by Hubert Marleau, Market Economist, Palos Management

A batch of economic indicators like the ISM surveys and ADP-employment numbers did not meet expectations, inciting the algos to create a strange twist in the bond market and produced a gamma-driven three day steep slide in the equity market that quickly recovered when BLS showed that the unemployment rate dropped to 3.5%.

In the past 4 weeks, the yield curve bearishly inverted in the short end but bullishly steepened in the long end. The differential between the 10-year bond yield and three months treasury bills remained negative while the spread between 10-year bond yield and 2-year bond widened. The message is clear.

On the one hand, the short end of the curve reflected the rising odds that the Fed would decrease its policy rate at the next FOMC meeting at the end of October. According to data from the CME Group, the Fed-fund futures market is now pricing a 90% probability of a 25 basis points cut by the end of the year, up from 40% merely a few days ago. The two-year-note yield which is often name the Wayne Gretzky measure of the Fed--not where the Fed (puck) is, but where it’s headed. The two-year-note’s yield of 1.39% suggests more rate cuts ahead.

On the other hand, the long end of the curve suggests that the anticipated reduction in the policy rate will reanimate the economy and keep it afloat.The market knows that the Fed is attuned to the risks of a downturn. Several regional Fed governors are on record that they would aggressively reacted if recession probability indicators were to shoot up.

It’s my opinion that the Fed will continue to ease it’s monetary stance even if the economy were to roll over, (I strongly expect), into its post crisis regime of two percent for growth and two percent for inflation. Currently the neutral rate is 55 bps lower than the policy rate. Whilst, the manufacturing sector is suffering mainly because the U.S. dollar is grossly overpriced. The best way to exert down pressure on the dollar is via higher bank reserves. There is a correlation between the reserve balances and the Fed trade-weighted dollar (DXY). That decision to lift bank reserves has already been made to appease the Repo market. In short, more bank reserves means more dollars in the foerign exchange markets. Additionally, the rising popularity of MMT is creating political pressure on the Fed to cheaply fund the government deficit. Lastly, an influential body of monetarists are pushing the idea that it would be expedient to allow the inflation rate to pass the 2% target.

The above rational may be enough to counter the fears of a contraction on the horizon. It remains that while the latest economic prints were disappointing but not dismal. U.S. economic data points are plainly falling back in line. As a matter of fact, there is a disconnect between soft and hard data. Businesses are not laying off workers or aggressively cutting work hours. The problem is with survey-based measures. Not only are they influenced by the ongoing trade disputes along with media talk of a possible recession, the indices are not observables. Moody’s Analytics came out with an interesting observation showing that surveys are reflections of the current narratives. For example, if one were to back out the sentiment component of the two ISM indices, one would find that the decline was mainly attributable to decreased sentiment That is why Friday’s jobs report suggested that the economy isn’t close to a recession.

According to Federal Reserve economist Claudia Sahm’s Recession Indicator, the employment data raises virtually no red flags about a downturn over the next two years. The indicator has both correctly signaled a recession 4-5 months before the start of a recession and has virtually never called a recession incorrectly since 1970. Put simply, the unemployment rate in the form of its three-month average, would have to be 0.50 percentage points above its minimum from the previous 12 months. The diffusion index is presently only 0.07. Based on this research, the unemployment rate would have to rise to 4.2% --- that would be equivalent to almost 1.0 million jobs lost. The Sahm Rule Recession Indicator is destined to a broad audience because it’s been recently added to the massive Federal Reserve Economic data system---a famous and publically accessible tool. It will certainly become in time a popular guidepost like the Taylor Interest Rate Rule, the Friedman Money Supply Rule and the Phillips Trade-off Curve.

JPMorgan’s Kolanovic, a super star on Wall Street, argues that the price of oil would have to rapidly surge and reach a range of $80 to $85 a barrel to produce enough of a negative impact to hurt consumers and, in turn, break the economy. This is still far away.

Last week, I advanced the idea that reflation could emerge on the grounds that 1) QE-Life is coming back to address the Repo issue and 2) that interest rates (1.88%) are generally lower and the annual pace of transactional money with zero maturity (6.2%) is generally higher than the ongoing nominal growth of the economy (4.1%). There is empirical evidence and theoretical validity that monetary conditions like we presently have should translate into inflation. Unfortunately, it takes time and sometimes a lot of it, for these factors to do what it ought to do—that is raise the level of inflation.

However, the monetary effects on inflation do take a considerable less amount of time when the economy is running near potential. Today, the economy is running at full employment and one should expect a run up in price inflation relatively soon—perhaps 6 months. Using Okun’s law, a rule of thumb based on GDP and unemployment, potential growth is 1.6%. The economy is presently running at an annual pace of 2.0% because the Fed is juicing it up.

