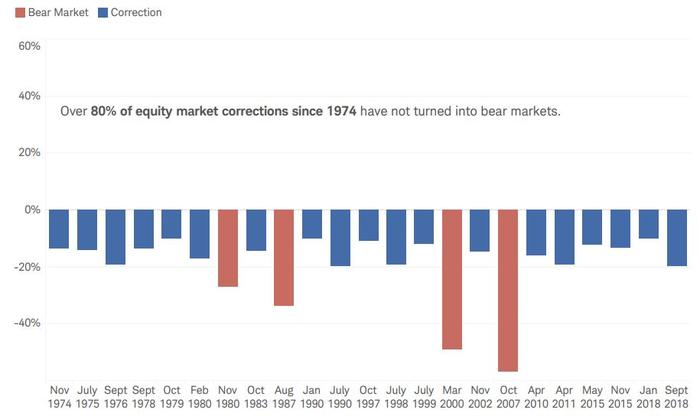

Nobody can predict with any degree of certainty whether a correction will reverse or turn into a bear market. However, historically most corrections haven’t become bear markets (that is, periods when the market falls by 20% or more). There have been 22 market corrections since November 1974, and only four of them became bear markets (which began in 1980, 1987, 2000 and 2007).

Since 1974, only four market corrections have become bear markets

Source: Schwab Center for Financial Research with data provided by Morningstar, Inc. Each period listed represents the beginning month/year of either a market correction or a bear market. The general definition of a market correction is a market decline that is more than 10%, but less than 20%. A bear market is usually defined as a decline of 20% or greater. The market is represented by the S&P 500 index. Past performance is no guarantee of future results.

But what if it really is the start of a bear market?

No bull market runs forever. While they can be scary, bear markets are a part of long-term investing and can be expected to occur periodically throughout every investor’s lifetime.

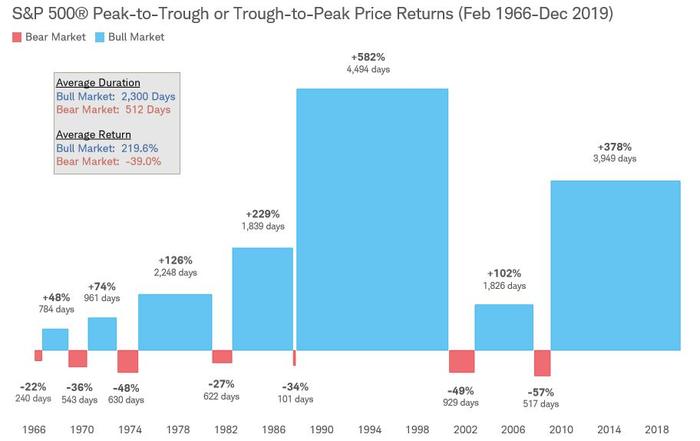

However, it’s important to keep them in perspective. Since 1966, the average bear market has lasted roughly 17 months, far shorter than the average bull market. And they often end as abruptly as they began, with a quick rebound that is very difficult to predict. That’s why long-term investors are usually better off staying the course and not pulling money out of the market.

Past bear markets have tended to be shorter than bull markets

Source: Schwab Center for Financial Research with data provided by Bloomberg. The market is represented by daily price returns of the S&P 500 index. Bear markets are defined as periods with cumulative declines of at least 20% from the previous peak close. Its duration is measured as the number of days from the previous peak close to the lowest close reached after it has fallen at least 20%, and includes weekends and holidays. Periods between bear markets are designated as bull markets. Indices are unmanaged, do not incur fees or expenses, and cannot be invested in directly. Past performance is no guarantee of future results.

What should I do now?

Worrying excessively about a bear market is counterproductive, but being prepared for one is always a good idea. Consider investing strategies that potentially could help your portfolio—and your emotional wellbeing—in case of a significant downturn. Here are some additional steps all investors should consider:

- If you don’t have a financial plan, consider making one. A written financial plan can help you craft an appropriately balanced portfolio. It can also calm your nerves and make it easier to stay the course when markets get bumpy: According to a Schwab survey, 60% of Americans with a written financial plan said they felt financially stable, compared with only a third of those without a plan.1

- Review your risk tolerance. It’s relatively easy to take risks when the market is rising, but market downturns sometimes can be a wake-up call to consider adjusting your target asset allocation. Consider how much loss you have the emotional and financial capacity to handle. Schwab’s investor profile questionnaire can help you determine your investor profile and match it to an appropriate allocation.

- Rebalance regularly. Market changes can skew your allocation from its original target. Over time, assets that have gained in value will account for more of your portfolio, while those that have declined will account for less. Rebalancing means selling positions that have become overweight in relation to the rest of your portfolio, and moving the proceeds to positions that have become underweight. It’s a good idea to rebalance at regular intervals.

- Take your life stage into consideration. If you’re a younger investor saving for a goal that is 15 or more years away, you have time to potentially recover from a market drop. However, the picture may change for investors nearing or in retirement. Regular rebalancing and appropriate diversification are important for you at this stage, and your risk profile typically will become more conservative as retirement approaches. If you’ve recently retired and begun to withdraw from your portfolio, you also should be aware that poor returns in the early years of retirement can have a very negative effect on a portfolio; consider taking steps to avoid selling assets in a down market, such as reducing your planned withdrawals or postponing large expenses.

1 Schwab’s 2019 Modern Wealth Survey, developed in partnership with Logica. The online survey was conducted by Logica Research from Feb. 9-17, 2019, among a national sample of Americans ages 21 to 75. The national sample was balanced to be demographically representative. The margin of error for the national sample is three percentage points.

Copyright © Schwab Center for Financial Research