Fixed Income Year-in-Review

Five themes you may (or may not) have noticed in 2019’s fixed income markets

by the Active and Strategic Fixed Income team, Jean-Guy Mérette, Vice President and Portfolio Manager, Fiera Capital

DECEMBER 2019

1 YIELD CURVE INVERSION

Past performance is not indicative of future results

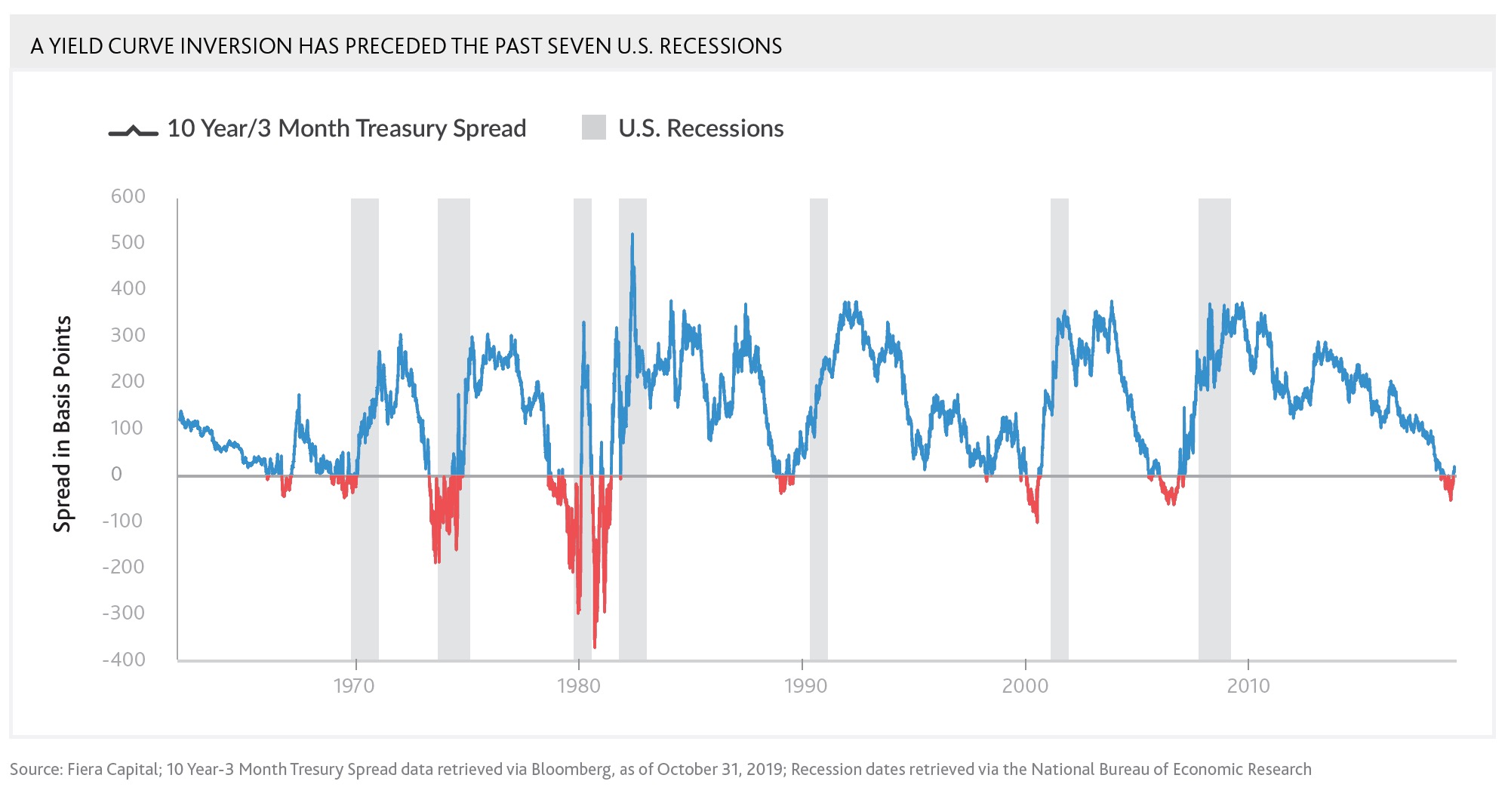

On March 22, 2019, a phenomenon not seen since the financial crisis hit the market: the yield on the U.S. 10-year note fell below that of three-month bills. An inverted yield curve is considered to be a leading indicator of a recession since over the past 50 years, all seven major U.S. recessions have been preceded by an inversion of this key segment of the yield curve. “This time it’s different” is what we’re being told. But why is it different?

