by Hubert Marleau, Market Economist, Palos Management

In the past few weeks, we’ve been bombarded with annual stock market forecasts for 2020. One should not be put to shame for not keeping up year-in and year-out with the best performing bet. It’s sheer madness to have a myopic view because even the best long term strategies will never be the best performers in any given year.

The percentage of all trading days throughout the S&P 500’s history since 1928 that have been up days is 52%. Bespoke calculated that even though just barely more than 50 % of trading days have been up, it has translated into an enormous yearly market return of 18,157%. William Bernstein, a very savvy investor, said: “Investment wisdom begins with the realization that long-term returns are the only ones that matter.” It’s not that market forecasts are unimportant. But the true colour comes out through time as a result of astute asset allocations. The stock market finished 2019 with a 28% gain. In the past eleven years, the stock market brought investors double-digit gains eight times.

The big question is whether another gain is in the cards for 2020. There is no easy answer. Ben Carlson, author of “A Wealth of Common Sense”, made the astute observation that the stock market has generally gone up following almost any type of market environment--roughly 3 out 4 years going back 95 years. Since 1926 on average, the S&P 500 had an overall year-over-year return of 11.9%, 11.7% following an up year, 13.1% following a down year, 11.5% following a double digit gain, 10.1% following double-digit losses and 14.1% following a single-digit gain or loss. While the statistics look great, it does not mean that there are no drawdowns. Bespoke Investment Group also pointed out in a recent report that the average drawdown in any given year since 1926 has been 16.3%, and in 58 of the last 95 years, there has been a decline of at least 10%.

The maximum drawdown for 2019 was less than 7%. However, one should not forget that the S&P 500 dropped 19.8% inside of three months in the latter months 2018. If it had not been for the 2018 fourth quarter debacle, the S&P 500 would have been up only8.0% year-to-date. For a variety of reasons like rising recession fears, the tightening stance of the Fed, lack of liquidity, an aging bull-run and growing trade disputes perfectly dovetailed with the end of the calendar year. About 90% of the powerful recovery in 2019 was a recapture of what was lost in Q/4 of 2018.

Assuming that the economy keeps rolling out a growth path of 2.0% under limited inflationary pressures while the cost of money stays about where it is now and the dollar rolls over, my preferred valuation metrics like the Rule of 20, the Fed Model, real earning yield and the Yardeni misery model, while more elevated than year ago, are reflecting historical averages and are just about right.

Back to the question: Will the market keep on posting new gains in 2020? It’s anybody’s guess and no one really knows. Yet, forecasters are out with their predictions. Ten macro-strategists recently surveyed by Barrons, produced a muted outlook for 2020. They see no recession for 2020, a return to earnings growth and stable interest rates. While the range of forecasts for the S&P 500 run between 3100 and 3500, the average is around 3325. That comes to a rise of 3.0%.

If one were to add a dividend layer of 2.0%, stocks could deliver a total return of 5.0% in 2020. It should be noted that industry analysts who make bottom-up target prices by aggregating company-level estimates have a similar prognostication. They expect a closing value for 2020 will be 3300. As a matter of fact, the BofA global fund manager December survey confirms that the bulls are back. The survey respondents now see rising profits in 2020 for the first time since August, pricing out the recessionary odds. A big reversal from the bearish sentiment of last June.

