by Carl R. Tannenbaum, Ryan James Boyle, Vaibhav Tandon, Northern Trust

Sometimes, things in life exceed your wildest dreams. And sometimes, you are reminded that you should be careful what you wish for.

My dreams were formed in the 1970s, a decade many would like to forget. It lacked the peace and prosperity of the 1950s, and couldn’t match the passion and possibility of the 1960s. The 1970s were bad: crime was high, cars were unreliable, clothing styles were overly bright and film themes were overly dark. And undisputedly, the world’s economy was very dark.

Oil shocks in 1973 and 1979 shook the foundations of Western economies. Heavy industries were hollowed out, putting millions out of work. Inflation raged, partly as a result of poor monetary policy. Efforts to tame runaway prices ranged from the counterproductive (wage and price controls) to the comical (President Ford’s “Whip Inflation Now” button). Nominal interest rates skyrocketed, choking off housing and business investment.

During this interval, economists developed a “misery index” that combined the unemployment rate and the inflation rate. It peaked at over 25% in a number of countries. I was one of the unemployed, and one of the ones rapidly losing purchasing power. I was hoping, somehow, that we could tame inflation and interest rates.

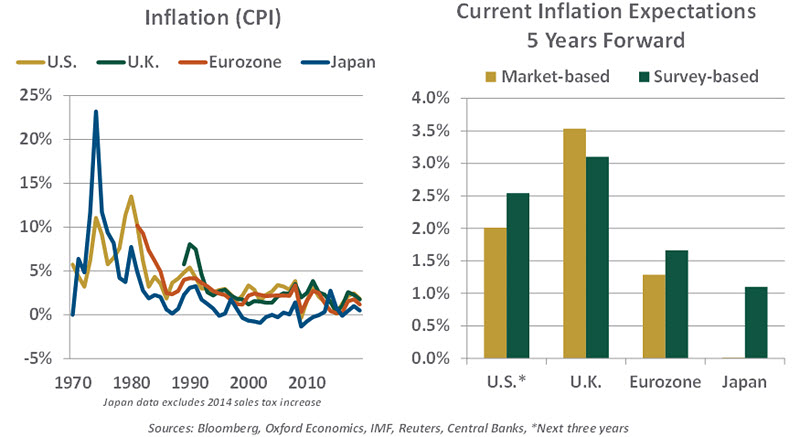

Today the misery index is less than 6% in many major countries. Interest rates are negative in a number of markets and barely positive in others. There is still concern over inflation, but today, we are worried it is too low.

A number of elements have combined to produce this outcome. This essay will attempt to enumerate the most major of them, and assess how they might progress going forward. This evolution will be critical to economic performance in the generation to come.

Winning Hearts and Minds

While we can try to model the economy, underneath all of that activity are human beings. We are not always rational actors; psychology can, at times, play an outsized role in our decision-making. This is an especially important foundation of inflation: if we expect prices to rise rapidly, we increase our wage demands in compensation. The resulting wage-price spiral can be difficult to arrest, given our vulnerability to confirmation bias and other behavioral imperfections.

Central bankers were overly indulgent of inflation in the 1970s, preferring to keep credit spigots open. Finally, at the end of the decade, Paul Volcker was appointed chairman of the Federal Reserve. Drawing on work from The Chicago School, Volcker set his sights on controlling the supply of money.

It was painful; the Fed’s credit restrictions pushed the U.S. economy into recession. But Volcker’s persistence in the face of heavy criticism finally reversed inflation expectations. At the beginning of the 1980s, respondents to the University of Michigan consumer sentiment survey were calling for inflation of more than 10%; at the end of the decade, that number had fallen to less than 4%.

Other central banks followed the Fed’s lead. Their commitment registered with investors, who began bidding up bond prices. Interest rates began a secular decline that continues to this day. The psychological battle had been won.

Some would say, though, that the campaign has become too successful. Central banks sought to cement their achievement by adopting inflation targets, which they have failed to meet. This has led inflation expectations to fall even further. In stark contrast to the situation of a generation ago, it is getting harder to convince consumers that inflation won’t continue to fall.