In the past, recessions have been caused by major global issues such as very high inflation in 1970s and 1980s or asset bubbles in late 1990s (tech) and in mid-2000s (housing). What’s clear this time around is that the primary driver of this year’s inversion and recession fears is market anxiety surrounding the U.S.-China trade war. Undoubtedly, this risk has the capacity to derail the economy. But the fact is that in the U.S., the unemployment rate is still near historic lows, inflation is close to the central bank target of 2%, and consumer spending is healthy. In short, notwithstanding the trade war, the economy, though slowing, is still near potential.

In the past, recessions have been caused by major global issues such as very high inflation in 1970s and 1980s or asset bubbles in late 1990s (tech) and in mid-2000s (housing). What’s clear this time around is that the primary driver of this year’s inversion and recession fears is market anxiety surrounding the U.S.-China trade war. Undoubtedly, this risk has the capacity to derail the economy. But the fact is that in the U.S., the unemployment rate is still near historic lows, inflation is close to the central bank target of 2%, and consumer spending is healthy. In short, notwithstanding the trade war, the economy, though slowing, is still near potential.

In our view, the correlation between the escalating tariff war and rate cut anticipations was too high in 2019 – at one point in August, as many as five rate cuts were partly priced-in by the market in response to potential new tariffs announced by both Washington and Beijing. We know it’s common practice in the fixed income world to always price the maximum risk, but we think bond market participants too-quickly discounted or just ignored the hard data. The fact is that there are major differences between “insurance cuts” and “recession cuts”.

2 INTEREST RATES BELOW ZERO

Don’t be so negative!

