by Franklin Templeton Investments Research, Franklin Templeton Investments

From Principles to Best Practices

Responsible investing frameworks such as socially responsible investing, positive screening, impact and thematic investing, and the integration of ESG principles have been applied to professionally managed assets in various forms for several decades. At Franklin Templeton, we have long been committed to responsible investing and the application of ESG criteria in our investment processes.

Yet, we recognise institutional investors are at different stages of their ESG journey. So, we commissioned a study to better understand how advanced they are in the process of integrating the principles of ESG into their investment decisions. Our study included a range of respondents—from investors just beginning to adopt an ESG framework to asset owners who have developed an organisational-level set of polices with ESG framework applied across portfolios. Our research found four themes to track the way asset owners are adopting responsible investing and ESG considerations over time.

Theme #1: Traction

As ESG considerations gain acceptance, there is broad consensus among study respondents on the benefits in regard to potential risk reduction, but differences of opinion regarding the impact on potential returns.

We discovered that developing expertise in ESG is a top priority for institutional investors, ahead of core categories such as investment strategy and technology. Our survey indicated that 80% of asset owners were allocating more resources to improve their ESG knowledge and 73% were expanding capabilities in this area.

These research findings reflect both ESG’s growing importance and the under-developed internal capabilities of many investors. As commitment rises, a rapid growth in ESG resourcing and dedicated teams often results, thus creating an increased appetite for research and data.

Most investors we surveyed agree on the advantages of incorporating ESG in terms of the risk-reduction potential. Moreover, some 46% of respondents rank risk reduction as the main benefit, well ahead of improvements to returns and fulfilling fiduciary duties. This is because seeing investments through an ESG lens often reveals long-term systemic risks, such as climate change, weak corporate governance structures, or poor environmental or social credentials. For example, an ESG check might flag assets that own coal-fired power stations, and the risk to a portfolio if demand for carbon-intensive energy were to drop.

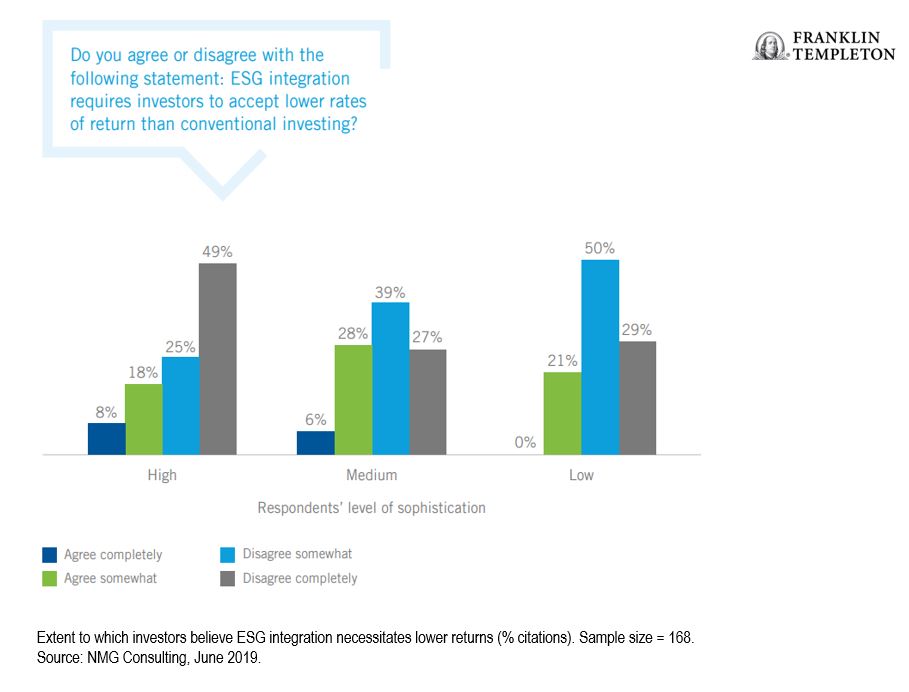

Views regarding returns exhibit much more variation in our study. Despite 70% of respondents having a positive view of the impact of ESG on investment returns, nearly one-third believe that ESG integration requires investors to accept lower rates of return.

