A late '90s-style reacceleration may not be in the cards.

by Dirk Hofschire, CFA, SVP; Lisa Emsbo-Mattingly, Director; Jacob Weinstein, CFA, Research Analyst, Asset Allocation Research and Cait Dourney, Analyst, Fidelity Viewpoints

Key takeaways

- Some investors have likened current global economic conditions to 1998, and wonder whether Fed monetary easing can once again ignite a global economic reacceleration.

- But unlike in 1998, the US has entered the late cycle and financial conditions have remained favorable—calling into question whether Fed action will be as effective this time around.

- China also now plays a weightier role in the global economy, but so far its recent industrial stabilization has been unable to reverse the global manufacturing slump.

- China's severe debt overhang has inhibited the stimulus response by policymakers, and the trade conflict with the US is exacerbating the economic headwinds that may blunt its ability to stimulate global growth.

- The late-cycle environment may spur volatility and a less favorable risk-return profile for asset markets than during recent years, warranting smaller cyclical asset allocation tilts and prioritization of portfolio diversification.

When the US Federal Reserve (Fed) cut its short-term policy rate in July for the first time in more than a decade, it cited the risks from global economic weakness as one of the key factors. Some investors have drawn a comparison with Fed monetary easing in 1998, when the US economy was relatively healthy but much of the rest of the world was experiencing a manufacturing and trade recession. Over the course of the next year in 1998 and 1999, the global economy rebounded, manufacturing and trade boomed, the US economy reaccelerated, and global stock prices rose sharply.

The key question facing asset markets today is whether the Fed's monetary easing can once again catalyze a global upswing and provide fundamental support for a reacceleration in global profit growth.

The global economy remains in expansion but the cycle continues to mature

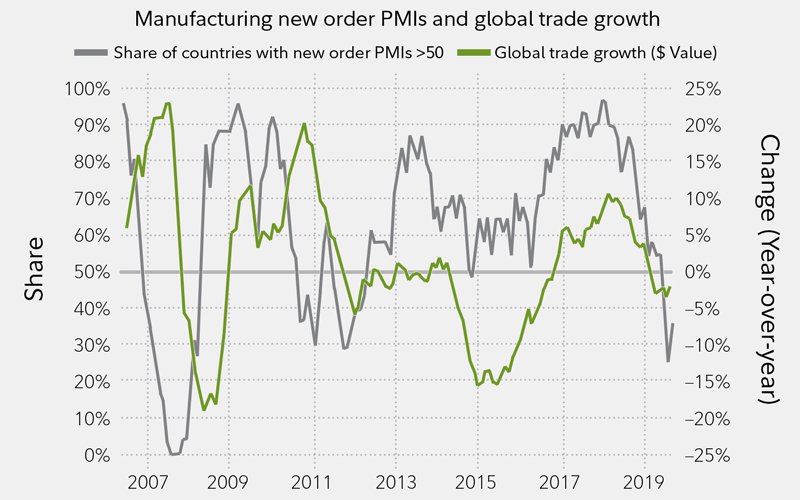

Today, the global economy continues to register positive growth, but the world is experiencing a synchronized recession in manufacturing and trade activity.

- The share of countries reporting new orders for manufacturing goods has dropped to near 35%, the lowest level since 2012.

- Global manufacturing and trade are closely correlated, and the year-over-year change in global trade growth has moved into negative territory.

- The escalation of trade policy tensions—particularly between the US and China—is exacerbating this trend and continued uncertainty is making it more difficult to find a floor in global trade activity.