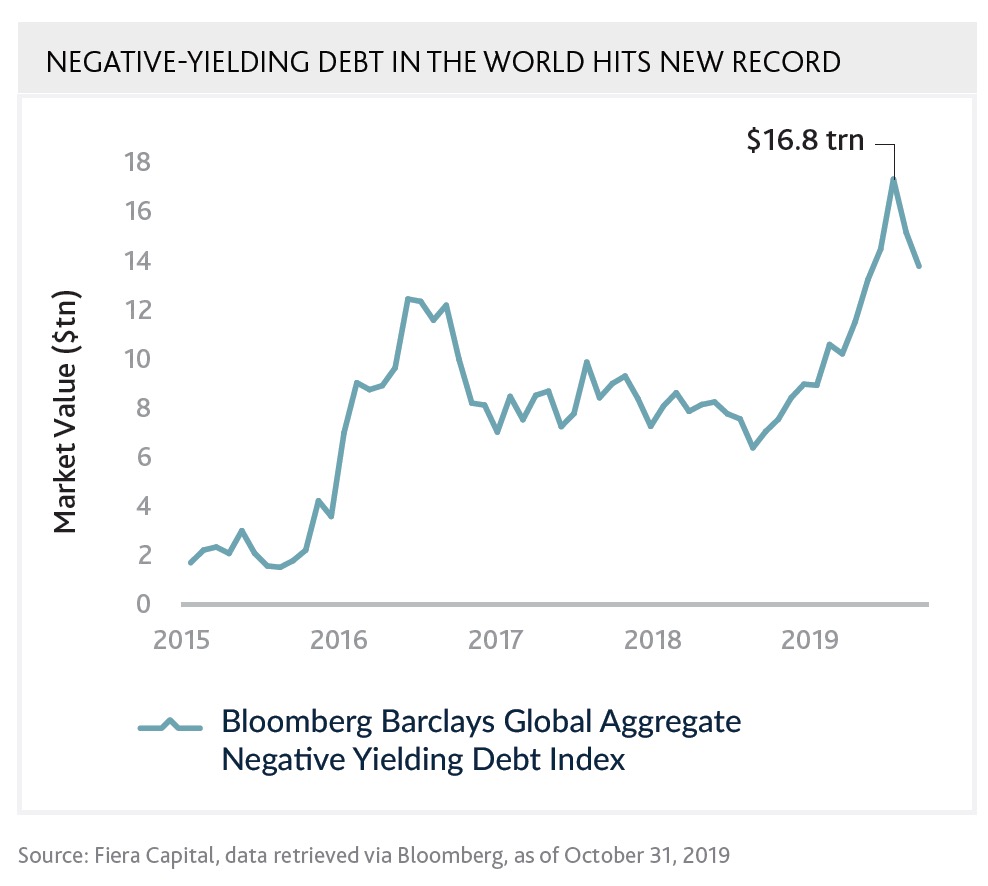

Negative rates in Europe were a major storyline this year. Sure, government yields across Europe are below zero, but even we were surprised to see some corporate bonds and even mortgage rates go negative, a first in history. With the ECB promising in September to buy €20 billion of sovereign bonds per month indefinitely, the two major questions one needs to consider are, “How much lower can European yields go?” and “Will we see the same thing in North America?”. Of course, no one can tell you the answer, but we have some thoughts.

Regarding the first question, it’s important to note that the ECB has a self-imposed limit of how much of a country’s debt outstanding it can hold – one-third to be exact – and some sources claim the bank has barely a year before it hits its threshold for German bonds. And the normally collegial Governing Council had some dissenting opinions on the decision to engage in the bond purchase program, noting that it should be used only in emergency situations. Unfortunately, this begets another question: If a recession officially hits Europe, what ammo does the ECB have left?

Turning to North America, no one can rule out the possibility of the Federal Reserve eventually moving into negative rates territory. What we know is that multiple Fed officials have expressed their desire for rates to stay above zero (despite Mr. Trump’s wishes), with some even publicly doubting the efficacy of negative rates to stimulate the economy. Moreover, at its October meeting, the Fed hinted that the rate cut would be its last until it could assess the impact of the 3 rate cuts. Considering the relatively strong state of the domestic economy, we doubt negative rates are on the near- term horizon.