The bottom line is that it is difficult and unorthodox to believe that inflation is as dead as a door knob. Higher productivity is the only thing that could possibly prevent a burst of inflation to occur. While I welcome back the recent emergence of productivity, it may not be enough for the to curb inflation prospects because the abundance of labour is quickly diminishing. It appears as if the stock market is in waiting. Many of the indicators like the Rule of 20, the earning yield-to-bond yield ratio and equity risk premium to vix index are neutral.

As I explained in my previous commentary, a bit more inflation would probably be tolerated by the Fed because the inflation targets have been missed most of the time since the Great Recession. Should my thesis prove correct, consumers might activate pent up demand, corporate pricing power could resume and corporate debt burden would lessen. Some of the sectors that have fallen behind the overall economy and the S&P 500 may fare better going forward than those which have. Yardeni’s morning letter of October 3, showed that analysts continue to expect big earnings gains for Energy (29.7%), Industrials (17.4%) and Materials (15.4%) in 2020 compared to 10.1% for the S&P 500 in spite of consensus expectation that aggregate S&P 500 earnings fell by 3% in Q3.

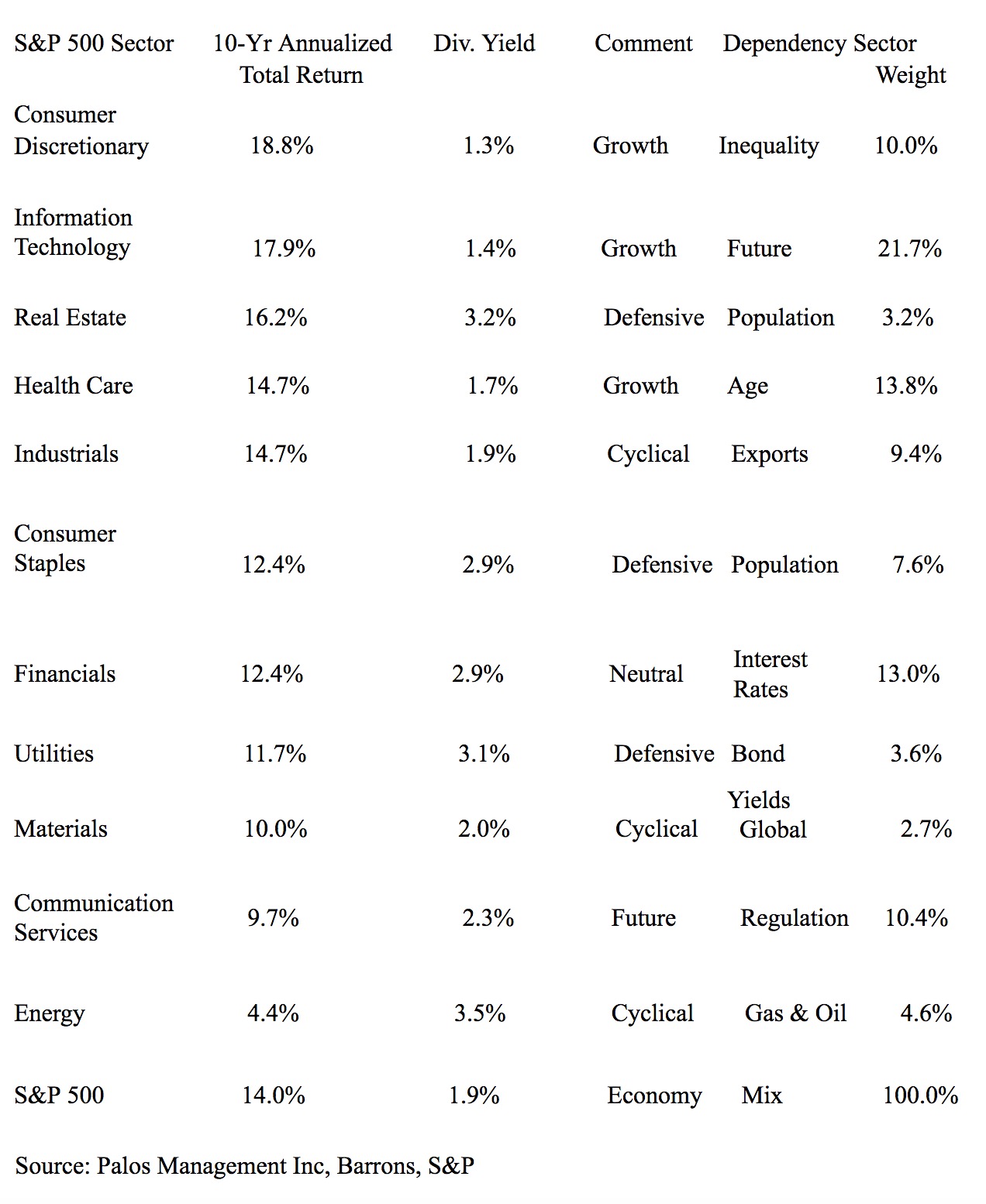

Looking at the 11 Sectors of the S&P 500 by the Numbers:

Copyright © Palos Management