by Craig Basinger, Chris Kerlow, Derek Benedet, Alexander Tjiang, RichardsonGMP

Modern Portfolio Theory has its foundation in the work of Harry Markowitz highlighted in his 1952 paper “Portfolio Selection.” Markowitz effectively argued that the risk and return of an investment should not be viewed in isolation. Further, he illustrated that diversifying a portfolio across more asset classes offers the proverbial free lunch for investors, reducing risk without reducing return expectations or enhanced returns with the same expected risk. This Nobel Prize-winning work guided asset allocators for years on how to mix stocks and bonds to achieve a targeted level of risk and returns.

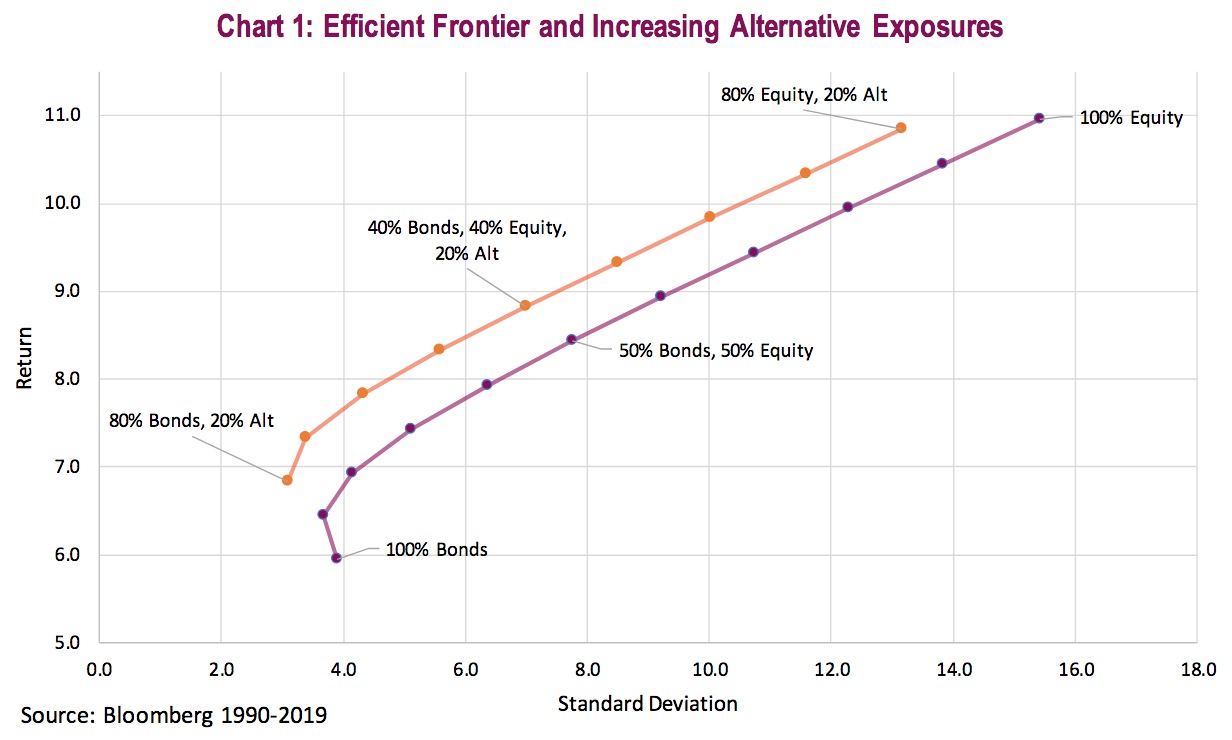

Most advisors and capital allocators still rely primarily on mixing stocks and bonds to achieve return objectives or achieve a client’s goals. However, amid the recent innovation in financial products, many are now incorporating alternative assets (Alts) and other products to further diversify risk and/or enhance returns. Many of these investment strategies have a lower correlation to traditional stocks or bonds and have thus expanded the efficient frontier beyond Markowitz’s renowned work (Chart 1).

Referring to Alts as an asset class can be slightly misleading due to the diversity of strategies employed across many different asset classes: long/short equity or bond; market neutral; global macro; activist; credit; private equity; futures trading; event driven; real assets; arbitrage and the list goes on.

