by Hubert Marleau, Market Economist, Palos Management

The spread of the Chinese virus could bring pandemic fears and cause widespread economic disruptions like stopping people from shopping, going out to restaurants or taking a holiday. The potentially deadly respiratory virus is rattling the financial and commodity markets. The S&P 500 printed the first daily loss of 1% or more since October 8. Meanwhile the CTAs were piling short positions in crude and copper, accelerating the declines. The incident has turned into a sell first and ask questions later.

While the economic impact is still unclear, things tend not to turn out as bad as feared. Look at what happened in 2003 with the SARS outbreak, stocks sold off in double digits but came back quickly when the market realized that the epidemic had been contained. Interestingly, the Skew Index which indicates how much investors are willing to pay for protection against tail risks or external shocks is down. Go figure!

Paul Tudor Jones made a comment in Davos that the “equity locomotive” is seemingly unstoppable.When asked if it was time to get off the train, he said: “the train has a long long way to go if you think about it”. In 1999, inflation (PCE Index) was running at an annual rate of 1.6% and there was no recession in sight. Today, economic conditions are very similar. The big difference is the federal funds rate was 4.75% back then compared to 1.63% now. Should this mysterious new coronavirus turn into a catalyst to push stock prices down, a lot of investors will take the opportunity to load up their portfolio with more risky assets. The fear of missing out (FOMO) is clear because the dip-buying tendencies are deeply entrenched. Why?

The characteristics of the economy have changed considerably over the years ensuring to some extent that growth can survive. Growing government regulations, intervention and assistance, plus the growing importance of the stable service sector, may have considerably reduce potential economic growth; but, at the same time, they may have brought about a significant degree of economic stability. The point is that the business cycle is more tamed, making booms and busts less frequent. The Bank of America has some interesting numbers on this phenomenon. “ Before the 1980s the economy was in recession 35% of the time but since then the figure has fallen...18% in the 1980s, 22% in the 00s and 0% in the 10s”. So, maybe stocks are just not as cyclical as they once were. A cycle that does not turn is not a cycle says the BofA. A BNP cycle model, which imputes a cycle clock from asset prices, shows that “the end of the traditional business cycle model is here--no more big and frequent amplitude, but more like undulations around a flat line”.