“Central banks have proven successful at lowering inflation expectations but unsuccessful at raising them.”

Central banks proved willing and capable of putting a cap on inflation. But they have yet to devise strategies to put a floor under inflation. Several techniques have been tried (forward guidance, yield curve controls, price level targeting) but none have been effective. Interestingly, both the Fed and the European Central Bank (ECB) have strategic reviews under way, aiming to modulate what people anticipate. The results will be available later on this year.

Ironically, it appears central banks have again lost control over the price level, but this time in the other direction. This diminishes their credibility, and could unmoor inflation expectations. Only this time, those expectations could drift lower, bringing an entirely different set of problems.

Going Global

Structurally, firms had much more freedom to increase prices in the 1970s. Competition wasn’t the sharpest; many industries were heavily concentrated, and “disruptors” weren’t yet on the scene. The U.S. government broke up the telecommunications titans in 1982 in an effort to foster a modicum of competition. (With the benefit of hindsight, cellular technology and internet connectivity would have made babies of the Bells in a natural way.)

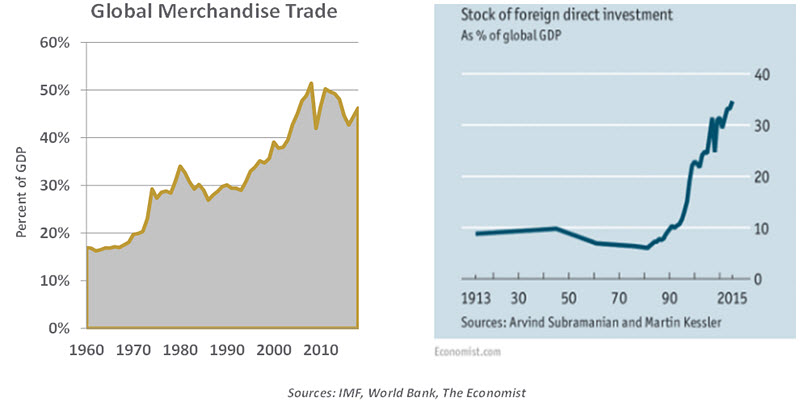

There was foreign trade in the 1970s, but it was more regional than global and accounted for a small share of gross domestic product (GDP) in most countries. Local regulations often discouraged foreign entrants, and tariffs sheltered domestic providers.

But the doors truly opened as the 1970s ended. A series of free trade agreements was signed, and international organizations coordinating internal commerce were chartered. The fall of the Berlin Wall in 1989, the introduction of the euro in 1999, and the entry of China into the World Trade

Organization (WTO) in 2001 were watershed moments of this evolution. New supply chains were formed, and the flow of goods and capital between countries mushroomed.

Expanded choice brought consumers lower prices, and keen competition from foreign providers forced domestic companies to get sharper. Labor mobility improved, components were sourced from optimal locations, and global supply chains were established. The resulting efficiency lowered costs and prices while boosting corporate profitability.

“The recent trend away from global trade will add to global inflation.”

The drive to “do what you do best and outsource the rest” reached its apogee just before the financial crisis, but it has been in slow decline ever since. While the provincial patterns of 40 years ago are unlikely to return, trade frictions will be with us for a while. As barriers rise, supply chains will have to be reoriented in ways that will likely increase costs; this will add incrementally to inflation in the years ahead.

Phillips Fails

The economist A.W. Phillips published an article in 1958 that analyzed nearly a century of data from the United Kingdom. It found an inverse relationship between rates of unemployment and increases in wages and prices. (Paul Samuelson and Robert Solow confirmed this relationship using American data a couple of years later.) This “Phillips Curve” became an important underpinning of economic policy.

The experience of the 1970s, when inflation and unemployment were high at the same time, seemed to challenge the inference of the Phillips Curve. But rapid increases in the money supply during that era distorted the relationship. Once central banks brought money growth under control, the Phillips Curve was restored.

