by Sonal Desai, Ph.D., Franklin Templeton Investments

New year, new decade—we’re off to the races. I have a few concerns about 2020, and some ideas on how to make it a successful year from an investment perspective—which I have just shared in Barron’s 2020 Roundtable in New York. But before I delve into that, let me elaborate on the lessons of 2019 and the underlying trends carrying us into the new year.

None of the doom-and-gloom predictions materialised in 2019. Trade tensions did not spiral into out-of-control trade wars; new tariffs affected selected companies and industries, but they did not have a major macro impact. The US economic expansion did not halt—it went on to become the longest in history, with unemployment at a 50-year low. China’s economy did not stall; it just slowed to a still-healthy 6% gross domestic product (GDP) growth rate.

US stock markets had a great year (albeit with a massive assist from the Federal Reserve [Fed]). The S&P 500 Index ended up nearly 30% and the NASDAQ more than 35%—the best performance in six years for both indices—and the Dow Jones Industrial Average gained 22%.1

A Wall of Worries?

The lesson, in my view, is that last year too many people in the media and in the markets worried too much about the wrong things. Here’s what I think we should expect—and in some cases worry about—in 2020:

I believe US politics will be the main source of volatility as we head toward the 2020 US presidential election in November. Some of the leading Democratic contenders have policy platforms that echo the Obama presidency, while others have put forward proposals that would fundamentally alter the business environment with a likely severe negative impact on growth and markets.

Even with a divided Congress, a new administration could enact substantial regulatory changes via executive order—as the current administration has done. I think the extent to which de-regulation measures over the past three years have supported economic growth has been seriously underappreciated—and we are similarly underestimating the negative impact that a rapid resurgence in regulations could have.

On the other side, a second term for US President Donald Trump would most likely involve a continuation of the erratic policy-by-tweet pattern that has already proved so disruptive in terms of market volatility and business investment uncertainty. As the November election draws nearer, I expect uncertainty on the course of future economic policy will weigh more heavily on markets.

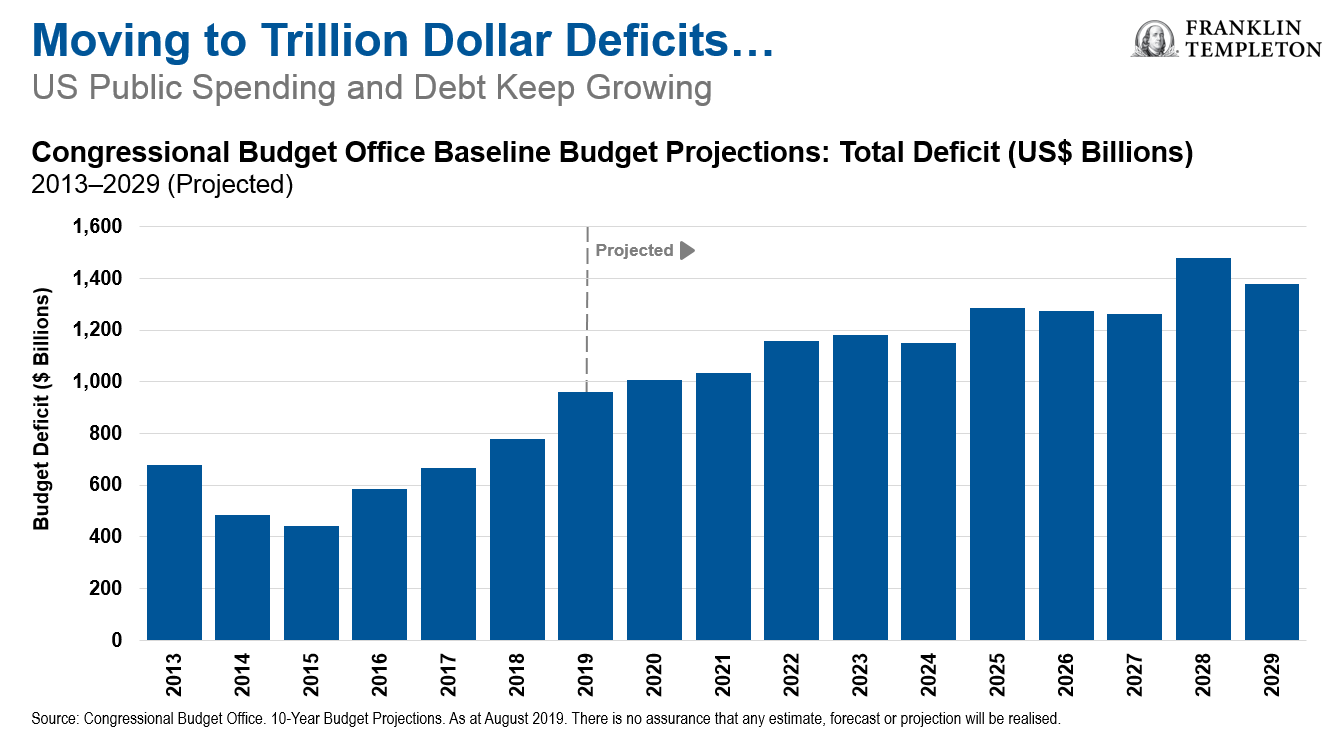

Regardless of who wins, US public spending and debt are likely to keep growing, which would make current US Treasury valuations look even more stretched.

