by David Whitehair, Franklin Templeton Investments

The media frequently explore the financial situation of millennials—from their parents' role in their finances to their spending on avocado toast. But when it comes to pensions, how do younger UK savers really feel about their financial future? Based on findings of a study we recently conducted in the United Kingdom, David Whitehair, Director of Defined Contribution (DC) Strategy, says there is a wide disconnect between how people feel about their pension and what it currently delivers. Few people feel that their pension reflects their values. We find that responsible investment (RI) has a role to play in better reflecting people’s values in workplace pensions.

Younger pension savers in the United Kingdom have grown up in a time of rapid change, affecting the way they think about financial affairs, not least about saving for their futures.

Meanwhile, the UK pension landscape has also seen significant changes in recent years. Government action that required auto pension enrolment and minimum contribution levels has dramatically boosted participation rates and savings levels.

However, for many younger defined contribution (DC) savers, the current minimum contribution levels will not be enough to build a retirement pot big enough to reach the accepted target of two-thirds of income in retirement. Therefore, more needs to be done to encourage younger savers to contribute more into their pension.

Why We Focused on Generation DC

Generation DC, those people aged between 22-38, are much less likely to have a defined benefit (DB) plan or property wealth to underpin their retirement finances. As a result, they are more likely to have to rely heavily on their accrued DC pension savings to fund their retirement income needs.

Recognising that emotional intensity drives decision-making and action, we commissioned a study to explore the motivations of Generation DC.1 We wanted to move past viewing Generation DC as statistics and better understand them as people.

In particular, we wanted to focus on the role that responsible investing (RI) could play in encouraging Generation DC to engage more with their pensions.

What Is Responsible Investing?

We use RI as an umbrella term to refer broadly to any investment strategy that takes account of environmental, social and governance (ESG) factors. There are many of these factors, including natural resource use and scarcity, pollution, product safety, employee health and safety, and shareholder rights.

Why RI Is a Powerful Motivator for Generation DC

As would be expected, accumulating the value of their pension pot is important to Generation DC. Forty-three percent of survey respondents ranked their employer’s contribution as the most important attribute of their pension. However, we found many want their DC plan to accomplish two goals: make money and align with their values. Our research revealed that only 22% of Generation DC feel their pension reflects their values.

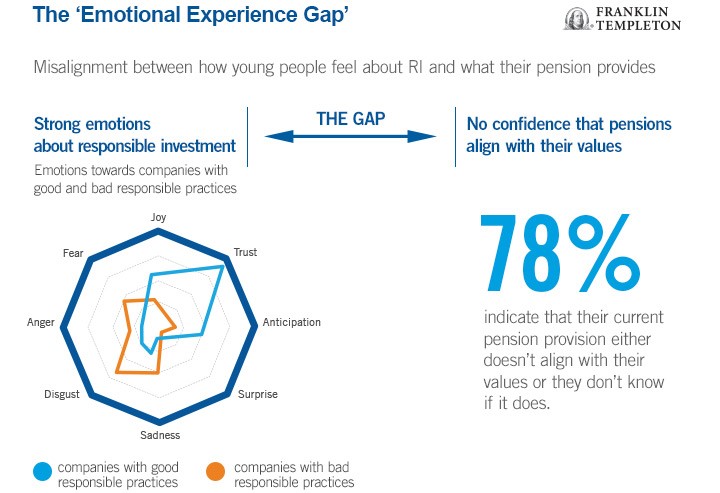

Our survey highlighted that people responded positively and with strong, intense emotions on issues relating to RI. This issue ranked second in importance in a list of attributes of their pension (ahead of fees and investment choice among others). We saw particularly strong negative emotions, including sadness and even disgust, when people felt that their pensions did not contribute positively to society.

This emotional experience gap, as we’ve coined it, articulates the challenge—and the distance—between what Generation DC want from their pension scheme and what is currently provided. In our view, RI can be one of the catalysts to help close this gap and bring about meaningful change.