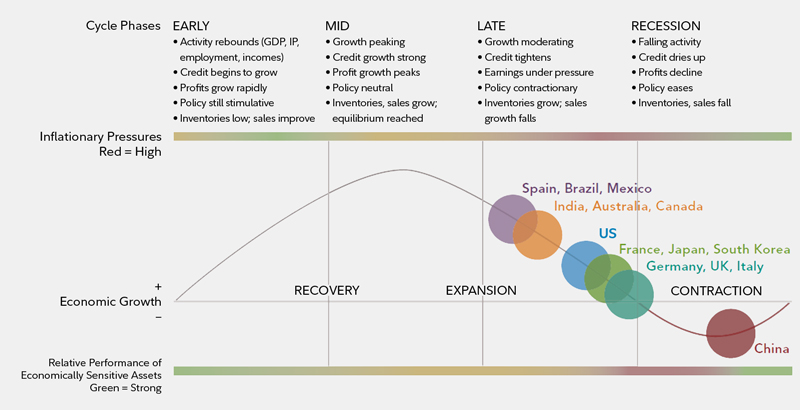

The global business cycle continues to mature, and most major economies are in the late-cycle phase.

- Consumption and domestic services have held up well in many large economies, including Germany.

- Overall, recession risks in Europe remain elevated as manufacturing conditions and business investment remain weak.

- China's economy has stabilized as a result of the past year's stimulus measures, but growth remains subdued and a complete reacceleration from its growth recession has remained elusive.

Unlike in 1998, the US has already entered the late-cycle phase, and financial conditions have remained favorable.

- These dynamics call into question whether Fed easing will be as effective in boosting the US economic outlook as it was in 1998.

- In 1998, financial markets had seized up in the wake of the failure of hedge fund Long Term Capital Management and thus benefited greatly from the Fed rate cuts.

- Moreover, history has shown that Fed easing tends to be less effective in late cycle than during the mid-cycle phase.

Global manufacturing and trade activity has weakened significantly

PMI: Purchasing Managers’ Index (>50 = expansion). Gray line includes 31 countries. Source: CPB Netherlands Bureau for Economic Policy Analysis, Markit, Haver Analytics, Fidelity Investments (AART), as of June 30, 2019.

Today vs. 1998: China matters more

Perhaps the biggest difference between today and 1998 is the greater importance of China to the trajectory of the global business cycle.

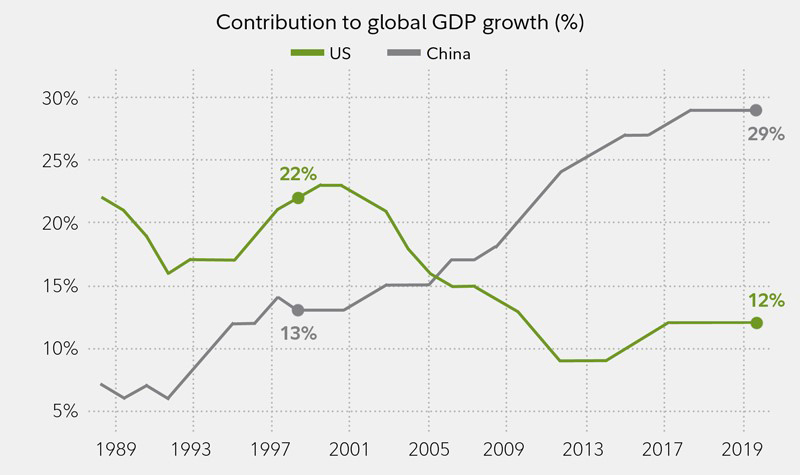

- When the Fed cut rates in 1998, the US accounted for more than one-fifth of global economic growth, much more important than other countries including China.

- Today, China contributes roughly 29% of global GDP growth, with the US accounting for less than half that amount.

- Moreover, China is the world's largest trader and incremental driver of manufacturing activity, the areas that are currently the weakest links in the global economy.

- As a result, an upswing in China's economy is likely necessary if the global economy is to sustainably reaccelerate like it did in the late 1990s.

China remains in a growth recession, while most major global economies have progressed to more advanced stages of the business cycle

Business cycle framework

The diagram above is a hypothetical illustration of the business cycle. There is not always a chronological, linear progression among the phases of the business cycle, and there have been cycles when the economy has skipped a phase or retraced an earlier one. *A growth recession is a significant decline in activity relative to a country’s long-term economic potential. We use the "growth cycle" definition for most developing economies, such as China, because they tend to exhibit strong trend performance driven by rapid factor accumulation and increases in productivity, and the deviation from the trend tends to matter most for asset returns. We use the classic definition of recession, involving an outright contraction in economic activity, for developed economies. Source: Fidelity Investments (AART), as of July 31, 2019.