Both early-stage ESG adopters and a number of the more sophisticated asset owners said that as they applied ESG factors to new asset classes, outperformance became harder to capture. Along with shifts in policy and regulation, greater confidence and clarity over the impact of ESG adoption on returns across asset classes would act as a catalyst to unlock wider adoption.

Figure 1:

Theme #2: Deepening

Responsible investing is best seen as a continuum of good practices, rather than as a series of independent silos. Each new approach—impact investing, active engagement or ESG integration—offers a distinct perspective that builds on what came before. For example, negative screening (excluding companies that don’t align with specific ESG values) is often considered a simple first step due to its relative ease of implementation.

However, as investors gain experience, we found they rarely jettison these early steps. Investors continue to find negative screening an effective tool for excluding entire sectors, such as tobacco and controversial weapons, that go against their values. So, while 82% of early-stage adopters who responded to our study use negative screens, more sophisticated investors use this approach almost as often (78%).

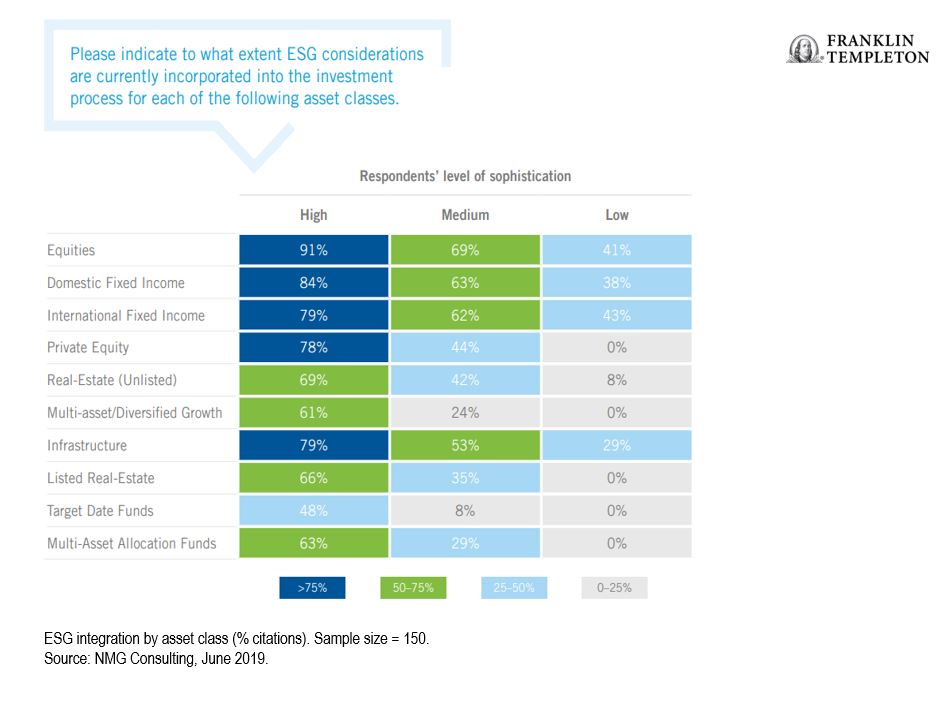

As investors become more experienced with responsible investing approaches, directly integrating ESG variables into the investment process becomes widely practiced: 91% of sophisticated investors surveyed do it, compared with 67% of those of mid-level sophistication and almost none of the early-stage ESG adopters.

The integration of ESG variables in fundamental analysis usually begins in public equity markets, not least because this is often the largest asset class in the portfolio and offers relatively the most robust ESG information. Once the implementation into equities is largely complete, investors then tend to look into other asset classes.

While our study found advanced investors lead the way in broadening the implementation of ESG, novices are catching up, with over half of them integrating ESG within their fixed income portfolios compared with more than 80% for advanced investors. ESG integration in private assets (e.g., private equity or unlisted real estate) and multi-asset solutions is high among advanced ESG investors but has room to grow.