3 THE FEDERAL RESERVE BALANCE SHEET

An economic experiment

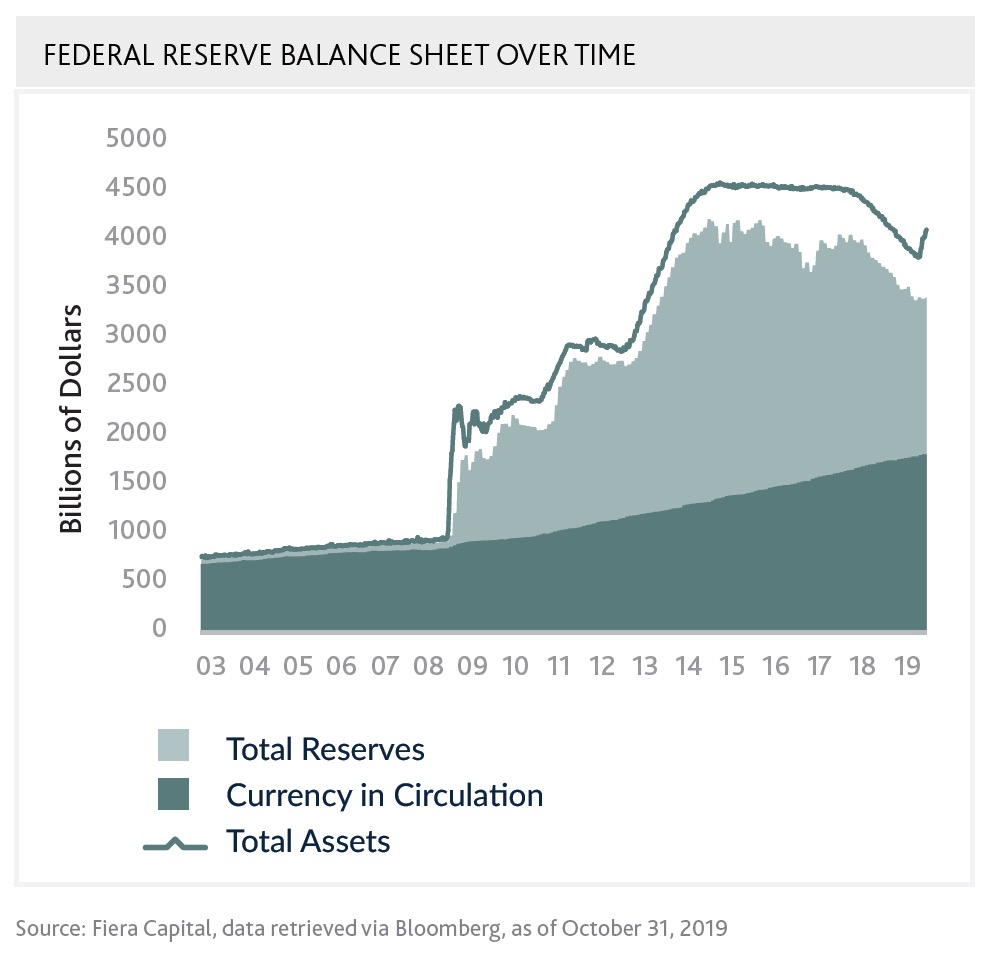

In October 2017, the Federal Reserve began letting Treasuries and Mortgage-Backed Securities on its balance sheet roll off rather than replacing them, as continued stimulus wasn’t warranted. This year, the bank shifted its stance and cut interest rates three times in a bid to prolong the expansion. Moreover, in September, the Fed started expanding its balance sheet at $60 billion per month, yet this time around, its motivation wasn’t to stimulate but rather, more technical in nature.

When the Fed began shrinking its balance sheet in 2017, it was in uncharted waters – at $4.5 trillion, it had never been this big, and thus shrinking it was basically a massive field experiment on the American economy. By decreasing its assets, the Fed was also reducing commercial banks’ excess reserves – money on which the banks rely heavily for liquidity purposes – which is a liability for the Fed.

When the Fed began shrinking its balance sheet in 2017, it was in uncharted waters – at $4.5 trillion, it had never been this big, and thus shrinking it was basically a massive field experiment on the American economy. By decreasing its assets, the Fed was also reducing commercial banks’ excess reserves – money on which the banks rely heavily for liquidity purposes – which is a liability for the Fed.

Yet at the same time, another liability account – currency in circulation – was growing at a faster pace than in the decade earlier, leading to further decreases in bank reserves. In selling off assets and thus decreasing excess reserves, no one really knew how far the Fed could go without doing damage to the money market. That question was answered on September 16th, 2019, when repo rates soared by 600 bps in a veritable cash crunch. Realizing that it has to keep a larger level of assets than originally planned, the Fed was forced to step in to provide much-needed emergency liquidity and, in the days that followed, announced a $60 billion per month Treasury-buying program.

One of the reasons behind the 2017 balance sheet reduction was to give the Fed some room to manoeuvre should it have to engage in a new round of QE in the event of a recession. If that happens, its first move would likely be to lower rates, but it has less ammo this time around – when the financial crisis hit in 2007, the Federal Funds rate was at 5.25% and today, it’s 1.75%. Thus, the bank only has so many cuts before it would have to move rates into negative territory, something that Fed officials have said they are not keen on doing. Should the doomsayers be correct, the Fed will have the choice of two unprecedented paths: a balance sheet over $4.5 trillion, or negative policy rates. Either way, it will be another experiment for the Fed with the guinea pig being the American economy.