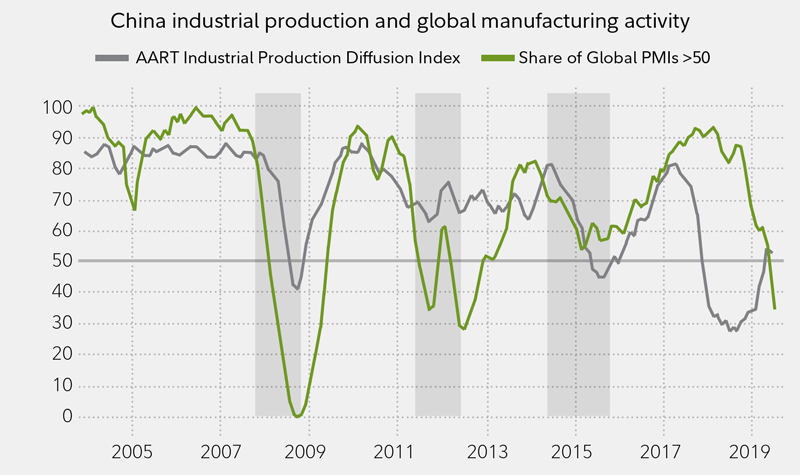

Unlike the past decade, China's stabilization has not yet driven a global reacceleration

Over the past decade, China's economic cycle has been a key driver of fluctuations in global manufacturing activity. So far, however, China's industrial stabilization during 2019 has failed to reverse the global manufacturing slump.

- Our China industrial production diffusion index, has recovered to above 50% after plummeting in 2018.

- Previously, rebounds in this index coincided with (and helped propel) global manufacturing recoveries, particularly in 2009-10 and 2016-17.

- Today, however, around two-thirds of the world's largest countries have purchasing managers' indexes (PMIs) that are below 50, indicating a contraction in manufacturing activity.

The US was the top contributor to global GDP in 1998, but now accounts for less than half of China's share

GDP: gross domestic product in purchasing power parity (PPP). 5-year averages. Source: International Monetary Fund, Fidelity Investments (AART), as of June 30, 2019.

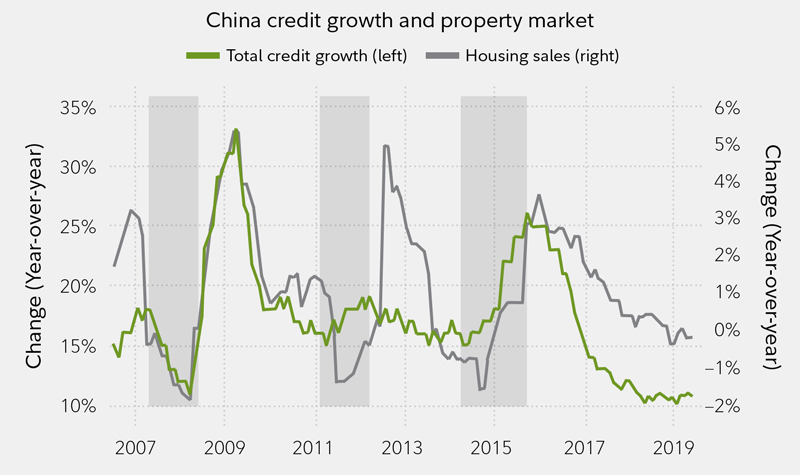

One possible explanation is that China's policy stimulus so far has been smaller and more narrowly focused than during prior upturns.

- While policymakers have eased fiscal policy and attempted to redistribute credit to the private sector, they have thus far avoided an across-the-board stimulus designed to rapidly increase credit growth and reflate the property sector.

- One reason for the weaker stimulus has been policymakers' recognition that prior stimulus episodes have left the economy with a severe debt overhang and an inflated real estate sector that threaten the country’s long-term financial stability.