All are endeavoring to create a performance stream that is materially different from regular investment approaches in public markets. Importantly though, this elevates the due diligence required in this space, not just in the strategy/manager itself but in how it fits within a portfolio.

And while there may be a “free lunch” in diversification, make no mistake that Alts are often trading one risk exposure for another. For instance, a long/short equity manager should have a low correlation to the equity markets, which reduces market risk – a risk most investors are well aware exists. However, by doing so, they often have increased stock-selection risk. If the companies that the manager shorted then rise in price while the long-equity positions fall, a lot of value can be lost even if overall equity markets are generally calm or even rising. Often credit strategies, which have gained in popularity thanks to lower interest rates, are taking on much more credit exposure than typical bond allocations. A good rule of thumb: if return expectations are higher then there is added risk – it just may not be simple market risk as with equities or other traditional asset classes.

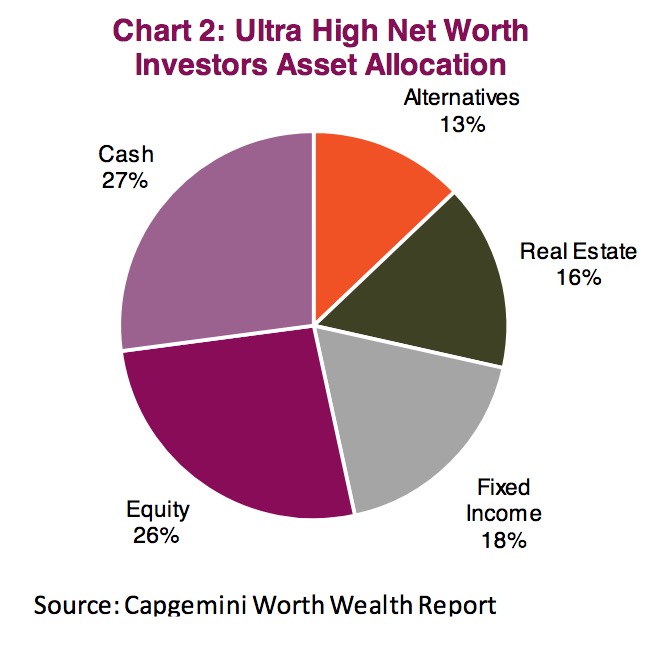

Institutions adopted using alts in their asset allocation decades ago and that trend has continued. The often-cited examples include the CPP Investment Board or the Yale endowment fund’s healthy weightings to Alts. We would caution using these examples as replicating their investment process, approach, research, access and scale is simply not feasible for just about everyone. The average public/private pension fund has about 19% allocated to Alts, according to AIMA Research. This drops to around 10% for endowments and foundations.