The Markets and the Fed: Tug of War

The tug of war between the markets and the Fed is likely to resume. In 2019, when the markets put the pressure on, the Fed capitulated. Stocks ended up about 30% in a year when corporate earnings were broadly flat, with the Fed’s interest rate cuts playing the determining role. This cannot be a comfortable situation for a central bank.

In 2020, I think the Fed will aim to stay put and keep short term rates anchored at current levels. This will be too accommodative for what I expect to be another year of healthy real US GDP growth, at about 2.5-2.75%. However, the Fed can give itself additional cover with its ongoing monetary policy strategy review—likely to favour some form of average inflation rate targeting, which would imply greater tolerance for a period of above-target inflation.

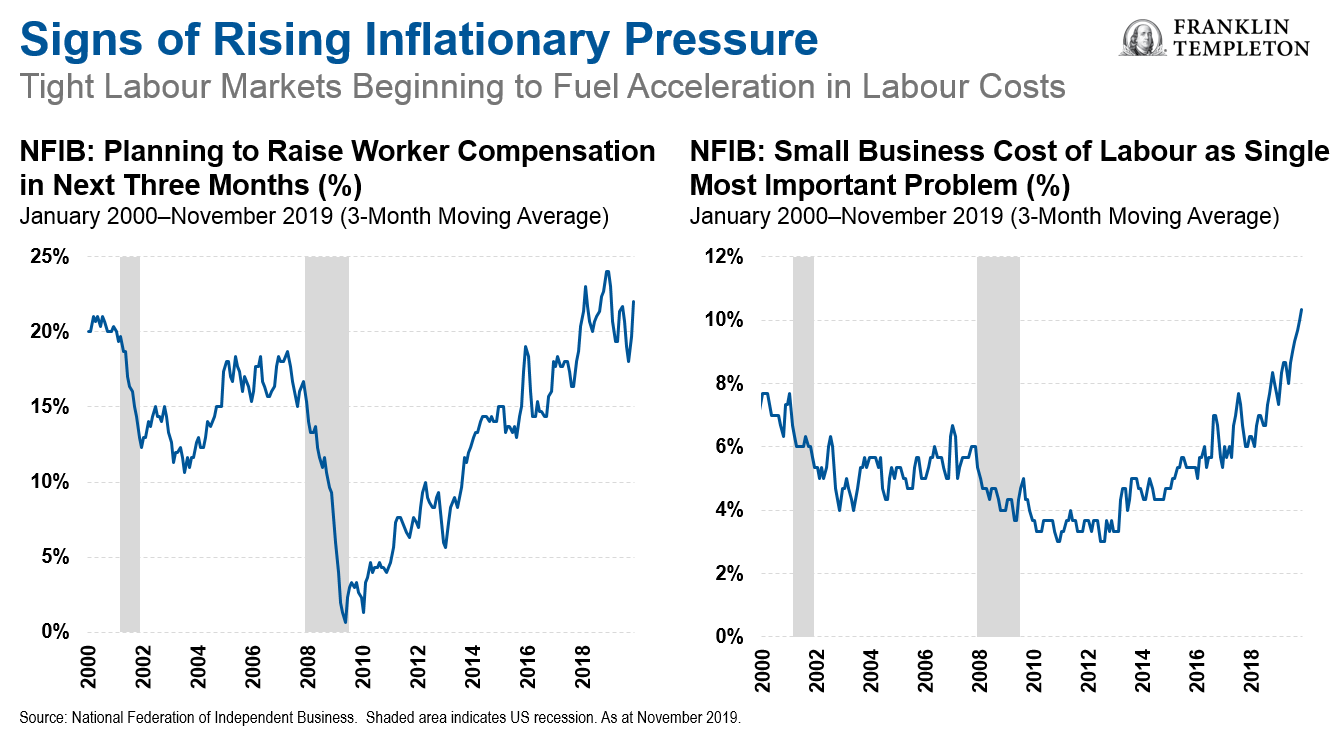

I also expect inflation will rise above the 2% target—the question is by how much. The very tight US labour market has begun to fuel a visible acceleration in corporates’ labour costs. The share of small firms reporting that labour costs are their most important problem is far higher than at any time in the past 40 years.

Even a moderate increase in consumer inflation, if quick enough, might make investors nervous and push long-term rates up more than markets expect. The idea that inflation is no longer a concern, widely embraced by policymakers and analysts, is a dangerous assumption.

Technological changes and globalisation have had a disinflationary impact on goods and services, but there is no guarantee that will last forever. Meanwhile, loose monetary policy has fuelled asset price inflation, confirming that the liquidity does end up causing inflation somewhere.