China's industrial production rally has not helped bring global manufacturing activity back into positive territory

Gray bars represent China growth recessions as defined by AART. Source: ISM, Markit, China National Bureau of Statistics (official data), Haver Analytics, Fidelity Investments (AART), as of July 31, 2019.

The trade confrontation with the US creates an untimely headwind that exacerbates the cyclical pressures on China's economy.

- Export growth has dwindled, particularly to the US, even before additional tariffs may go into effect.

- Concerns about supply chains have caused some businesses to invest less or relocate manufacturing production to other countries. While China’s economy has stabilized, a sustained reacceleration and major boost to the global economy appears unlikely.

- The Fed's easing will provide more latitude for China to further ease policy, but mounting domestic and trade headwinds imply more stimulus may be needed just to maintain activity at current levels.

China's recent stimulus has not catalyzed upturns in credit growth or housing sales like prior easing episodes

Gray bars represent China growth recessions as defined by AART. China credit growth estimate based on current economic conditions. Source: China National Bureau of Statistics (official data), Haver Analytics, Fidelity Investments (AART), as of June 30, 2019.

- Depreciation of China's currency is a double-edged sword—it helps exporters, but puts more pressure on businesses borrowing in foreign currencies, on capital outflows, and on the financial system in general.

- We are closely monitoring the real estate market and banking system for signs of additional stress or alternative signals that Beijing is moving to a more comprehensive stimulus effort that attempts to once again reflate property markets.

Asset allocation implications

Over the past decade, swings in China’s economy—and in the global economy outside the US in general—have been extremely important to global financial markets.

The cyclical swings in global trade and manufacturing, underpinned by China’s accelerations and decelerations, have displayed a strong correlation with the performance of global stocks.

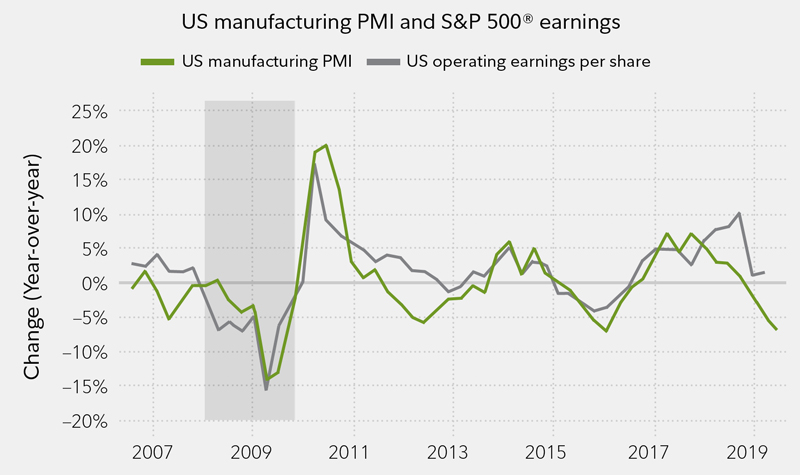

While the US economy has been relatively stable over the past 10 years, stock market fluctuations have been heavily influenced by global trends. US corporate profits have tended to follow the manufacturing cycle, which is extremely global in nature and has reacted to trade movements in China and around the world.

As a result of late-cycle dynamics in both the US and global economies, the distribution of potential asset- return outcomes is less favorable than during earlier phases of the cycle. The move to a global monetary easing cycle may boost asset valuations and provide support for financial conditions in the near term, but heightened trade policy risks and a multitude of economic headwinds may blunt the ability of monetary easing to stimulate global growth. Overall, we expect the late-cycle environment to provide more volatility and a less favorable risk-return profile for asset markets than during recent years. The more asymmetric risk profile warrants relatively small cyclical asset allocation tilts and prioritization of portfolio diversification.

US stock earnings have been correlated to the US manufacturing cycle—which is driven largely by global trade.

Shading represents US economic recession as defined by the National Bureau of Economic Research (NBER). Source: Standard & Poor's, Institute for Supply Management, NBER, Fidelity Investments (AART), as of June 30, 2019.

Copyright ©