How to think about Alts

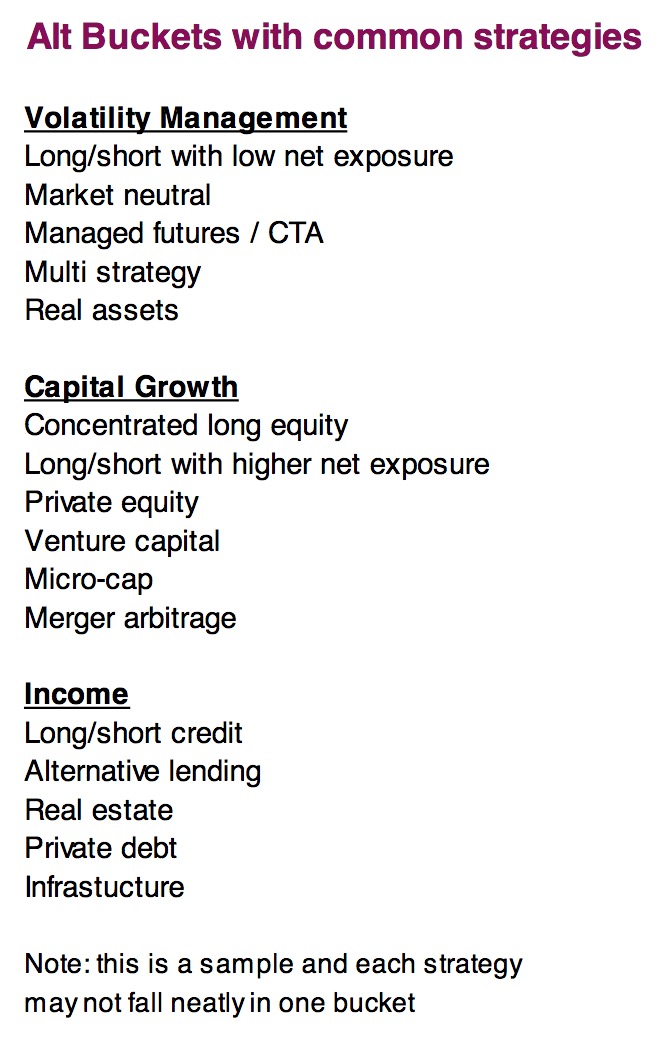

A useful framework that Richardson GMP’s Alternative research department uses to categorize Alts helps bucket the many diverse strategies into more easily understood groups. This grouping depends on the manager’s strategy and historical performance, and is less dependent on the actual end investment used. The three main buckets used are Volatility Management, Credit/Income and Capital Growth. (See table).

Volatility Management. The primary objective of these Alts is to reduce the market risk or other risks for the overall portfolio. Long/short, market neutral, some real assets or futures trading often fit into this bucket. Having a low correlation to the market or strong downside protection is crucial. Upside participation is often a distant second objective.

Credit/Income. This group is more focused on either generating income or on strategies in the credit market. Long/short credit, alternative lending and private debt are the main strategies. The popularity of this group has increased dramatically over the past few years due to traditional banks becoming less active in certain credit markets and the low-yield environment causing many investors to move down the credit spectrum in search of yield.

Capital Growth. This group is all about growth and can be much more volatile than others. Private equity, venture capital, concentrated long portfolios, activist and some long/short with higher net market exposure fall into this group.

We find this to be a more constructive framework to consider Alts as it is more focused on their impact on the overall portfolio.

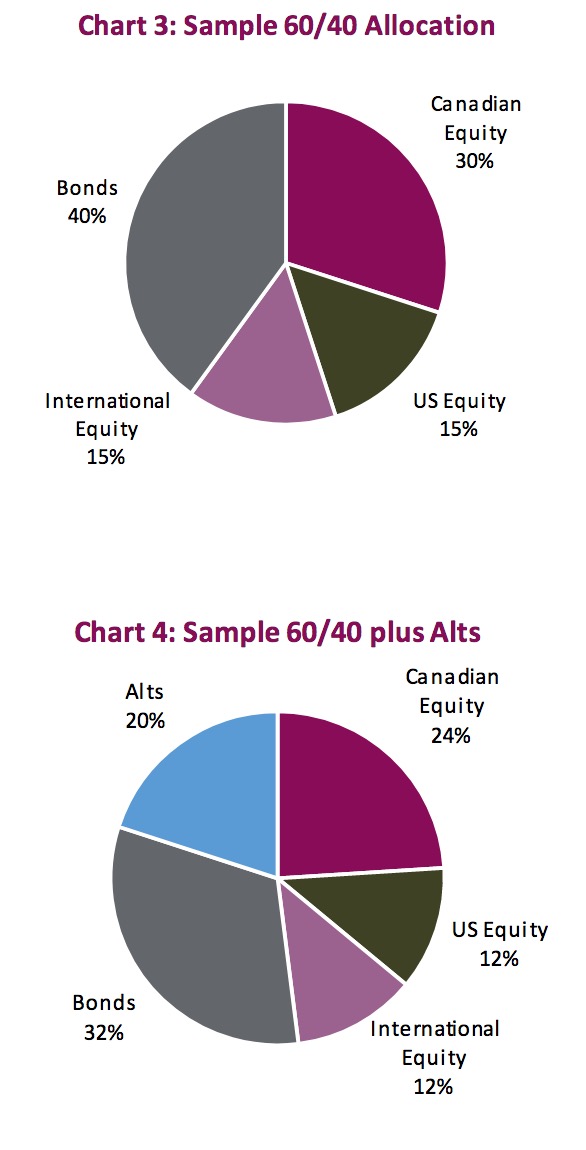

There is no right answer to this often-asked question and our view changes over time with the market cycle. Obviously much depends on the investor’s goals, tolerance, portfolio size, etc. In our asset allocation services, we generally range from 10-20% max for those wanting to incorporate Alts into their portfolio (sample allocations in Chart 3 & 4). But as with anything, the devil is in the details and other elements like the managers/strategies and the market environment should also be considered.