4 U.S. TREASURY VOLATILITY

A roller coaster ride

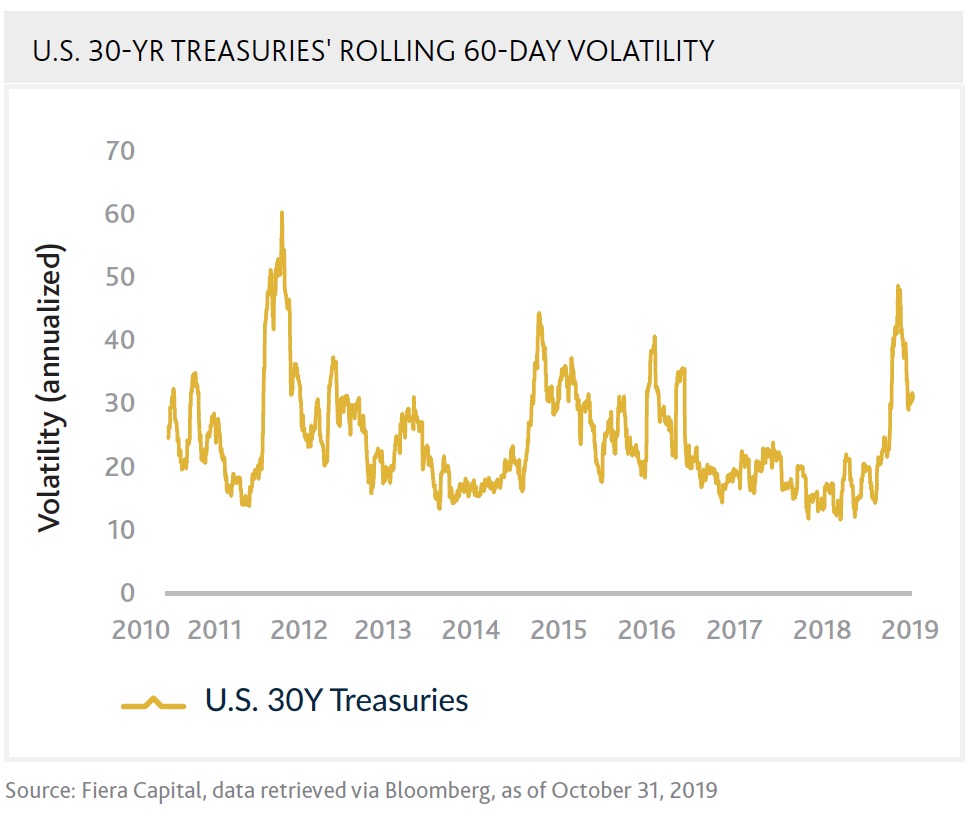

In 2019, yield volatility reached levels unseen since 2011, with rates becoming particularly choppy during the third quarter, as investors digested a flurry of headlines surrounding the U.S.-China trade war. After hitting an all-time low of 1.95% on August 27th, the 30-year rate rebounded by more than 45 bps in only 2 weeks to 2.37%, and then gave back 35 bps by October 4th. The Fed cutting rates three times fueled the downward trend but fears of a recession were front and centre as well. What’s worrying is that when we compare this year’s drama to previous periods of heightened volatility (specifically, 2011 and 2015), it’s the first time that the source of the volatility is U.S. economic growth.

At the peak of the European debt crisis in 2011, Portugal, Ireland, Italy, Greece and Spain were at the brink of default and yields were rising across the Eurozone. At the same time, U.S. Treasury yields fell to historically (at that time) low levels as a result of a global flight to safety. In the 2014-2015 episode of volatility, the ECB lowered its benchmark rate below zero for the first time, and with the Fed target rate at 0.25%, investors feared that a negative rate policy could become a possibility in the U.S as well, despite the strength of the U.S. economic outlook. In both cases, the fundamentals in the U.S. prevailed over the outside noise, and yields quickly returned to levels which reflected the growing U.S. economy.

In 2019, however, market volatility is being driven by the trade war and its potential impact on the U.S. manufacturing sector, inflation and consumer purchases. Coupled with the fact that the economy has experienced one of its longest periods without a recession on record, it’s fair to say that the underlying root cause of the Treasury volatility is worries about a potential downturn. We don’t pretend to know if a recession is right around the corner. But, we’d wager that with China and the U.S. still far from signing a complete deal – despite what the rumour mill may have to say – volatility is here to stay for the foreseeable future.

