by Russ Koesterich, CFA, Blackrock

Russ explains why monetary easing matters more than geopolitical risks for the markets right now.

Absent a year-end meltdown, stocks will have enjoyed a stellar year. That stocks would post +20% gains was not obvious back in January, when investors were preparing for some combination of a recession and trade war. What saved stocks? It has not been stellar economic growth or a surge in corporate earnings. While the recent easing in trade tensions has helped, what has really saved stocks is what has worked time-and-time again this cycle: monetary easing.

Back in early September I highlighted the tug-of-war between geopolitical uncertainty and easier financial conditions. At the time I suggested that better liquidity would likely support risky assets. Since then global stocks have risen by approximately 6%, with riskier parts of the market, notably emerging markets and technology, rising roughly 8%.

Today I would make the same argument: Liquidity is likely to beat uncertainty, or at least until early 2020. I would cite three reasons in favor of this scenario: some easing of geopolitical risk, accelerating liquidity on the back of expanding central bank balance sheets and the likelihood that better liquidity will lead to economic stabilization.

- For now, geopolitical uncertainty is receding. Geopolitical risk appears to be fading, at least from the summer peak. The BlackRock Global Risk Index has fallen by around 20% since August.

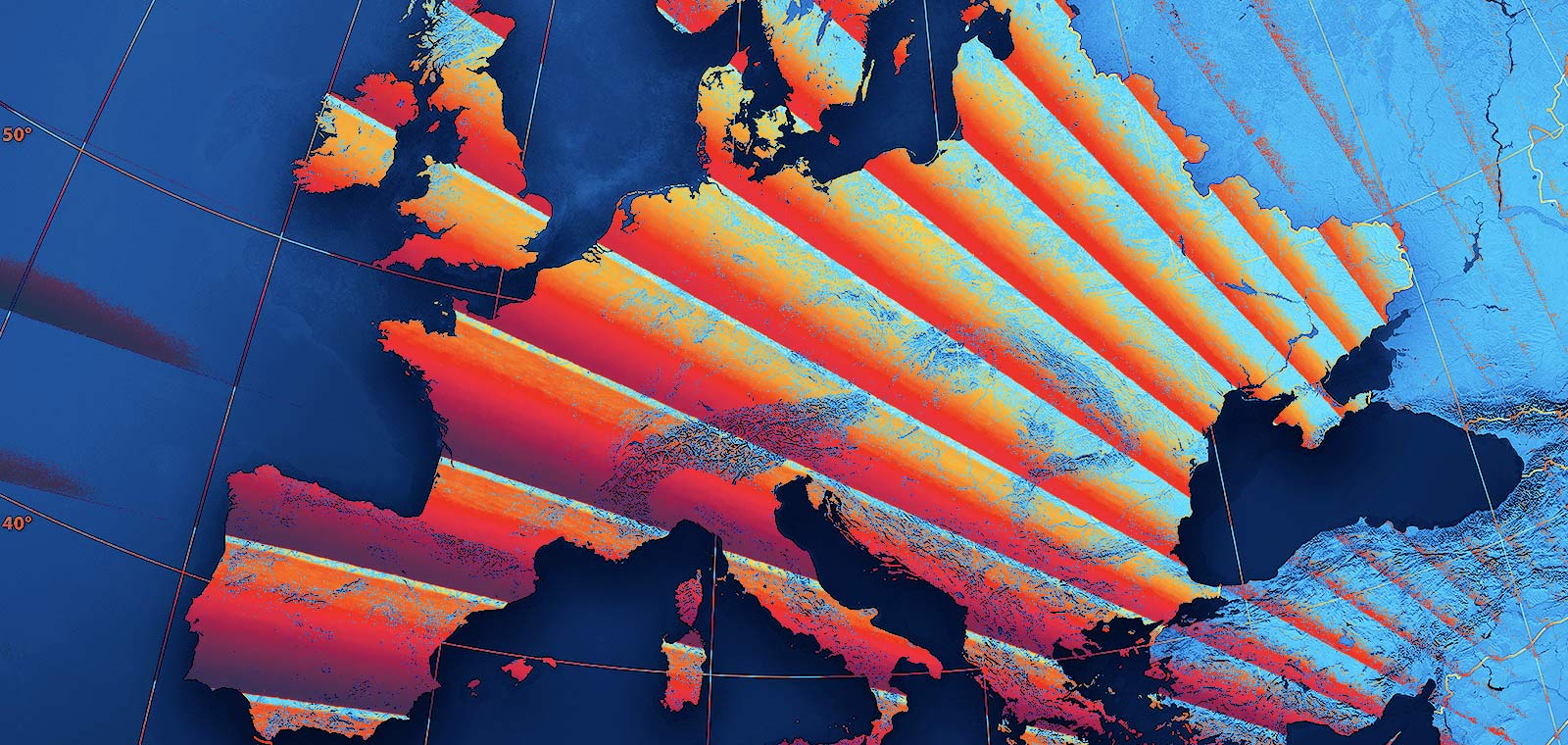

- Global liquidity is improving. While the Federal Reserve may take a break from cutting rates, most measures of financial conditions are improving. In particular, central banks are once again buying assets. The European Central Bank (ECB) has resumed its quantitative easing program and the Fed, partly as a response to recent dislocations in the money markets, is once again expanding its balance sheet. As a result, the cumulative balance sheet of the Fed, ECB, Bank of Japan and Bank of England is rising for the first time since 2017.

- Better liquidity suggests stabilizing growth. The improvement in global liquidity should lead to improving, or at least more stable, growth. Looking at the BlackRock Financial Conditions Index suggests growth estimates are likely to accelerate during the next quarter (see Chart 1).

What could change this dynamic?

Either a more hawkish tilt by central banks, which is highly unlikely in my opinion, or a rise in political uncertainty would be the most likely candidates. That said, for uncertainty to have a meaningful impact it will need to lead to a reduction in business and consumer confidence. In other words, political uncertainty itself is unlikely to disrupt financial markets unless there is some evidence that it is impacting the behavior of companies and consumers. If it were to rise to the point where it did so, that would be a game changer.

That said, for now, hiring remains robust and consumers continue to spend. In this regime greater liquidity should prove an effective balm for the occasional case of geopolitical jitters.

Russ Koesterich, CFA, is a Portfolio Manager for BlackRock’s Global Allocation Fund and is a regular contributor to The Blog.

*****

Investing involves risks, including possible loss of principal.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of November 2019 and may change as subsequent conditions vary. The information and opinions contained in this post are derived from proprietary and non-proprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This post may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any forecasts made will come to pass. Reliance upon information in this post is at the sole discretion of the reader. Past performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly in an index.

©2019 BlackRock, Inc. All rights reserved. BLACKROCK is a registered trademark of BlackRock, Inc., or its subsidiaries in the United States and elsewhere. All other marks are the property of their respective owners.

USRMH1119U-1005814-1/1

This post was first published at the official blog of Blackrock.