The current accepted wisdom holds that we are in “Secular Stagnation”, that growth in advanced economies will be perennially slow because weak aggregate demand will depress investment and bond yields forever. It concludes that we need a perennially loose monetary policy and greater public spending—and that these policies carry no risk, since inflation is dead and debt is free.

The period of relative macroeconomic stability from the mid-1980s on known as the “Great Moderation” used to enjoy the same unquestioning acceptance—until it didn’t. Economics has not yet found a convincing explanation of why inflation remains muted even with a record-strong labour market—I think it’s unwise to fully trust something we don’t fully understand.

So, I am concerned by this carefree push for looser monetary and fiscal policy—from top economists like Larry Summers urging us to stop worrying and love the debt, to MMT’s (Modern Monetary Theory) magical thinking that “there is no budget constraint”. We are sowing the seeds of financial instability to be triggered at the first signs that secular stagnation is not so secular after all, but merely another transitory phase.

I also think the discussion on growth prospects has too quickly dismissed the supply side of the equation: because productivity growth has been sluggish over the past decade, many economists have assumed it will always be slow, and have focused on how to boost aggregate demand. This underestimates the potential of digital innovations making their way through all sectors of the economy, from finance to manufacturing.

Here I see an impatient, schizophrenic attitude.

On the one hand, we agonise over the disruption in our own industries, and debate how to handle the imminent automation of most jobs. On the other hand, we assume there will be no positive impact on productivity and growth because we haven’t seen one yet. But implementing these new technologies takes time. It requires new skills, organisational changes, new ways of running and managing the business. It’s true in finance and it’s even more true in industry. It takes time. But it’s already happening.

Nobel prize economist Robert Solow declared in 1987 that “you can see the computer revolution everywhere except in the productivity statistics”; a few years later productivity growth doubled—an important lesson worth keeping in mind today, as other economists compare the hype of artificial intelligence and robotics to the sluggish productivity growth and conclude that new innovations have no growth-boosting power. Adaptive expectations are a dangerous bias.

Trade War Fears Overblown, but Still Rustling

Trade tensions are here to stay. The December “phase one” agreement between China and the United States confirmed that fears of trade wars were overblown—but let’s not take it as a major cause for optimism. President Trump’s 140-character approach to trade policy has been very disruptive, but regardless of how next year’s elections play out, the global trade environment has changed in a structural fashion.

The economic and strategic competition between the United States and China will only grow more intense as China keeps investing in advanced technologies; the global shift to greater nationalism will also prove long-lived. This will not cause trade wars and a global recession, in my view. But from an investment perspective, I expect it will keep impacting specific companies and industries, and it will keep shifting the relative competitiveness and attractiveness of different countries.

What to Expect in 2020

Overall, I do not expect any dramatic shifts in the macro outlook in 2020; if anything, I believe the consensus remains too pessimistic. I think global growth should remain on an even keel, with US GDP growth at 2.5-2.75%, the eurozone around 1% and China around 6%.2

We will again face significant volatility from multiple sources, including political uncertainty, geopolitics and the media’s instinct to hype just about every risk that emerges on the horizon.

How should investors approach 2020? In Part 2 of the Barron’s 2020 Roundtable, which will be published this coming Saturday (January 18, 2020), I elaborate on the investment implications of this complex environment and offer my key recommendations—so stay tuned.

Meanwhile, I wish you all a successful 2020—it definitely promises to be an eventful and interesting year.

Important Legal Information

This material reflects the analysis and opinions of the authors as at 14 January 2020, and may differ from the opinions of other portfolio managers, investment teams or platforms at Franklin Templeton. It is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed and the comments, opinions and analyses are rendered as at the publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market, industry or strategy. The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as of the publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

All investments involve risks, including possible loss of principal.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (FT) has not independently verified, validated or audited such data. FT accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments opinions and analyses in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the US by other FT affiliates and/or their distributors as local laws and regulation permits. Please consult your own professional adviser or Franklin Templeton institutional contact for further information on availability of products and services in your jurisdiction.

What Are the Risks?

All investments involve risk, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Changes in the financial strength of a bond issuer or in a bond’s credit rating may affect its value. Investments in foreign securities involve special risks including currency fluctuations, economic instability and political developments. Investments in emerging market countries involve heightened risks related to the same factors, in addition to those associated with these markets’ smaller size, lesser liquidity and lack of established legal, political, business and social frameworks to support securities markets. Such investments could experience significant price volatility in any given year. High yields reflect the higher credit risk associated with these lower-rated securities and, in some cases, the lower market prices for these instruments. Interest rate movements may affect the share price and yield. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Treasuries, if held to maturity, offer a fixed rate of return and fixed principal value; their interest payments and principal are guaranteed.

For timely investing tidbits, follow us on Twitter @FTI_Global and on LinkedIn.

1. Indices are unmanaged and one cannot invest in them. They do not include fees, expenses or sales charges. Past performance is not an indicator or guarantee of future results.

2. There is no assurance that any estimate, forecast or projection will be realised.

This post was first published at the official blog of Franklin Templeton Investments.