by Robert Christian, Franklin Templeton Investments

Pricing dislocations in Europe, performance dispersion across the credit spectrum and shifts in the political landscape should likely provide abundant opportunities for select hedge strategies in the year ahead, according to K2 Advisors. The team shares some macro themes and questions its focused on, and shares its outlook for various hedge strategies.

Macro Themes We Are Discussing

Are Sector and Geographical Rotations Likely to Continue in 2020?

We expect a rotation from those equity market sectors that formally had strong earnings growth into sectors that have lagged in the past few years. We believe this sector rotation should benefit equity hedge fund alpha1 as managers look to buy past laggards while using past leaders as market hedge positions.

Likewise, cyclical sectors and value factor-sensitive securities may outperform defensive and growth-oriented sectors. Much of the negative economic and earnings growth news may be priced into European and emerging market equities, while much of the positive news is potentially priced into US equities and the US dollar. A rotation into non-US equity markets may become evident in 2020, and many macro commodity trading advisors (CTAs) and equity long/short managers may benefit from this shift.

Are Investors’ Global Inflation Expectations Too Low?

We wonder if consensus inflation expectations are too low given global growth seems to be stabilising. If wage or price inflation surprises to the upside, the Treasury yield curve may steepen in 2020, and some bond markets may come under pressure as interest rates rise. Credit long/short hedge fund managers should benefit from this scenario, in our opinion, as the performance variance between bonds in different countries or sectors should offer alpha opportunities.

Has the Rally in Global Government Bonds Gone Too Far?

According to Bloomberg, as at 30 December 2019, the Federal (Fed) funds futures market is forecasting the US Fed funds rate to be near 1.39% as of December 2020. This is not much lower than the current level of 1.55%. It seems to us that interest-rate cuts might mostly be priced into bond valuations. We wonder if a potential selloff in global bond markets may present a good hedging scenario for managers in the relative value, event-driven, and macro/CTA strategy categories.

What Impact Will Upcoming Political and Trade Events Have on Market Volatility and Hedged Strategies?

With the November 2020 US election cycle fast approaching, we expect market volatility to increase from the current low levels. Campaign policy headlines involving the health care and energy sectors could influence investor perceptions leading up to the election. Hedged strategies may benefit by going long the sectors thought to benefit from a policy tailwind, while hedging out equity market volatility through short positions in sectors potentially hurt by policy statements. Additionally, the ongoing Brexit and trade discussions should contribute to investor uncertainty and cross-sector and cross-asset class volatility.

First-Quarter 2020 Outlook: Strategy Highlights

Long-Short Equity Europe

We expect renewed interest in European equities as investors rotate to undervalued European markets, potentially improving the relative valuation dislocations between Europe and the United States. Broad macro uncertainties about the US-China trade war and Brexit have temporarily diminished, and central banks continue to accommodate investors’ appetite for risk-on assets. Many European companies even offer relatively high dividend yields, which we believe are sustainable based on payout ratios and corporate debt levels.