5 GREEN BONDS

Waiting for the green light

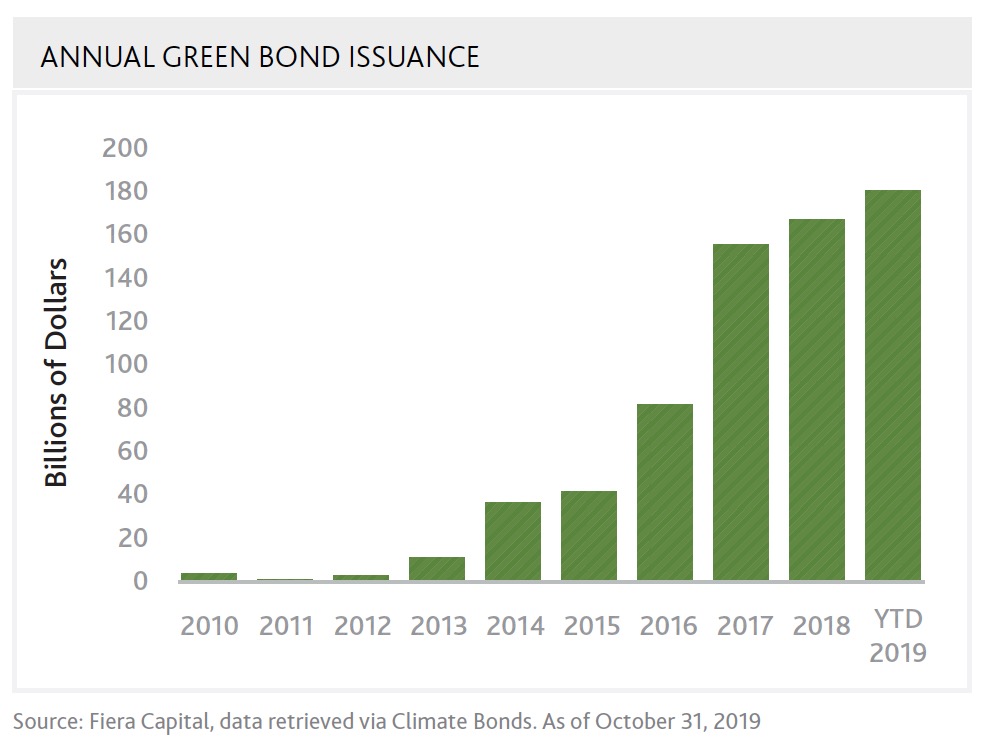

Climate change drew significant attention in 2019, and investors were not blind to the call to action; asset managers the world over are adapting to the increasing demand for sustainability solutions. Notably, Norway’s KLP – one of the largest pension funds in the world – made news when it announced that it sold all of its holdings in companies deriving their income from oil sands. In the realm of clean investing, of particular interest to us is the Green Bond market. At about a half-trillion U.S. Dollars outstanding, Green Bonds – debt issued by corporations, governments and supranational agencies specifically to finance climate or environmental projects – are but a drop in the bucket of the $100 trillion global bond market. Yet they have been attracting significant attention of late: in the first three quarters of 2019, Green Bond issuance of $190 billion has already surpassed that of full year 2018, and is projected to be at $250 billion by year’s end.