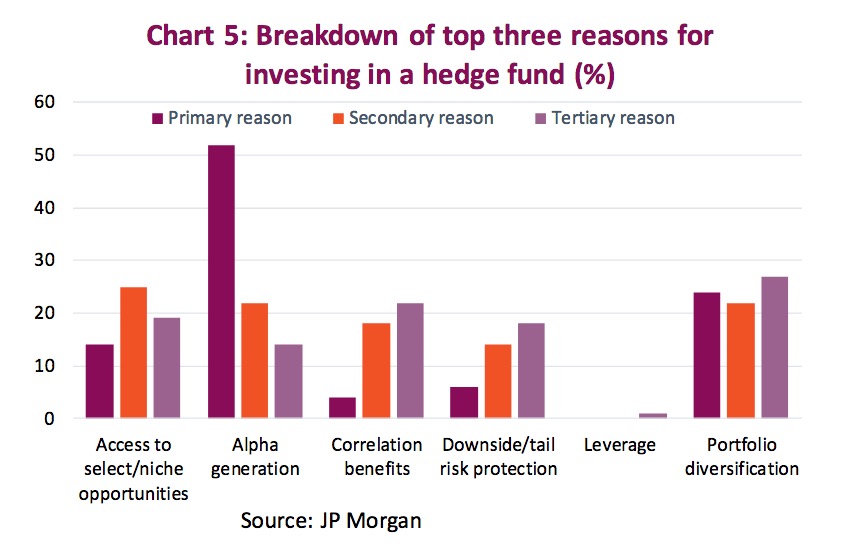

Shifts in monetary policy, historically unusual correlations, low yields and an aging economic cycle may be putting traditional assets at a slight disadvantage. The increased availability of Alts offers a different set of tools to implement an investment strategy, many of which may be well designed for the current market environment. For instance, the ongoing shift towards passive strategies only highlights the importance of having truly active differentiated sources of returns to complement that cheap beta. A recent survey by JPMorgan highlighted the top reasons investors gave for investing in Alts (in this case hedge funds, Chart 5). Better returns scored the highest but it’s worth noting that portfolio diversification also scored very well.

With markets currently reaching new all-time highs, and in the midst of an aging bull market, with very low yields available in the bond market, we believe the time is right for investors to start preparing for an eventual downturn. One approach is to alter your strategic asset allocation to get ready for periods of rising volatility in the future. While there are numerous volatility management solutions, all with their unique benefits, Alts, notably the volatility management strategies, typically lose less than the overall market. Some even generate their best returns during market meltdowns.

As a result, we have been recommending a higher tilt towards volatility- management strategies at this point in the market cycle.

Alts shouldn’t replace the core

Alternatives are not a magic bullet by any measure and there are many wrong reasons to add Alts to a portfolio. Some investors find them alluring based on the fact that ‘Yale is doing it’, for instance. As we have mentioned, replicating the institutions’ process and access is near impossible. While having access to unique investment strategies has the allure of greater sophistication, failure to adequately understand these strategies can lead to disappointing results.