Long/Short Credit

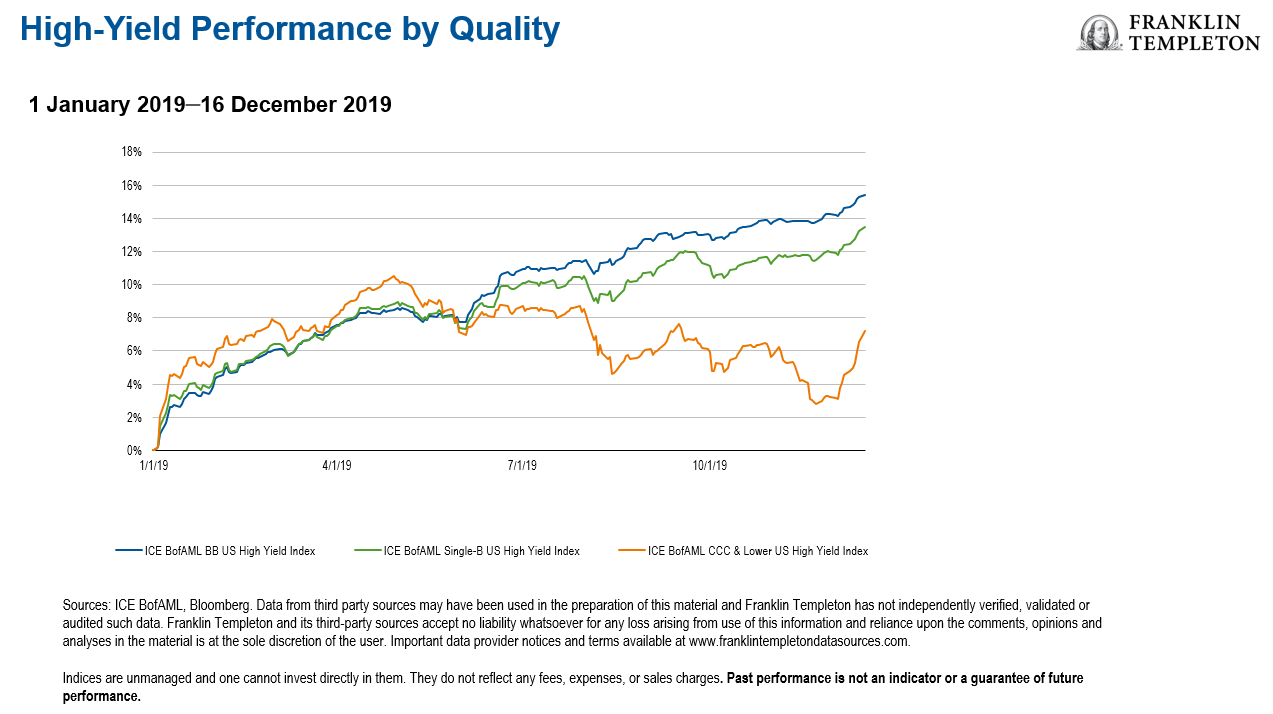

High-yield bonds have experienced elevated levels of dispersion in 2019, particularly across the quality spectrum. Higher-quality bonds have rallied given higher sensitivity to interest rates, and lower-quality bonds have lagged due to both macro and idiosyncratic credit concerns. This dispersion could provide managers with a better environment in which to pick specific credits. That is particularly salient on the short side, as weaker credits, particularly those in challenged sectors such as health care and retail, have experienced sharp declines in response to negative fundamental developments. We expect this dispersion to continue into 2020 as investors become more discerning into the later stages of the credit cycle.

