by Invesco Global ESG team, Invesco Canada

Responsible investing is becoming more mainstream as demand increases for strategies that incorporate ESG factors into their investment process. The drivers come from regulatory pressure, demographic shifts such as the growing influence of millennials, and the greater availability of corporate data on ESG issues. More generally, investors want their investments to align with their own values, especially if it offers the potential for better risk-adjusted performance.

The different elements of ESG

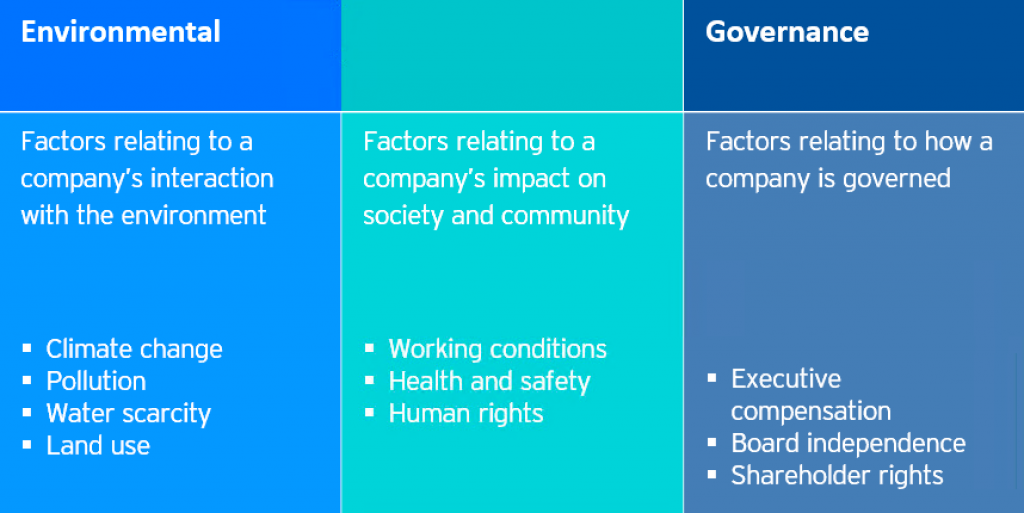

It’s easy to define what the E, S and G mean in isolation, but when put together, the term “ESG” could mean very different things to different people. What one investor is looking to achieve from their investment may be entirely different from what someone else wants. Neither is right or wrong, but it’s important to make a distinction between strategies that integrate ESG and those that do not.

The following illustration delineates the differences between traditional notions of “ethical investing” from the integration of ESG data into a strategy. Ethical investing generally focuses on aligning investment holdings with a tailored set of ethical criteria, excluding specific companies or sectors. For example, a strategy may exclude tobacco on ethical grounds.

Strategies focused on ESG integration will consider environmental, social and governance data about companies in which they may or may not invest. These factors are integrated with traditional financial considerations in making an investment decision. Such strategies may involve exclusions, or may opt for engagement with the companies in which they invest, encouraging the businesses to improve their ESG scores.

You can also combine these ethical and ESG integration elements into a single strategy. For example, an index creator may exclude certain securities based on ethical criteria and integrating ESG considerations into the now filtered index. At this point performance becomes the primary objective.

ESG performance and financial performance are connected

An integrated strategy will use ESG considerations typically as qualitative measures alongside more traditional financial metrics to value a company. By understanding a given company’s ESG exposure, an analyst can more accurately assess the risks within a company and gauge how successfully management deals with those risks.

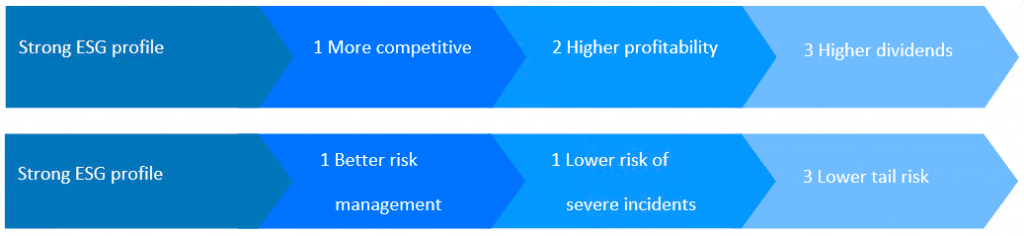

A company with a strong ESG profile could potentially have certain characteristics that may flow through to greater profitability and/or lower risks.

An integrated strategy will use ESG-related factors in the same way it uses more traditional financial metrics to value a company. By understanding ESG factors, an analyst may more accurately assess the risks within a company and gauge how successfully management deals with risks. In addition, ESG analysis can help identify opportunities for future revenues.

Invesco’s approach to ESG

Size matters when you need a big voice and being one of the largest asset managers in the world provides our passive ETF investors with an opportunity to make a real difference.1 Proxy voting is an integral part of our investment process, for active and passive strategies. Our aim is to encourage the companies in which we invest to adopt best-in-class ESG practices. We believe that proxy voting rights should be managed with the same care as all other elements of the investment process. We vote for proposals that we believe can maximize long-term shareholder value.

This post was first published at the official blog of Invesco Canada.