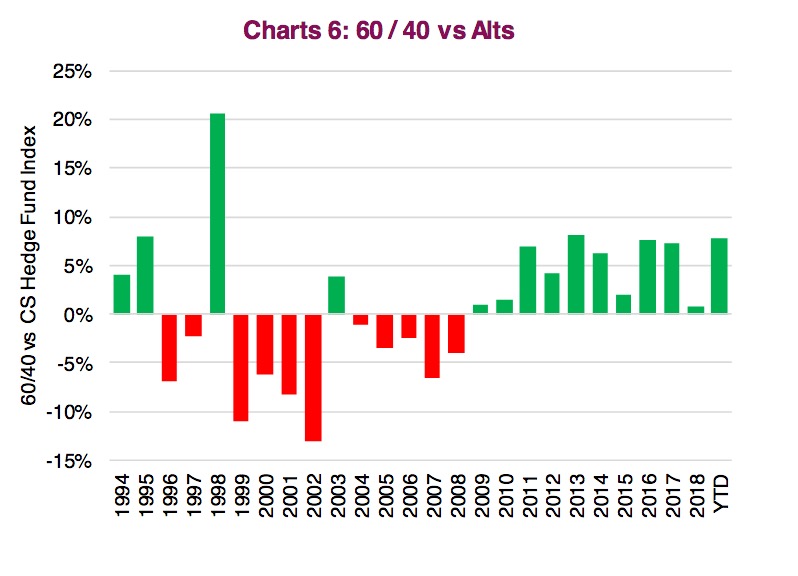

The recent lacklustre performance in the space combined with materially higher fees certainly gives reason for pause. Not lost on many investors is the fact that a 60% U.S. equity and 40% bond allocation outperformed the Credit Suisse (CS) Hedge Fund index for 11 years in a row (Chart 6). And even in 2008, the year Alts should have shined, this index was down 19%. That is better than the 23% drop of the 60/40, but clearly both leave a lot to be desired.

Countering the above comparison, we would point out that the CS Hedge Fund index consists of diverse strategies and its performance is the dollar weighted average of them all. Some did very well during 2008, others did not. Others have done well over the past few years. And we would highlight that the current bull market has been a momentum U.S. equity-led cycle, significantly benefiting the 60 in the 60/40. Alts complement a traditional approach; they should not replace it.

Due diligence is critical

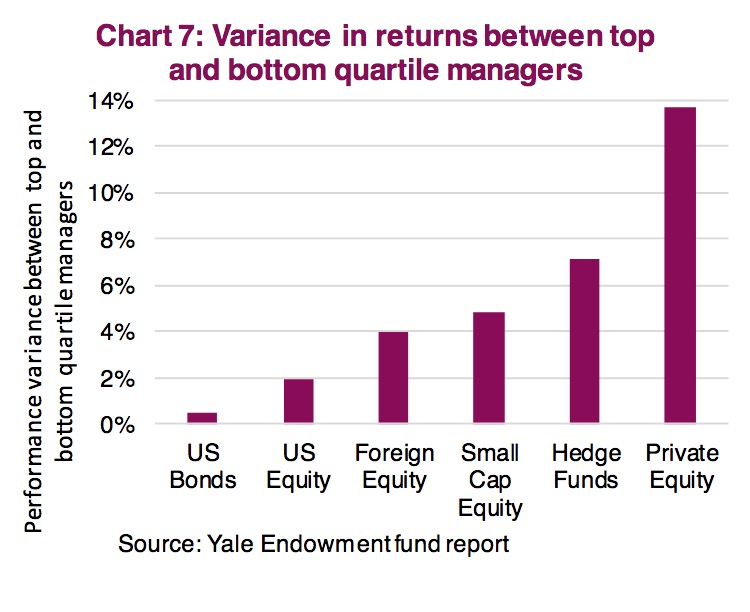

Given the diversity of investment strategies from one manager to another, the often- limited track record and less regulatory oversight, the need for quality due diligence on Alts is often more important and impactful compared to other asset classes. The performance difference between the top and bottom quartile bond manager was 0.5% based on a recent Yale Endowment report (Chart 7). Devoting resources to bond manager due diligence in an attempt to identify the top quartile manager certainly has a limited return on time and effort invested.

This variance in returns begins to expand as you move into equities (2%), foreign equities (4%) and then substantially increases for hedge funds (7%) and private equity (14%). If the variance in returns is greater, there is a greater benefit in investing with the better-performing managers. And the return on your due diligence should be greater.

Leveraging a dedicated team that focuses on researching these managers is critical. It is a less regulated part of the investment industry, increasing the need for operational due diligence, not just in terms of the investment strategy. Culture, background, experience, compliance culture all have heightened importance. It is beyond the scope of this report to go into the due diligence process, suffice it to say that it should be much deeper and more involved than just deciding which Canadian equity manager to choose.

Enter liquid Alts

Decades ago, alternatives were available exclusively to institutional investors who could afford to devote large sums of capital to take direct investments into private companies, real estate, infrastructure, and other “alternative” investment strategies. The demand for these types of investments eventually led to the development of structured products run by asset managers specialized in a given esoteric asset class. Those Alts, often made available via an offering memorandum (OM), could be purchased by accredited investors, generally those with over a million dollars in investable assets. Now, thanks to changes in regulations, as of January 2019, Canadian investors can access many of these solutions through what are deemed “liquid alts”.