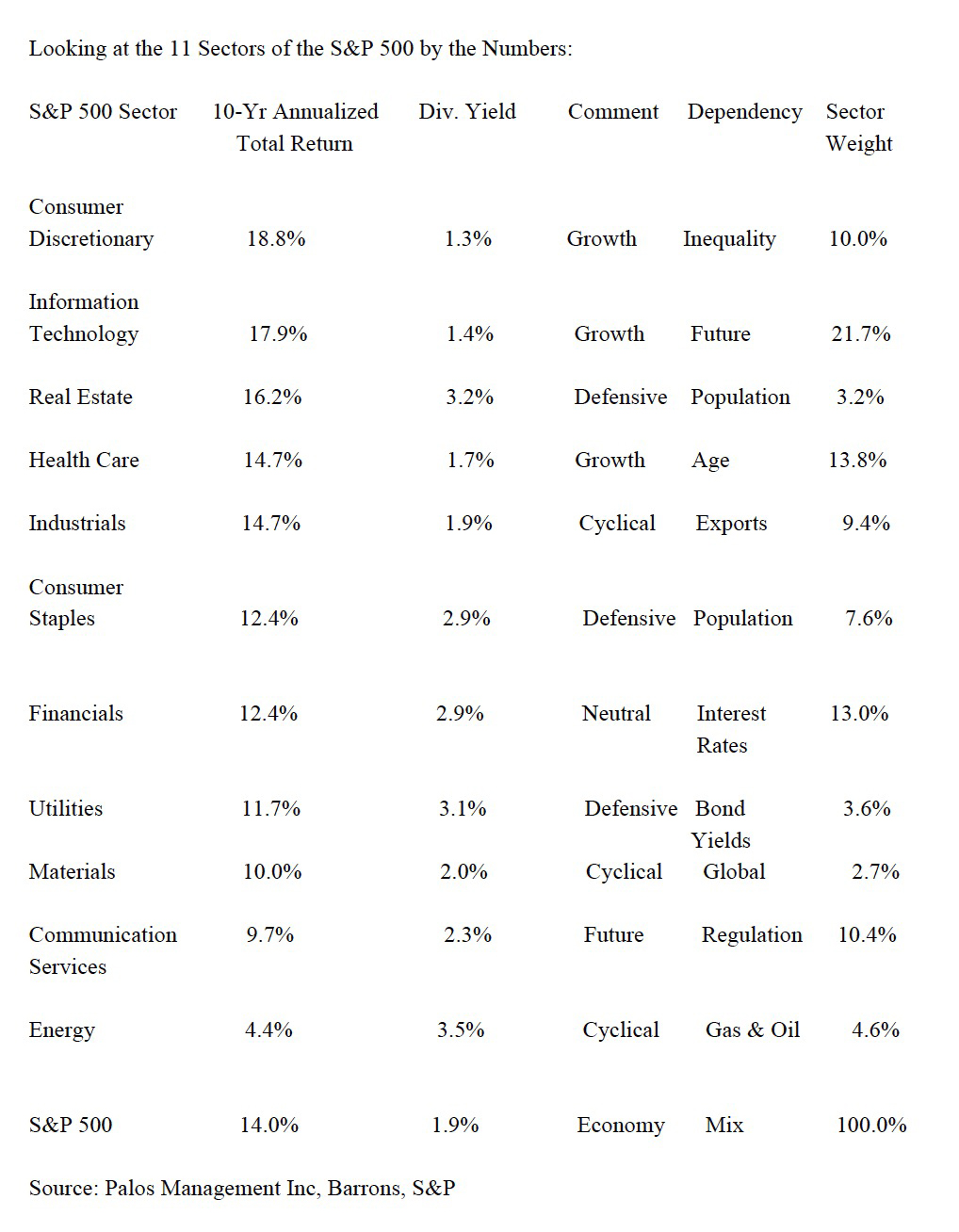

Interestingly, the forecasters have an almost unanimous preference for the Financial and Health Care sectors. Other favourites are the Industrial, Energy, Materials, Consumer Discretion and Technology. Few forecasters like Consumer Staples, Utilities, Real Estate, and Communication Services. The consensus narrative for 2020 has coalesced around the point that the large number of global interest rate cuts and an abatement of trade tensions will together usher in a sustainable pro-cyclical rotation.

While I go along with the commodity-reflation story, it’s not blind faith. Investors can easily get swept up in this new trend of thought for “fear of missing out” and disbelieve prior market zeitgeist that economies are in an end of cycle slowdown heading into recession. What has partly happened is that many investors have come around to the idea that the world is not ending. Accordingly, portfolio adjustments are taking place, taking advantage of cheap cyclical industries. As I pointed out in previous missives, there are numerous commodity-reflationary catalysts that strongly suggest that one ought to overweight portfolios with pro-cyclical positions.

I also like international companies whose profit margins are secure because they have a lot of pricing power or are insulated from cost push pressure. Companies with low labour content that are in a monopsony (market power over labour as being the only employer) or enjoy being in a monopolistic, duopolic or oligopoly situation (one or few sellers facing many buyers) that can benefit from a lower value dollar could do relatively well.

Unfortunately, the aforementioned outlook for equity prices is not bulletproof. Many political and/or economic things could go wrong. This is why I’m keeping an exposure in traditionally defensive sectors that act as good bond proxies. I think that the best way to monitor how the macro narrative will evolve in 2020 is to closely watch the forex and bond markets. The bottom line is that the equity market would love it if the dollar were to move a bit lower with few changes in real rates. There are many “What If’s” that could screw this up, but fortunately not very likely.

The catchphrase on which the current narrative based is Jerome Powell’s belief that the economy is in a “good place”. It means that monetary policy is appropriate and a material reassessment of the outlook like a sharp rise in inflation or a major slowdown in growth, would be needed in order to put rate changes back on the table. Clearly the market reaction would be bad. While the bar for monetary policy changes is high, it's not impossible. However, scenarios that may not seem plausible right now could happen including the election variable. There is no need to enumerate all the infinite permutations of “What If” scenarios. The combination of movements in the DXY and in the ten-year bond yields will tell if the prevailing story will hold. Below are a few key examples:

-

- • If the dollar strengthened because U.S. growth was doing better than the rest of the world while U.S. bond yields were to fall because U.S. growth had fallen below a tolerable threshold, stock prices would likely trend lower.

• If the dollar weakened because the U.S. growth had not done as well as the rest of the world while the U.S. bond yields were increasing because U.S. inflation had risen to an intolerable level, stock prices would tend to trend lower.

• If the dollar strengthened because U.S. inflation had risen faster than in the rest of the world while U.S. bond yields were rising because U.S. growth had risen far too fast, stock prices would likely become very volatile.

• If the dollar weakened because the U.S. inflation had fallen faster than in the rest of the world while U.S. bond yields were falling because growth had fallen to an intolerable level, stock prices would fall.

I could go on for an eternity with all kinds of unlikely but possible scenarios. Suffice it to say that the aforementioned ones are not in the cards. Yet the possibilities warrant some attention. Things have a tendency of changing fast. In this connection, it would be foolish for investors to only watch the stock market for clues. A big change in real yields, up or down, accompanied with a dramatic upward move in exchange value of the dollar and or a restoration of yield curve inversions would telegraph a bad message.

As the year progresses, I will do my best to inform you of what is going on and hopefully interpret what will go on correctly.

Looking at the 11 Sectors of the S&P 500 by the Numbers:

Copyright © Palos Management