Figure 2:

Theme #3: Interpreting ESG Factors

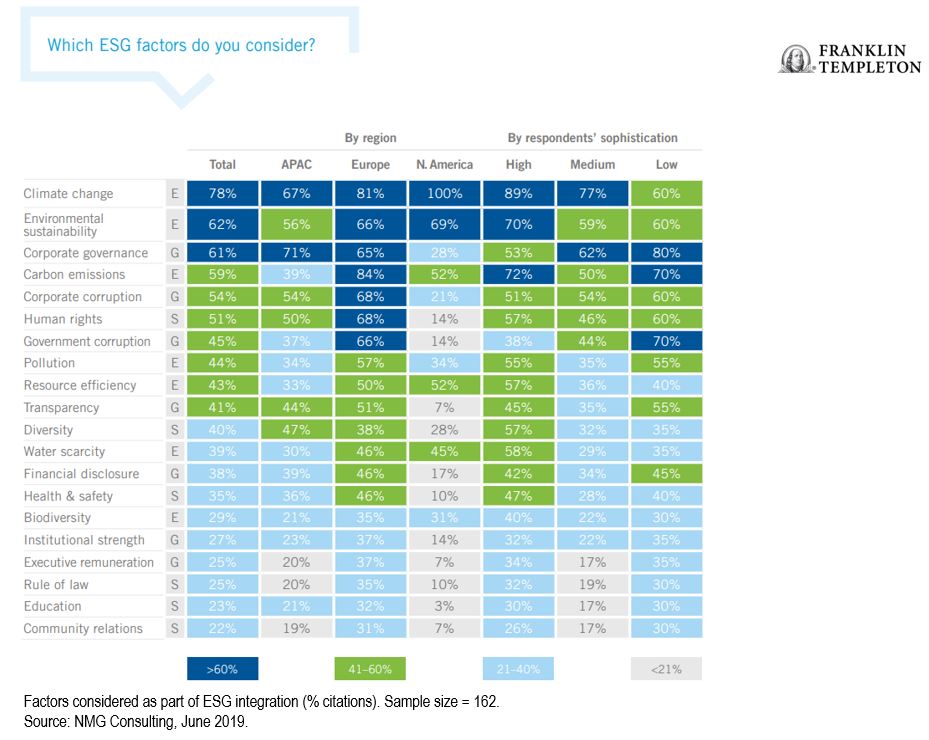

Our study found investors consider a wide range of factors across E, S and G in their investment processes. Asset owners in the earlier stages of ESG adoption are more likely to have an initial focus on governance factors. As investors grow in sophistication, environmental factors start to take precedence in their portfolios, as seen in Figure 3.

Figure 3:

Many respondents measure the carbon footprint of their portfolios and develop climate change risk models to understand how exposed their portfolios are to this. One ESG investor in Asia said: “We can no longer ignore climate change in our risk models. This issue will be something that investors in Asia will examine more seriously”. Investors newer to ESG are likely to place a relatively higher emphasis on governance issues such as transparency in government or corporate corruption.

