This week’s trading in North American equity markets has been relatively quiet so far but a number of looming deadlines and developments, particularly related to global trade, still have the potential to move stocks and commodities in the coming days.

The Fed’s final meeting of the year was a non-event. The US central bank confirmed its recent program of interest rate cuts is over for the foreseeable future with no members seeing another cut through the end of 2022 at least. For next year, 12 members expect interest to hold steady through the year and 4 members are forecasting one interest rate increase. Recent economic data including nonfarm payrolls and consumer price inflation were higher than expected supporting the Fed’s neutral stance.

Trade news has been mixed. The battle over impeachment in the US didn’t stop Congress and the White House from finalizing the USMCA trade deal with Canada and Mexico and sending it to legislatures for final ratification. On the other hand, US-China trade talks still appear to be dragging on. The US has threatened to raise tariffs against China if the Phase One deal isn’t finalized by Sunday. Whether a) a deal is reached by Sunday, b) enough progress is made that the US delays the implementation of new tariffs, or c) the US proceeds with new tariffs, could have a significant impact on the direction of stocks and markets in the coming days. Note that expectations of a deal or at least that the tariff truce will continue have underpinned market gains in recent months, so any signs of things going off the rails could be bearish.

Today the UK is holding a Parliamentary Election with Brexit the main issue. Over the campaign, support has coalesced around the two main parties with the pro-Brexit Conservatives leading over Labour, and smaller parties seeing their support evaporate. Parliament has been deadlocked since the last election in June of 2017 so investors appear to be at least looking for someone to win decisively enough to move forward and end the twisting in the wind which has hurt the UK economy. Depending on the result, we could see swings in UK stocks, European Stocks, the British Pound and the Euro. Today is also new ECB President Lagarde’s first meeting so investors may looks for signs of what tone she plans to set for her administration.

In this issue of Equity Leaders Weekly, we look at what market action in Copper and in global communications stocks are telling us about expectations for the global economy heading into 2020.

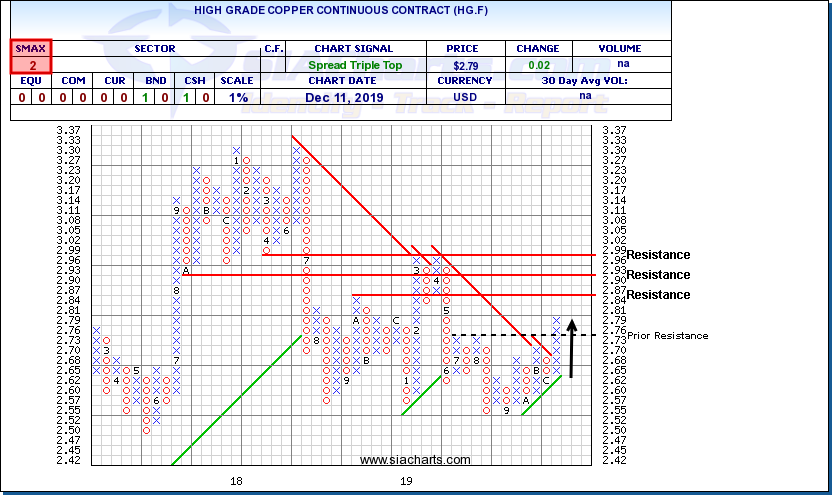

Copper Continuous Contract (HG.F)

With so many widespread uses in electronics, construction and other industries, the orange metal’s sensitivity to economic conditions has earned it the nickname “Dr. Copper, PhD in Economics”. Copper (HG.F) has spent most of the last two years in the doldrums, impacted by the trade wars that have slowed trade flows and economic activity around the world, particularly China.

Copper bottomed out back in September and this month, it has turned decisively upward, snapping out of a long-term downtrend and then breaking through $2.75 to complete a large (11-column wide) Spread Triple Top base to signal the start of a new uptrend. Next potential resistance appears near $2.87 then the $2.93 to $3.00 area, based on previous column highs and lows and a round number. Initial support moves up to the $2.73-$2.75 area near the recent breakout point.

Copper’s accelerating recovery suggests that investors are starting to see or anticipate a recovery in global economic activity and resource demand heading into 2020, which could have wider bullish implications for Commodities and International Equities.

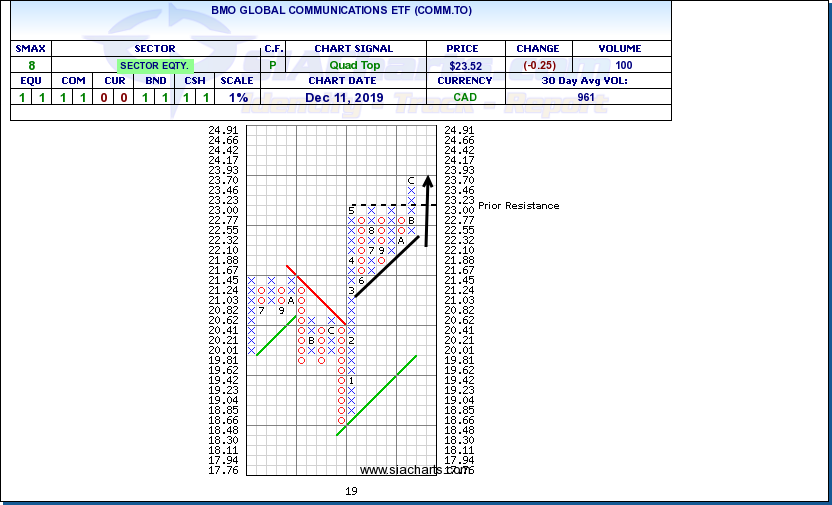

BMO Global Communications Index ETF (COMM.TO)

BMO Global Communications Index ETF (COMM.TO)

The BMO Global Communications Index ETF (COMM.TO) holds a basket of stocks from around the world related to communications including cable, telephone and wireless carriers, internet/social media companies, smartphone producers, video game producers and others. The basket is weighted approximately 67% US, 10% Japan, 4% Canada and 19% ROW.

This portfolio, which consists of companies with global operations and companies from around the world operating locally, provides some insight into consumer demand for information and entertainment from around the world.

After rallying to start the year, COMM.TO consolidated between May and November. In recent weeks the ETF has attracted renewed interest, and just completed a classic, textbook, Quadruple Top Breakout from a pattern of consistently higher lows, a sign of accelerating accumulation. This rally indicates improving sentiment toward the global communications sector which could also be read as improving sentiment toward the global economy.