by Eric Winograd, AllianceBernstein

The US Fed held rates steady in December and plans to continue that stance through 2020. But a lot can happen to change the Fed’s mind—after all, it entered 2019 expecting to hike rates and ended up with three cuts. What does 2020 have in store?

The outlook is unusually cloudy. Geopolitical events like the US-China trade war could reignite, and the looming US elections, with every House seat, 35 Senate seats and the presidency on the ballot, could leave the US economy and financial markets on volatile ground.

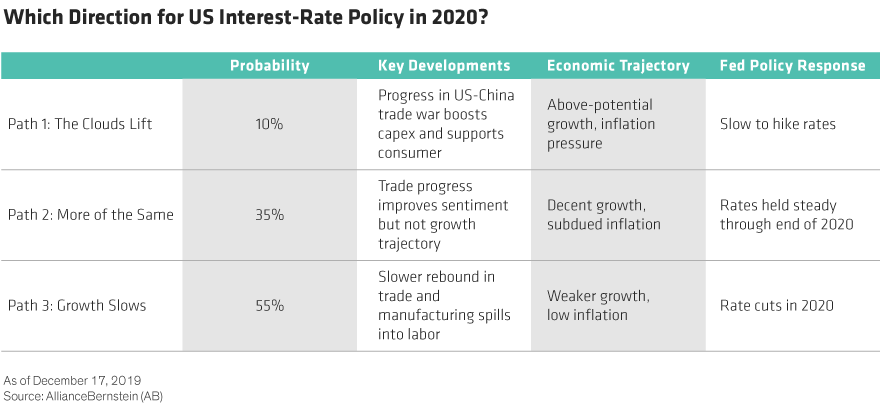

Given the substantial amount of uncertainty, we don’t think it’s practical to put a single forecast on the Fed’s policy actions for 2020. We think a better approach is to establish a range of scenarios and what the Fed might do in each case. As the year progresses, we can better evaluate which path the US economy is on and update expectations accordingly.

As we see it, there are three main paths that could influence the Fed’s next moves (Display).

Path One: The Clouds Lift and Growth Picks Up

The recent Phase One US-China trade agreement could prompt businesses to reboot investment spending, a major culprit behind the late-2019 economic slowdown. If investment picks up, consumer spending should remain strong and the economy could top its 2.0% growth potential in 2020. Strong growth and strong labor markets could heat up inflation, leading to rate hikes.

We agree that the economic outlook has become somewhat brighter lately, but we still think inflation will remain subdued. Even if it does perk up, we think the Fed will see this as a desirable outcome, and will still be very slow to raise interest rates. For that reason, we have a relatively low probability on this scenario. Probability: 10%.

Path Two: More of the Same—With the Fed on Pause

In the second scenario, the positive trade news would improve sentiment—but not by enough to push the US economy into a faster growth trajectory. Gross domestic product growth would be decent, but not strong enough to raise inflation. In this path, 2020 would essentially look a lot like 2019—with solid though unspectacular growth and little upward price pressure.

This outcome is the Fed’s base-case scenario. If it plays out, officials expect to leave rates alone throughout 2020. The probability of this scenario has risen in recent weeks, but we’re not quite as confident in it as the Fed is. This path also presumes no new or renewed shocks that hurt the US economy, and we think that’s an optimistic take. Probability: 35%.

Path Three: Growth Slows and the Fed Steps In

Manufacturing and trade may not rebound quickly—either because of trade wars, rising political uncertainty, or simply a still-weak global economy. In this event, we’d expect trade and manufacturing weakness to eventually spill over into labor. Even slight jobs weakness would be enough to slow the broader economy, because strong employment has fueled consumption—the key growth driver in 2019.

While we don’t expect a sharp deceleration, some weakening is more likely than not. Inflation will likely remain low, so we think the Fed will quickly counter signs of labor weakness with rate cuts. It’s very hard to know how many rate cuts this would entail—the Fed will probably start reductions when the labor market starts to wobble and keep cutting until it bounces back.

The labor market is strong right now, so if rate cuts happen, they probably won’t start for at least a few months. But some weakening, which would spill over to consumption, is more likely than not. That’s why we assign the highest probability to this path: the Fed resuming rate cuts in 2020, with the total number of rate reductions determined by when the cuts begin. Probability: 55%.

If we weight these three paths by their respective probabilities, the central tendency of our forecasts is for one to two 2020 rate cuts. However, given the cloudiness involved with forecasting 2020, it’s a better idea to watch the US economy in the near term to determine which of the three paths it’s on. Armed with a clearer view, we’ll be better able to formulate more concrete expectations for Fed policy.

Eric Winograd is a Senior Economist at AB.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

This post was first published at the official blog of AllianceBernstein..