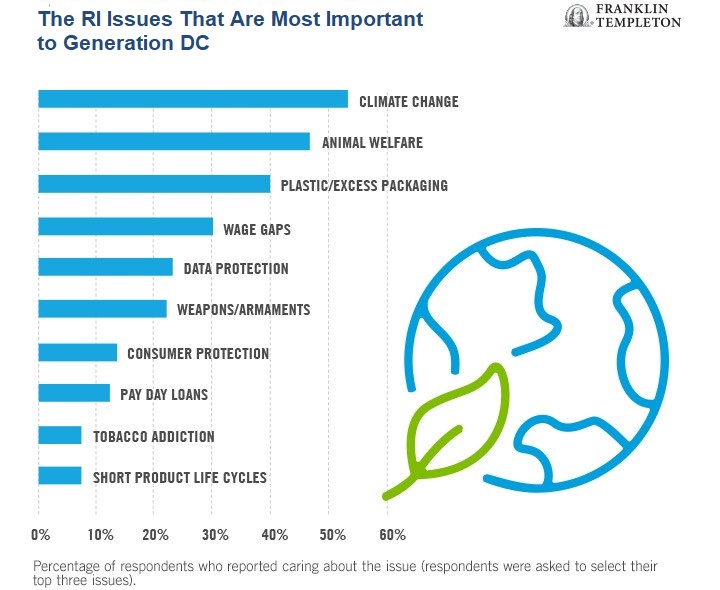

We also found clear alignment between the issues that Generation DC cares about and those which many in the fund management industry focus on through RI, as the graphic below shows.

Savings Implications

According to our survey, a surprisingly high proportion (45%) of Generation DC said they would likely pay more into their pension if they knew RI was incorporated.

The amount by which Generation DC would increase their monthly contributions if they knew that their pension plan incorporated RI is very material. Seventy percent of those polled said that they would contribute between 1% and 3% extra per month.

If our findings became a reality, our calculations show Generation DC members alone would be willing to add £1.2 billion in additional contributions per annum.2 This only scratches the surface of the estimated £328 billion pension savings gap3 but would represent progress, nonetheless.

What’s more, our research found that more than half of Generation DC respondents want RI built into their default investment fund. As a group, they also want more information on how DC plans are incorporating RI.

As always, turning the insights we’ve identified into action will require retirement savings influencers (pension scheme operators, sponsors, advisers, investment managers and regulators) to think anew. We invite you to download our full report here and join the conversation on how best to address the clear misalignment between how Generation DC feel about RI and what their pension currently delivers in this area.

Get more perspectives from Franklin Templeton Investments delivered to your inbox. Subscribe to the Beyond Bulls & Bears blog.

For timely investing tidbits, follow us on Twitter @FTI_Global and on LinkedIn.

Important Legal Information

This material is intended to be of general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any security or to adopt any investment strategy. It does not constitute legal or tax advice.

The views expressed are those of the investment manager and the comments, opinions and analyses are rendered as at publication date and may change without notice. The information provided in this material is not intended as a complete analysis of every material fact regarding any country, region or market.

Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. FTI accepts no liability whatsoever for any loss arising from use of this information and reliance upon the comments, opinions and analyses in the material is at the sole discretion of the user.

What Are the Risks?

All investments involve risks, including possible loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount invested. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Bond prices generally move in the opposite direction of interest rates. Thus, as prices of bonds in an investment portfolio adjust to a rise in interest rates, the value of the portfolio may decline. Special risks are associated with foreign investing, including currency fluctuations, economic instability and political developments.

______________________________________

1. We partnered with Adoreboard, a world leader in artificial intelligence (AI) focused on measuring emotional responses to quantify human experiences (HX).

2. Calculations are based on the total 6.31 million DC savers aged between 22-39 (source: ONS ASHE Survey 2018) and earning the median salary in the UK for this age group £28,086 per annum(source: ONS annual employment survey 2018). Qualifying earnings calculated as £21,950. This number excludes any additional matching employer contributions.

3. Source: International Longevity Centre, 2017.

This post was first published at the official blog of Franklin Templeton Investments.