Macro Discretionary

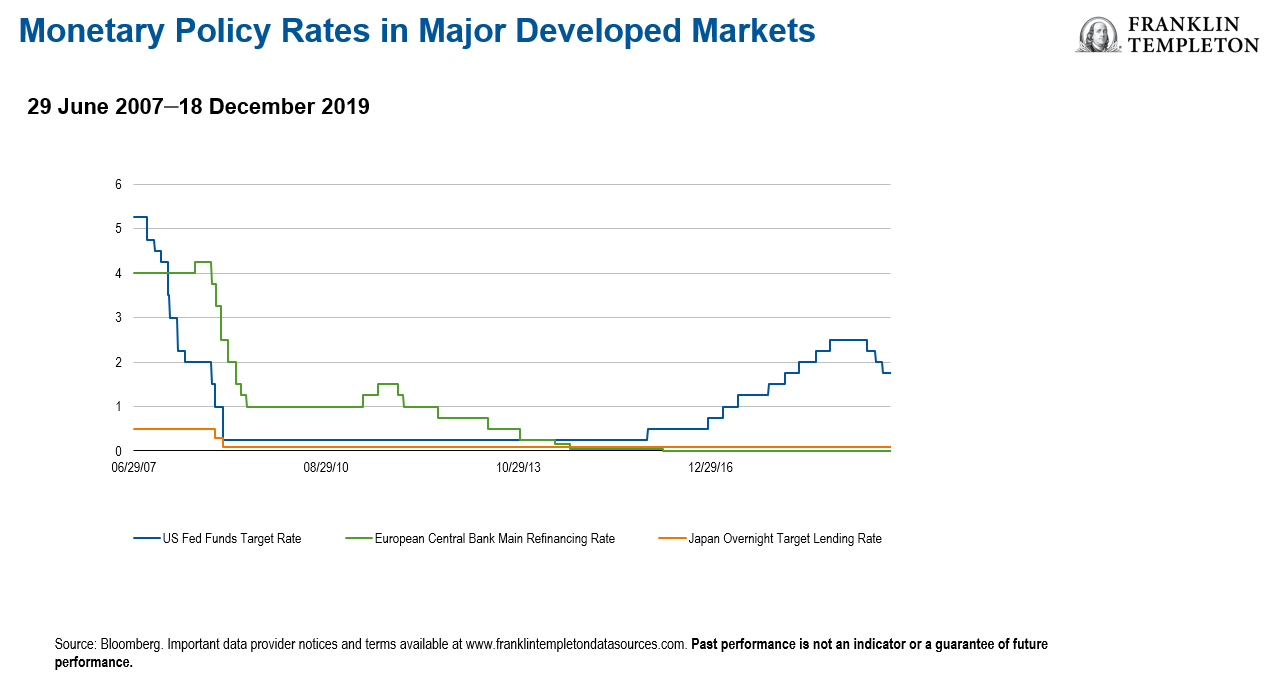

Markets are starting to recognise the effective limits of monetary policy, which has been a key supporter of asset prices in the years following the Global Financial Crisis just over a decade ago. With developed-market monetary policy rates at or near the perceived lower bound, attention has started to shift to the prospect of expansionary fiscal policy, particularly in Europe. Directional and relative value macro opportunities may arise from key policy changes as well as associated shifts in the political landscape with considerable focus on the US presidential election.

Get more perspectives from Franklin Templeton delivered to your inbox. Subscribe to the Beyond Bulls & Bears blog.

For timely investment updates, follow us on Twitter @FTI_Global and on LinkedIn.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as of 9 January 2020 and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton Investments (“FTI”) has not independently verified, validated or audited such data. FTI accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the U.S. by other FTI affiliates and/or their distributors as local laws and regulation permits. Please consult your own professional adviser or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

The information in this document is provided by K2 Advisors. K2 Advisors is a wholly owned subsidiary of K2 Advisors Holdings, LLC, which is a majority-owned subsidiary of Franklin Templeton Institutional, LLC, which, in turn, is a wholly owned subsidiary of Franklin Resources, Inc. (NYSE: BEN). K2 operates as an investment group of Franklin Templeton Alternative Strategies, a division of Franklin Resources, Inc., a global investment management organization operating as Franklin Templeton.

What Are the Risks?

All investments involve risks, including possible loss or principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Investments in alternative investment strategies and hedge funds (collectively, “Alternative Investments”) are complex and speculative investments, entail significant risk and should not be considered a complete investment program. Financial Derivative instruments are often used in alternative investment strategies and involve costs and can create economic leverage in the fund’s portfolio which may result in significant volatility and cause the fund to participate in losses (as well as gains) in an amount that significantly exceeds the fund’s initial investment. Depending on the product invested in, an investment in Alternative Investments may provide for only limited liquidity and is suitable only for persons who can afford to lose the entire amount of their investment. There can be no assurance that the investment strategies employed by K2 or the managers of the investment entities selected by K2 will be successful.

The identification of attractive investment opportunities is difficult and involves a significant degree of uncertainty. Returns generated from Alternative Investments may not adequately compensate investors for the business and financial risks assumed. An investment in Alternative Investments is subject to those market risks common to entities investing in all types of securities, including market volatility. Also, certain trading techniques employed by Alternative Investments, such as leverage and hedging, may increase the adverse impact to which an investment portfolio may be subject.

Depending on the structure of the product invested, Alternative Investments may not be required to provide investors with periodic pricing or valuation and there may be a lack of transparency as to the underlying assets. Investing in Alternative Investments may also involve tax consequences and a prospective investor should consult with a tax advisor before investing. In addition to direct asset-based fees and expenses, certain Alternative Investments such as funds of hedge funds incur additional indirect fees, expenses and asset-based compensation of investment funds in which these Alternative Investments invest.

__________________________

1. Alpha is a mathematical value indicating an investment’s excess return relative to a benchmark. It measures a manager’s value added relative to a passive strategy, independent of the market environment.

This post was first published at the official blog of Franklin Templeton Investments.