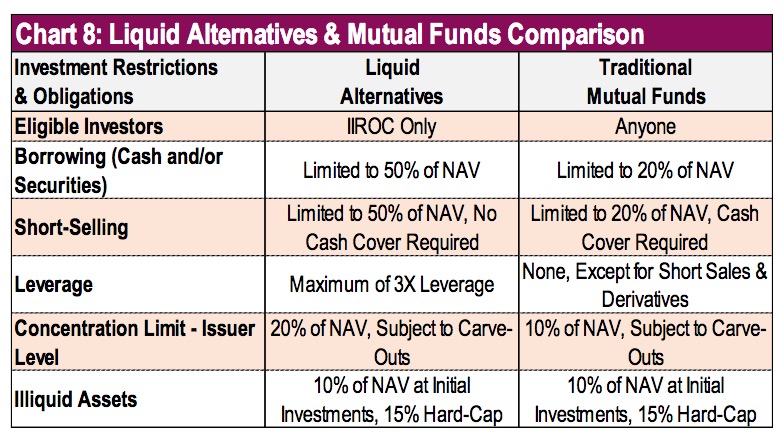

Retail demand is expected to drive widespread adoption of liquid alternatives, which Scotia estimates will be a $100-billion market by 2025. As of September 2019, there was $4.5 billion in the category spread across over 60+ products. However, future expected growth will not come easily – at least in the near term. Many liquid alts are being classified as high risk, despite their underlying economics. This is because of the complicated management style that many of these managers employ, thus forcing the hand of compliance departments to default the risk rating to high risk. In a way, this rationale makes sense because of how much latitude there is between a liquid alt in comparison to a traditional mutual fund (Chart 2). Another headwind is that there are limited options due to the category’s infancy. Many advisors rely on recommended lists from their internal research departments. However, due to their limited track records, very few options have made their way onto these lists.

Even with the advent of these strategies, liquid alts likely won’t be the Holy Grail for retail investors seeking to implement Alts into their portfolio. Despite the widening corridors, investing in these solutions is still more akin to fitting a round peg in a square hole for many. We see three broad categories of issuance into the space. The least concerning are those managers who are running a strategy that actually fits within the new rules for liquid Alts. This is a great option for those that backed off buying that OM fund because of liquidity, paperwork, and/or qualification requirements to access the vehicle. However, approach with caution those solutions based on an OM that had to be drastically modified to meet the new criteria, or others that are novel products launched to ride the early momentum.

Conclusion

As investment options increase, there are opportunities to enhance either return expectations or risk (or both). Alts, which are now much more widely available, offer a compelling tool for portfolio management that was previously harder to access. This may hold great potential benefits for investors. However, they also have risks and require a higher level of diligence and monitoring, which should not be taken lightly. Certainly, Alts can serve as a portfolio enhancer, but the core should remain the core.

Source: All charts are sourced to Bloomberg L.P. and Richardson GMP unless otherwise stated.

This publication is intended to provide general information and is not to be construed as an offer or solicitation for the sale or purchase of any securities. Past performance of securities is no guarantee of future results. While effort has been made to compile this publication from sources believed to be reliable at the time of publishing, no representation or warranty, express or implied, is made as to this publication’s accuracy or completeness. The opinions estimates and projections in this publication may change at any time based on market and other conditions, and are provided in good faith but without legal responsibility. This publication does not have regard to the circumstances or needs of any specific person who may read it and should not be considered specific financial or tax advice. Before acting on any of the information in this publication, please consult your financial advisor. Richardson GMP Limited is not liable for any errors or omissions contained in this publication, or for any loss or damage arising from any use or reliance on it. Richardson GMP Limited may as agent buy and sell securities mentioned in this publication, including options, futures or other derivative instruments based on them. Richardson GMP Limited is a member of Canadian Investor Protection Fund. Richardson is a trademark of James Richardson & Sons, Limited. GMP is a registered trademark of GMP Securities L.P. Both used under license by Richardson GMP Limited. ©Copyright November 18, 2019. All rights reserved.

Copyright © RichardsonGMP