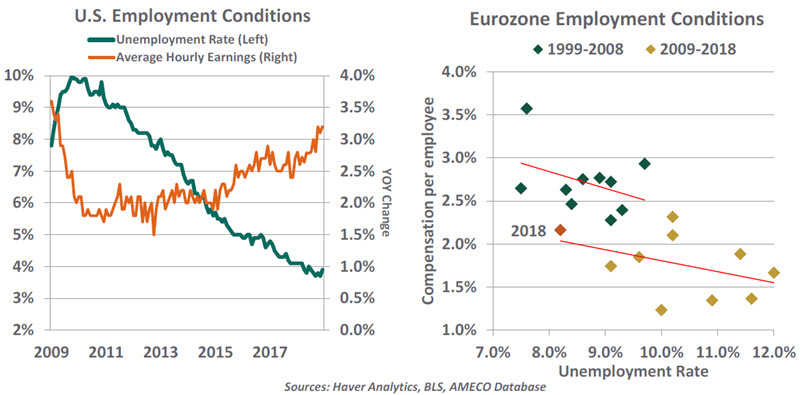

Today, however, many markets have very low unemployment and very low inflation. This has led observers to wonder whether the Phillips Curve has weakened, or expired. Considering this question requires breaking the Curve down into two important components.

The first is the link between unemployment and wage growth. The data strongly suggest that supply and demand in the labor market still interact in the normal way. During the past decade, wage growth has accelerated as unemployment has fallen; but nominal and real wages have not escalated as rapidly as they did during past business cycles.

Some have pointed out that productivity growth during the past decade has been modest, which would explain slower growth in compensation. But others note that measuring productivity (especially in service industries) is an imprecise exercise. They urge caution against using the official statistics to gauge the proper scale of wage increases.

Even as unemployment has fallen to historically low levels, there are a number of other theories for why wage growth has remained sluggish.

“Wages have risen as unemployment falls, just not as rapidly as in the past.”

- The mismeasure of the labor force. With joblessness well below the levels economists associate with full employment, it seems clear that the statistics are missing reservoirs of workers who are available for hire. Those who had been outside of the labor market are coming back in, adding supply that keeps wages from rising too rapidly.

- Declining unionization. Membership in labor organizations has ebbed substantially across countries since 1980. Some of this represents the rise of service occupations, which are less likely to have unions. But global evolution toward consumerism has led attitudes towards unions to become less favorable. And political regimes have certainly become less protective of organized labor than they were in the past.

As a result, labor’s share of national income has been in persistent decline. Corporate profits have been the beneficiary of this trend, and are one reason for the tremendous equity market gains seen over the past thirty years.

- The structure of work. The rise of “gig,” or piece-work, employment is hailed by some as a liberator for workers, who are able set their own schedules. As of 2017, the Bureau of Labor Statistics found 6.9% of U.S. workers self-identified as independent contractors and freelancers. But this arrangement could also be an inhibitor to workers’ wages, as they lack the leverage that comes with being part of a broader organization. As an example, a graphic artist contracting for himself probably cannot command the same fee as a graphic design firm. Self-employed workers also forgo benefits like paid time off, retirement savings and medical insurance.

- Industry concentration. Market concentration within industries has been rising steadily since the early 1990s. From semiconductors to cereal, the power of industry leaders has increased, with barriers to entry rising. Workers with specialized skills in a particular field will find a limited number of firms that might hire them, impairing their ability to attract higher wages.

- Automation. Throughout history, automation has tended to increase wages by making workers more productive. Nonetheless, some see the current wave of automation in the service sector as running counter to this identity. Analytics and artificial intelligence are rapidly taking on repetitive tasks that human beings have traditionally performed. This reality and the threat of machines overtaking men and women puts a cap on what firms are willing to pay personnel.

These elements have altered, or have the potential to alter, the dynamic between demand and supply in the labor market. Nonetheless, the data shows wages are responsive to unemployment. And so, if the Phillips Curve is indeed dead, the murderer can be found in the link between wages and prices.

It is hard to underestimate the influence of the internet on inflation. Greater access to information makes consumers more astute; e-commerce platforms allow them to compare offers and features rapidly and cheaply. The data clearly show differences in price evolution between product categories that are commonly sold online and those that are not. Further, prices for given products can evolve differently through different retail channels; as inflation is increasingly measured using online prices, we can expect downward pressure on the price level.

