by Larry Adam, Chief Investment Officer, Raymond James

Key Takeaways

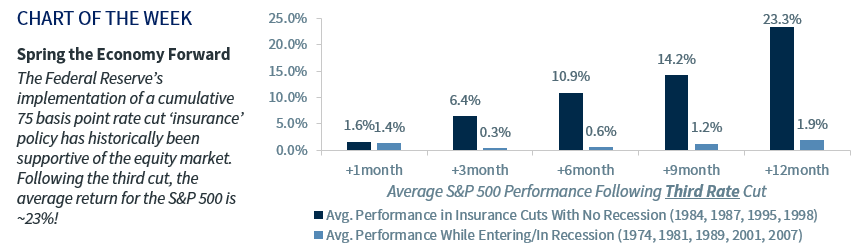

- The Fed Rate Cut To ‘Spring’ The Economy Forward

- Economic Data Releases Put Recessionary Fears to ‘Rest’

- Signing Date for Phase One Trade Deal Still ‘In The Dark’

Don’t forget to turn your clocks back this weekend! As Daylight Saving Time comes to an end this Sunday, our daylight hours will diminish, but we get an extra hour of sleep – something we all admittedly need this time of year. However, this bonus hour of slumber is not the only good news worth sharing, as the S&P 500 has already notched two record highs this week, overtaking the previous high set on July 26. The past few days have certainly given the financial markets enough reasons to stay ‘awake,’ as ~35% of the S&P 500 market capitalization reported earnings and a multitude of economic data points were released (i.e., ISM Manufacturing Index, non-farm payrolls, and wage growth). This week, we hope to ‘shed some light’ not only on some of the recent developments but also on our overall outlook for the economy and financial markets as we enter into year end.

- Spring The Economy Forward | While the clock may be ‘falling back,’ the Federal Reserve (Fed) wants to keep the current record economic expansion (128 months) moving forward. As expected, the Fed implemented its third 25 basis point ‘insurance’ rate cut this year at Wednesday’s Federal Open Market Committee (FOMC) meeting. In the Fed’s guidance, Chair Powell said they would continue to “assess the appropriate path” for interest rates in light of “incoming information.” We believe this third cut may be the ‘charm’ to propel the economic expansion further. Over the last 30 years, when the Fed has implemented an ‘insurance’ rate cut policy of 75 basis points, the equity market has been ‘lights out’ as the S&P 500 has posted a 12-month forward return of ~23%, on average. The combination of the Fed rate cuts, a healthy consumer, and a strong labor market gives us confidence in our positive economic outlook with only a small probability of a recession. Continued economic growth should lead to accelerating earnings growth that should keep the equity market well supported.

- Trade Talks Won’t Hit Snooze | President Trump and President Xi were expected to have a formal signing of the first phase of the trade deal at the November 16-17 APEC Summit in Santiago, Chile. This week, Chilean President Piñera cancelled the forum amid escalating domestic issues. Over the past several months, any negative development surrounding the US/China trade negotiations would have rattled the financial markets, but there had already been word from US officials that putting the specifics of the deal on paper could extend (but not derail) the signing past the summit date. In addition, to assuage market fears, President Trump quickly tweeted that a new location would be found. With Trump set to travel to Europe in early December for the NATO summit, a neutral meeting place is a strong possibility. Although the exact date and location remain ‘in the dark,’ we believe both sides will ‘stay alert’ to avoid the December 15 consumer-sensitive tariff deadline.

- Not Losing Any Sleep | With two-thirds of the S&P 500 market capitalization having reported, the prospects of a ‘dream-worthy’ third quarter earnings season are looking ‘dim.’ At the headline level, S&P 500 earnings are currently expected to be down 2.6% year-over-year. While earnings thus far have come in better than expected, the 1.5% upward revision in earnings to date is less than half the 20-quarter average of 3.3% and the worst observation over the last five years. While this may very well be the first quarter of negative earnings growth since 2Q16, we are ‘not losing any sleep’ over it. The reason: guidance has remained optimistic overall, the percentage of companies beating their earnings estimates (73%) is above average, sales growth remains healthy and the return to positive earnings growth is likely to occur as early as next quarter’s earnings season.

- Recessionary Fears Put To Rest | As we entered into this week, anxious investors were ‘stirring’ not only because of the Fed’s looming rate cut decision but also in anticipation of the numerous economic data points to be released. The preliminary reading of 3Q19 GDP brought some immediate relief, as the 1.9% growth rate was above the consensus estimate of 1.7% and only slightly below the 2Q19 rate of 2.0%. Personal consumption expenditures posted another strong quarter (2.9%), but we had hoped business investment would ‘wake up’ instead of posting its largest decline since Q415 (-3.0%). Instead of ‘counting sheep,’ investors are counting jobs! The US economy added 128,000 jobs in October, and the August and September reports were revised up a combined 95,000 jobs. The ISM Manufacturing Index, while still in contraction territory, saw a slight rebound to 48.3 after declining to 47.8 last month – the lowest level since 2009. These supportive trends reaffirm our overall positive economic outlook, and we reiterate our forecasts for 2019 and 2020 GDP growth of 2.2% and 1.7% respectively.

Read Larry Adam's Full View as PDF

All expressions of opinion reflect the judgment of Raymond James & Associates, Inc., and are subject to change. Information has been obtained from sources considered reliable, but we do not guarantee that the material presented is accurate or that it provides a complete description of the securities, markets or developments mentioned. There is no assurance any of the trends mentioned will continue or that any of the forecasts mentioned will occur. Economic and market conditions are subject to change. Investing involves risk including the possible loss of capital. International investing involves additional risks such as currency fluctuations, differing financial accounting standards, and possible political and economic instability. These risks are greater in emerging markets. Companies engaged in business related to a specific sector are subject to fierce competition and their products and services may be subject to rapid obsolescence. Past performance may not be indicative of future results.

Copyright © Raymond James