Theme #4: Filling in Data Gaps

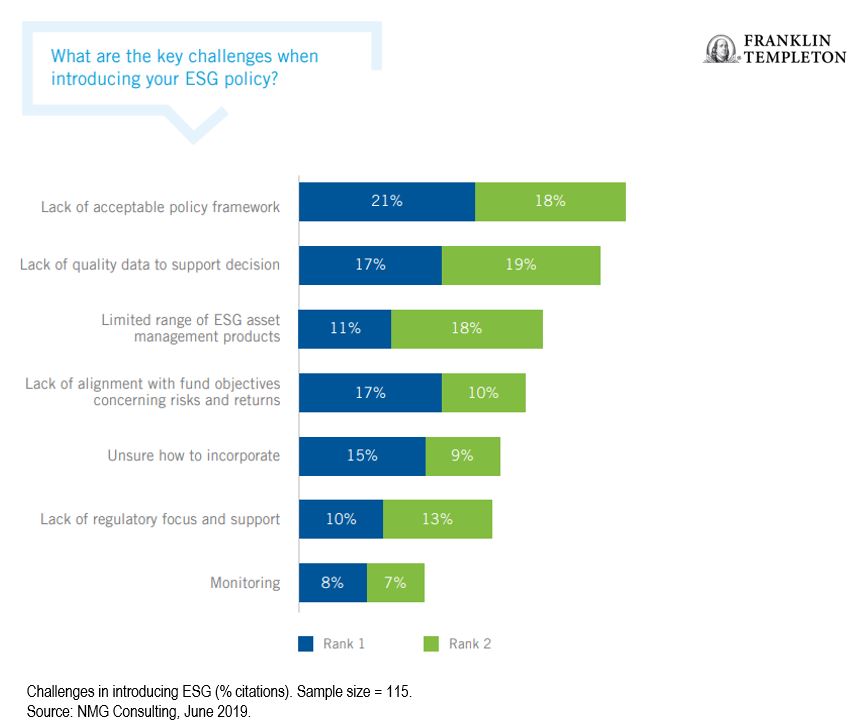

The lack of high-quality data is an impediment to wider ESG adoption. Despite some progress in this area, many investors say they still struggle to find vendors with a full suite of ESG information for prospective investments.

Asset owners scrutinise potential investment candidates, including their suppliers, to ensure they are aligned with, and delivering on, their ESG goals. In some cases, they find discrepancies between a company’s business operations and its ESG goals. As one foundation in North America explained: “We see a number of organisations striving to demonstrate certain virtues, but their investments and actions tell a different story. No data agency has been able to properly score organisations with these conflicting values.”

Figure 4:

The strong demand for better ESG data has created an industry-wide recognition that change is required. Recent initiatives by asset owners have included pressing larger organisations to release information on their carbon emissions and utilisation of fossil fuels, and discussing the formation of open, central repositories of robust and standardised ESG data.

Respondents in all regions expressed support for efforts from voluntary ESG initiatives, acknowledging the need for a focused, structured and well-resourced push to reform ESG data quality. Yet, asset owners understand that voluntary ESG initiatives will not be enough and that local and international regulation will be required. Public policy on issues such as climate disclosure needs to be more clearly defined to allow investors to make better ESG decisions.

Conclusion

Recent and less sophisticated ESG adopters in the study say they need more guidance and direction. Many are struggling to find the best way to integrate ESG considerations into their policy and portfolio construction, and with how to convince sceptical stakeholders of the benefits of ESG.

For inspiration, they look to global ESG leaders. Though ESG leaders say setting an example starts at home, and that it is vital to adopt gold standard ESG practices and principles in their own organisations. This includes seeing ESG values reflected in organisational and employee culture and behaviour. It also involves building participation in groups such as Principles for Responsible Investment (PRI) and the C40 Cities Climate Leadership Group.

Finally, there is engagement with companies on ESG issues. Asset owners want better research and more innovation in order to build confidence that outcomes will match intentions. However, available research can be contradictory, and reporting doesn’t always match asset owners’ real-world assessments. Despite the limitations in data, knowledge and resources, many investors do not question the importance of ESG-related issues and their potential long-term impact on portfolio performance. We believe more discussion is needed to address these issues.

Asset owners deserve to know how their responsible investing choices will impact the performance of their portfolios and asset managers need better tools to apply ESG frameworks to their investment strategies. In our view, the long-term financial outcomes for pension fund members, policyholders and individual investors depend on this.

The full report can be found here (for institutional investors only).

NMG ESG Survey Methodology

Franklin Templeton partnered with NMG Consulting to undertake a comprehensive study of the progress of asset owners in this field. The global ESG study was designed to map the complete adoption journey, with a focus on investors already implementing some form of ESG considerations.

NMG met senior professionals at institutional and wholesale investment companies between April and June 2019 in 21 markets, representing around US$20 trillion in assets.

*****

Important Legal Information

The comments, opinions and analyses expressed herein are for informational purposes only and should not be considered individual investment advice or recommendations to invest in any security or to adopt any investment strategy. Because market and economic conditions are subject to rapid change, comments, opinions and analyses are rendered as of the date of the posting and may change without notice. The material is not intended as a complete analysis of every material fact regarding any country, region, market, industry, investment or strategy.

Data from third-party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user. Products, services and information may not be available in all jurisdictions and are offered by FT affiliates and/or their distributors as local laws and regulations permit. Please consult your own professional adviser for further information on availability of products and services in your jurisdiction.

To get insights from Franklin Templeton delivered to your inbox, subscribe to the Beyond Bulls & Bears blog.

For timely investing tidbits, follow us on Twitter @FTI_Global and on LinkedIn.

What Are the Risks?

All investments involve risks, including potential loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions.

This post was first published at the official blog of Franklin Templeton Investments.