by Fred Fromm, Franklin Templeton Investments

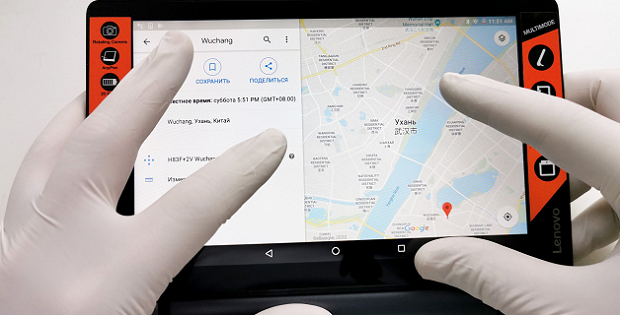

There’s no question the Novel Coronavirus has brought suffering to many people, and we certainly don’t wish to downplay the seriousness of the situation. It also has caused a sense of panic among investors globally, as we’ve seen some volatile market reactions in the wake of the virus’s spread. One prime example surfaced on February 3, when China’s commodity markets tumbled after re-opening following the Lunar New Year holiday. The question is whether the markets’ often panicky short-term reactions to these types of shocks are justified.

Although concerns related to the potential economic damage from the coronavirus and its containment efforts have weighed on commodity prices and related equity values, as we examine the situation through an investment lens, we believe the fundamental trends in place prior to reports of the outbreak are unlikely to change meaningfully. Recent economic reports have further supported signs of a recovery, and governments are likely to provide further monetary stimulus to help offset the virus’s downstream effects on economic activity. In addition, lower commodity prices can act as a form of stimulus by lowering costs to consumers, particularly for transportation fuel.

Quarantines in China, along with the government’s targeted closures of businesses and mass transit in regional hot spots, will influence commodity demand, but we believe the negative consequences should be short-lived as weather warms into the spring, the spread of the virus wanes and vaccinations and drug treatment regimens are developed. While the situation remains fluid, if history and the 2003 SARS (Severe Acute Respiratory Syndrome) epidemic are any guides, markets will recover—and perhaps strongly—once the virus is decoded and contained.

Meanwhile, the People’s Bank of China recently announced significant capital injections into the country’s banking system to help offset its slumping domestic equity market. However, concerns have lingered over the threat the Novel Coronavirus poses to global oil demand. The virus’s economic fallout is also tied to a range of other industrial commodities used in transportation and manufacturing. As the contagion spreads, commodity traders continually reassessed the impact of shutdowns in the world’s biggest energy user and producer of steel, coal, refined copper and other base metals.

China is the world’s largest oil importer and second-largest oil consumer—it currently uses roughly 13.5 million barrels of crude oil daily (mb/d), or nearly 10 mb/d more than it produces.1 Attempts to contain the coronavirus have crippled regional travel at a time when fuel stockpiles typically build on a seasonal basis. In this environment, the spectre of oversupply has made crude oil extremely sensitive to demand concerns, even if viewed as short term in nature.

Global oil markets experienced some relief when the Organization of Petroleum Exporting Countries consortium (OPEC+), including Russia, announced a joint technical committee meeting to discuss the virus’s short-term impact on oil demand. In our view, OPEC could recommend temporary production curtailments, though Russia has been slow to confirm their position on the matter, which has raised some questions as to whether such a reduction will take place, furthering pressure on crude oil prices.

Investment Implications

At the company and industry level, trends remain positive for many natural resource companies in the energy and materials sectors, with a focus on cost control and capital spending discipline. This should set the stage for better returns and growing cash flow generation that can be used to improve balance sheets and return cash to shareholders. With the fourth-quarter 2019 earnings season well under way, so far most natural resource companies have reported financial results and forward-looking views that have met or exceeded analysts’ consensus expectations.

We believe a combination of factors—including those mentioned above—will begin to attract more investors who are rightfully sceptical following several years of weak returns within commodities-driven industries. In the energy sector, previously poor returns were due, in part, to investments made during the peak of the last cycle when development opportunities were limited and costs were relatively high. Conversely, the investment environment over the past couple of years has provided ample opportunities to pursue projects with much stronger and durable return profiles.

More recently, the prevalence of weak returns in the oil and gas exploration and production industry can be chalked up to the early stages of development for unconventional US resources, also known as shale or tight rock. Rather than see it in this light, as one might view an early-stage technology company, many short-sighted investors have concluded that the resource type is simply not economically viable, a view we do not share.

For example, management of Chevron, one of the largest and oldest energy producers in the Permian Basin of Texas, stated on their latest earnings call that they expect to achieve returns in the Permian of 20% on an “all-in” basis, which includes all acquisition, development and production costs. This, in turn, is expected to boost Chevron’s current companywide returns of 7%, as their Permian shale production grows to over 20% of total production.2

Similarly, we expect returns and cash generation to improve for select small- and medium-sized producers as they mature and gain economies of scale, which should be recognised by investors and, if not, by other producers seeking to grow their resource base through acquisitions.

While we obviously can’t predict the full ramifications of the coronavirus, commodities were generally viewed as highly susceptible to potential demand weakness. Related natural resource equities were overly punished by investors, in our view, particularly when compared to the broader market. During a time when sentiment and momentum dominate market action, stocks that have performed poorly are easy targets for raising cash, and we think this could create a potential opportunity to invest in energy and materials equities where longer-term fundamentals remain solid.

Many natural resource stocks have completely retraced their fourth-quarter 2019 rallies and are once again trading near multi-decade and, in some cases, all-time lows. In the current environment, we are therefore comfortable adding back to core holdings, with a particular focus on higher-quality companies with robust balance sheets that have previously appeared fully valued to us.

Get more perspectives from Franklin Templeton delivered to your inbox. Subscribe to the Beyond Bulls & Bears blog.

For timely investing tidbits, follow us on Twitter @FTI_Global and on LinkedIn.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as of publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own professional adviser or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

Issued in the U.S. by Franklin Templeton Distributors, Inc., One Franklin Parkway, San Mateo, California 94403-1906, (800) DIAL BEN/342-5236, franklintempleton.com—Franklin Templeton Distributors, Inc. is the principal distributor of Franklin Templeton’s U.S. registered products, which are not FDIC insured; may lose value; and are not bank guaranteed and are available only in jurisdictions where an offer or solicitation of such products is permitted under applicable laws and regulation.

CFA® and Chartered Financial Analyst® are trademarks owned by CFA Institute.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors or general market conditions. Investing in the natural resources sector involves special risks, including increased susceptibility to adverse economic and regulatory developments affecting the sector. Growth stock prices may fall dramatically if the company fails to meet projections of earnings or revenue; their prices may be more volatile than other securities, particularly over the short term. Smaller companies can be particularly sensitive to changes in economic conditions and have less certain growth prospects than larger, more established companies and can be volatile, especially over the short term. Investing in foreign companies involves special risks, including currency fluctuations and political uncertainty.

______________________________________

1. Source: International Energy Agency.

2. Source: Chevron Corporation, Q4 2019 earnings call, 31 January 2020.

This post was first published at the official blog of Franklin Templeton Investments.