“The application and potential application of automation will limit wage growth for certain kinds of work.”

Services have been something of a holdout in this evolution, as some do not lend themselves as easily to internet sales. But that is changing. The cost of shelter, the biggest component of many price indices, has been impacted by online listings and virtual tours. (Like other intermediaries, real estate agents face a challenging future.) The cost of medical care, which also accounts for a substantial fraction of consumer expenditures, is under a microscope from major purchasers like insurance companies and national health services. The analytics being performed by buyers of care are beginning to bend the medical cost curve.

“E-commerce makes us better consumers.”

With purchasers pushing back, vendors are having a harder time passing along cost increases.

Even if labor compensation increases, it is not clear that firms can ask consumers to pay more for products. As amazing as it may sound, the influence of e-commerce may be in its early innings; penetration is likely to increase across countries and categories. The internet has the potential to make many more things even less expensive in the years ahead.

A final, subtle contributor to low inflation is the collective aging of populations in many countries. Fear of outliving one’s savings causes retirees to spend carefully and become more price-conscious. Workers nearing retirement are less likely to seek higher wages aggressively from a current or alternative employer, and they are much less likely to move for a better job. Demographic trends around the world will create more frugal consumers who have more time to find low prices. And that too will limit inflation.

Policy Implications

The consequences of high inflation are clear. Purchasing power is diminished, investment is stunted, and markets perform poorly. But as we discussed in a recent video, it is not immediately clear why low inflation would be a problem. Such an environment should enhance purchasing power, invite investment and allow markets to perform well. All of these things have occurred over the past thirty years.

But low inflation raises the risk of deflationary intervals, during which consumers might defer purchasing because they expect products to become cheaper in the future. The resulting drop in spending can put further downward pressure on prices, creating a self-reinforcing cycle that is difficult to reverse. Japan has had struggled with deflation since 1990, partly because of the extreme aging of its population. With demographics in other major economies tending older, “Japanification” has become an international concern.

Very low inflation begets very low interest rates. (At the extreme are nearly $14 trillion of bonds with negative yields in markets around the world, a phenomenon I certainly never thought I would see during my lifetime.) This is good for borrowers, and has been helpful for heavily indebted sovereigns. But it hinders savers and creates immense challenges for retirement systems like pension plans. Low interest rates also mean that when recession hits, central banks have less leverage to rekindle economic activity. That forces them into alternative monetary strategies whose long-term effects are unknown.

Rather than trying to rebuild their policy reserves as the global expansion continues, central bankers continue to press hard to achieve their inflation objectives. They see this as a test of their credibility and commitment. The Fed and the European Central Bank, among others, are considering redoubling efforts to get inflation above targeted levels for a time.

But the long series of secular forces described earlier will make this a difficult task, and the potential side effects of too-easy policy could be substantial. Going forward, fiscal strategies may need to take the lead; deficit spending is often criticized as inflationary, but that might be just what the doctor ordered in the current circumstance.

“If interest rates stay lower for longer, there could be dangerous consequences.”

I would still much rather have today’s problems than the ones we had forty years ago, but today’s problems are problems nonetheless. If we fail to put some kind of floor under inflation, my wildest dreams could turn into an international nightmare.

Information is not intended to be and should not be construed as an offer, solicitation or recommendation with respect to any transaction and should not be treated as legal advice, investment advice or tax advice. Under no circumstances should you rely upon this information as a substitute for obtaining specific legal or tax advice from your own professional legal or tax advisors. Information is subject to change based on market or other conditions and is not intended to influence your investment decisions.

© 2020 Northern Trust Corporation. Head Office: 50 South La Salle Street, Chicago, Illinois 60603 U.S.A. Incorporated with limited liability in the U.S. Products and services provided by subsidiaries of Northern Trust Corporation may vary in different markets and are offered in accordance with local regulation. For legal and regulatory information about individual market offices, visit our terms and conditions page.

Copyright © Northern Trust