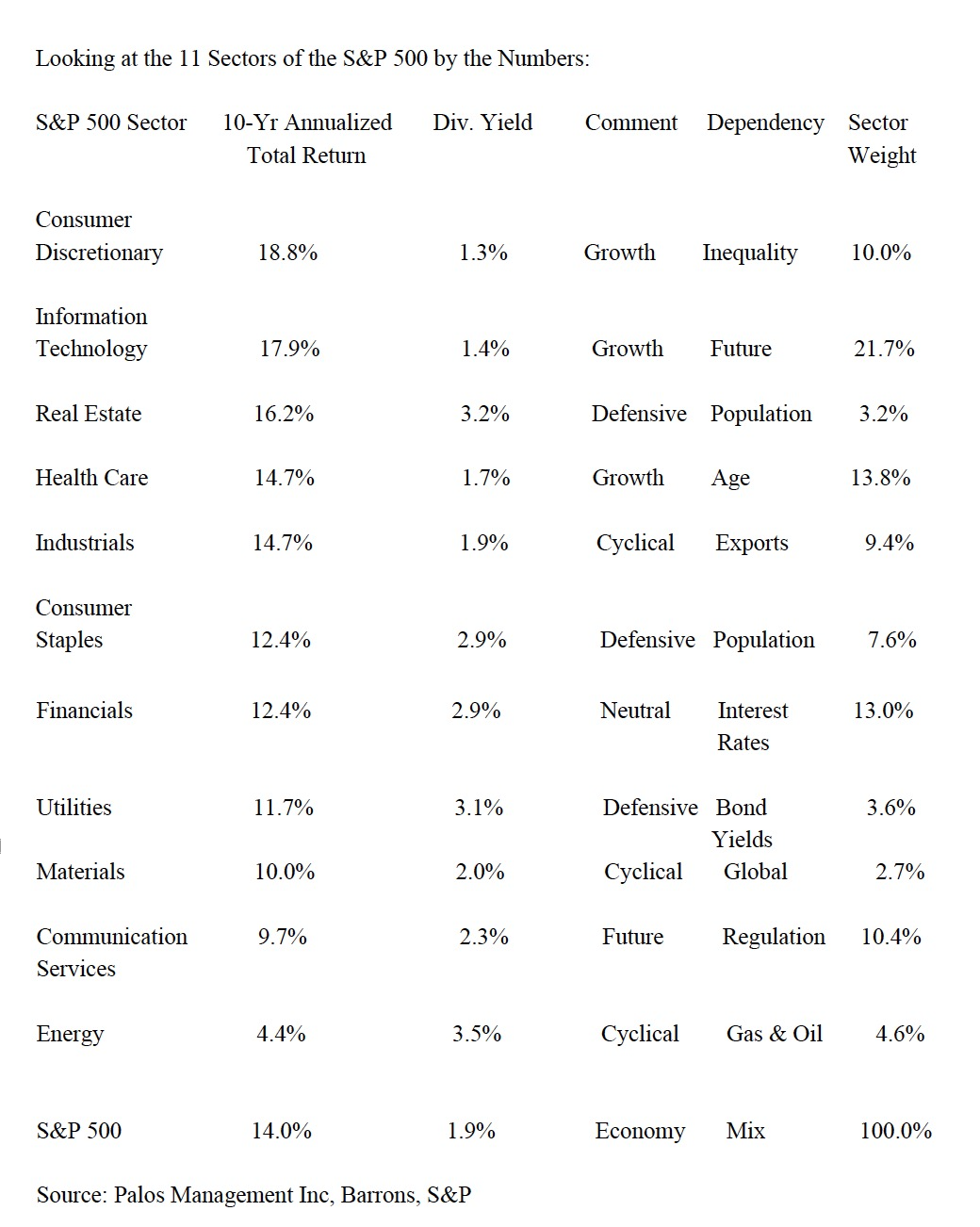

Let’s look at some revealing facts:

JPMorgan wrote in a note to clients that individual investors are less leveraged than they were nine months ago. It is striking that net debit balance has been unwound as stock prices surged. In other words, investors have been prudent and may not be as maxed out as they were a year ago.

Monetary conditions are very accommodating. The Goldman Sachs’ Financial Condition Index is at a near record level and the St-Louis Fed’s Financial Stress Index registered the lowest reading since the index was created at the end of 1992.

All the NowCasting Models have positive estimates for Q/4 economic growth around 2.0%. For example, the Goldman Sachs current activity indicator (CAI) rebounded in January to an annual rate of just below 2.0%. The results of Moody’s probit model show that the odds of GDP growth exceeding 3% in the next year may be less than 2%, but the chance that GDP growth will be at 1% or lower is only 15%.

Economic models at Moody’s Analytics and Bloomberg show that the odds of having a recession in the next six to twelve months range between 10% and 26%.

The global manufacturing slump may have bottomed out. IHS Markit’s purchasing managers indexes for Japan, the UK and Europe contracted but at a much slower pace than expected. According to IHS Markit’s Phil Smith, the prints show that the struggling manufacturing industry appears to be stabilizing while the service sector continues to grow.

What’s not to be happy about. Low inflation combined with low recession risk is a recipe for low volatility. Andrew Bailey, the incoming BoE governor, in an interview with the Times last week said he needs to be prepared to deal with falling asset prices, such as equities and houses. As Mike Mackenzie wrote on Friday in the FT: “Little wonder investors downplay risk and fundamentals when central banks are focused on asset prices.”

The apparently unbeatable economic expansion is arousing the animal spirits of investors. The belief in the invulnerability of the economy is based on this one phrase that Chair Jerome Powell said in a press conference: “So I think we would need to see a really significant move up in inflation that’s persistent before we would consider raising rates to address inflation concerns.” Powell’s words have convinced investors that the federal funds rate could remain at the current level for a long time, or at least until the rate of inflation conclusively goes above the target rate of 2.0%. In other words, as long as the policy rate (1.50%) stays near or below the neutral rate (1.50%), relatively good outcomes can be expected in the labour, housing and consumer spending markets.

Consequently, investors need to monitor inflation indicators very closely because it will weigh heavily on their thinking about the outlook for stocks. The PCED inflation rate is the one number to watch because it is a comprehensive measure which is revised as new information is discovered and as new techniques are developed. It reflects the substitution effect and the changing composition of spending. That is why the chain-type price index for PCE is the preferred inflation measure of the Federal Reserve.

In the year ended November 2019, the headline and core PCED inflation rate rose 1.5% and 1.6% respectively. More importantly, there appears to be no upward pressure at this time. Over the past three months, the core rate was up only 1.3% (saar). Given that there is a structural decrease in the natural rate of employment (NAIRU), other variables like productivity gains, expectations, energy prices and exchange rates should be put on the watch list. At this time, none of these variables suggest an upward pressure on inflation.

As an aside, did you know that when stock prices have been up in January, the full year returns for the S&P 500 have been positive 100% of the time!

Copyright © Palos Management