by Larry Adam, Chief Investment Officer, Raymond James

Key Takeaways

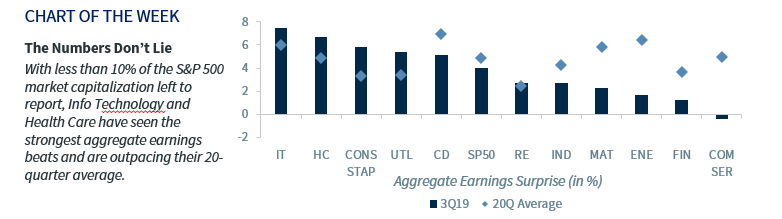

- Info ‘Technology’ Boasts the Strongest Aggregate Beats

- The ‘Art’ of Interpreting Earnings & Future Guidance

- Lower for Longer Yields Provide ‘STEAM’ for Equities

Today, November 8, we celebrate National S.T.E.A.M. (Science, Technology, Engineering, Art & Mathematics) Day. This date is appropriate as “NOV-8” is a play on the word ‘IN-NOV-ATE,’ an attribute necessary to maintain the competitive edge of the US economy.

Many schools have adopted these areas of focus to instill the value of a well-balanced education in students. As your Investment Strategy team, it is our responsibility to be innovative and well balanced in how we conduct, construct and disseminate our market views.

Admittedly, while there are clearly S.T.E.M aspects to analyzing historical numbers and trends, there is an ‘Art’ to how we convey our outlook. Consistent with our approach, we overlay the S.T.E.A.M. subjects to our assessment of the third quarter earnings season.

- Science Behind The Strength of Health Care | With less than 10% of the S&P 500 market capitalization left to report, the Health Care sector has been a standout with 85% of companies beating EPS estimates. The magnitude of beats has been impressive too, with companies topping estimates by 6.7% on average, well above the previous 20Q average of 4.9% and the S&P 500 average of 3.9%. These results arrived at an opportune time, as political risk associated with Medicare-For-All proposals have kept the sector ‘under the microscope.’ Health care costs will undoubtedly remain a top concern amongst both parties as we go further into the election cycle, but we think the sector’s underperformance is overdone. Health Care has trailed the S&P 500 by 8.8% over the last 12 months, and is trading at a significant discount (~15%) to the broader market. Favorable demographics, attractive valuations and earnings momentum lead us to remain constructive on Health Care.

- Technology At The Top | While technology is ever-changing, one thing has remained the same—the sector’s outperformance. Technology is up ~40% year to date, outpacing all other sectors by at least 10% and the broader market (S&P 500) by ~15%. Therefore, it is no surprise that the sector has had the strongest aggregate beats of any sector at 7.5%, topping its 20Q average of 6%. While trade tensions and a stronger dollar could weigh on the outlook, 2020 earnings are expected to rise 10% year-over-year. This estimate has been resilient throughout this earnings season, rising 0.5% and making it the only sector to see positive revisions. The Technology sector remains one of our favorite sectors due to the secular trend of rapid advancements across our entire economy, from artificial intelligence to robotics to medical enhancements to communications. In the near term, continued strong earnings, attractive valuations, buybacks and seasonality reinforce our positive view.

- Engineering Earnings | Share buybacks continue to support this bull market. From 2016 to 2018, S&P 500 companies bought back ~$650 billion in stock annually, on average. 2018 saw the largest amount of buybacks of the three years, with companies purchasing ~$830 billion of their own stock. These buybacks have not only boosted the attractiveness of equities for investors (~3.5% buyback yield), but have also financially ‘engineered’ earnings growth. Over this same time period, earnings growth outpaced net income growth by ~7-8%, which suggests that buybacks added ~2-3% to earnings growth on an annual basis.

- Art of Interpretation | While 3Q19 earnings growth is projected to decline 1.5% year-over-year, it is up to investors (and us) to interpret the results and guidance from management and ‘paint a rosy or dark picture.’ We choose a more optimistic view on earnings, because top line revenue growth remains healthy at ~5% (and it is rare to go into an earnings recession without negative sales growth), management guidance remains positive with little reference to a recession and global growth appears to be bottoming (especially if we get any truce in the trade war). As a result, we forecast 5-6% earnings growth in 2020, which will be necessary for the equity market to move higher as the 18.7x LTM P/E leaves little, if any, upside for multiple expansion.

- Mathematics of the Market | When we do the math, lower for longer interest rates should be supportive of equity valuations. Discounting dividends or earnings back to present value increases valuations the lower interest rates fall, especially with US Treasury yields near multi-year lows (10-year Treasury yield: 1.94%). Global negative yielding debt, currently accounting for ~22% of total outstanding global bonds, also makes equities attractive on a relative basis. As an example, ~50% of the S&P 500 constituents have a dividend yield above the 10-year Treasury yield. Given that low global yields could potentially stimulate the global economy and earnings growth, this should provide the ‘steam’ to power equity markets moving forward.

Read Larry Adam's full note as PDF

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.

Copyright © Raymond James