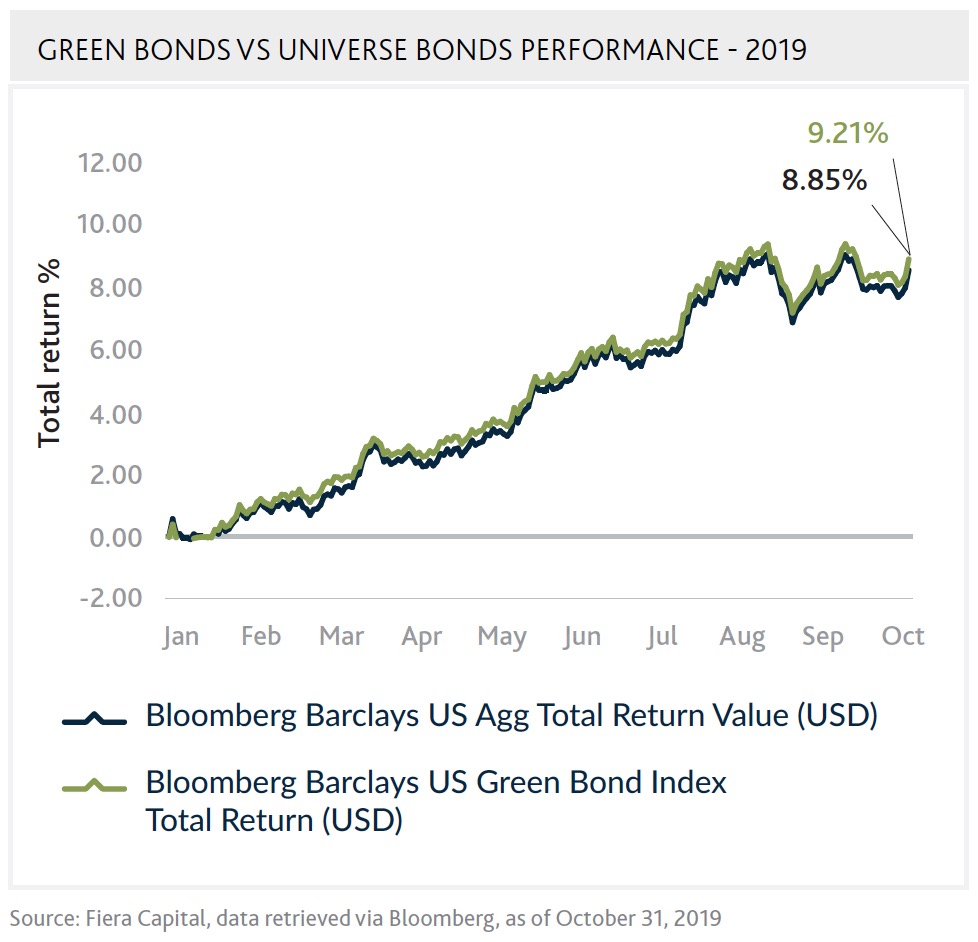

For sure, challenges still remain for Green Bonds to be considered mainstream. For one, lack of supply and issuer variety have been major impediments to the growth of the asset class. But with the aforementioned increasing interest among investors, this is beginning to shift: this year, Pepsi and Apple issued Green Bonds with strong investor demand. Moreover, there is also a stigma that investing in green assets means sacrificing returns and/ or moving up the risk spectrum. But the fact is that Green Bonds are backed by the general creditworthiness of the underlying issuer and rank pari passu to other unsecured debt; thus, they have the same risk as any other bond issued by the company or organization in question. And with the same risk profile, it’s understandable that Green Bonds trade with a very similar return and risk pattern as traditional bonds.

There is a small catch - while we’re starting to see increasing volumes in Europe and in the U.S., the Green Bond market is still somewhat too fringe for us to give them the green light. That said, with risk and return on par with traditional corporate bonds, we don’t see any reasons not to own them if and when the market matures. For the environment’s sake, keep them on your radar.

Jean-Guy Mérette, Vice President and Portfolio Manager, Active and Strategic Fixed Income Team Fiera Capital.

*****

IMPORTANT DISCLOSURES

This information is prepared by Fiera Capital Corporation ("Fiera Capital") and is intended for use by residents of Canada only. The information and opinions expressed herein are provided for informational purposes only, are subject to change and should not be relied upon as the basis of any investment or disposition decisions. Past performance is no guarantee of future results. All investments pose the risk of loss and there is no guarantee that any of the benefits expressed herein will be achieved or realized. Valuations and returns are computed and stated in Canadian dollars, unless otherwise noted.

The information provided herein does not constitute investment advice and it should not be relied on as such. It should not be considered a solicitation to buy or an offer to sell a security. It does not take into account any investor’s particular investment objectives, strategies, tax status or investment horizon. There is no representation or warranty as to the current accuracy of, nor liability for, decisions based on such information. Any opinions expressed herein reflect a judgment at the date of publication and are subject to change. Although statements of fact and data contained in this presentation have been obtained from, and are based upon, sources that we believe to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed. No liability will be accepted for any direct, indirect or consequential loss or damage of any kind arising out of the use of all or any of this material.

Views expressed regarding a particular company, security, industry or market sector should not be considered an indication of trading intent of any funds or accounts managed by any Fiera Capital entity. Each entity of Fiera Capital only provides investment advisory services or offers investment funds in the jurisdictions where such member and/or the relevant product is registered or authorized to provide such services pursuant to an exemption from such registration.

Copyright © Fiera Capital